Guven Ozdemir/iStock via Getty Images

Facing macroeconomic headwinds of inflation and persistent rate hikes, equities seem to be the least attractive asset class after consistent downward earnings revisions and increasing equity risk premiums. At a glance, many stocks may appear cheap on traditional metrics like P/E, P/B or even P/S ratios, allowing investors to purchase highly valued companies at discounted prices relative to their future cash flows. For months, we have been observing equities across different markets and noticed a widening disparity between equity fundamentals with top-down macroeconomic trends and respective price movements in the Turkish market. As such, we are short on Turkish equities via iShares MSCI Turkey ETF (NASDAQ:TUR) as we believe it provides the easiest and cheapest way to gain exposure to sectors of the market that we think will deteriorate in the next 12 months. Our reasons for TUR’s downward movement in price are built on beliefs that Turkey’s macroeconomic policies are not sustainable after the US Fed’s announcement of a 75 bps rate hike, coupled with inconsistent fundamentals in Turkey’s respective sectors.

For context, TUR is an ETF that seeks to track the investment results of a broad-based index (MSCI Turkey IMI 25/50 Index) composed of Turkish equities. It consists of 47 equities, with the top 10 constituents taking up slightly more than half of the total portfolio allocation as of 27th September 2022. With an expense ratio of 0.57%, it provides relatively inexpensive coverage of industries mirroring its benchmark (MSCI Turkey IMI 25/50 Index) with portfolio allocations almost similar to its benchmark as well. According to SeekingAlpha Quant and Author ratings, both seem to postulate that TUR is either a strong buy or a hold. However, we hold a contrarian view that this ETF should behave in stark contrast to the current macroeconomic headwinds.

Investment Theses

An Expensive and Volatile Mechanism

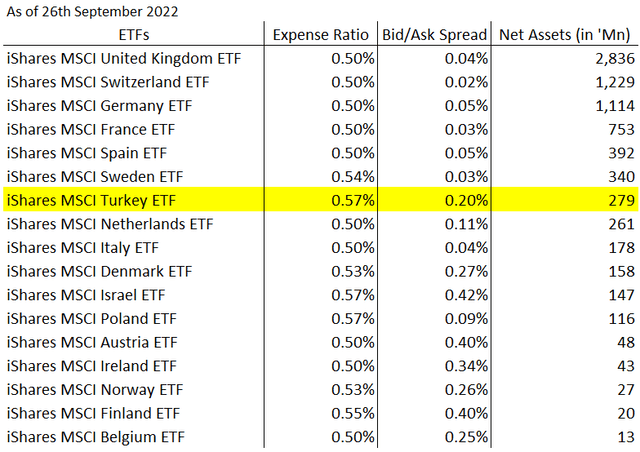

Peer Comps in Descending Order of Size (iShares BlackRock Funds Information)

Before we discuss how some of its components have overvalued fundamentals, the mechanism of TUR is inherently more expensive and illiquid compared to other European countries’ ETFs. For its net assets under management, it charges a higher expense ratio compared to its peers and has a 30-day median bid/ask spread of 0.20%, which is rather illiquid compared to other funds of its size. Precisely because of its size and illiquid nature, we think that there is a greater benefit in going short on this ETF than its expense cost.

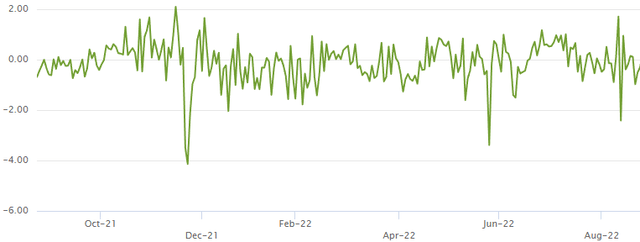

TUR’s Premium/Discount Relative to NAV (iShares BlackRock Funds Information)

By examining the YTD premium/discount relative to the NAV of TUR, we think that the huge standard deviations could present an opportunity for TUR’s underlying constituents to even be mispriced on an intraday trading basis.

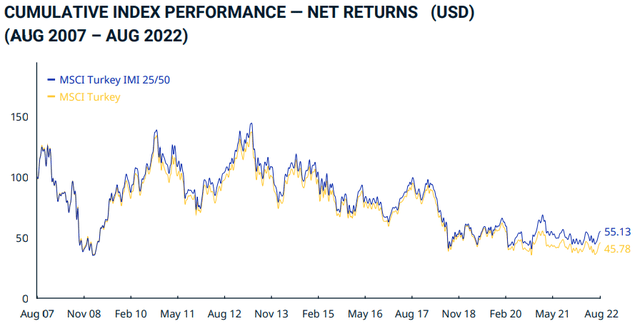

Net Returns Comparison between TUR and its Benchmark – MSCI Turkey IMI 25/50 Index (MSCI)

On top of that, we observe increasing tracking error as seen from the increasing divergence between TUR and its benchmark. As a result of a greater standard deviation between the returns of an investment and its benchmark, this signals to investors that this ETF will not fully capture the upsides of the benchmark, nor has it succeeded in minimising its downsides from TUR’s long-term performance against its benchmark as seen from the diagram above.

Overvalued from Top-Down Macro Perspective

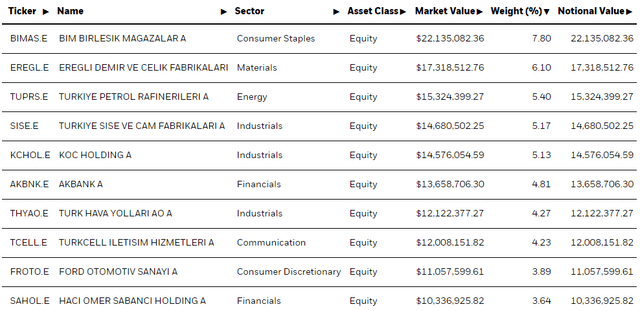

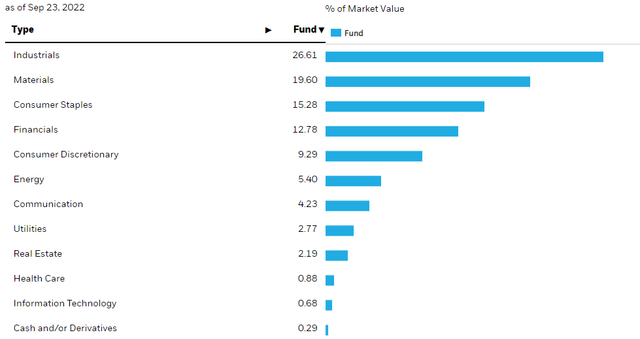

TUR’s List of Top 10 Constituents (iShares BlackRock Funds Information) TUR’s Portfolio Composition by Sector (iShares BlackRock Funds Information)

Looking into its constituents, we noticed that this ETF has huge exposure to the industrials and financials sector based on its overall portfolio composition and its top 10 constituents. We believe that these two sectors would be the ones to lead the fall of TUR as a result of their monetary policies.

Despite inflation soaring to a 24-year high at 80.21%, the Monetary Policy Committee of Turkey continues to lower benchmark interest rates by 100 bps from 13%, moving forward with an unorthodox monetary easing policy. Interest rates have since fallen 400 bps YTD, causing the Lira to depreciate by over 50% against the US Dollar. The financial impact of such a move would be decreased export revenue that could affect the industrials and materials sector, especially its constituents such as Ereğli Demir ve Çelik Fabrikaları which sells iron and steel rolled products, Türkiye Sise Ve Cam Fabrikalari which sells glass products, and Ford Otomotiv Sanayi which sells automobiles internationally.

It is worth noting that prices of steel and iron have come down from the previous year, as well as automobiles constitute the largest export for the country. We believe that the current market has not priced in the effect of the increased cost of production and decreasing prices of products year on year, and would bring down the valuation of these companies once earnings adjustments kick in. Not forgetting the devaluation of the Lira could also lead to more expensive imports, such as motor vehicle parts and accessories for the assembly of automobiles and refined petroleum. This could further affect other sectors such as energy and the airline industry.

TUR is exposed to these industries mainly through Türkiye Petrol Rafinerileri which operates oil refineries and Türk Hava Yolları which is Turkey’s national airline. Regardless of the countries Turkey decides to import its energy supplies from, it is going to eat into the profit margins of these industries even after doing business with Russia in Rubles, after the domestic currency depreciated over 60% against the Rubles YTD.

Currently, the President of Turkey is seeking concessions from Putin and the leaders of the Gulf Arab states to support the country’s source of energy, amidst his reelection campaign taking place next year. As a result, Erdogan’s administration also pushed for huge unsustainable fiscal expenditures, such as the USD50 billion home-ownership project and extending loans to businesses under the Credit Guarantee Fund. We think that there will be some form of stimulus or incentives for the population, given that there would be a joint candidate from the Turkish opposition running against the incumbent. This would further stress the country’s finances after running a current deficit of USD 4.01 billion in July 2022.

We think that the government would be left with no choice but to eventually raise interest rates to combat inflation. This would affect the financial sector such as Akbank T.A.S. and Haci Ömer Sabanci that TUR is exposed to. Foreign investors have dumped the country’s local bonds after a rapid devaluation of the Lira, leaving any price movement to be driven by compliance with the Central Bank’s decision rather than economic fundamentals.

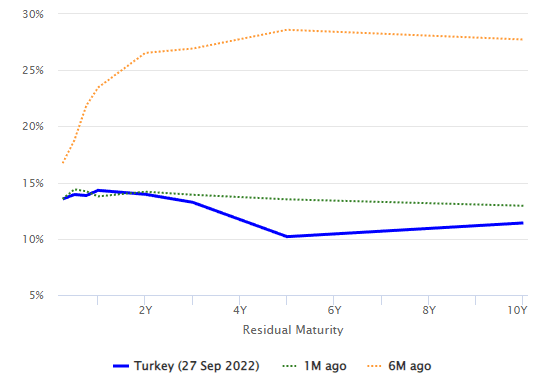

Turkey’s Bond Yields (Highcharts)

As such, we can distinctively see upon closer inspection of the country’s yield curve that the yield curve is gradually flattening compared to six months ago. In fact, had Turkey’s Central Bank not brought down interest rates recently, it would have been almost flat about a month ago. A flat yield curve means investors of different maturities of bonds of the same credit quality are rewarded asymmetrically, which means investors of longer-term bonds do not get excess compensation for the risks associated with holding onto such investment products. In this case, it can also signal that the Central Bank could raise interest rates in the near term due to the poor economic outlook as bond yields across maturities have to compensate buyers more or less equally while waiting for the Central Bank’s decision.

This could have a devastating impact on the financial sector with exposure to bonds when interest rates finally rise or an outflow of investments into the industry with such low rates on the Lira-bond.

Valuation

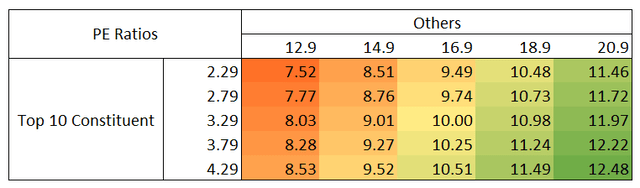

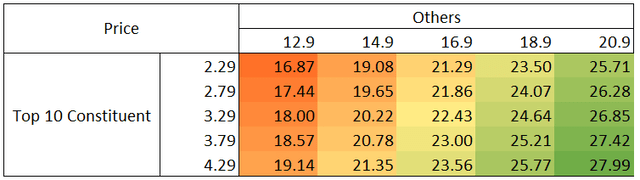

Despite the ETF boasting a PE ratio of 10 as of 27 September 2022, its top 10 components only have a weighted average of 3.29. That would mean that the remaining 49% of the other 37 constituents would have a PE weighted average of 16.9, which is unsustainable for these constituents to be predominantly exposed to highly cyclical industries like Industrials and Materials and even industries facing macroeconomic headwinds like Consumer Discretionary and Financials. To put numbers into perspective, the S&P500 average PE ratio has dipped from 23.1 to 18.8 since the start of the year, while the BIST has fallen from 9.28 to 6.47 in the same period. We think that there is a significantly high possibility that the other 37 constituents could see subsequent downward earnings revisions towards the end of 2022 and since the Borsa İstanbul Stock Market (BIST) is free float market capitalization weighted, this would mean that there could even be further room to fall even for the top 10 holdings for TUR.

Sensitivity Analysis of PE Ratios (Author’s Spreadsheet) Sensitivity Analysis on TUR Price (Author’s Spreadsheet)

As per our sensitivity analysis on PE ratios, we believe that TUR’s bear case should price the ETF at $16.96. This is assuming that earnings do not change, which we have proposed in our investment theses that it could. If so, our bear case valuation would probably be the best-case scenario.

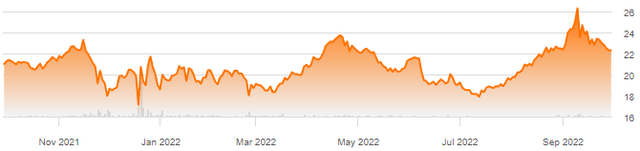

YTD Price of TUR (Seeking Alpha)

Looking at the price movements of TUR, there is evidently more room for the stock to move downwards after bullish momentum from the past few weeks.

Risks

Shorting an ETF allows our investment theses to play out and provides the least amount of risk with diversification into several equities. However, the risk that comes with shorting is unlimited downside potential with limited upsides after taking a short position. Looking at the long run, TUR has fallen from both 3Y and 5Y time frames, which mitigates the risk of having to cover our short position any time soon given the current macro situation.

In addition, other risks that could impact our shorts on TUR would be the appreciation of the Lira against the US Dollar. If Lira somehow is able to strengthen against the US Dollar despite depreciating more than half in value, we could see strong export revenue and a positive inflow of capital into Lira bonds, thus lifting earnings for the Industrials and Financials sector that TUR is heavily exposed to. Besides, a stronger domestic currency could also lift investors’ sentiment and overall consumption of goods and services of the population, thus benefitting the Consumer Staples, Consumer Discretionary, and even the Materials sector as manufacturing output increases.

Lastly, the most important risk that we identified would be a shutdown risk. We have seen many Russian ETFs that suffered a halt in trading before being written down to zero in value after the Russians made a vigorous onslaught on neighbouring Ukraine. With Turkey’s inflation reaching a 24-year high and its Lira being decimated, local food and energy prices could soar out of control if there is no active government intervention. We think that there is a chance of political instability, on top of the high costs of living that could lead to protests and riots. All of that could cause the markets to be closed and trading to be halted, hence making it difficult to get out of a short position.

Conclusion

In all, iShares MSCI Turkey ETF is a unique contrarian trade that we think is worth the risk. Not only does it propose an attractive risk-reward ratio on the charts, but TUR’s decline is also confirmed by macroeconomic headwinds that are persistent and tacky to resolve. Until our investment theses are proven to be invalid in time to come, TUR will always provide an opportunity for arbitrageurs and opportunists to capitalise on the volatility for a quick alpha.

Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!

Be the first to comment