metamorworks

We are pleased with Trimble’s (NASDAQ:TRMB) Q2 2022 results, where the company outperformed expectations and delivered strong ARR and gross margin performance. Organic revenue growth was 6%, but more importantly in our opinion recurring revenue grew significantly with ARR reaching $1.51 billion, which is an increase of +12% overall and +15% organic.

The company also reported that it is making solid progress with its Trimble Construction One offering, which is a bundled offering of construction software solutions, currently targeted toward contractors. Thanks to Trimble Construction One, its win rates are going up, sales cycles are becoming shorter, and average deal size is increasing.

Other interesting news included the fact that the company divested five businesses in the quarter. For these businesses, the revenue profile was greater than 90% hardware, so they did not align well with the company’s software strategy. The company also reported that its acquisition pipeline is relatively full at the moment, so there might be M&A news coming soon.

Importantly, the company sounded very confident that if we enter a recession, the company is well positioned to face it. Although, the company continues to see strong demand and healthy market indicators. CEO Rob Painter said the following during the earnings call:

On the investor front, the topic has been almost singular, that is the macroeconomic environment and recessionary clouds. Broadly speaking, market indicators and demand remain strong on an absolute basis. On a relative basis, it seems that our end markets are catching their breath and coming off a bit of a high point. Inflation is a top concern.

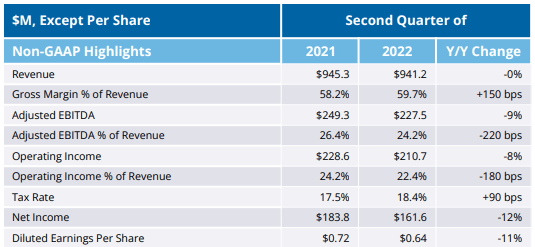

Q2 2022 Results

Net income and EPS were both lower than prior year levels, yet ahead of expectations. Over the last 12 months, the company generated $470 million of free cash flow, and through the first half of 2022, it generated just over $173 million of free cash flow, both of which are below its long-term goal of generating cash flow in excess of non-GAAP net income.

Backlog stands at $1.6 billion, of which approximately $240 million is hardware. Hardware backlog came down by approximately $110 million in the quarter, about half from divestitures and half from improving supply chain execution.

Financials

Gross margin of 59.7%, a record level for Trimble, was driven by a favorable mix shift towards software offerings and the net impact of pricing and cost. Despite this record gross margin, and revenue being almost the same compared to the prior year, elevated company expenses made the operating income fall about 8%. This coupled with a slightly higher tax rate resulted in diluted earnings per share falling roughly 11%.

Trimble Investor Presentation

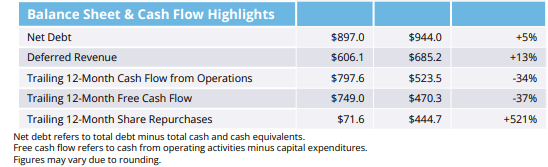

Balance Sheet

Trimble ended the quarter with net debt just slightly over 1x EBITDA, which means the company has a strong enough balance sheet to provide resilience and ample dry powder to invest in the company’s growth.

Trimble Investor Presentation

Guidance

Trimble is raising its guidance on ARR growth to 16% for the year. For total revenue and EPS, three factors lead them to project a more cautious outlook for the full year: FX, supply chain and demand.

For the full year, the company is expecting revenue in the range of $3.76 billion to $3.82 billion, which represents organic total revenue growth of 9% to 11%. Overall revenue growth and organic revenue growth are expected to improve sequentially from the second quarter through the third and fourth quarters, reflecting increased pricing and increased software and recurring growth. The impact of divestitures on the company’s revenue will be approximately 5% in both the third and fourth quarters. Gross margins are expected to sustain the improvement seen in the second quarter into the second half of the year, driven primarily by pricing but also by moderating supply chain costs. The company’s outlook for full year operating margins remains at 23% to 23.5%, while the revised full year EPS range is now $2.70 to $2.80.

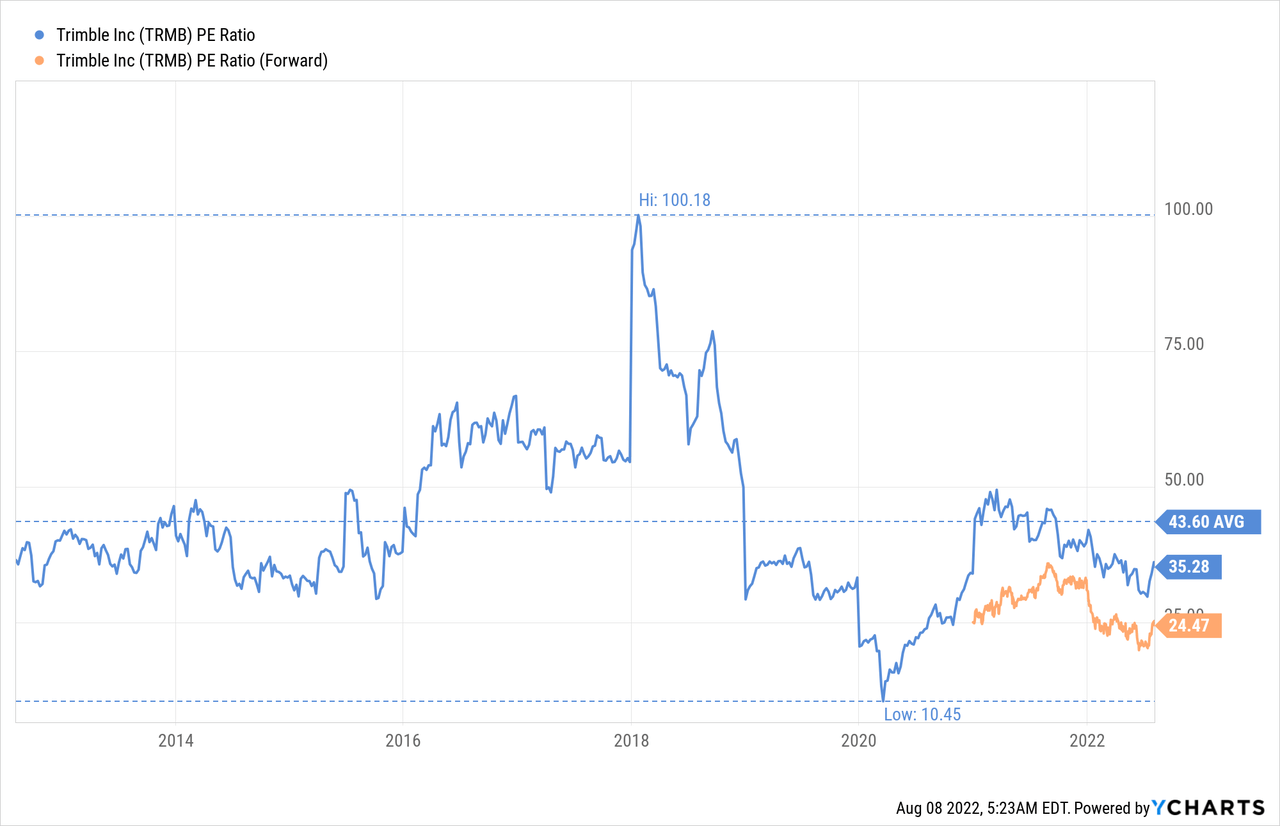

Valuation

We continue to believe that shares are cheap. We went into a lot more details on the valuation in a previous article. So here we’ll just show the updated graph of the price/earnings ratio and the forward p/e ratio, and note that shares remain significantly below the ten-year average. This is despite accelerating ARR growth and a greater mix of the much more attractive recurring revenue, vs. a higher mix of hardware sales in the past.

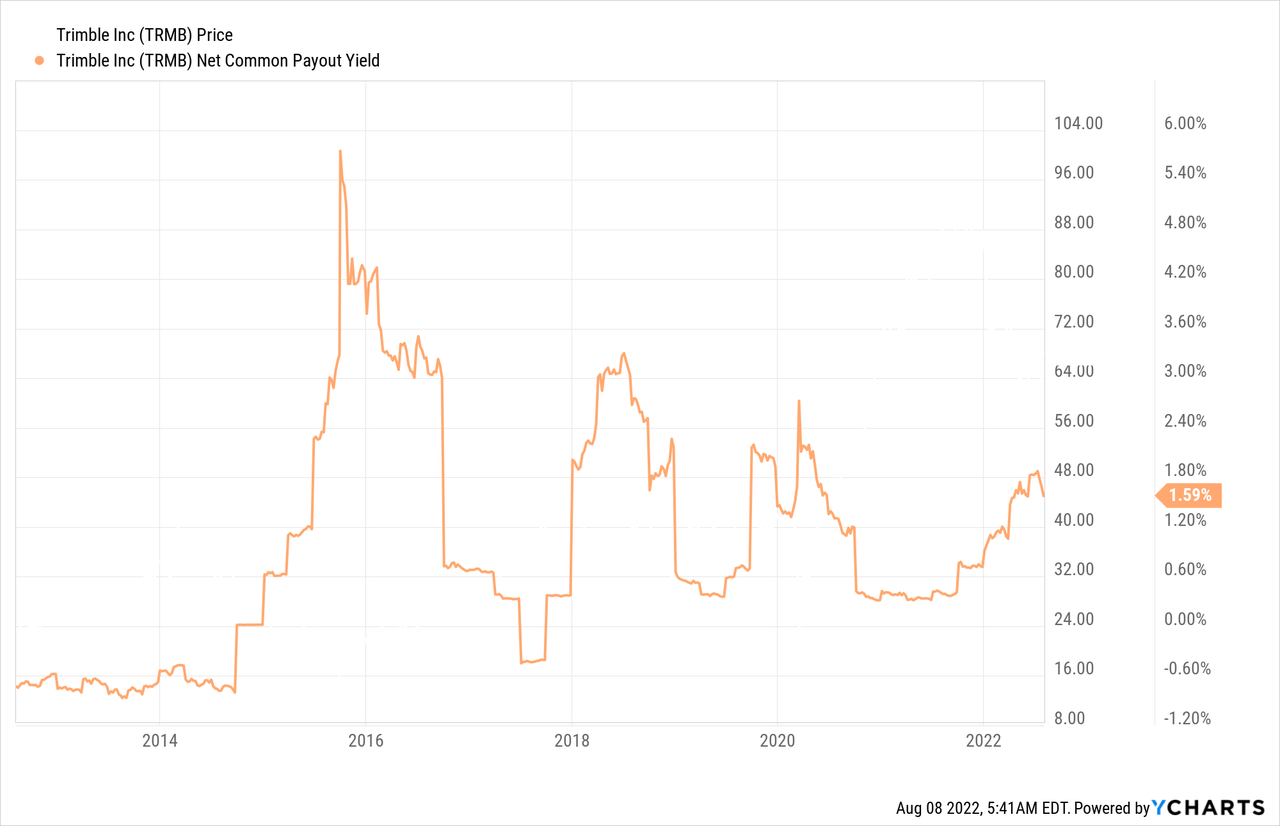

The company appears to see value in the shares too, as they have recently ramped up share buybacks, as can be seen with the Net Common Payout Yield.

Risks

The biggest risk we currently see for Trimble is a recession, but the company seems to be well positioned to survive it if it comes. The balance sheet is strong, recurring revenue is a bigger part of the business, and the company remains well diversified geographically.

Conclusion

Trimble reported another solid quarter, with ARR growing at a very healthy pace, but diluted earnings per share were slightly lower than the previous year. The company continues to be focused on growing recurring and software revenues, as seen by its decision to exit five hardware businesses during the quarter. Management sounded confident that business conditions remain healthy, but that if a recession arrives, the company is well-equipped to navigate through it. Shares continue to look cheap, and the company appears to agree, since it is buying back shares in a significant way.

Be the first to comment