MicroStockHub

Introduction

The investing legend, Warren Buffett has a famous saying that likens certain companies to cigar butts whereby metaphorically speaking, discarded shares can be picked up cheaply for one or two last good puffs that lead to outsized returns from an otherwise troubled company. Now the good days for Transocean (NYSE:RIG) seem like a distant memory as they have struggled to navigate the rough seas following the oil price crash back in late 2014, which saw oil companies become wary of growth. After seeing their share price down over 90% and their deep junk credit rating of only CCC-, this cigar butt analogy seems quite fitting but disappointingly, it seems prudent to sell now and leave this cigar butt to burn out.

Executive Summary & Ratings

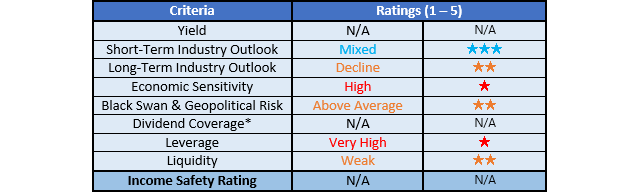

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing dividend coverage through earnings per share cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

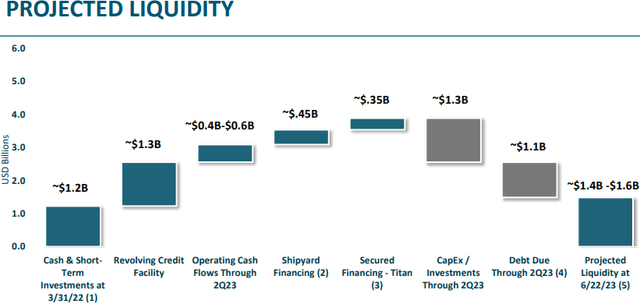

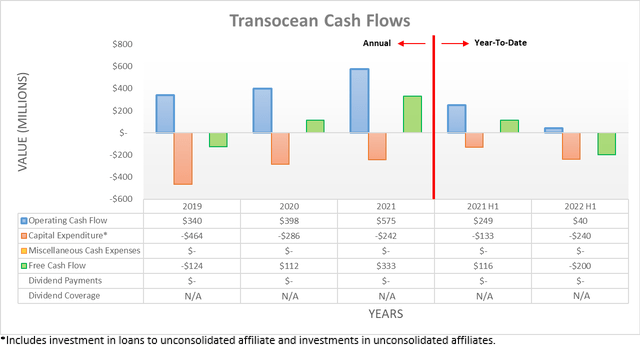

The last half-decade of suppressed oil investment was particularly rough, although to Transocean’s credit they still managed to generate $575m of operating cash flow during 2021, which gave rise to $333m of free cash flow thanks to their relatively low capital expenditure of only $242m. Disappointingly, thus far 2022 saw minimal operating cash flow with a result of only $40m for the first half, which is down massively from their previous result of $249m during the first half of 2021. Even if removing the impacts of their temporary working capital movements, their underlying operating cash flow during the first half of 2022 only increases to $258m and thus once again, materially below their previous equivalent result of $331m from the first half of 2021. When looking ahead this does not appear poised to improve, as there is a very concerning guidance contained within their projected liquidity from the end of the first quarter of 2022 to almost the end of the second quarter of 2023, as the graph included below displays.

Transocean June 2022 Investors Presentation

If initially glancing past quickly, it seems to show their liquidity improving across the next year as the final number on the right at the 22nd of June 2023 is higher than the beginning number on the left at the 31st of March 2022 but alas, the way the graph is presented skews this view. In my opinion, it seems dubious to separate their circa $1.3b of credit facility availability from their cash and short-term investments balance at the beginning but leave them combined at the end. Unlike the other various moving parts, their credit facility availability is not a new additional inflow or outflow but rather a pre-existing source of liquidity as of the 31st March 2022. If included within their cash and short-term investments to display their total liquidity at the beginning, it would have been circa $2.5b and thus the ending would have actually shown their liquidity draining to only circa $1.5b at the midpoint.

I am not suggesting management engaged in anything misleading from a legal standpoint, although in my view, their graph would have been better titled along the lines of “projected liquidity drain” or when looking deeper into their numbers, “projected cash burn”. If ignoring the items pertaining to their financing sources, such as the $450m of shipyard financing and instead focusing on the cash inflows and outflows from their operations, the implied guidance is very concerning. Despite operating conditions for the oil industry reaching their best point in a decade, they are still only forecasting their operating cash flow to total $500m at the midpoint, which is lackluster given that 2021 saw a result of $575m. Meanwhile, their capital expenditure is forecast to climb to $1.3b, which is well ahead of their level of sub-$300m from 2020-2021 and thus they are effectively forecasting free cash flow of negative $800m. Since the second quarter of 2022 already saw $78m of negative free cash flow, this implies that the next twelve months should see a cash burn of slightly over $700m.

To make this even more concerning, their guidance was formulated in June 2022, which as a reminder saw oil prices well above $100 per barrel before recession fears gripped markets. Since then oil prices have been pushed back to circa $90 per barrel, and unless economic activity starts looking more positive, it is likely to make oil companies even warier of investing to increase production and thus create a headwind that could ultimately see them struggle to even meet this lackluster operating cash flow guidance.

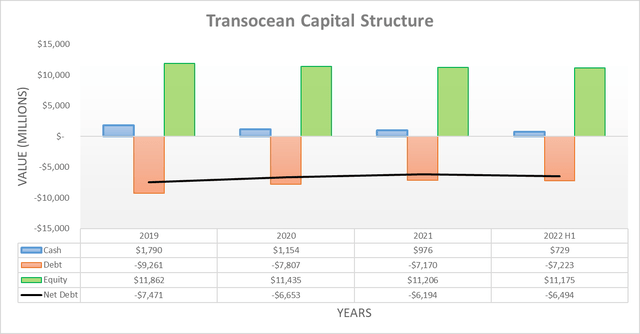

Despite their shareholders enduring years with no dividends, sadly, this pain was largely in vain as they remain overleveraged with their net debt currently sitting at $6.494b. Even though this was a decrease versus where it ended 2019 at $7.471b, if their guidance comes to fruition, it seems that their net debt is going to keep marching higher during the next twelve months and once again climb back over the $7b mark, thereby reversing out years of hard work. Suffice to say, their leverage is clearly within the very high territory given their minimal operating cash flow that pales in comparison to their net debt, which makes assessing their leverage in detail redundant, as the outcome is abundantly clear, especially as their liquidity is far more important in this situation.

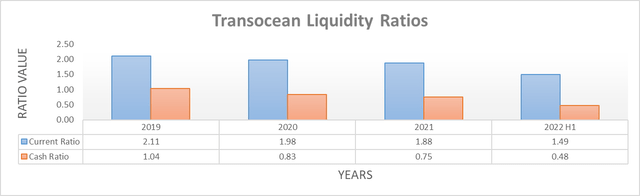

On the surface, their liquidity actually appears surprisingly good with their current ratio sitting at 1.49 and their cash ratio following along at 0.48. Although, this rapidly changes when overlaying other considerations, in fact, instead of being strong as these ratios would suggest, their liquidity is actually weak for two issues, the first of which relates to their credit facility.

If thinking back to earlier in the analysis, remember their $1.3b of credit facility availability as of June 2022? Well, merely one month later in July, this was subsequently reduced to only $774m through to the 22nd of June 2023, which reduces to only $600m through to the 22nd of June 2025, thereby less than half its previous level as recently as June this year. Admittedly, this comes with the benefit of extending its maturity until June 2025 versus June 2023, although this merely kicks the proverbial can down the road.

Apart from draining even more from their liquidity than was previously discussed, this sends a very bad signal that debt markets have little appetite to extend funding. When it comes to refinancing a credit facility during booming operating conditions, it is seldom problematic with lenders happy to simply roll over the facility into a new one with a later maturity. Although in this situation, their lenders are clearly less than pleased with their outlook, which is understandable given their guidance for negative free cash flow and thus as a result, it appears that they are losing support at the worst of times as monetary policy tightens at the fastest pace in many years.

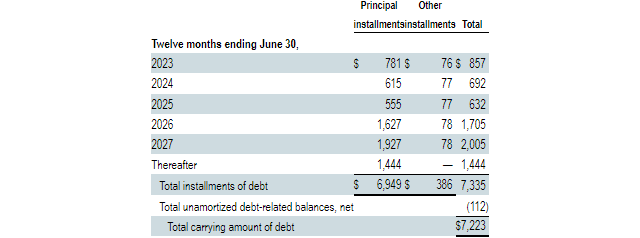

Thanks to their $729m cash balance, they should still remain a going concern during the next twelve months but when looking further afield, the pressure is simply unrelenting, which forms the second issue hindering their liquidity. Even after navigating the remainder of 2022 and 2023, once 2024 rolls around, they face another $615m of debt maturities, as the table included below displays.

Transocean Q2 2022 10-Q

Due to their forecast of negative free cash flow during the coming twelve months, it drains most, if not all of their cash balance. Whilst they can lean upon their credit facility to repay their 2024 debt maturities, this only buys one year of breathing room as it matures during 2025, which once again sees another $555m of additional maturities. This is already extremely concerning but to make matters worse, 2026 and 2027 see even larger maturities at $1.627b and $1.927b respectively.

Since their free cash flow peaked at only $333m during the past three years and they are seemingly forecasting no operating cash flow growth in the coming year, it seems very unlikely that they can generate enough free cash flow to repay this debt. Since their lenders significantly slashed their credit facility availability, it seems reasonable to assume that debt refinancing elsewhere is not going to be smooth and likely, completely off the table, in my opinion. If offshore drilling sees a sustained recovery, perhaps debt markets may become more accommodating but given the short-term economic risks and long-term clean energy risks, this is a very risky notion to stake an investment upon.

Conclusion

Anything is possible, although the odds do not appear to be stacked favorably for investors seeking a metaphorical cigar butt as there are far too many negative fundamentals. Apart from facing the same long-term threats as everyone in their industry from the clean energy transition, they also have to transverse an unrelenting wave of debt maturities in an era of tighter monetary policy, whilst also simultaneously increasing capital expenditure, which sees them potentially losing support from their lenders. I am not necessarily expecting bankruptcy but at the same time, the risk is certainly possible as they deal with these debt maturities and thus I believe that a sell rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from Transocean’s SEC Filings, all calculated figures were performed by the author.

Be the first to comment