Eric Broder Van Dyke

‘Tis the season for ghosts and ghouls. In which case, my long-term readers knew this article was coming.

Every year around this time, I like to give the big kids a fair share of treats. Why should the little ones have all the fun, after all?

Don’t we deserve something too – especially after we walked the kiddos around to get those piles of sweet stuff? And then they go and try to delegate how much of “their” candy you’re allowed to eat?

As the father of five, I’m going to tell you… Not on my watch. On my watch, there’s something for everyone.

Of course, once my grandson hits the candy-eating stage, I might have to rethink my position. But we’ll save that for then.

For now, I’ll only issue a quick caution despite my stance of everyone being able to enjoy Halloween equally. Because there are a few differences between the kind of enjoyment the kiddos get from their candy hoards and the opportunities I’m writing about today.

This brings to an article I’m writing now, “Trick or Treat, These Are Some Spooky REITs.” There, I note how kids always know which houses aren’t worth stopping at.

So while we’re exploring the profit potential of the real estate investment trust (“REIT”) world… shouldn’t we be just as savvy?

Considering the stakes, it seems safe to say we should be even more so.

The Danger Is Real

Here’s a bit of that “Spooky” article I’m working on now:

“There’s always that house you knew wasn’t worth the trek when you were a kid trick-or-treating.

“Maybe it was the dentist who gave out toothbrushes… Or the miserly neighbor who would give out old candy that he’d gotten on markdown.

“Or, worse yet, it was THAT house: the one you and all your friends would whisper about. The one with the creepy woman who had a wart on her nose.”

Of course, life does go on – quite easily, in fact – if you get a toothbrush or two in your bag of loot. And one stale Twix or bag of Runts isn’t going to kill anyone either.

As for the woman with the wart, everyone has their physical flaws. Contrary to the scary movies’ mantra, that doesn’t automatically make you a threat.

“But the adult world is filled with much more dangerous cases of bait-and-switch. As mentioned earlier – something we all know far too well to some degree or another – that includes in the stock market.”

Clearly, we want to avoid companies that aren’t well-managed or are poorly placed. We also want to reject any opportunities that are overpriced, even if they’re extremely desirable in every other regard.

Once their stock prices tumble – and they inevitably will – shareholders who bought in at the wrong time are left tricked out of their treats. When we buy in at fair value or, even better, below, our returns are much safer.

Fortunately, there’s still a lot left to enjoy after we’ve strategically selected our route around the investment neighborhood.

But So Is the Upside

So what kind of Halloween goodies are we looking for right now?

As implied above, we want well-managed companies that are well-placed to take on the current economy… and whatever further issues we’re headed into.

This brings me back to my “Spooky REIT” article, which added:

“This is hardly a Halloween quote, but I’m still going to reference it since it’s relevant in October. And November… December… January… February…

“As well as every other month of the year. ‘A rising tide lifts all boats’ no matter what season it is.”

I fully understand that finding the boats that will stay afloat even when the storm sets in isn’t so easy. It requires time, energy, and know-how.

You have to investigate each company, being careful to consider a wide array of questions – and demand appropriate answers. For instance, what are these REITs’ funds from operations numbers showing?

And what is FFO anyway?

Plus, even once you do all that work, there are no guarantees that what you bite into won’t leave you sick to your stomach anyway. I always want to make that very clear.

I have recommended some stinkers before, no matter that I spend hours poring over the data available. And with my “from the ground up” real estate insider understanding, too.

But, my track record speaks for itself in that I’ve uncovered many, many more wins – more than enough to cover the losses. So, no, there are no guarantees out there in the stock market, only varying degrees of certainty.

And I’m very certain that the following companies can overcome any mischief this month. Or in the months to come.

A Picture To Remember…

As you can see below, this is a ramp:

This could be useful for backing up the truck if you decide to purchase shares in the four REITs that I’m highlighting.

Besides that, I thought that by using the “ramp” analogy you could remember the name of four of my favorite REITs…

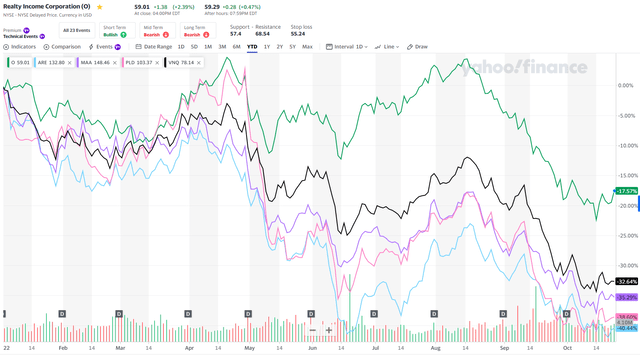

Yahoo Finance (O is in green, VNQ is in black, MAA is in purple, PLD is in pink, ARE is in blue)

Why are these four REITs my favorite?

Two words: Quality + Value

Let’s take a closer look at these fab four REITs…

Realty Income Corporation

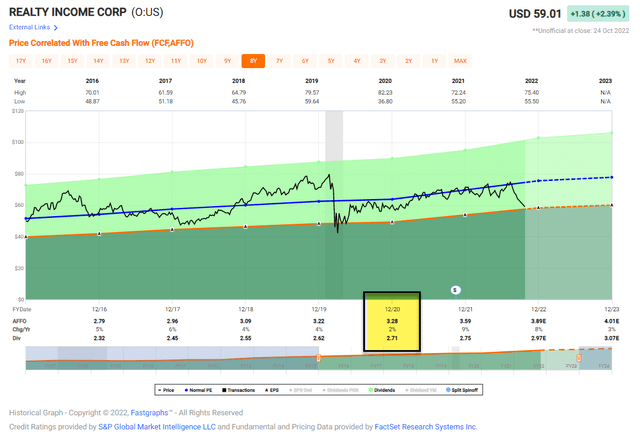

Realty shares are down around -18% year-to-date and including dividends, shares have returned around -14%.

That’s certainly not typical for this REIT that I consider one of the most predictable performers in our coverage spectrum.

In 2021, the company returned over 23%, and in 2020 shares returned around -12%. However, during normal times, and for example, from 2010-2019, shares returned an average of 13%.

Now we all know that the primary overhang for this high-quality blue chip is rising rates, and specifically the fear that the company will not be able to grow earnings and dividends due to a higher cost of capital.

I find that myth to be somewhat long in the tooth…

Realty has been preparing for rising rates for over a decade, so it’s not like some sort of “black swan” event that caught the management team off guard.

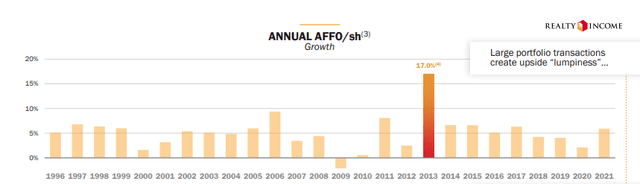

In fact, the black swan that nobody predicted was Covid-19, and just take a look at the graph below to illustrate how Realty was impacted in 2020:

As you can see, this REIT took a lick’n and kept on tick’n…

In other words, its AFFO (adjusted funds from operations) kept growing in one of the worse economic meltdowns in history…

What about the upcoming “garden-style” recession?

Realty has a massive portfolio of over 11,000 properties, and many of its clients have non-discretionary, low price point, and / or service-oriented components to their business. This helps the company mitigate recession risks and in fact, Realty has managed to grow earnings 25 out of 26 years.

I just don’t see that trend coming to an end, anytime soon.

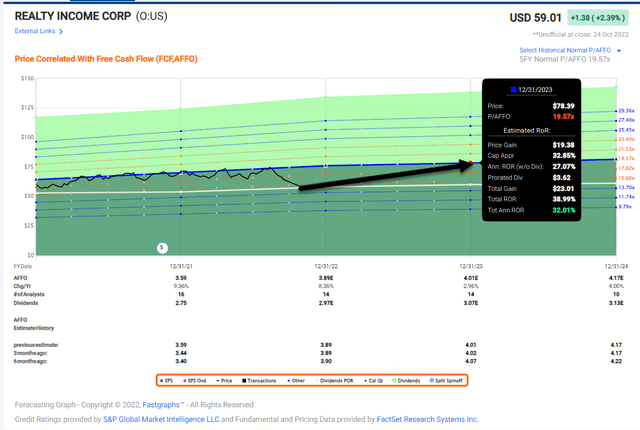

Realty scores a perfect quality score (of 100), and we find shares attractive today, based on a P/AFFO multiple of 15.4x and dividend yield of 5.2%.

Could they get cheaper?

You’re guess is as good as mine, but I know that I will be backing up the truck, if and when that happens. Meanwhile, I’m adding more to my kids’ college accounts on a very frequent basis.

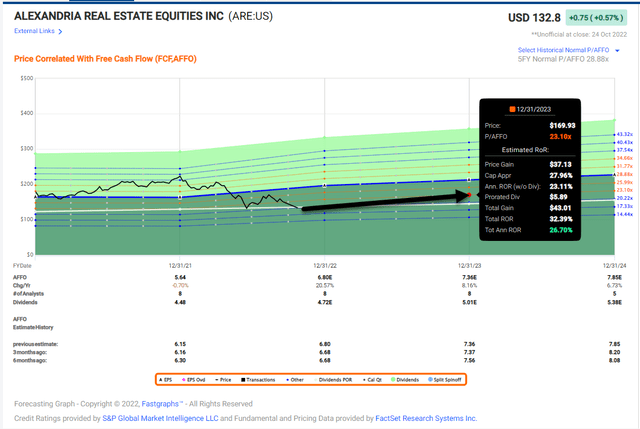

Alexandria Real Estate Equities, Inc.

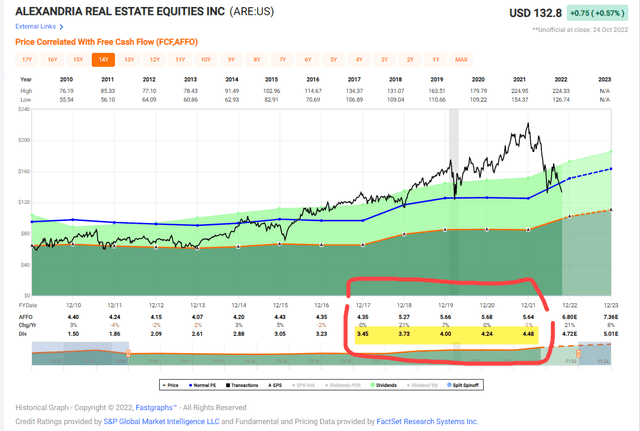

Alexandria shares are down -40% year-to-date and including dividends, shares have returned ~ -38%.

That’s a big difference from the performance in 2021, when the life science landlord returned ~28%. Even during 2020, shares returned around 14%. And from 2010 – 2010 shares returned an average of 11.4%.

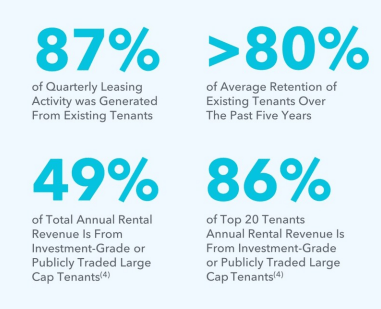

Alexandria’s differentiated business model is also rooted in predictable cash flows from investment-grade or publicly traded large cap tenants.

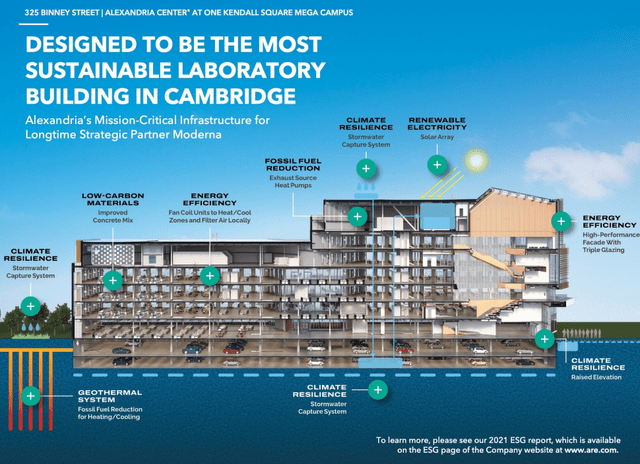

The REIT has deep strategic relationships with some of the world’s leading companies, such as Moderna, which leased over 1 million square feet with Alexandria during 2021, including the largest life science lease in the company’s history aggregating 462,100 RSF.

Alexandria has over 1,000 tenants that drive its very stable and predictable business model:

ARE Supplemental

The company’s solid leasing activity continues to surpass is quarterly averages. During Q3-22 the company completed 1,7 million square feet of leasing activity – 87% of which was generated from the roster of over 1,000 tenants.

Also, same property NOI (cash basis) growth was 10.6% in Q3022 that represents the third highest quarter in company history.

The company has demonstrated solid and consistent dividend growth hat has resulted in dividend increases of around 6.5% annually over the least five years.

Additionally, the company has generated $1.3 billion of cash flows from operating activities after dividends retained for reinvestment.

Once more, Alexandria scores a perfect 100 out of 100.

While shares are trading at a discount – with a P/AFFO of 20.1x and dividend yield of 3.6%. Meanwhile, analysts (8) are forecasting growth of 8% in 2023.

Excluding 2021 – which was clearly an outlier year for life science firms – we believe Alexandria deserves a valuation of at least 23x, which translates into a 25% 12-month total return target for iREIT.

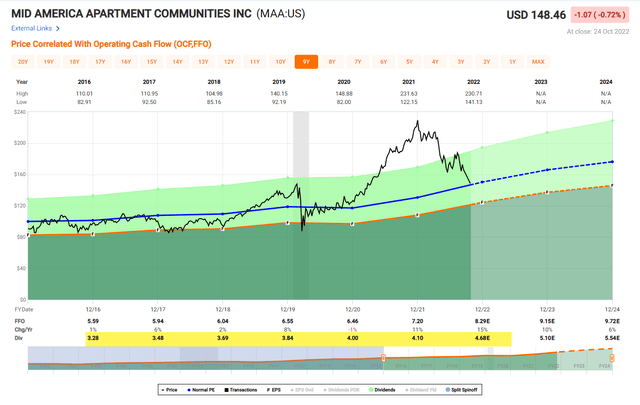

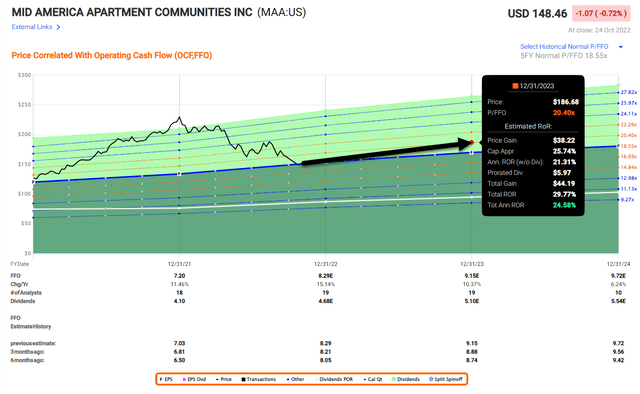

Mid-America Apartment Communities, Inc.

Mid-America Apartment shares are down -33% year-to-date and including dividends shares have returned -31%.

That’s a big difference from 2021 when Mid-America returned a whopping 84% during 2020 shares were virtually flat.

One of the great things about owning apartment REITs is that you are much better positioned during inflation because of pricing power. Remember, rentals are generally 12-months so the landlord can bump the rent faster than most other property sectors.

One key differentiator for Mid-America is its Sunbelt focus in which the company is able to capture benefits of high growth and demand. The company’s diversification within the Sunbelt mitigates periodic supply-side pressures and also drives superior full cycle performance.

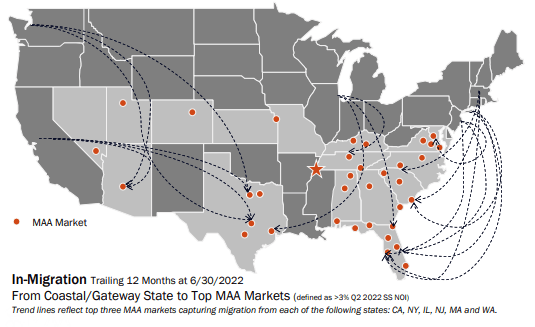

Migration trends are important, especially when you consider the surge in population shifts away from peer coastal and gateway states to Sunbelt markets. Over 50% of move-ins for Mid-America are from non-MAA states (CA, NY, IL, NJ, MA, and WA).

Mid-America Investor Presentation

In addition, supply deliveries for 2022 remain relatively consistent to slightly below 2021 levels and deliveries are above historical averages.

It’s unlikely that new supply can catch up with the housing shortage in the near term. Also, escalating development costs, higher construction costs and supply chain challenges will continue to pressure new supply.

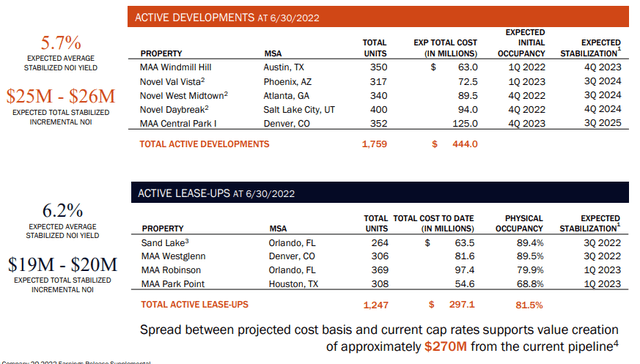

Also, Mid-America has an established history of disciplined capital deployment that will govern growth through new development.

The REIT owns/controls land sites in Denver, Tampa, Orlando and Raleigh; and is negotiating potential pre-purchase opportunities in Salt Lake City and Charlotte.

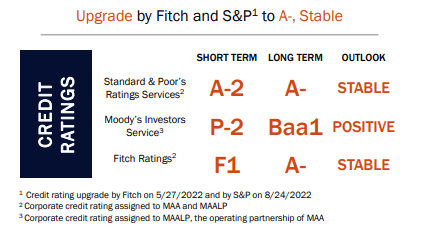

Mid-America Investor Presentation

Much like the other two REITs I already mentioned, Mid-America generates consistent and compounding Core FFO and dividend growth driven by its high-quality earnings stream. The company has a strong dividend track record with steady growth and well-covered dividend.

Mid-America scores a 99 out of 100, based on quality, which puts the company in an elite classification.

We admire the management team for maintaining a strong, investment-grade balance sheet so the company is positioned to pursue new growth opportunities. The recent ratings upgrades reflect continued strength.

Mid-America Investor Presentation

We sold our shares in Mid-America when shares hit extreme levels, and now we get another bite at the apple.

Shares are currently trading at 18.4x (in-line) with a dividend yield of 3.4%. While this is no bargain, we’re most attracted with the growth prospects in which analysts are forecasting FFO per share to increase by 10% in 2023.

Once again, the built-in pricing power is advantageous, and we believe this REIT is well-positioned to continue to deliver steady, reliable, and predictable profits for quite some time.

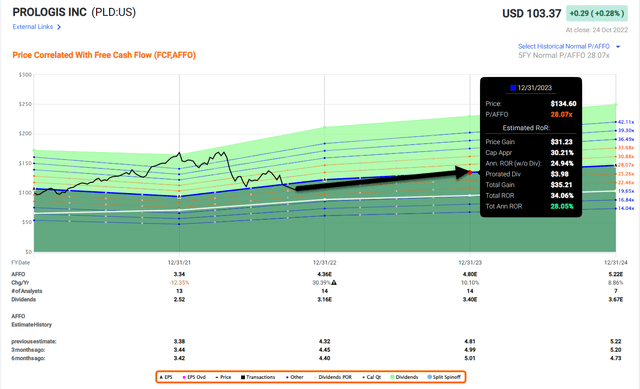

Prologis, Inc.

Prologis shares are down around -38% year-to-date and including dividends, shares have returned around -36%.

Why?

You would think that a super-powered logistics landlord would be climbing to new highs right now…Besides, in 2021 the company returned a whopping 76%.

Much of the pullback YTD has to do with the fear of rising rates, which is expected given the fact that REITs seem to always get categorized as bonds – at least in the eyes of Mr. Market.

Another force driving down shares in Prologis has to do with the e-commerce headwinds, as FedEx (FDX) has telegraphed global volume softness with possible real estate rationalization.

This is a potentially significant headwind for industrial fundamentals if it represents a cyclical downturn with other logistics providers, although that’s not just being reflected in Prologis’ most recent quarterly results.

In Q3-22 the company reported Core FFO/sh of $1.73, $0.07 above the Street. This beat was primarily driven by $0.03 of stronger core operating results and an $0.08 FX benefit.

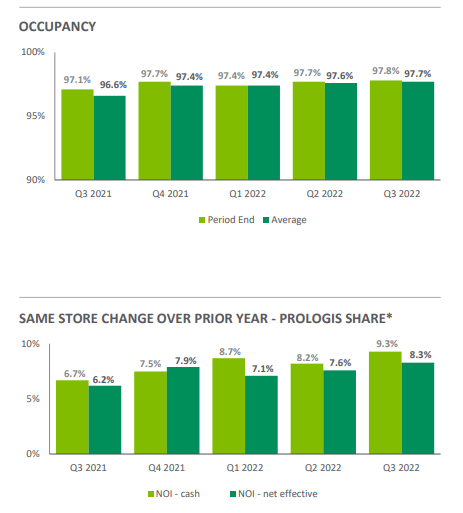

Also, Q3-22 operating fundamentals remain robust, with occupancy and SSNOI growth at record levels, embedded MTM increased to 62%, and monthly lease proposals and lease gestation periods recovered from Q2-222 levels.

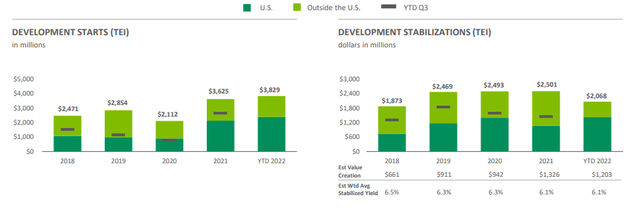

During the quarter, Prologis acquired $673.2 million of properties at a 4.2% cap rate and contributed $127.4 million at 3.7% (the company did not have any third-party dispositions in Q3).

It also started ~$1.1 billion of new developments, 52.8% of which were build-to-suit (up from 25.6% in q2). The company’s development pipeline includes ~$6.4 billion of total investment (up 24.7% vs. Q3-21) with a weighted average yield of 6.1% (up 30 bps sequentially).

Prologis expects its development pipeline to grow by another ~$1.5 billion with the Duke Realty acquisition that closed on 10/3/22.

In Q3-22 Prologis grew GAAP SSNOI 8.3% (a company record) as quarter-end occupancy increased 140 bps y-o-y, to 97.8% and GAAP leasing spreads were positive 48.4% (59.7% at PLD’s share).

Over the past 12 months, Prologis has completed 182.1 million SF of new and renewal leasing, 11.9% higher than the prior period. Q3-22 turnover costs of $2.69/ SF per year were (5.9%) lower than the company’s trailing four-quarter average and have steadily declined as a percent of lease value, from a peak of 8.9% in Q3-21 to 6.8% in Q3-22.

Prologis Supplemental

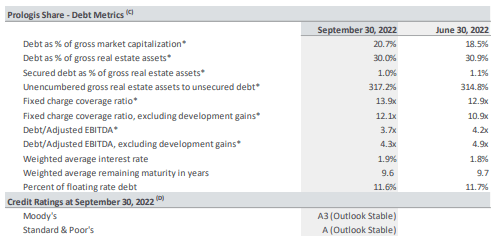

Prologis scores a perfect 100 out of 100 based on quality and of course this score is powered by the A-rating and impressive strength of the balance sheet.

In Q3-22 the balance sheet remains strong with 4.3x Debt/Adj. EBITDA excluding development gains (-60bps q/q). During the quarter the company and its JVs issued $3.1 billion of debt at a weighted average rate of 3.6%. With $5.3 billion in cash and availability, the company noted its ability to be opportunistic.

Prologis Supplemental

Shares are currently trading at 24.8x P/AFFO with a dividend yield of 3.1%. Over the last five years shares have traded at an average P/AFFO multiple of 27.1x. In addition, analysts are forecasting growth (in AFFO per share) of 10% in 2023 and 9% in 2024.

This puts shares in Strong Buy territory!

In Closing…

What’s your favorite REIT treat?

I may come out with a higher yielding trick-or-treat list in a few days, but for most investors, I think the list I provided in this article is perfect.

There’s no reason to get too cute right now, and I encourage all readers to focus on quality…

Remember, the cream always rises to the top!

Happy REIT Investing…

PS: No Tricks, Just Treats (Stay Tuned for some “Spooky REITs”)

PSS: Correct answer is “D” – Charlie Brown got a Rock

Be the first to comment