McKevin

In a bear market condition when the S&P 500 companies are reporting their lowest earnings growth since Q3 2020, early-stage business development companies like Trinity Capital (NASDAQ:TRIN) and TriplePoint Venture Growth (NYSE:TPVG) continue to generate record-breaking income and earnings growth. They both surpassed expectations and boosted their quarterly dividends, which helped push their yields into the double-digit range. In addition, their robust performance is likely to continue into the following year as tightening policies could keep compelling early-stage companies to raise money from business development companies. Hence, cash returns from BDCs like Trinity Capital and TriplePoint Venture Growth are likely to amplify in the following year. Nevertheless, when it comes to a better entry point and cash returns, Trinity has an edge over TriplePoint.

Why BDCs?

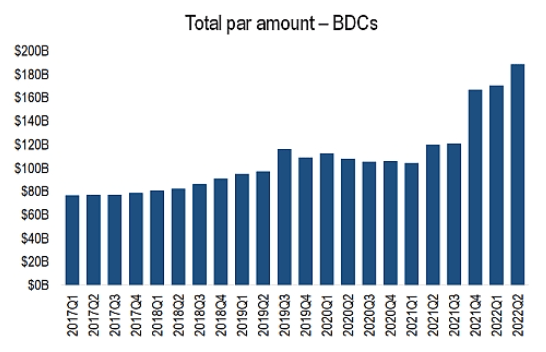

Pitchbook.com (BDCs Total Par Amount)

Growth and value stocks may face more pressure next year due to decade-high interest rates and the looming recession. Despite that, it’s quite difficult to avoid the buying opportunity in high-yielding business development companies. This is because these companies are benefiting from tightening policies from traditional lenders and slowing venture capital investments. As of the end of the second quarter of 2022, the BDC loan portfolio rose to $188 billion from $109 billion at the end of 2019, representing a whopping increase of 73%. Data for the third quarter is not yet available, but trends indicate that the debt portfolio might have grown further. In addition to a rosy short-term outlook, business development companies have robust long-term fundamentals. Due to their simplified lending process, BDCs are becoming an increasingly popular alternative option for cash-strapped startups, allowing founders to avoid selling equity stakes at a significant discount to venture capitalists.

Despite the solid outlook for the entire industry, it is still important for investors to be careful when selecting stocks. This is because each BDC has a different risk-reward profile, as well as different strategies when it comes to portfolio management and growth.

Trinity Capital Looks Attractive for Long-term Investing

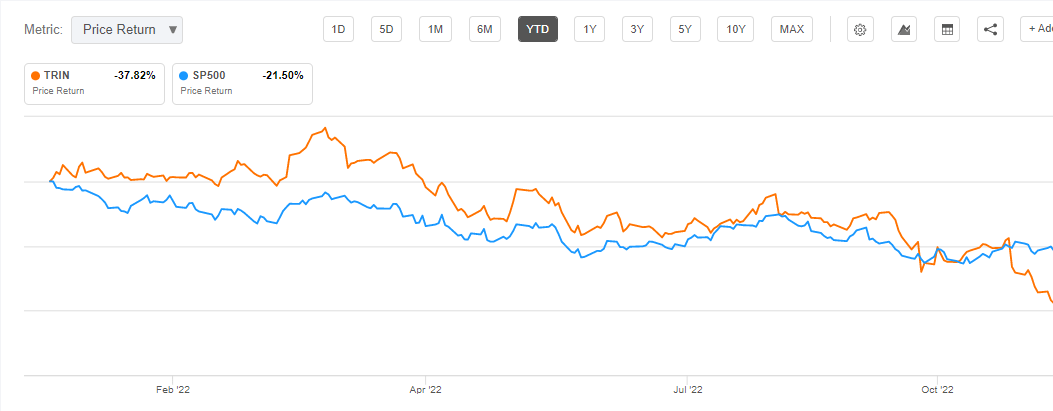

Seeking Alpha (Trinity Capital Share Price)

According to Warren Buffett, investors should be “fearful when others are greedy, and greedy when others are fearful.” However, this does not mean every beaten-down stock is a good bargain. In the case of Trinity Capital, its share price plunged around 37% year to date, with most of the declines occurring in the past two months after two of its portfolio companies declared bankruptcy. Lower price targets from analysts also contributed to the selloff. Nonetheless, I believe investors’ overreaction has created an attractive buying opportunity for long-term investors. These two investments represent only 3% of its portfolio, with 97% of its portfolio performing as expected. The investments in these companies are also collateralized by critical equipment, which means the loss will be much lower than the actual investment. Moreover, with approximately $67 million in capital gain spillover, the company is in a position to offset potential capital losses.

Its most recent financial results and dividend distribution also show that the bankruptcy of two of its portfolio holdings has had no major impact on the company’s financial performance. In the third quarter, the company generated a record $38.7 million in net investment income, up 15.5% sequentially and up 77.5% from the year-ago period. High-interest rates and fee income contributed to the net investment growth. The company’s strategy of offering loans at floating rates while taking debt at fixed rates has also been contributing to net investment income growth. Trinity’s management mentioned in a conference call that a 100 basis point increase boosts its income by $4.8 million.

Cash Returns are Likely to Grow

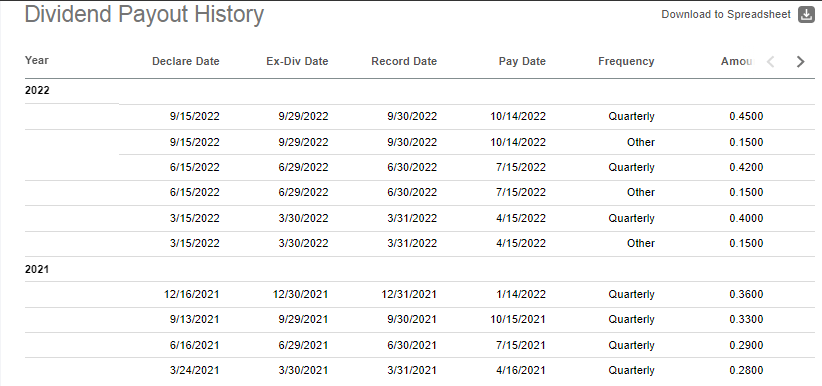

Seeking Alpha (Dividend History)

In Q3, the company raised its quarterly dividend to $0.45 per share, marking the eighth consecutive quarter of dividend growth. This represents an increase of 7.1% over the previous quarter and 36% over the year-ago period. Besides its regular dividend, TRIN paid a supplementary dividend of $0.15 per share in the first three quarters of the year. Therefore, its stock yields around 20% when we include a supplemental dividend.

As its net income is expected to grow in the following quarter, the dividend growth looks sustainable. Analysts expect TRIN to report $0.51 earnings per share in the fourth quarter, up from $0.40 in the previous year’s quarter. It is also notable that Trinity Capital has topped estimates seven times in the last eight quarters. For the full year, the consensus earnings estimate is $2.12 per share, reflecting a substantial growth from $1.50 per share in 2021. In 2023, the extension of the growth trend is also highly likely due to the Fed’s ultra-hawkish stance on fighting inflation through rate hikes. In addition, Trinity’s $510 million of investments in new and existing portfolio companies in the last three quarters is likely to contribute to income growth.

Valuations

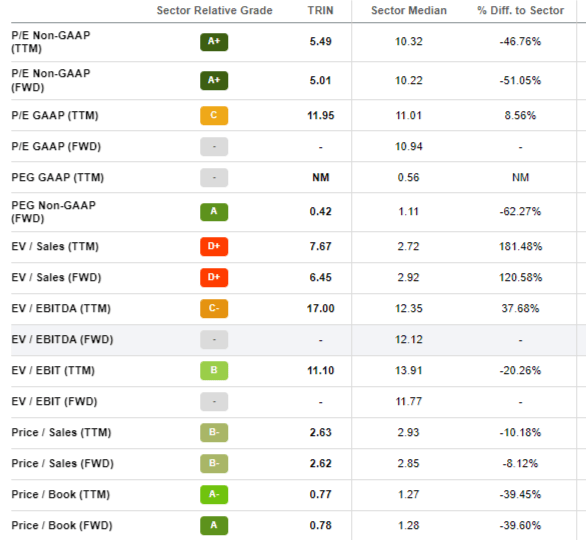

Seeking Alpha (Valuations)

Another factor that makes Trinity an attractive pick is its low valuations. Its trailing and forward price-to-earnings ratios of 5.49 and 5.01 are almost half the sector median. Low PE ratios are attributed to robust earnings growth trends combined with a steep share price selloff. Its trailing and forward price-to-book ratios are also down around 39% from the sector median. The company earned an A plus grade on valuation based on Seeking Alpha’s quant grading system. Moreover, the stock price is also trading below its net asset value of $13.74 per share.

Where Does TriplePoint Venture Growth Stand?

Another great company in the business development space that is offering a buying opportunity is TriplePoint Venture Growth. In 2022, the company’s share price has fallen around 30% due to broader market volatility. Despite poor stock price performance, the company looks financially and fundamentally strong. It generated record-breaking revenues and earnings in every quarter of 2022, and its portfolio value reached nearly one billion dollars for the first time. TPVG achieved record earnings of $0.51 per share in the third quarter, compared to $0.41 per share in the previous quarter and $0.32 per share a year ago. In Q3, a weighted average annualized portfolio yield of 13.8% was achieved on total debt investments. With an aggressive investment strategy and floating interest rate for portfolio debt, the company’s income and earnings are likely to grow in the following quarters.

However, TriplePoint Venture Growth trails Trinity Capital on a number of key metrics. As an example, Trinity’s net investment income in the third quarter grew 77% year over year, while TriplePoint’s net investment income increased by 40%. In comparison to TPVG’s year-to-date funding of $320 million, TRIN’s investment funding in new and existing companies stood above $500 million. Aside from higher funding and net investment income, Trinity Capital’s distributions are also higher than TriplePoint’s. TRIN has raised dividends in the past eight consecutive quarters. Its latest quarterly dividend of $0.45 represents a 38% increase from the year-ago quarter. Moreover, its stock yields around 20% when we include its supplemental dividend. TriplePoint, on the other hand, has a lower dividend yield and dividend growth rate than TRIN. Moreover, the company has not paid any supplementary dividends to shareholders so far in 2022.

In Conclusion

Since stocks are down significantly and market uncertainty is likely to extend into next year, it might be prudent to invest in high-yielding BDCs such as Trinity Capital and TriplePoint Venture Capital. These companies have the potential to offer hefty cash returns to shareholders in a high-interest-rate environment. Although both TRIN and TPVG are solid dividend stocks, TRIN has an edge over TPVG when it comes to long-term capital appreciation and cash returns.

Be the first to comment