anyaberkut

What happened?

In April 2022, Netflix entertained the idea of offering an ad-supported tier in order to cushion its shrinking subscriber base. On 4/21, I published an article suggesting how Netflix’s decision could benefit The Trade Desk (NASDAQ:TTD) as the streaming giant would need an ad tech partner to bring its advertising offerings to market. Contrary to mainstream opinion, Netflix ultimately chose Microsoft (MSFT) as the exclusive partner to handle all ads on the streaming service. While this turned out to be a disappointment to investors as the stock was down as much as ~12% on the day following the 7/13 announcement, Trade Desk remains a strong beneficiary of the structural shift towards CTV advertising.

CTV remains a big opportunity despite Netflix becoming a walled garden

Netflix’s ad-supported tier will unquestionably expand the CTV advertising TAM, but the company’s decision to make its CTV inventory exclusive on the Microsoft platform means there will be no upside for others from Trade Desk to Roku (ROKU) to Magnite (MGNI). Essentially, Netflix has become a walled garden much like Google’s YouTube. However, it’s important to recognize that the overall CTV opportunity remains highly attractive as traditional TV continues to step into irrelevance.

The decline in traditional pay TV subscriptions (cable, satellite, telco, MSOs, etc.) is evident in US viewership data. Per eMarketer, total pay TV viewers in the US are expected to fall from ~150 million in 2021 to ~135 million in 2023, while pay TV ad spend will experience muted growth from $65.7 billion in 2021 to $66.3 billion in 2023, a meaningful decline from $70.6 billion in 2019. In addition, US pay TV households are estimated to decline from 68.5 million in 2022 to 57.2 million in 2026, with pay TV penetration dropping 10% from 52% to 42% in the same period.

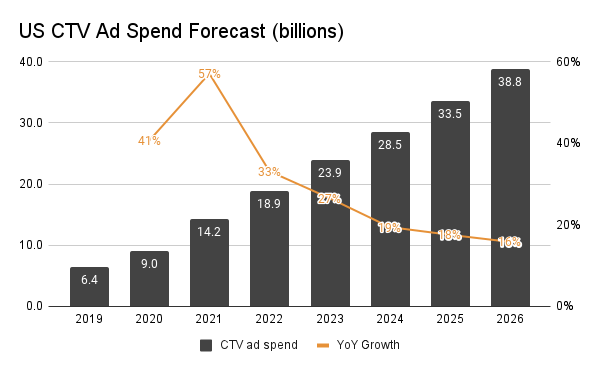

On the other hand, while 2/3 of the US population are already CTV users, CTV viewership is expected to increase from ~218 million in 2021 to ~228 million in 2023 as more Americans look for more affordable and personalized ways to watch the content they want. This is why US CTV ad spend is poised to grow at a 22% 5-year CAGR from $14 billion in 2021 to almost $39 billion in 2026 (eMarketer). The key takeaway here is that CTV advertising remains a sizable opportunity for Trade Desk even though Netflix has decided to close the loop with Microsoft.

eMarketer, Albert Lin

Per Trade Desk’s disclosure, video (incl. CTV) makes up 40% of platform ad spend. Although the company doesn’t break out the specific percentage of CTV, I’d imagine CTV to account for 30%-35% of total ad spend on the demand-side platform [DSP].

Microsoft isn’t the most competitive player when it comes to ad tech

Microsoft has a small presence in the digital advertising world, with search and news advertising revenue of ~$10 billion in 2021 (<6% of revenue) vs. Google’s $150 billion. While companies like Trade Desk, Roku and Magnite are already experienced players in the CTV space, Microsoft is yet to catch up. In June, the software giant completed the $1 billion acquisition of Xandr, an ad tech platform that mostly focuses on display advertising with very little CTV exposure. In my opinion, the lack of relative experience and know-how means the Microsoft-Netflix partnership will likely require some extra fine-tuning vs. say a Netflix-Magnite partnership that makes Netflix’s CTV inventory available through Magnite’s supply-side platform [SSP]. The Street thinks Netflix advertising could happen as soon as 4Q22, but 1H23 seems to be a more reasonable timeline, in my view.

Let’s not forget about the recently announced deal with Disney

On 7/12, Trade Desk reached a deal with Disney to allow advertisers to launch targeted ads on Disney’s properties such as Hulu, ESPN+ and ABC. This means campaign managers on the Trade Desk platform will have access to linear and CTV inventory from Disney’s portfolio when running programmatic ads. Disney+ is expected launch an ad-supported tier in the US later this year, with international access coming in 2023. This should further expand the available CTV inventory on the Trade Desk platform.

If case you’re wondering why Disney chose Trade Desk over other partners, my view is that Trade Desk has a clear strategy of being a neutral ad tech platform without the desire of being in the content aspect of business. Google’s DV360 has YouTube, and Roku’s OneView has the Roku Channel. These services all compete with Disney’s offerings, which could also help explain why Netflix decided to go with Microsoft instead of Google or Comcast (CMCSA). Of course, there’s speculation that Netflix may have something else in mind (analysis here).

Final thoughts

Trade Desk remains a highly competitive player in the programmatic advertising space driven by steadily increasing CTV viewership. While markets were initially disappointed by Netflix’s decision, Trade Desk has proven to be a valuable partner to major streaming players such as Disney. The retail media side of the business is also picking up steam (analysis here) with recently announced partnerships with Albertsons (ACI) following earlier deals with Walmart (WMT) and Walgreens (WBA). UID2 has been gaining significant traction with support from publishers, SSPs and data partners. Lastly, the new OpenPath initiative provides advertisers with direct access to publisher inventory right from the Trade Desk platform. While valuation remains a source of risk at 40x NTM earnings, it is reasonably close to the March 2020 low of 36.5x. With the forward multiple being drastically de-rated from 127x in November 2021 to 40x today, I see the risk/reward profile becoming increasingly attractive for Trade Desk.

Be the first to comment