DNY59

Introduction

I do not like publishing bear articles. I have nothing to gain from a falling price, and folks tend to assume the worst. I hope you will give me the benefit of the doubt as I try to outline what I see as very significant risks that Trinity Capital Inc. (NASDAQ:TRIN), a business development company (“BDC”), is harboring on its books, so that you – as investors – can make an informed decision about the stock.

On the face of it, a double-digit dividend yield and a 23% discount to book value seem to make for an attractive entry point. I disagree. I think there is much worse to come.

I believe that Trinity Capital’s assets are highly likely to face significant impairment over the coming 12 months. I believe the dividend will ultimately be cut, and the balance sheet will come into question, and I believe management is delusional about the risks they are facing.

Venture Debt

Let’s start with a brief recap of Trinity Capital’s strategy: venture debt. They are lending money to grow businesses, with unproven economics and certainly without a long history of profitability. In their investor presentation, they note that they have been lending money to Axiom Space:

…who are developing the world’s first commercial space station.

This seems crazy to me. Even if I wanted exposure to such an incredibly speculative business, I would certainly want to be exclusively in the equity part of the cap stack. After all, if Axiom actually works, it’ll be a ground-breaking business: perhaps a 1000x bagger. If it doesn’t work, it’ll be worthless. Why would I want capped, debt-like returns, with all of the downside risk?

One answer is that it has been a highly profitable strategy in the bull market of the last decade. When things are going well, fundraising is easy, and venture firms are tossing around the wallet. Your debt will be fine. There is always a “greater fool,” and you’ll always be paid back.

But the elevated level of underlying risk means you are still getting paid handsomely. Yields are high, write-offs are low. Trinity’s loans yield 15%+, with sweeteners in the form of warrants and equity. This should already be a hint to the risk profile of the book.

What investors today should be pondering is what happens when fundraising for cash-burning companies stops. I believe that is where we are today. Venture fundraising is incredibly tricky. The crypto space is dead. ARK Innovation ETF (ARKK) – a grab-bag of speculative assets – has fallen by 80% from its peak.

The greater fools have run out of money, and so these businesses have to stand on their own two feet and produce their own cashflows. Can they?

Book analysis

Let’s get into what Trinity Capital has on its books.

Management believes that the book “continues to perform well.” Only 1.3% of the loan book is in non-accrual, meaning interest is not being paid. There are a few other impairments, but nothing major.

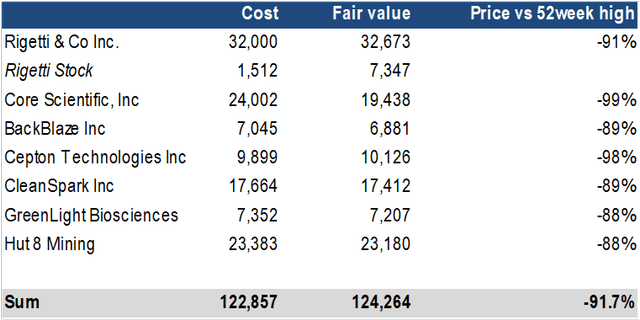

I found this hard to believe, so I ran down the schedule of investments, looking for listed businesses. I figured that listed businesses would at least give us some steer for how the market is valuing them and would give us some insight into the numbers. I found 7 loans which fit into this category, which I’ve presented with some key statistics below:

You are reading that right: of Trinity Capital’s listed investments, the share price is – on average – down 91.7%.

Just this Wednesday, Rigetti – one of the book’s largest exposures, valued at 7% of net assets – announced the eponymous founder was suddenly departing. It is rudderless, even as cash is going up in flames. Core Scientific, as many investors will know, will almost certainly go bankrupt. There is further crypto exposure in the list above.

Take a look at Cepton Technologies, too. Analysts predict it will make a GAAP loss of $54.4m this year, on $8.3m of revenues. It managed to scramble and find some funding, but Trinity’s loan runs through to 2026. There’s a whole lot more funding required. Who will be left holding the bag?

Personally, I wouldn’t want to be anywhere near any of these loans.

But wait…

If you know Trinity’s business well, you might be itching to make a point of clarification here.

You might note that all of Trinity’s lending is either secured on something or is specifically designated equipment financing. Surely that will mean there is some level of recovery?

Sure: there will be recoveries. I don’t think these positions are total write-offs.

That said, I am highly skeptical about the practicality of recovering crypto-mining equipment, and even more dubious you will get a decent price for it in the current environment. All of these investments – which were held at full value in the September marks – will, I believe, have to take very significant write-downs.

If these were proper assets – buildings, blue-chip receivables, whatever – the borrowing businesses would not need to pay double-digit interest rates. I believe investors will find Trinity Capital has a very difficult time recovering what it believes it is owed.

Ok, so what’s the hole?

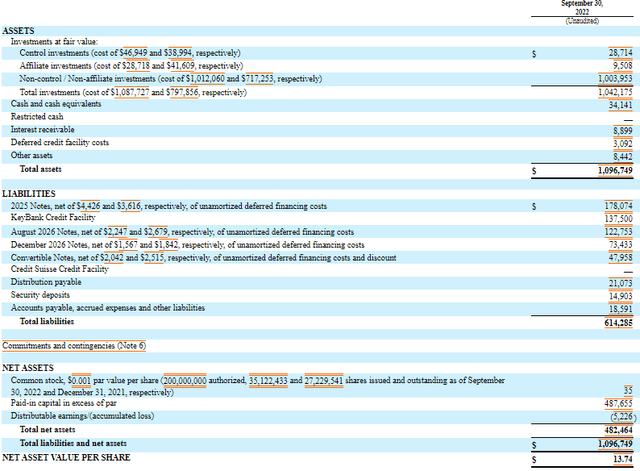

Well: let’s consider that the business is rather levered. I reproduce the balance sheet below, for ease of reference:

Total assets are $1.1bn, but net assets are only $482m. A 5% change in total asset value has an 11% change in net asset value. Here are some obvious adjustments you might make:

- Simply writing Rigetti & Co’s equity position to market value precipitates a $5m write-down. That’s over 1% of net asset value.

- Core Scientific’s crypto-mining equipment will almost certainly need to be sold to allow some recovery. In the recent conference call, the business noted that it was likely worth $10m. Including recovery costs, we can probably chop $10m+ off the value of this loan: that’s ~2.5% of net asset value.

- Hut 8 Mining just announced that they, too, are burning money. A $24m net loss in the Q3 period, which had a substantially higher Bitcoin price than today, hardly augurs well for that business. I see similar risks to the Core Scientific position above: another 3% of NAV up in flames?

From a small sub-set of the book, we have found a number of real issues.

Better the Devil you know

The concerning thing for me is that the loans I have highlighted in this piece are simply the ones with a listed entity. I haven’t cherry-picked anything, I haven’t selectively picked the worst, and I haven’t tried to make a point. I’ve shown you all the ones for which there is publicly available data.

If these are the public ones – and you’d hope, generally, that better quality companies make it to the public arena – how is the rest of the book doing?

That’s my real concern.

The rest of the book is a roll call of the sort of stuff which public markets have obliterated this year, and for which future funding is drying up. I will be absolutely amazed if, in 12 months’ time, Trinity Capital has not had to make very significant impairments to its book.

Conclusion

My concern is that there is not much that could stop Trinity Capital from dramatically losing the faith of the market. It is expensive – $10m per quarter in non-financing structural costs – over 8% of NAV per annum. It is unproven, with a short history. And its marks are, I believe, fanciful.

BDCs are at their most lucrative when they trade at or above NAV. They can grow through share issuance, they can spread costs over a larger asset base, and they can build a following of loyal investors.

Trinity, in my view, is going in the opposite direction.

Be the first to comment