Prostock-Studio

Tremor International Ltd (NASDAQ:TRMR) recently announced meaningful acquisitions, and expects an impressive increase in video reach and an increase in the number of clients. The expectations of investment analysts appear completely disconnected from the current valuation of the stock. In my view, more acquisitions, larger data sets, and supply path optimization would lead to free cash flow generation. Under a basic discounted cash flow model, the implied fair price is more valuable than the market price, and the downside risk is limited.

Tremor International

Tremor International sells access to a video-first platform so that clients can run advertising campaigns for brands and different media groups.

I believe that the company is quite interesting because of the data it controls. However, the company has also signed several acquisitions that may make the group much more valued in the coming years.

In line with the previous words, the most interesting factor came out in the most recent quarterly report. Tremor entered into a definitive agreement to acquire Amobee. It is currently expanding its CTV and video reach, and is repurchasing a sizable number of shares.

Source: Tremor International Ltd. Second Quarter 2022 Earnings Call

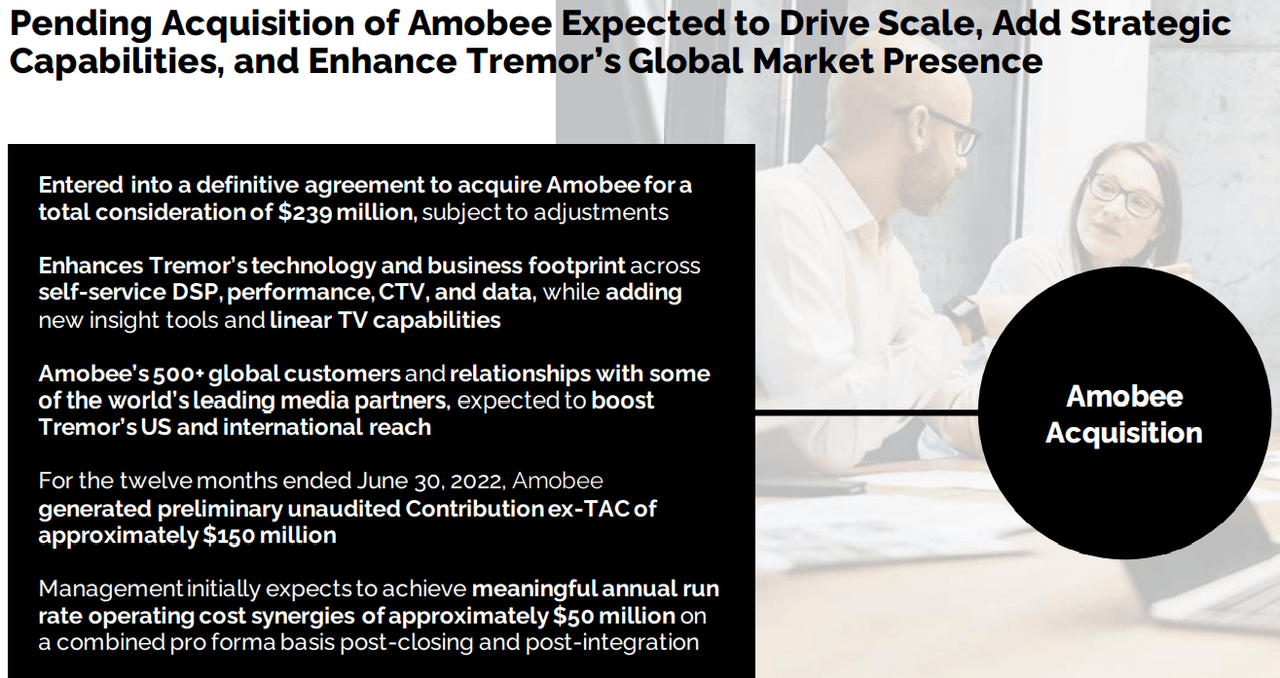

I also appreciate the level of transparency offered about the most recent transaction signed. The acquisition of Amobee Is expected to add strategic capabilities and enhance global market presence. In addition, we can expect an increase in the customer base as Amobee could bring around 500 global customers. Finally, let’s note that the company expects a meaningful annual run rate operating cost synergies of approximately $50 million.

Source: Tremor International Ltd. Second Quarter 2022 Earnings Call

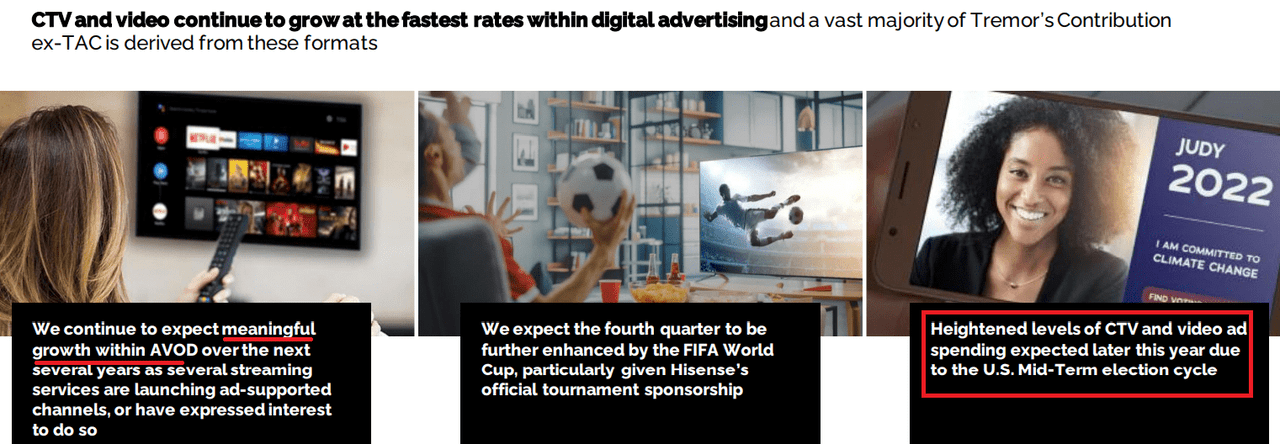

In my view, we are about to see significant improvement in the company’s figures. Tremor expects meaningful growth within AVOD over the next few years as new streaming services are launched. Besides, improvement in video ad expansion can be expected for the fourth quarter thanks to the U.S. Mid-Term election cycle.

Source: Tremor International Ltd. Second Quarter 2022 Earnings Call

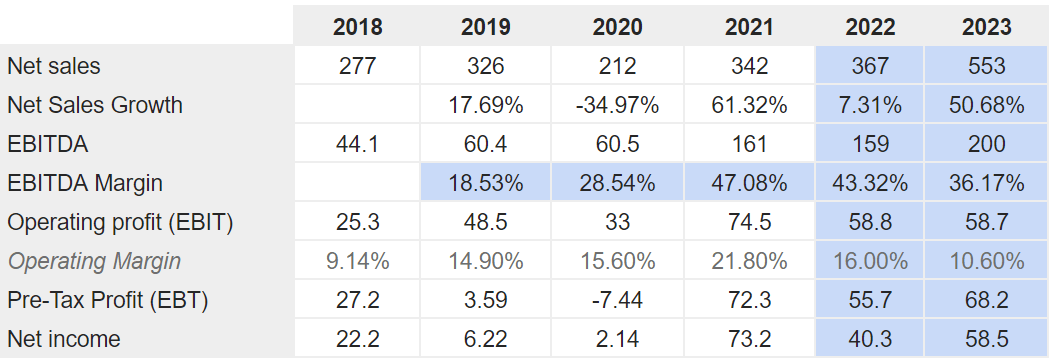

Impressive Sales Growth Expected By Analysts For 2023, Growing Net Income, And Double Digit EBITDA Margin

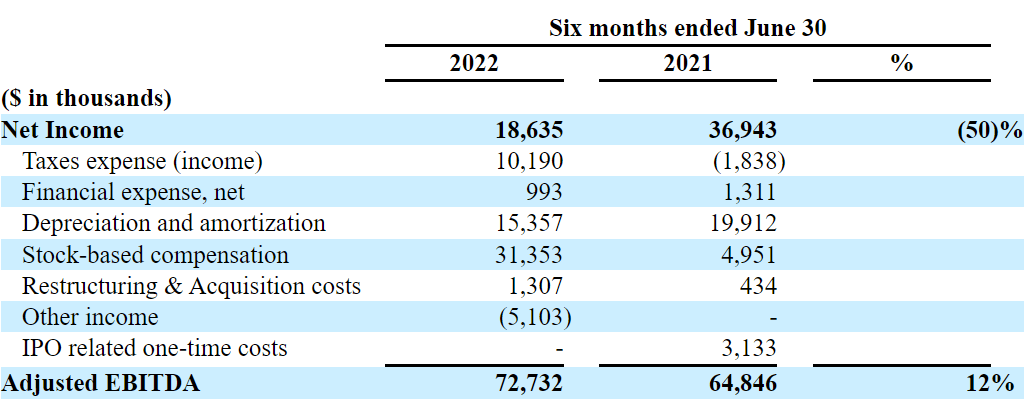

Tremor’s figures are expected to get better in 2023 and 2024. Let’s explain the most recent report before we go to the future of Tremor. For the six months ended June 30, 2022, a net income of $18 million was obtained, and tax expense was $10.19 million with small financial expenses of $0.9 million. Depreciation and amortization was close to $15 million, with stock based compensation of $31 million and some restructuring & acquisition costs worth $1.3 million. The other income was $5.103 million with an adjusted EBITDA of $72.7 million.

Source: Last Quarterly Report

For 2023, estimates include net sales of $553 million with a sales growth of 50.68%. Regarding EBITDA, analysts expect $200 million, with an EBITDA margin of 36%, an operating profit of $58.7 million, and an operating margin of 10.60%. Pre-tax profit would stand at $68.2 million with a net income of $58.5 million. In my view, stock demand would increase if Tremor really delivers such impressive financial performance.

Source: MarketScreener.com

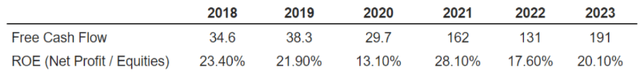

Investment analysts also estimate that the ROE will likely be close to 20.10%, and 2023 FCF would reach $191 million, 45% more than that in 2022.

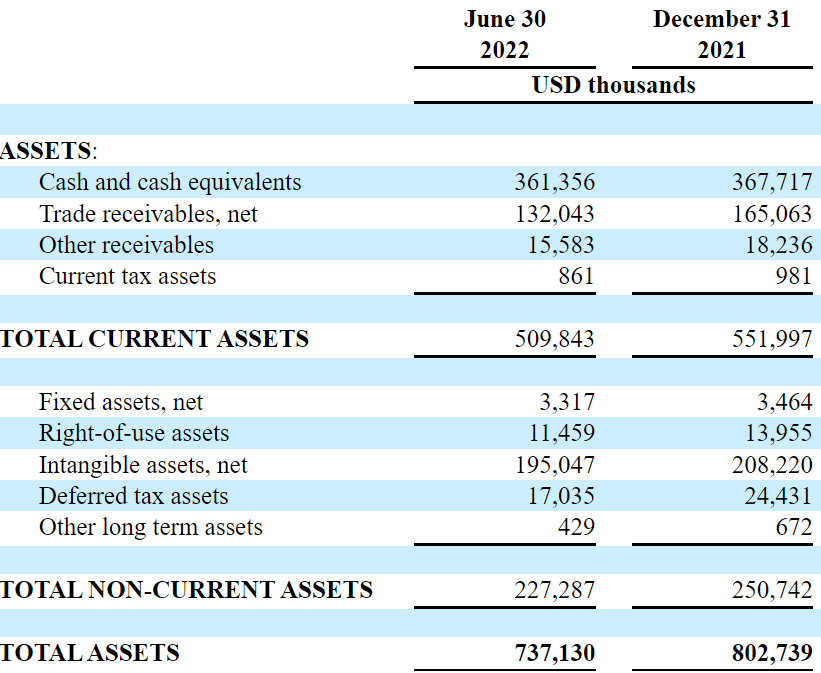

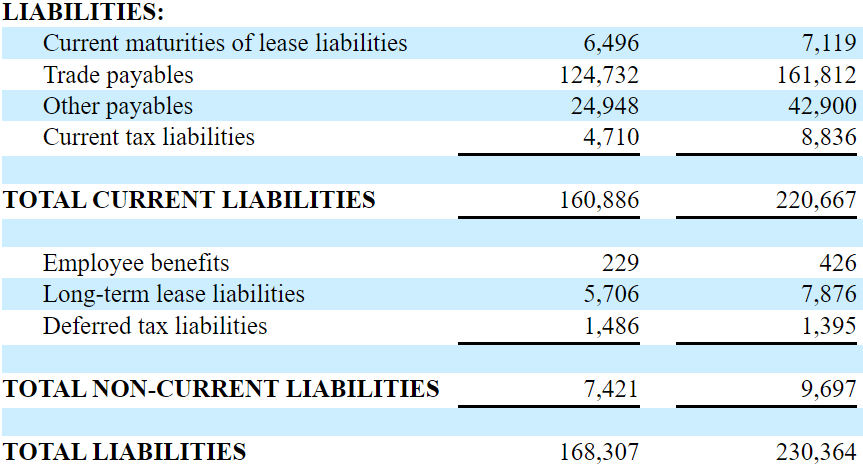

Balance Sheet

As of June 30, 2022, Tremor International reported cash and cash equivalents of $361.356 million, with a receivable trade of $132.043 million. The company’s balance sheet appears to have a significant amount of liquidity, with total current assets of $509 million. The most relevant non-current assets were intangible assets of $195.043 million and deferred tax assets of $17.035 million. The total assets stand at $737 million, and the asset/liability ratio is equal to 4x, so I wouldn’t worry about the company’s total list of liabilities.

Source: Last Quarterly Report

With regard to the list of liabilities, the current maturities of lease liabilities is worth $6.496 million, with trade payables worth $124.732 million and the total current liabilities worth $160.886 million. Finally, long term lease liabilities are worth $5.7 million, and total liabilities stand at $168.307 million. Notice that the company does not seem to have financial debt.

Source: Last Quarterly Report

Base Case Scenario

Without having a look at the company’s stock performance, I believe that Tremor’s strategy appears smart. Tremor is currently acquiring different targets, and building a platform rich in data. As a result, management believes that efficiency and supply path optimization could offer one of the best options for customers. Considering the expectations of other investment analysts, I believe that many in the market are expecting Tremor’s business strategy to work out. The following lines are from the last annual report:

Our strong focus on product development and successful integration of multiple key acquisitions over the past few years has resulted in a vast, intuitive, and data-driven platform with the ability to service a wide variety of customers across almost all digital channels. We firmly believe that end-to-end is the most efficient operating model in the industry, providing simplicity, greater reach and usage of data, improved supply path optimisation, and increased transparency, all of which enhance returns for customers.

I also believe that Tremor could be significantly profitable thanks to CTV and Programmatic activity. I really celebrate that management noted in the annual report that investments are going in this direction:

We intend to further capitalise on the rapidly expanding marketplace within which we operate, with our core growth engines remaining focused around CTV and Programmatic activity, such as PMP and self-serve platforms.

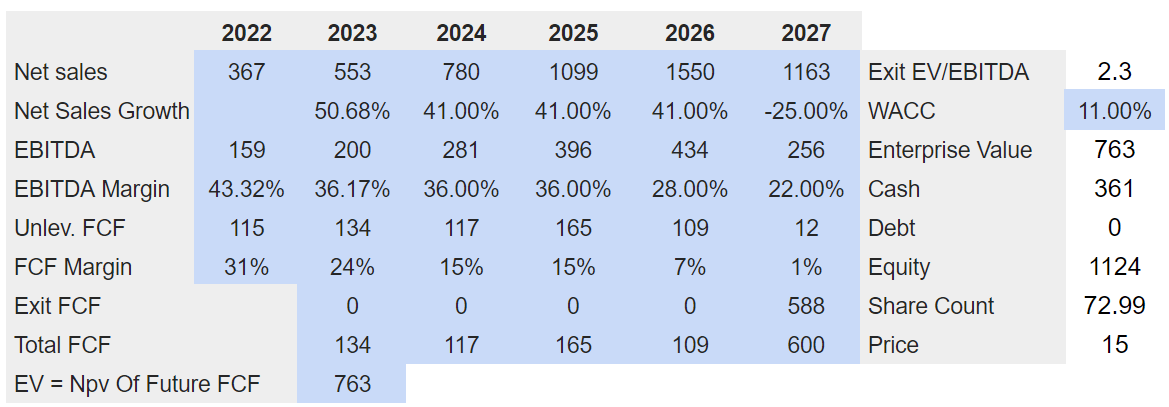

Under this case scenario, I assumed that the company will grow at a rate close to that of the target market. According to market experts, the global digital video advertising market could grow at close to 41.1% until 2027. It is quite an impressive growth rate:

The global digital video advertising market size to be valued at USD 292.4 billion by 2027 and is expected to grow at a compound annual growth rate of 41.1% during the forecast period. Technological advancements and changing consumer behavior have propagated advertisers to adopt innovative ways of digital video advertising.

Experts believe that social media and other applications are making the use of video to advertise more and more popular. I assume that they are not wrong. I believe that many things that we do today online could be made much easier through online video. In this particular case, Tremor would most likely make a lot of money.

There is a growing trend amongst individuals to adopt visual media via platforms other than traditional cable and satellite TVs. Over The Top media platforms, and social media applications are enabling advertisers to enhance their service delivery methodologies to offer new revenue channels for marketers and broadcasters.

Under the previous conditions, I designed a discounted cash flow model that includes sales growth close to 41%, EBITDA margin around 36%-22%, and 2026 FCF margin of 7%. The results include unlevered free cash flow between $115 million and $12 million, with a discount of 11% and an exit multiple of 2.3x, and implied fair price close to $14-$15.

Source:Author’s Work

I Don’t Believe That The Downside Risk Is That Significant

On many occasions, Tremor made investments without a clear idea of when it will get paid or find advertisers. It talked about this issue in the annual report. If management has difficulties in making such financial projections, I don’t think the projections of financial analysts out there can be that credible. Under this scenario, I assumed that some of the company’s investments may fail, which would lead to less free cash flow than expected. As a result, I believe that the stock price could fall.

We often have long sales cycles, which can result in significant time and investment between initial contact with a prospect and execution of an agreement with an advertiser or publisher, making it difficult to project when, if at all, we will obtain new advertisers or publisher and when we will generate revenue from them.

Changes in the current data protection regulations could affect the company’s future revenue growth and EBITDA margins. Management may have to pay more to control and assess data owned about viewers, clients, or employees. As a result, Tremor’s free cash flow would be lower than expected, which would drive the stock price down.

We are subject to laws and regulations related to data privacy, data protection and information security and consumer protection across different markets where we conduct our business, including in the United States, the European Economic Area and the United Kingdom and industry requirements and such laws, regulations and industry requirements are constantly evolving and changing.

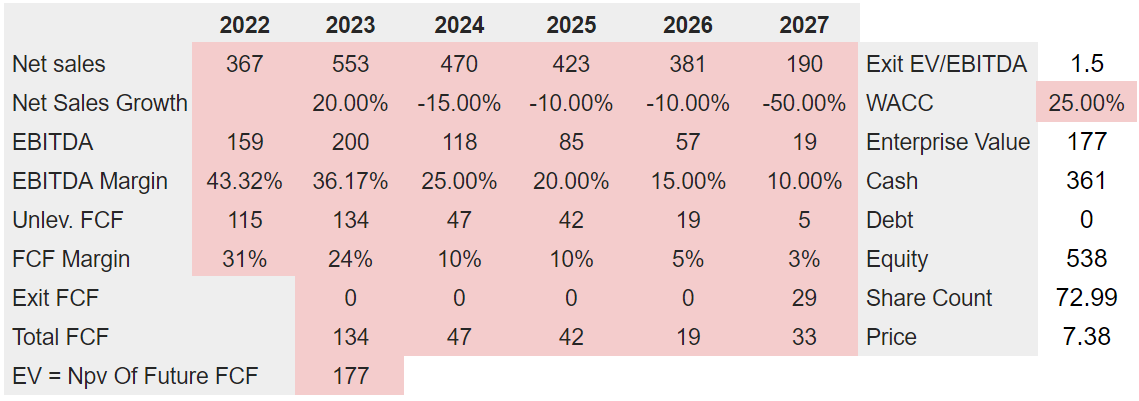

Under the previous conditions, I included bearish net sales growth around -15% and -50%. Also, with 2024 EBITDA margin of 25% and FCF margin between 24% and 3%, the implied equity valuation would be $960 million. Finally, if we also include an EV/EBITDA multiple of 1.5x and a discount of 25%, the fair price would stand at close to 7.38%, and the equity would be equal to $538 million.

Source:Author’s Work

Conclusion

Tremor International recently signed a new acquisition, which may increase the customer base, and announced improvements in the CTV and video reach. Investment analysts are expecting double-digit sales growth and double-digit EBITDA margins. I don’t really see how the current stock price makes sense. Under very conservative assumptions about future free cash flow generation, I believe that the fair price is significantly higher than the current market price. I even considered a case scenario with very bearish assumptions, which didn’t turn out to result in a large downside risk.

Be the first to comment