Darren415

This article was first released to Systematic Income subscribers and free trials on Aug. 12.

In this article, we catch up on Q2 results from the Business Development Company Trinity Capital (NASDAQ:TRIN). TRIN is currently trading at a total dividend yield of 14.4% and a valuation of 108%.

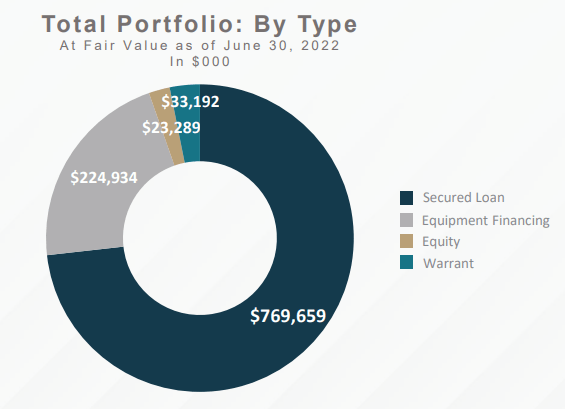

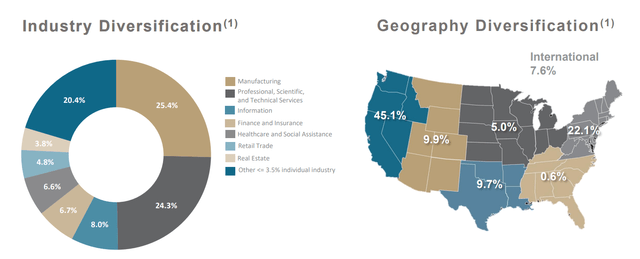

The company has a venture debt flavor with, unusually for a BDC, a significant allocation to equipment financing.

TRIN

Outside of this focus on borrowers in the Manufacturing sector, the company has a more traditional BDC allocation to Information, Tech and Scientific services, among others.

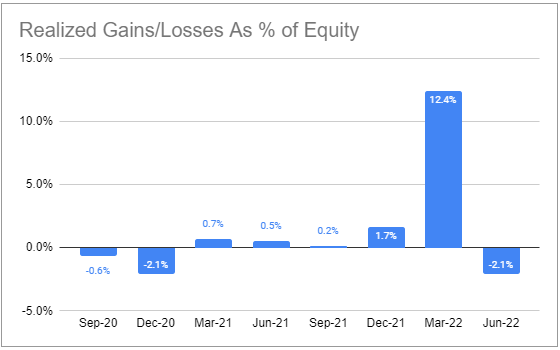

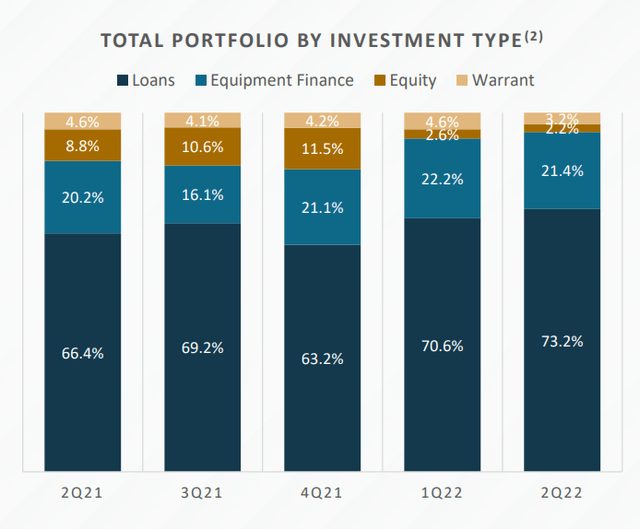

Historically, the company had a relatively high allocation to equity and warrants, however, this has fallen more in line with the sector average as a number of larger positions with net gains were realized. TRIN still maintains 125 warrant positions in 75 portfolio companies, providing it potential further upside.

Quarter Update

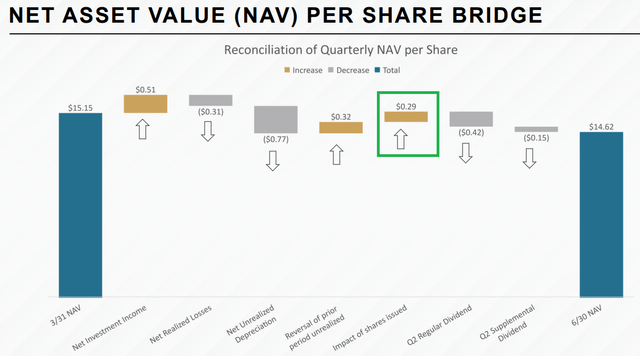

TRIN issued around $60m worth of stock in Q2 which resulted in about a 2% accretion to the NAV. The company has been growing its asset base aggressively and additional share issuance at a premium to NAV is an attractive way to do that even if it puts pressure on the stock. Along similar lines, the company also raised around $3m via its ATM offering program.

The company then tapped its 7% bond in about the same amount to leverage the equity provided by the share issuance. The additional bond was issued at 99.52% of principal which translates into one of the highest bond yields in the BDC space. This speaks to the fact that TRIN doesn’t have an investment-grade rating from the 3 major agencies which is likely due to its short track record as well as a lower first-lien allocation.

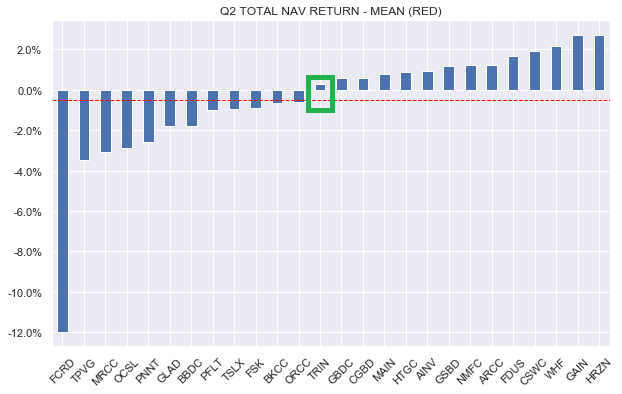

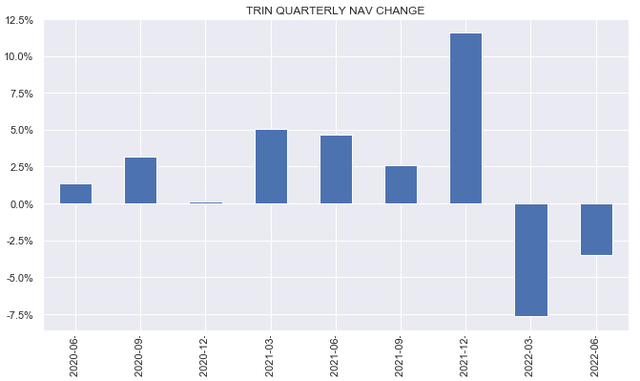

The NAV fell around 3.5% on the quarter, primarily due to unrealized depreciation of around 5% as well as the $0.15 supplemental.

In total NAV return terms TRIN eked out a positive return of 0.3% for the quarter, besting the sector.

Systematic Income

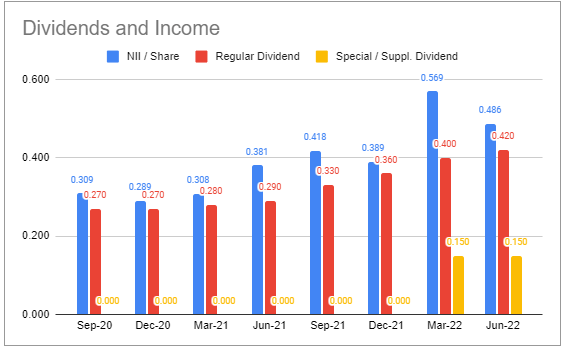

Net investment income fell to $0.486 from $0.569. Our numbers are slightly different from the headline figures reported by TRIN (Q2 NII of $0.51) – our figure is a post-tax number.

Systematic Income BDC Tool

The drop in net income was due to three factors. First, was a not unexpected fall in fee income – the Q1 number was unusually high. Two, the share issuance was a temporary drag on income which will be reversed in the next quarter as the cash is fully allocated and leveraged. And three, the company had higher management fees due to an increase in headcount.

Systematic Income BDC Tool

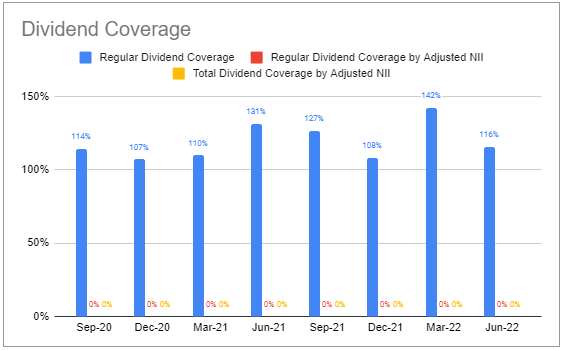

Coverage of the base dividend remains strong at 116% and should continue to improve, all else equal, as we discuss in the Income Dynamics section.

Systematic Income BDC Tool

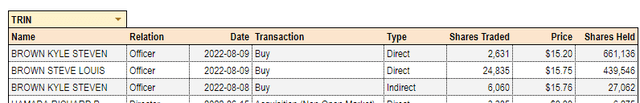

Finally, it’s worth noting that the CEO has continued to acquire shares recently.

Income Dynamics

In this section we highlight some of the key factors that will drive net income over the medium term.

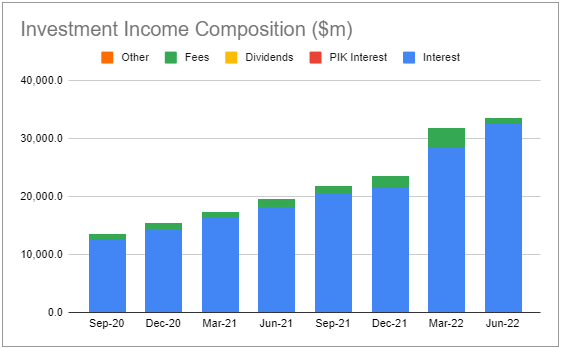

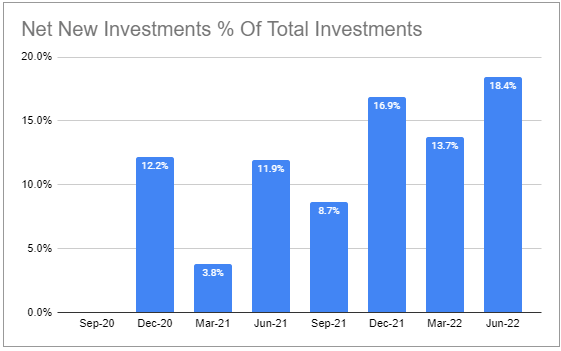

TRIN continues to allocate capital at an aggressive pace. Net new investments have continued to run at a double-digit pace.

Systematic Income BDC Tool

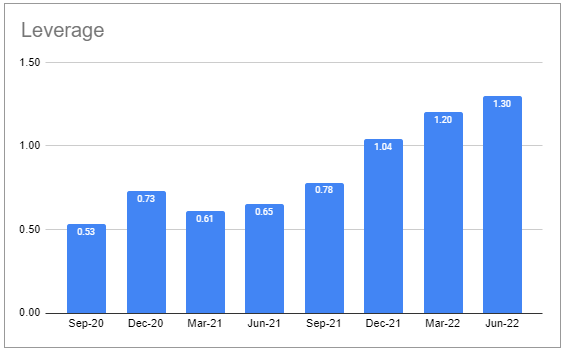

Some of that reflects the recent share issuance as well as the continued increase in leverage. Leverage is at the higher end of the 1.15-1.35x target range and management said they plan to bring it down towards 1.25x.

Systematic Income BDC Tool

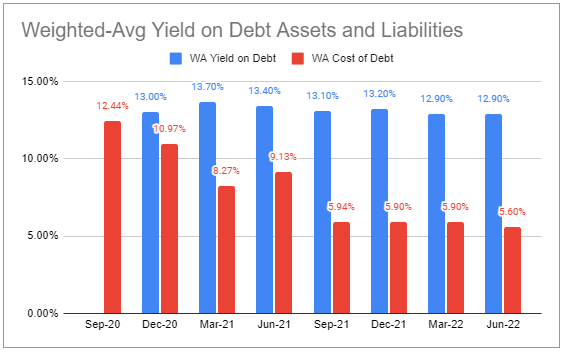

Asset yields held steady over Q2 while debt expense fell. This is very different from the trend in the broader sector where both asset yields and debt interest expense have tended to increase.

Systematic Income BDC Tool

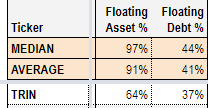

The company has a relatively high proportion of fixed-rate assets so its asset-side yield will be less responsive to rising short-term rates.

Systematic Income BDC Tool

The drop in debt interest expense was due to an increase in the usage of the lower-interest rate floating-rate credit facility. Debt expense will move higher once the new bond tap is taken into account.

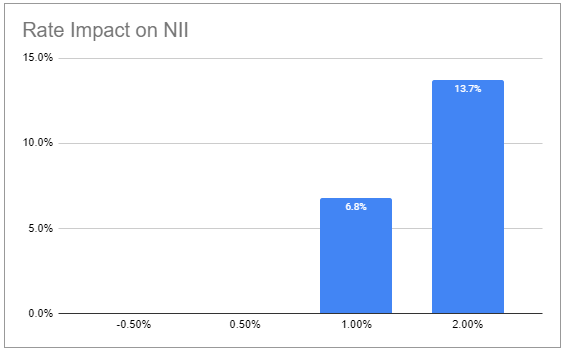

Net income beta to rising rates is positive but is about 60% of the broader market.

Systematic Income BDC Tool

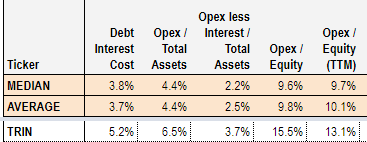

The company’s operating expenses remain fairly high. First, interest expense is around 1.5% above the sector average. And two, expenses ex-Interest Expense are also about 1% above the sector average even though the company is internally-managed. Both of these figures will likely move towards the sector average over time.

Systematic Income BDC Tool

Portfolio Quality

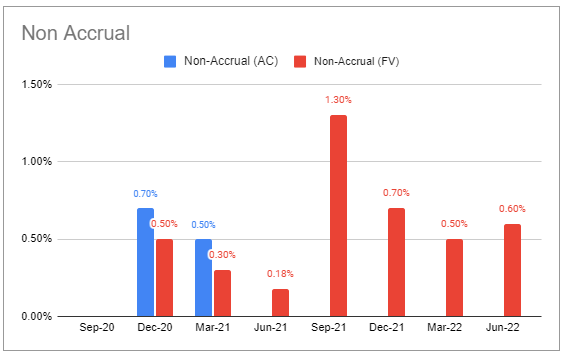

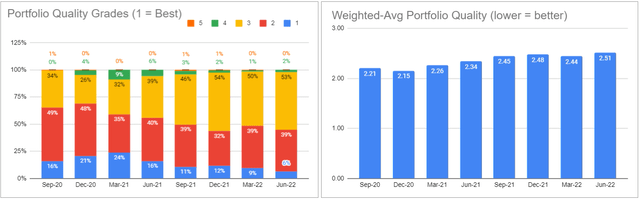

There are four companies on non-accrual in the portfolio with a fair-value basis of 0.6% – up slightly from 0.5% but still below the average in the sector.

Systematic Income BDC Tool

TRIN had a realized loss in the Store Intelligence position which was previously marked down on an unrealized basis and achieved a full recovery based on that marked-down level. At the very least it’s good to see that realized losses are taken without further downside surprises in valuation.

Systematic Income BDC Tool

The internal weighted-average portfolio rating worsened slightly from the previous quarter – a trend that is fairly common across the sector given the headwinds for corporate indicators such as interest coverage and others.

It’s worth nothing that TRIN does carry some bitcoin mining exposure via its equipment financing portfolio. The company has loans to three publicly traded digital asset mining and hosting companies, equating to about 7% of its portfolio at cost. The sector has taken a hit this year. On the call management guided that the loans are still around 90% LTV which is fairly high although the miners are expected to be profitable at a bitcoin price above $8k vs. $24k as of this writing.

Valuation And Return Profile

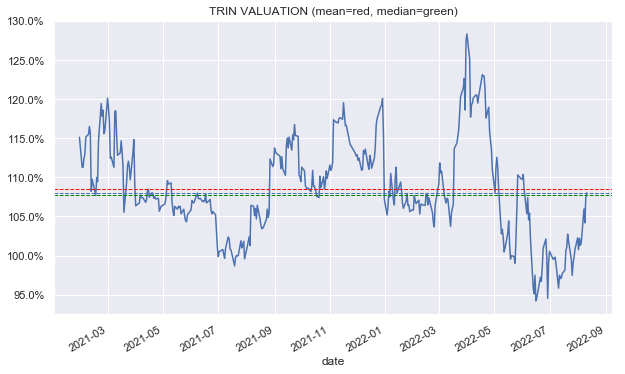

TRIN has traded in a very wide valuation range of 95-130% over the past few months and is currently around the middle of that range.

Systematic Income

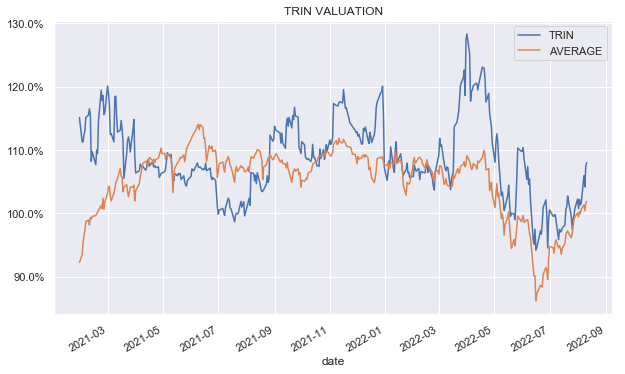

It has also tended to trade above the average sector valuation historically.

Systematic Income

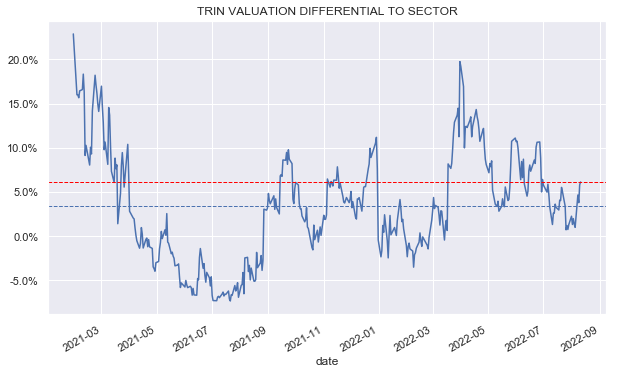

This chart shows that more clearly, highlighting that TRIN has tended to trade at a valuation about 4% above the sector average (blue line) which is now closer to 6% as of this writing, making it somewhat expensive on this basis.

Systematic Income

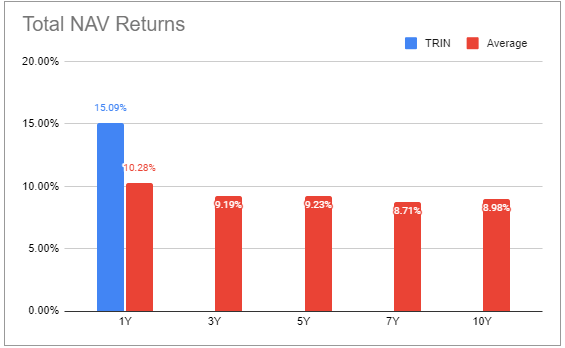

TRIN doesn’t have a long public track record but out of the 5 quarters for which we have data it has outperformed the sector in 4 of them. Over the past year it has bested the broader sector by close to 5%.

Systematic Income BDC Tool

Takeaways

Overall, TRIN had a decent quarter. Although the NAV underperformed, total NAV return was positive over Q2, slightly above the average BDC. Net income is expected to continue to grow and we should see additional dividends coming later this year due to the large spillover.

The stock price has underperformed the sector somewhat year to date, however, that was off a fairly expensive valuation so it’s not overly surprising. The public offering as well as ATM issuance also kept pressure on the price.

From a BDC portfolio allocation perspective, TRIN offers additional diversification potential. Its venture-debt flavor (also seen across a few other BDCs) as well as its equipment financing business (much less common) provides a different source of returns from the traditional middle-market BDC.

In our view TRIN is an attractive buy at an average valuation slightly above the sector average. This is why we rotated into a TRIN position in our High Income Portfolio when its valuation premium over the sector was in the low single-digits, less than it is now. At current valuations, we are not adding to the position and the stock is rated Hold. The stock is likely to remain volatile and should allow investors a better entry point.

Be the first to comment