Lemon_tm

Introduction

In January 2022, I wrote a bullish article on SA about electric vehicle (EV) direct current (DC) fast charging company Tritium (NASDAQ:DCFC) in which I said that it looked undervalued considering it listed at a forecast 2026 EV/EBITDA multiple of 4.1x and needed only $68 million of funding to achieve positive free cash flow in 2023.

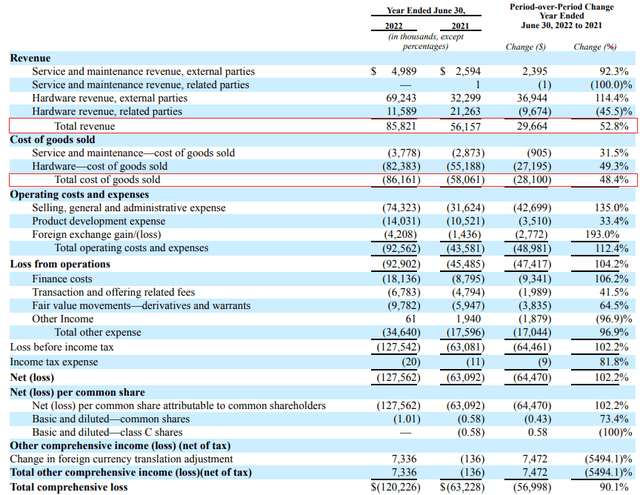

This looks like a bad call at the moment as the market valuation of Tritium is down over 70% as of the time of writing and the loss from operations more than doubled in FY22 to $92.9 million. The margins are much lower than expected and economies of scale seem negligible, so I’m no longer bullish on the stock. Let’s review.

Overview of the recent developments

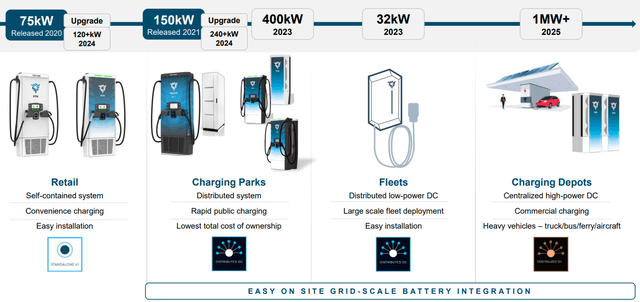

In case you haven’t read my previous article about Tritium, here’s a short description of the business. The company is among the largest manufacturers of EV DC fast chargers manufacturers in the world with market shares of about 20% in the USA and 10% in Europe as of June 2022 (page 37 here). Its main products at the moment include 50 kW, 75 kW, and 175 kW standalone chargers as well as 150 kW and 350 kW distributed chargers. The company has so far sold over 7,600 DC fast chargers, and about 11,000 connectors across 42 countries. Tritium currently has four offices and employs about 550 people.

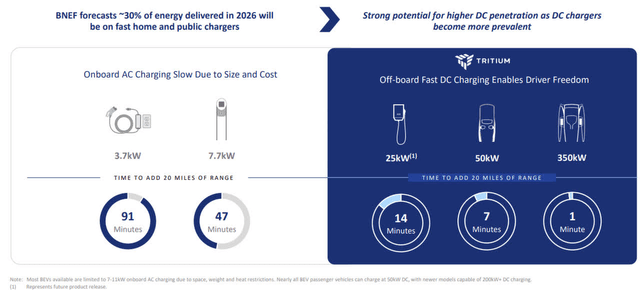

As electricity coming from the grid is always alternating current (AC), EV DC chargers are much faster than the AC ones as the converter is located inside the device itself. The downside is that DC chargers tend to be bulky, which limits the number of car parking spaces.

However, Tritium’s chargers have a relatively small footprint. Also, the company has a competitive advantage through its proprietary liquid-cooled, IP65-rated charger technology which is estimated to lower total cost of ownership by up to 37% over a decade of operation compared to competitors who use air-cooled systems. Looking at the product roadmap, Tritium plans to significantly increase the capacity of its chargers over the next few years and focus on commercial charging solutions.

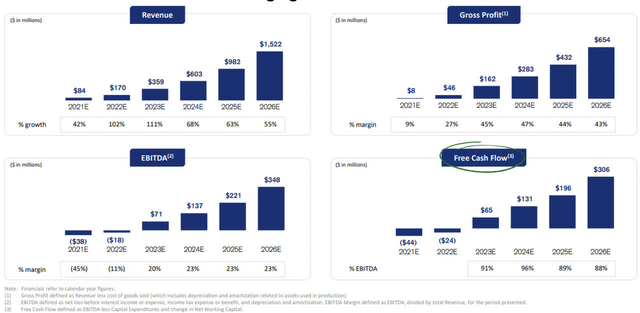

Moving on to the financial performance of Tritium, the forecasts just before the January 2022 listing were that revenues for this year would double to $170 million while gross profit would more than quintuple to $46 million. EBITDA and free cash flow were expected to become positive in 2023.

Tritium’s fiscal year ends in June so we’re not comparing apples to apples here, but I think it’s obvious that the company is far behind these estimates. For example, the gross profit was still negative in FY22 while EBITDA came in at minus $91.3 million (depreciation expenses were $1.6 million). According to the forecasts, EBITDA for 2021 and 2022 combined was supposed to be minus $56 million.

Economies of scale appear to be negligible as the gross profit margin barely improved in FY22 despite the number of stand-alone chargers sold soaring by 47% to 1,194 and the average selling price increasing by 4.9% to $24,734 per unit (due to the introduction of higher-powered models).

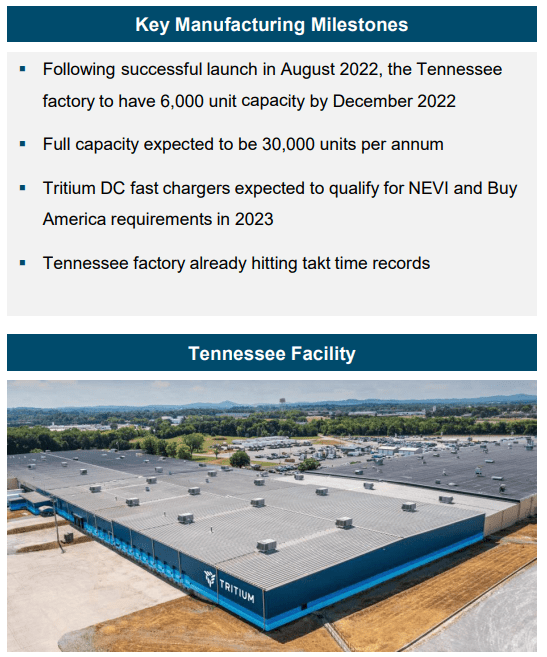

Tritium opened a new facility in Tennessee in August 2022, which is expected to have an annualized capacity of about 6,000 units by December, and this translates into $148.4 million based on the average selling price of stand-alone chargers in FY22. At full capacity, production there can potentially be increased to as many as 30,000 units annually.

Tritium

This plant was expected to help Tritium reach sales of about $170 million for calendar 2022 but unfortunately that goal won’t be met either. You see, the company is around six weeks behind the planned production ramp up due to supply constraints and recruitment delays and this is set to shift about $45 million of revenues into 2023. As a result, revenues for the 2022 calendar year are expected to come in at only $125 million. Considering the order backlog was $149 million as of June, I don’t expect the Tennessee plant to reach full capacity anytime soon.

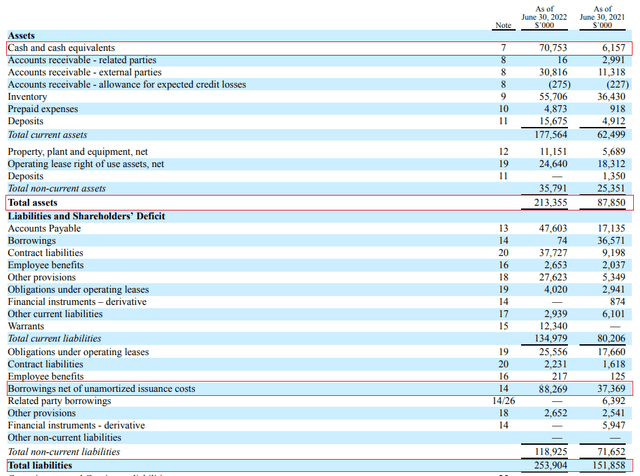

Turning our attention to the balance sheet, the situation doesn’t look good as shareholders’ equity was negative as of June while long-term debt rose to $88.3 million. However, Tritium has an asset-light business model, so I’m not concerned that the company could run into liquidity issues in the near future. In FY22, capital expenses stood at just $7 million and the Tritium had $70.8 million in cash and cash equivalents at the end of June. In addition, the company recently extended its credit facility by $60 million to $150 million and established a committed equity facility for up to $75 million.

Overall, I continue to think of DC fast charging as the future for EVs due to the significant decrease in charging time and I expect Tritium to remain a leading player in this market thanks to its proprietary liquid-cooled charger technology. However, I’m concerned that gross margins barely improved in FY22 and that the loss from operations surpassed $90 million. This raises concerns about the margins of the Tennessee plant.

Investor takeaway

Tritium’s revenues are growing rapidly, and I think the company can still meet the revenue goals for the coming years set during its January listing as the Tennessee facility is a game changer with its 30,000 unit per year capacity. However, the gross margin barely improved in FY22 despite much higher sales of stand-alone chargers and their average selling price increasing by 4.9%. I’m concerned that economies of scale are too low and that the loss from operations could rise significantly as the Tennessee facility ramps up production.

In view of this, I think that risk-averse investors should avoid this stock. The risks here just seem too high at the moment.

Be the first to comment