CloudVisual

Transocean Ltd.’s (NYSE:RIG) backlog increased significantly thanks to Wintershall Dea and OMV and their contract with Transocean Norge. RIG also announced $181 million in contracts for ultra-deepwater drillship Asgard. These two contracts were announced on 22 September 2022 and 6 September 2022, respectively.

The offshore sector recovery is gaining traction. If there is no full-scale economic depression, it will be successful. Oil prices also have some bullish catalysts. So, there is no need to worry too much. In my view, the debt exchange is not the main reason why Transocean’s stock is not performing as well as it could. But I fully agree there are periods when RIG’s shares are artificially manipulated, plus the market is not going through its best days.

Backlog increase

On 22 September the company announced it was awarded a long-term contract with Transocean Norge. Here is quote from the company’s press-release:

“Transocean said the full contract period is 1,071 days at an average dayrate of $408K, which would contribute $437M in backlog, assuming all project approvals are received.”

There is still some uncertainty, but the recent award is significant.

Transocean also said on 6 September that:

“the ultra-deepwater drillship, Deepwater Asgard, received two contract awards in the U.S. Gulf of Mexico for a total of approximately 14 months of work, adding $181 million in firm backlog.”

In my view, the most notable change I noticed was in the contract dayrates Transocean charged. True, we should take inflation into account. But contract dayrates around $400,000 and more have not been announced by the company for ages. Add to this the fact Transocean signed a $915 million contract with Petrobras on 1 August. Please have a look at the dates as well. That’s a long time ago when Transocean was announcing new contract awards so frequently.

But the best may be yet to come.

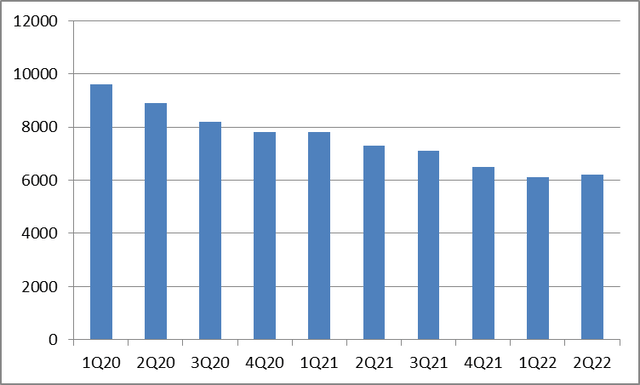

The diagram below shows Transocean’s backlog stopped decreasing in 2Q 2022. But the recent additions of $915 million for Petrobras, $321 million for Deepwater Conqueror, $181 million for Deepwater Asgard and, if all the approvals are received, $437 million in backlog for Transocean Norge make the picture look much better (the last number is approximate).

Transocean’s statement reads, “assuming that all approvals are received…” It is true that contract backlog is consumed quite fast. But if we sum all these additions up, we will get $1,854 million in new backlog. If we add to these the 2Q figure of $6,200 million, we will get $8,054 million, or about $8 billion in contract backlog. I assume the figure right now might be less than that. But the very fact Transocean’s backlog has begun growing substantially is inspiring, in my view.

Table – Backlog history (in $million)

| Reported period | Backlog number (in $million) |

| 1Q20 | 9600 |

| 2Q20 | 8900 |

| 3Q20 | 8200 |

| 4Q20 | 7800 |

| 1Q21 | 7800 |

| 2Q21 | 7300 |

| 3Q21 | 7100 |

| 4Q21 | 6500 |

| 1Q22 | 6100 |

| 2Q22 | 6200 |

Source: prepared by the author based on the company’s data.

Diagram – Backlog history (in $million)

Source: prepared by the author based on the company’s data.

Some of my opponents and Transocean bears might argue RIG will stop receiving any high-worth contracts thanks to the oil price crash. Let me explain why the current situation might not significantly threaten Transocean’s well-being.

The Fed, the global economy, and oil prices

Do not get me wrong, I do not pretend to have a crystal ball to foresee the future. We live in a highly unstable and constantly changing world. The central bankers are getting very hawkish. The biggest threat to the stock market is the Fed’s stance. Jerome Powell recently announced there are many more hikes to come as inflation readings are breaking multi-decade record highs.

All of this is really doom and gloom for the stock markets and the oil prices. However, we do not know if the next recession will be long and severe. It might be a short one. At the same time, the oil markets might still suffer from undersupply. Right now, investors and day-traders are focused on the Fed’s actions. At the same time, they forget the EU is preparing the eighth sanctions package against Russia. One of the most widely discussed measures in the package is the oil price cap. It means the EU members would refuse to buy Russian oil at the market prices but would impose the maximum price barrier. Russia would, in turn, refuse to sell oil at the prices set by the EU authorities. Obviously, this would leave the EU without Russian oil, thus making the prices surge.

Another bullish factor for oil is the end of Chinese lockdowns. As many of you know, China pursues a zero-COVID policy. It means even a very small number of Covid-19 infections discovered in a given region makes Chinese authorities put the whole region on a stringent lockdown. Now China is opening up and it looks like the whole Covid-19 story is over in this country. It is important since China is the largest oil importer.

Offshore recovery

Now let me also tell you more about the scale of the offshore sector recovery. Many contracts announced by Transocean carried very sound dayrates. Almost all of them exceeded $400,000 per day. But more is yet to come. Transocean’s CFO Mark Mey says $500,000 daily rates are quite possible in the company’s future.

Mey even thinks that the high daily rates are “inevitable” if the macroeconomic environment stays unchanged. Transocean’s CFO expects the dayrates to reach that level within ten months. By that time many of Transocean’s contracts would expire, and new ones would be signed.

It might be easy to accuse RIG’s top management of excessive optimism, but Mey is not alone. Seadrill’s (OTCPK:SEDRF) representative, for example, expects to reach the $500,000 mark in dayrates by year’s end. Earlier on in July, Schlumberger (SLB), an oilfield giant, spoke positively about the future of the offshore business, predicting that the recovery would “outpace visibly the 2016-2019 cycle.” Schlumberger also added that the offshore returns would only grow in the future.

You might disagree, given a recession might be near. It is a valid argument, of course. But we do not know when it will come and how long it will last. After all, if the supply issues stay here for a long time, the oil prices will stay high for years. Moreover, recessions come and go. In my view, the most interesting example of poor economic performance and expensive energy sources was in the 1970s in Europe and the U.S. There was stagflation (high inflation and poor or even negative economic growth) and sky-high oil prices. A situation like this is also possible now.

We should also remember that offshore drilling, especially harsh-environment and ultra-deepwater, requires long-term investments. So, it is likely oil majors would sign new contracts without paying too much attention to short-term volatility.

Bondholders’ speculations and the recent debt exchange

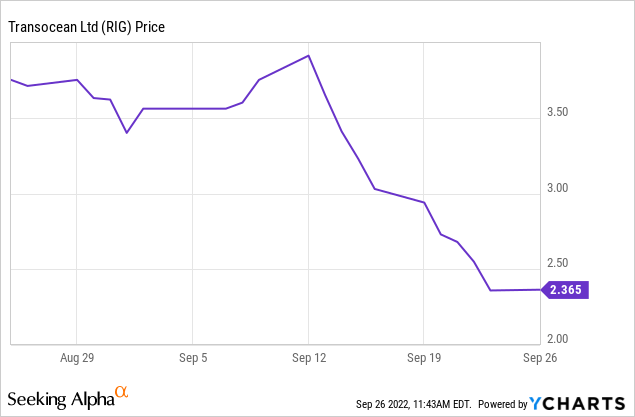

It was recently mentioned by my fellow-contributor Henrik Alex that the recent debt exchange was the main reason for the plunge in Transocean’s share price. The recent exchange was announced on 13 September. Whilst this explanation is valid, I do not think it was entirely because of that.

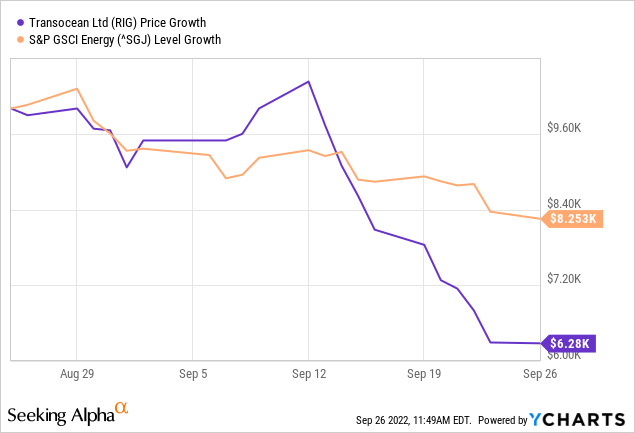

On and after 13 September the oil market started plunging, which affected the energy indices and many oil companies’ shares.

This can be seen from the diagram above representing RIG’s stock price and the S&P 500 GSCI Energy (^SGJ) index. However, as concerns Transocean’s shares, these are more volatile than the S&P 500 GSCI index.

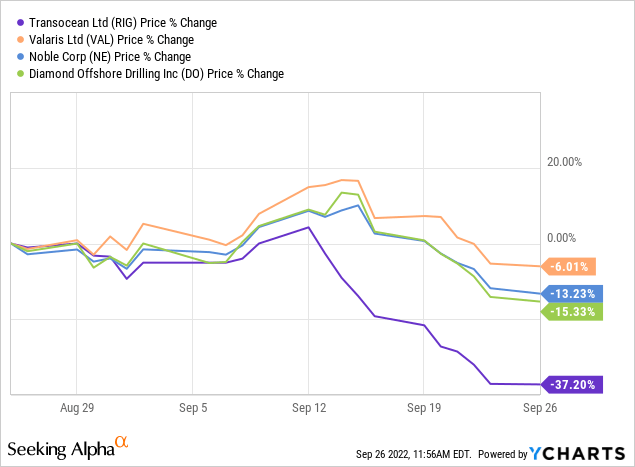

Higher volatility is also typical of RIG as opposed to its close offshore rivals Noble Corp. (NE), Diamond Offshore (DO), and Valaris (VAL). In my other article, I wrote that RIG is a better company than NE, DO, and VAL when it comes to the backlog and the fleet. However, investors are more positive about RIG’s competitors than RIG itself due to the latter’s much higher debt load.

Henrik Alex also says the $300 million in New Exchangeable Bonds is probably being subject to holders using convertible arbitrage strategies. So, most of the recent share price declines are due to short sales. I would rather agree. But it is not the first time RIG’s shares have been manipulated by the market and especially the bondholders.

The most notable time when this happened was in autumn 2020. At the time, Transocean was taken to the court by Whitebox Relative Value Partners as a company not fulfilling its obligations towards the bondholders. All that was due to RIG’s debt exchange. As a reminder, the court ruled Transocean’s actions did not violate the law. At the same time, everyone predicted Transocean was going bankrupt and RIG’s stock price fell to extremely low levels. So, now, in my opinion, Transocean’s stock is as undervalued as it was at the time.

Conclusion

By all means Transocean’s shares are volatile and probably not ideal for very conservative investors. At the same time, it looks like there is plenty of growth opportunity. Do not get me wrong – it is very hard to predict the future and I do not pretend to. Central bankers are getting very hawkish, whilst analysts are predicting a recession is near. However, it seems likely energy sources will be in short supply for a while, whilst offshore recovery is at full pace. In my view, it looks likely patient investors will be rewarded.

Be the first to comment