Chesky_W/iStock via Getty Images

TuSimple (NASDAQ:TSP) is a small cap idea that well placed to capitalize on the autonomous driving trend, and specially, for autonomous trucks, and bring innovative disruption to the traditional trucking industry. In fact, if TuSimple is able to execute according to expectations, this could be a very huge industry opportunity for the company with a first mover advantage.

Investment thesis

TuSimple is a clear global leader in autonomous trucks as evident by its first mover advantage in driverless level 4 autonomous trucks as well as its strong relationships with global OEMs. Its competitive advantage includes the innovation in the features it brings to the autonomous truck scene that competitors and the industry end up trying to catch up to. In addition, the company has a large TAM to be disrupted due to the problems and issues the traditional trucking industry is facing. Lastly, the partnerships with large and global OEMs ensure that when TuSimple is ready to commercialize, it is able to do so in scale and at better economics.

Overview

TuSimple was founded not too long ago in 2015 and is attempting to develop and commercialize the first level 4 autonomous heavy duty truck. The goal is to develop these trucks that can be deployed on its Autonomous Freight Network (“AFN”), which currently comprises of about 50 level 4 autonomous trucks in the states of Arizona, Texas and New Mexico. The company has a strong ecosystem of shippers, third party service providers, freight brokers including UPS, DHL, Union Pacific, amongst others that helps to improve on the network effects of its AFN and increase density and use of its terminal network. TuSimple plans to commercialize its AFN in the “Texas triangle”, comprising of Dallas, San Antonio and Houston, by end of 2023.

There are 2 business models that TuSimple runs on, depending on the needs of its customers. First, it has a carrier-owned capacity model, which is for customer that prefer to sue their own fleet and these customers will purchase TuSimple’s L4 autonomous truck from its OEM partner (more on the 2 OEM partners below) and subscribe to TuSimple Path, which enables autonomous operations. These customers are expected to have a payback period of less than 1 year for their upfront capital investment into the L4 autonomous trucks due to the lower freight costs achieved. In addition, these customers pay TuSimple a per mile, usage-based fee for access to TuSimple Path

Second it has a TuSimple capacity model, where customers can access the company’s L4 autonomous truck fleet and does not need to worry about the risks involved with owning these truck assets. These customers will be charged a per mile rate that is likely to be at a decent discount to current market freight rates.

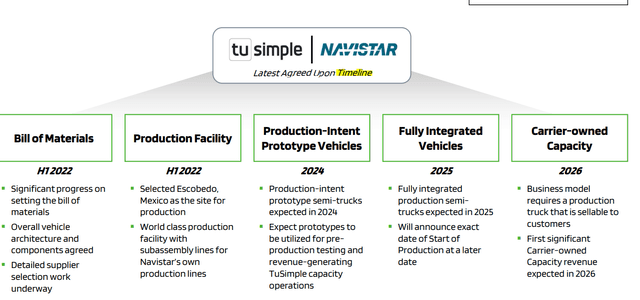

Lastly, in terms of timeline, I am of the view that most of the acceleration in revenues and profits will come in 2026/2027. As can be seen below, its partnership with one of its OEM partners (more about this below) will ramp up from 2026 as the first significant revenues is expected then.

TuSimple and Navistar partnership timeline (Investor presentation)

A large TAM ready for disruption

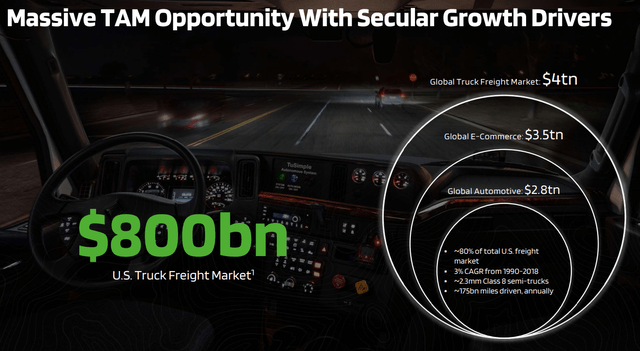

TuSimple operates within a $4 trillion global truck freight market. However, I think that the company will be focusing its efforts on the US market in the near term, addressing the $800 billion TAM in US truck freight market.

TuSimple TAM (TuSimple investor slides)

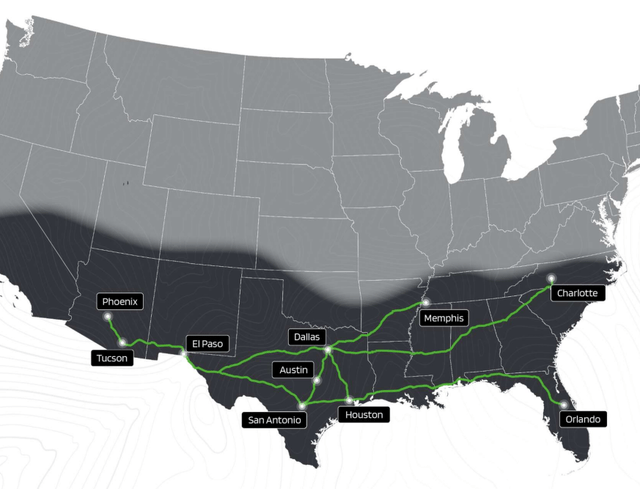

According to the US Bureau of Transportation Statistics, 80% of the goods in the US are transported through just 10% of the trade corridors in the US. Of which, TuSimple’s AFN initially intends to cover the Texas triangle, comprising of the routes between Dallas, Austin and Houston. According the company, its current Autonomous Freight Network (“AFN”) routes already has a TAM of $10 billion to $13 billion in potential freight revenues.

Major US trade corridors (TuSimple Investor Relations)

Furthermore, there are many other factors pushing for disruption in the traditional freight transportation industry globally.

First, there is a global shortage of drivers that can be alleviated by the use of TuSimple’s autonomous trucks. In the US, there is a shortage of 80,000 truck drivers, while in Europe and Germany, the shortage of drivers is estimated to be around 400,000 and 80,000 respectively. This is due to the ageing workforce as well as difficulty in recruiting younger drivers.

Second, driver costs are a significant part of a truck’s cost per mile. As per the National Private Truck Council, almost 40% of the truck’s cost per mile comes from the driver’s wages and almost 61% of the truck’s total cost per mile comes from driver-based costs. As such, it is no wonder that many global truck OEMs are interested in autonomous truck technology that can replace the need for a driver and thus, lead to significant reductions in the truck’s cost per mile.

Third, medium and heavy-duty trucks actually make up almost 24% of the total US transportation greenhouse gas emissions and the use of autonomous technology can help to reduce this. There has been some tests and studies done that found that the use of TuSimple’s technology to replace traditional methods could lead to 13% fuel savings and 10% improved fuel efficiency.

Last but not least, 94% of accidents that occur are due to errors made by humans and the use of autonomous driving technology could help reduce errors made by humans and thus eliminate up to 94% of accidents that may occur in the future.

Global autonomous truck leader and first mover

It is well recognized that TuSimple is currently the leading player in the global autonomous truck race. Not only does it have solid relationships with global OEMs that can help them scale and commercialize more quickly, it also has one of the most comprehensive autonomous freight network and it is currently the first and only autonomous and driver out trucks on public roads with the highest number of road miles tested by its trucks. I think that this is testament to the technology that TuSimple brings, as well as the steadfast approach of management and this brings greater confidence that the urgency that management shows can translate to better execution in the future.

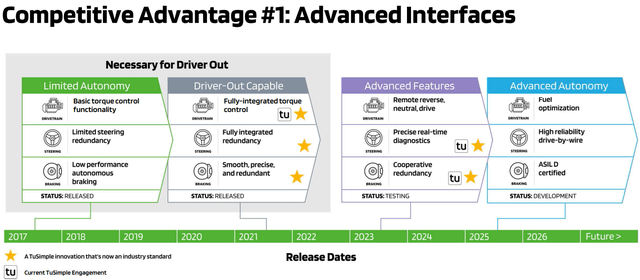

One of TuSimple’s competitive advantage is, in my view, its ability to think ahead and create unique and innovative features that later becomes an industry standard. That, to me, shows that the company is setting the path and the high standards of the industry that competitors are just attempting to play catch up to its innovative features.

TuSimple competitive advantage (Investor presentation)

In addition, TuSimple is ahead of other peers in the autonomous truck space, as can be seen below, as it is the first to test driverless miles, before other peers. This is crucial because companies need to finetune their driverless operations and ensure the algorithm and technology is perfect before it can demonstrate to customers that its technology is safe and works well without any drivers in the vehicle.

First company to be driver out in AV trucking (Investor presentation)

All in all, its technology lead helps to reduce some of the risks associated with future commercialization and scaling up of the operations as it ensures that TuSimple is able to use its competitive moat and attract better quality customers through its innovative technology and processes while competitors that struggle to keep up will be out of the race.

Partnerships with top global OEMs brings scale and credibility

Earlier in 2020, it was announced that Navistar (NAV) entered a strategic partnership to develop level 4 autonomous trucks that are targeted to have a 2024 production date. The 2 companies have had a technical relationship for 2 years before this partnership was announcned. In addition, Navistar took a minority stake in TuSimple as part of the partnership. Navistar has one of the largest sales channels in the US that, in my view, is crucial TuSimple to be viable in the long run due to the scale in commercial operations this will bring. Thus, this partnership brings the leading technology together with the scale it needs to succeed, thereby driving TuSimple down the path towards successful execution and commercialisation.

In addition, it was announced in late 2020 that Traton Group, which is one of the largest commercial vehicle manufacturers in the world and a subsidiary of Volkswagen Group (OTCPK:VWAGY), entered into a global partnership to develop autonomous trucks. This partnership will focus on the testing of TuSimple’s technology on its Scania brand of trucks to develop autonomous trucks that provide better safety, cost reductions as well as improved efficiencies. This partnership of a level 4 autonomous driving technology company with a global OEM is a first for the Europe region and these tests will be done along a route in Sweden. This partnership also brings TuSimple’s technology to new international markets for like Sweden and potentially Germany. This partnerships makes sense in the region as it is said that Germany currently is lacking almost 60,000 to 80,000 drivers due to an ageing workforce and a shortage of drivers. In addition, Traton also has taken a minority stake in the company as part of the partnership. In my view, the choice of partnering with TuSimple validates the company’s technology and strategy.

Regulations fairly supportive

It is worth highlighting that in my view, regulations in the US for autonomous trucks seems fairly supportive, as the US Department of Transportation has stated that it is “committed to facilitating a new era of transportation innovation and safety and ensuring that our country remains a leader in automation.” It has also released some guiding principles for autonomous vehicles as well as a plan to advance its work to “prioritize safety while preparing for the future of transportation.” As such, I think it’s a positive that the government is rather supportive of these new technologies in transportation which is good for the company’s push in US.

Valuation

Given that the company’s ramping up in terms of revenues and EBITDA is back end weighted towards 2027, my forecasts stretch a 6 year time horizon from 2022 to 2027. I apply an implied terminal 2027F EBITDA multiple of 15x and discount rate of 40% to derive a 2022 target price. The 2027F EBITDA multiple was deliberately conservative to ensure that these estimates are not too over the top and overly optimistic.

As such, my target price is $14, implying a 93% upside from current levels.

Risks

Regulatory risks

Although there are currently no regulatory barriers for the industry, there is still a risk that the regulatory environment could change for the worse if regulators make tougher rules for autonomous trucks that makes it more difficult or costly to comply.

Geopolitical risks

There is the risk that political relations between China and US may worsen and this may negatively impact TuSimple. This is because the company intends to launch commercial operations in both countries and this then presents a potential risk to its future growth.

Technology risk

While TuSimple may appear to be the current global leader in autonomous trucks, this may change as new technology may appear or competitors may catch up to the company’s technology. Furthermore, there is not yet a clear public acceptance of autonomous technology yet and this may prove to be another risk to the autonomous technology that the company is developing.

Conclusion

Although still at a rather early stage, TuSimple is able to demonstrate its leadership in autonomous trucks, thereby giving it a first mover advantage and thus, a competitive moat in this area. The TAM for the segment TuSimple is targeting is large and ready to be disrupted due to implicit issues faced by the industry. Furthermore, regulations appear favourable for autonomous trucks in the US. Lastly, the strong partnerships it has forged with global OEMs gives TuSimple a further vote of confidence for the company and its technology. To conclude, my target price is $14, implying a 93% upside from current levels.

Be the first to comment