Slaven Vlasic/Getty Images Entertainment

This article is contributed by Jun Hao from our Superstocks Seekers team.

Introduction

The Trade Desk (NASDAQ:TTD) is the largest independent demand-side platform providing advertisers access to the world’s most premium inventories. TTD has partnerships with well-known publishers like Sky Sports and has attracted advertisers like Procter & Gamble (PG) onto the platform. Combined with its strong data analytics, it helps advertisers to drive the highest return on their ad dollars.

The company was founded in 2009 by current CEO Jeff Green and CTO David Pickles.

CEO Green fell in love with digital advertising back in 2000 as a digital media buyer at an agency. In 2004, he built the world’s first ad exchange which was ultimately acquired by Microsoft. He and CTO Pickles eventually left and founded TTD to bring data-driven digital advertising to advertisers over upfront advertising. Upfront requires advertisers to buy ad inventories in bulk in advance, with no measurements or data insights into whether these ads will perform.

A common characteristic we found in software companies like TTD is that these founders tend to have deep domain expertise and they often have a critical problem that they want to solve in the industry. CEO Green is one of such.

Now, let us go in-depth into the company.

Digital Advertising Ecosystem

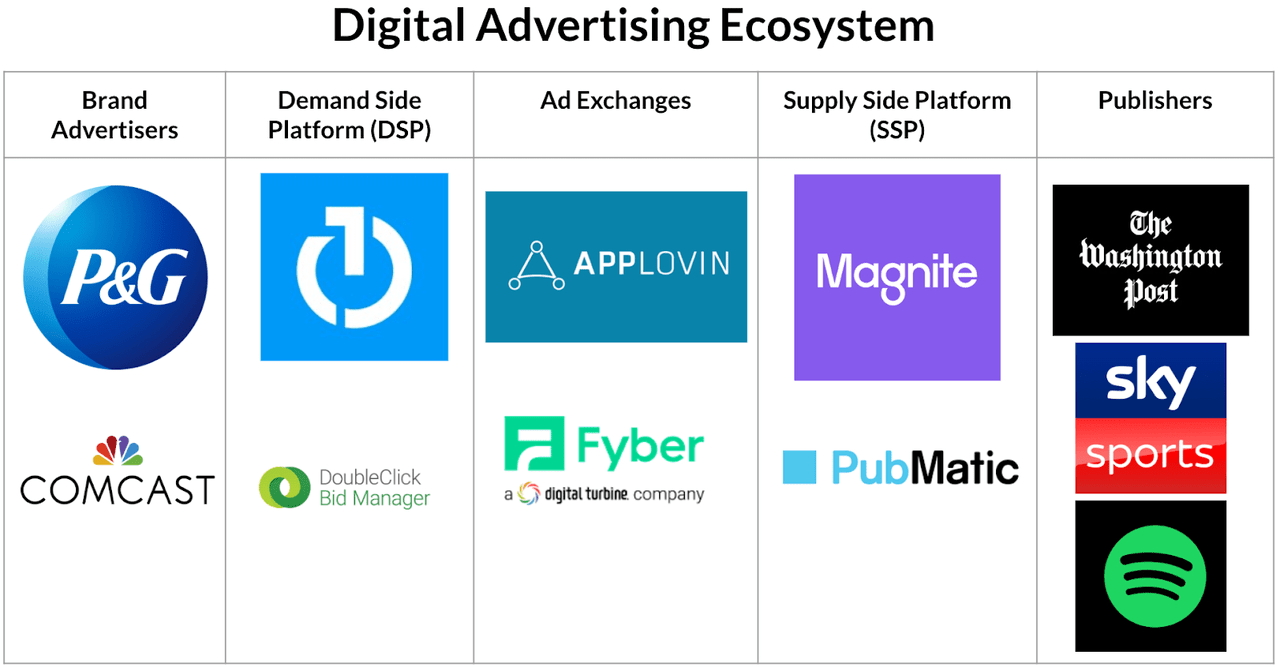

(Source: Author’s Diagram)

Let us first understand the role that TTD plays in the digital advertising ecosystem.

There are 5 primary players – brand advertisers, publishers, a demand-side platform (“DSP”), ad exchange, and a supply-side platform (“SSP”), and they work hand-in-hand to facilitate the transaction of digital ads. Advertisers go to DSP to purchase ads, while publishers go to SSP to sell their ad inventories. An ad exchange is a marketplace that simply exists to allow the transaction of ads to take place between advertisers and publishers.

As the largest DSP, the platform has access to some of the world’s premium inventories and top advertisers spenders on the platform.

Portfolio of Premium Inventories

Brand advertisers usually care about 2 things – (1) What ad inventories can they have access to reach their target audiences, and (2) how can they utilize data insights to improve the effectiveness of their ad campaigns? All of these lead to: where can they spend to get the highest returns possible on their ad dollars?

According to TTD partners directory, it has over 225 partners. These can be ad exchanges like AppLovin (APP), SSPs such as Magnite (MGNI), and publishers themselves. This is huge considering that each SSP and ad exchanges also have direct access to many publishers, this tells us the reach and frequency that TTD has. Therefore, it is not surprising to see why top global advertisers like Procter & Gamble and Comcast (CMCSA) allocate their ad dollars to the TTD platform.

With the right inventories, advertisers are able to reach targeted audiences more effectively.

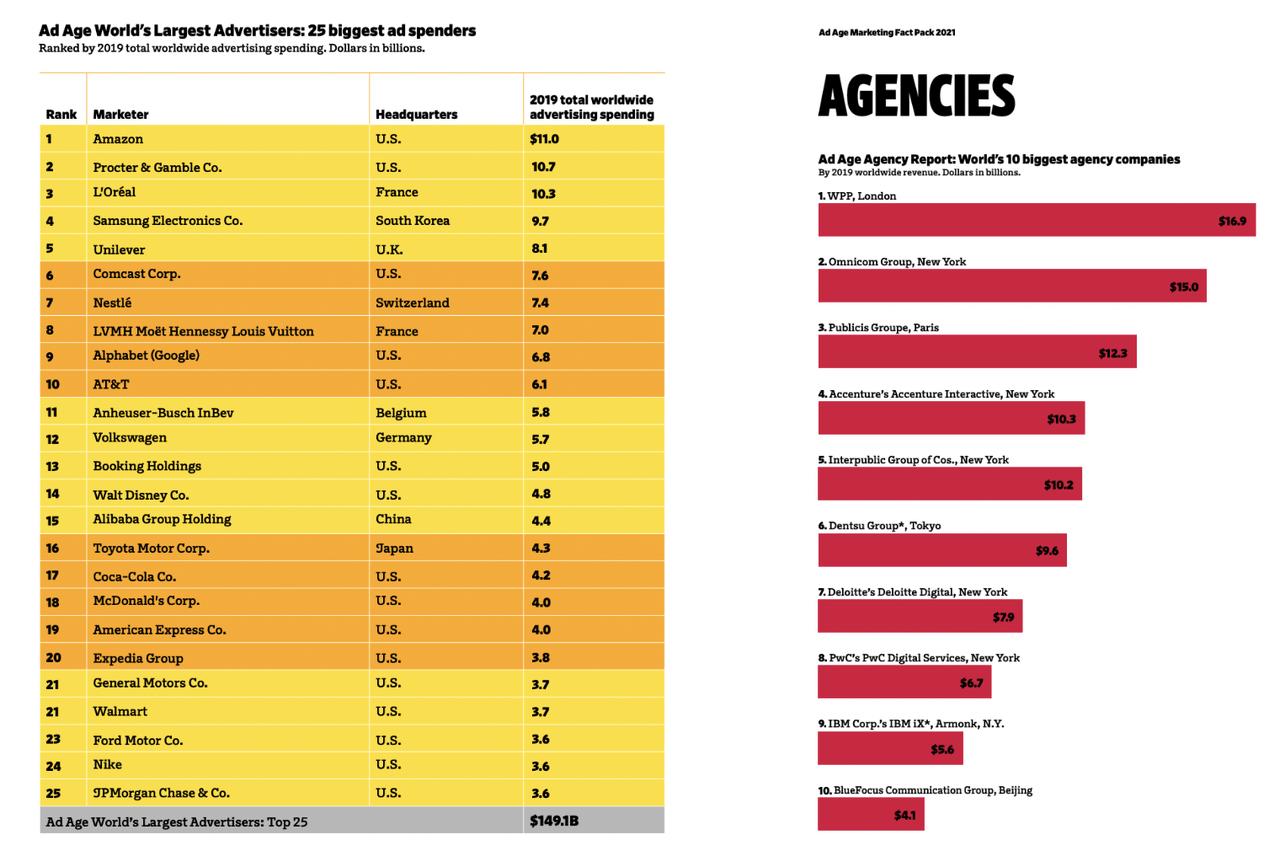

(Source: Ad Age Marketing Fact Pack 2021)

Over 75% of the Ad Age top 200 advertisers spent on the platform, and furthermore, the top brand agencies such as Omnicom Group and Publicis, who represent some of the largest brands are also using TTD.

These strong ties with top advertisers and agencies show that having access to a wide array of premium inventories is extremely critical in driving even more advertisers and spending. In our view, this speaks highly of the value that TTD is bringing.

Of course, having access to these inventories is not sufficient. Advertisers must also be able to put their data to work to refine and improve the effectiveness of their ad campaigns.

This brings us to our next portion.

Strong Data Analytics

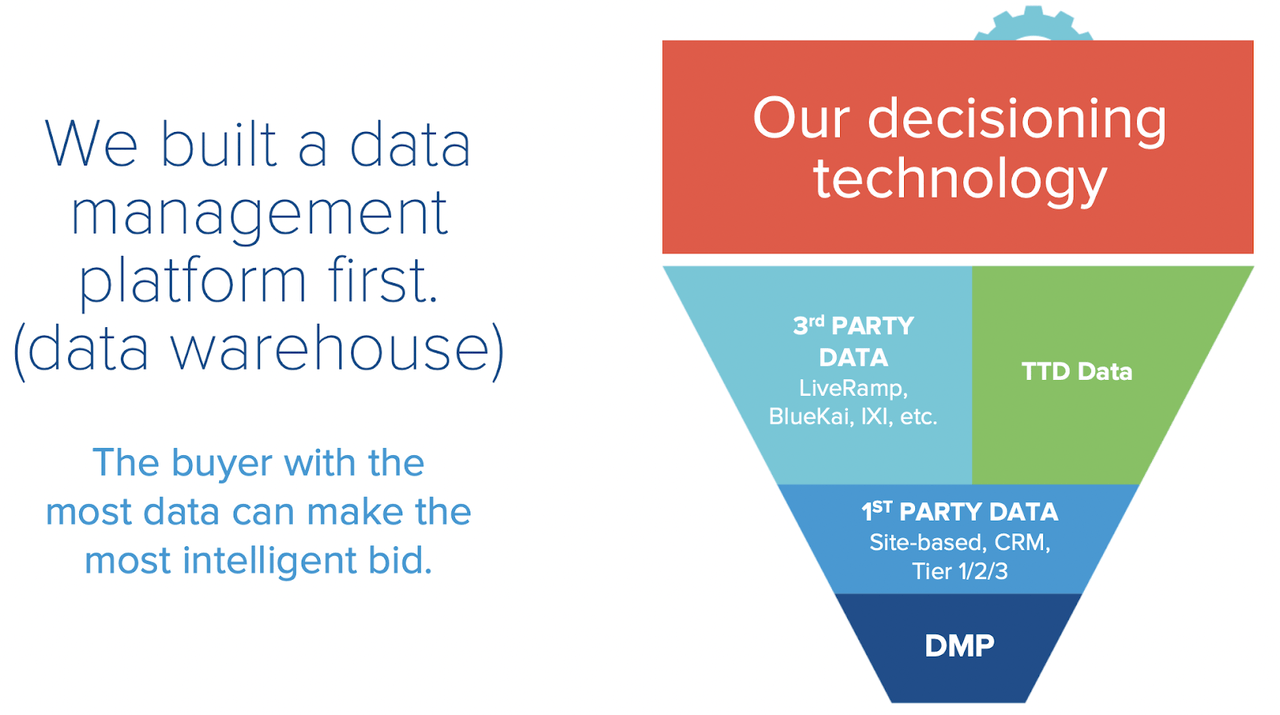

(Source: 1Q22 Presentation)

TTD’s data management platform (“DMP”) is the platform advertisers use to manage their ads.

Within the DMP, advertisers can upload their first-party (“1P”) data such as their CRM data, and access third-party (“3P”) data through its data partners. 3P partners are willing to make their data accessible through TTD because they can leverage its massive advertisers base, and in return, the company earns a cut for facilitating the transaction. This makes it a win-win-win situation for all parties.

So, with the DMP, advertisers can gain insights into their audiences.

TTD’s artificial intelligence (“AI”) and machine learning (“ML”) engine called KoA, can make sense of the data, provide recommendations to help advertisers optimize their ad campaigns across different channels, and automate the buying process. They also get measurable insights and reports on their campaigns. Not only that, they will receive Unified ID (“UID”) 2.0, which is an upgrade alternative to 3P cookies that helps to improve advertisers’ match rates (We will be going more in-depth into UID 2.0 in a short while).

This is a highly intelligent platform that uses a data-driven advertising approach to empower advertisers to yield the highest ROI possible.

This also means that there is a flywheel effect in play here.

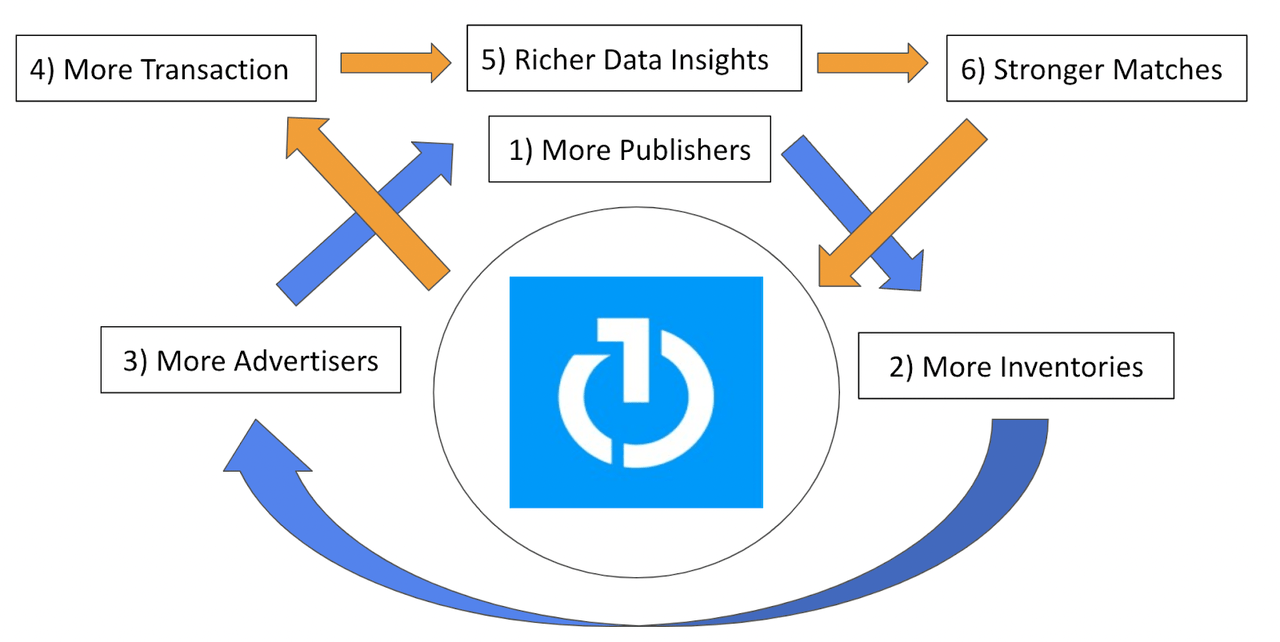

(Source: Author’s Diagram)

The combination of growing inventories will attract even more quality advertisers to the platform, which in turn attracts even more quality publishers and vice versa. Not forgetting, TTD will ingest more data, resulting in richer data insights, and creating stronger matches between advertisers and publishers. It is no wonder that for the last 7 years, TTD maintained a strong retention rate of 95%.

Unified ID 2.0

Why Are Third-Party Cookies Phasing Out?

The ad tech industry largely revolves around data as data are valuable assets. It can be analyzed to provide insights so that advertisers can deliver more personalized and relevant ads.

To do that, 3P cookies are designed to track and collect personal information on users’ activities on the site. Using these data, extensive customer profiles can be created. However, the problem is that all of these are done without users’ consent or awareness, making them privacy-invasive. This is why Google announced the removal of 3P cookies by 2023. This is a significant blow to the industry due to Chrome’s market leadership and advertisers’ dependence on 3P cookies. Cookies are also less effective as they can be removed from the browsers and AdBlock software can also prevent 3P cookies from working. Since advertisers rely heavily on cookies to collect data, this is worrying for them.

Moving forward, the digital ad industry has to prepare for life without 3P cookies. But how can they adapt?

Enter Unified ID (“UID”) 2.0, an identifier created by TTD to improve advertisers’ match rates and to replace the privacy-invasive third-party (“3P”) cookies.

UID 2.0: Greater Control And Privacy

UID 2.0 was created to provide users with greater control and privacy.

Unlike 3P cookies, TTD does not keep personally identifiable information as it requires only the users’ email addresses or phone numbers. This email address or phone number will be converted into UID 2.0 (i.e. alphanumeric identifier) and further encrypted and hashed to prevent users from abusing it, such as by building customer profiles out of these data or combining it with other sensitive data. Users can also choose to opt out anytime.

This is an upgrade alternative to 3P cookies.

Combining UID 2.0 with TTD’s Adbrain, it integrates and analyzes anonymized data of the same user across different devices, giving advertisers the ability to measure more effectively across different devices to reach their targeted audiences, which is not possible without 3P cookies.

The larger the UID 2.0 footprint, the higher the match rates it can deliver to advertisers. This is why TTD is focused on scaling UID 2.0 by driving the adoption from publishers and SSPs.

The reason is publishers own the relationship with end-users, and they tend to have existing sign-on systems. They explain to users the value in inputting their email address or phone number, in exchange for the free content as users are required to understand the trade-off. For small to medium publishers without existing sign-on systems, TTD is already working with Criteo to build a new single sign-on.

But without enough users’ consent, advertisers find it hard to meet their campaign objectives.

According to CEO Green during his 1Q22 earnings call, he is already seeing massive adoption by publishers and SSPs:

UID 2.0 does not need some magic number of single signs to be on par with the billions of cookies out there to be successful. We are already seeing widespread adoption by integrating with existing publisher sign-on systems…we’re only a few weeks into beta testing. The list of publishers, advertisers and data partners that are currently in the integration process or committed to UID 2.0 is larger than those that we’ve announced publicly. The progress we’ve made on USD 2.0, the momentum we are seeing is all beyond anything we could have envisioned this early.

Based on the success of TTD’s previous version of UID 2.0, called UID, nearly every major SSP and ad exchange adopted it. Thus, we firmly believe that UID 2.0 will follow suit as the industry marches towards a better internet by providing users with more control and privacy.

Betting Heavily On Connected TV In The Early Days

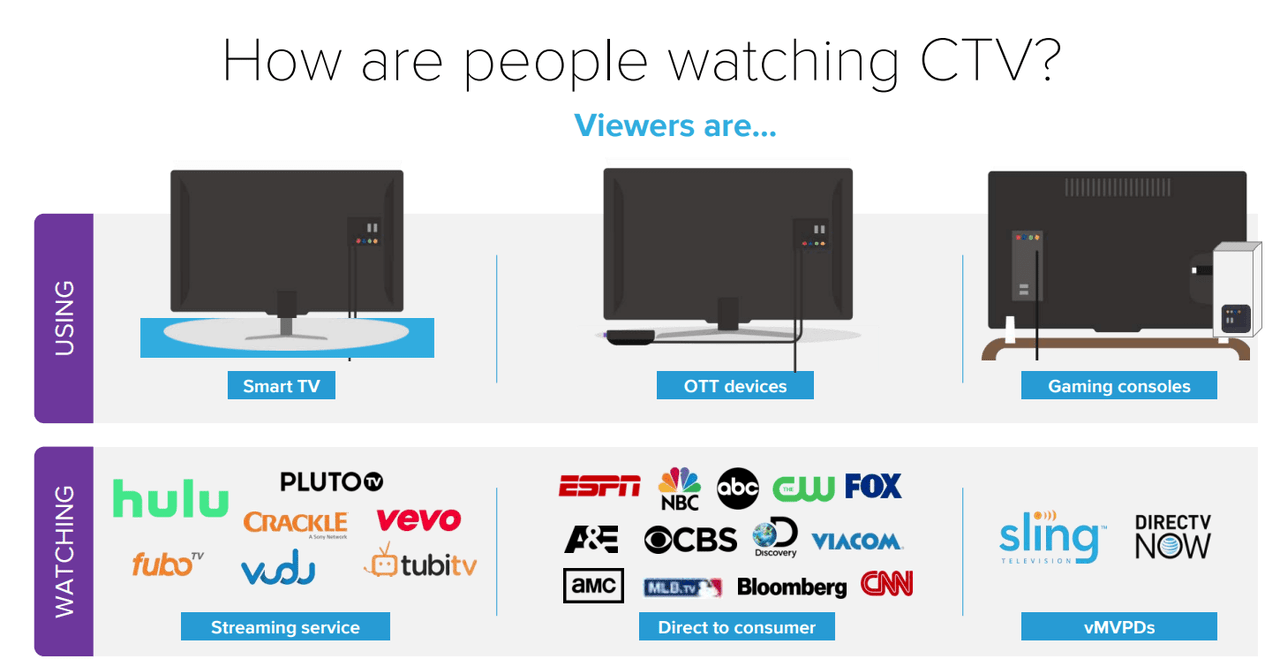

(Source: 2019 Investor Day)

Many years ago, CEO Green foresaw that traditional TV will gradually lose market share to on-demand CTV and he bet heavily on the CTV market in TTD’s early days.

People were moving away from cable networks to TV content streamed on the internet through CTV devices. These include over-the-top devices (“OTT”) such as Roku (ROKU), smart TVs, and gaming consoles. There is also a rise in internet streaming platforms, particularly subscription video on demand (“SVOD”) and advertising-based video on demand (“AVOD”) platforms such as Hulu, Sony Crackles, Netflix (NFLX), and Disney+ (DIS), which can be viewed through mobile or smart TVs.

These resulted in the production of more CTV inventories as well as a more fragmented market. This allows TTD to pursue partnerships and consolidate these inventories for advertisers. Thus, allowing them to capture market share.

TTD is partnered up with the world’s largest companies, including others like IQiYi, TVB, HOOQ, VIU, Sky Sports, Peacock, Discovery Plus, and many others. CEO Green said that they are the largest aggregator of CTV ad impressions across every major content provider, and they reached over 80 million households in the U.S. To put things into context, there are about 124 million U.S. TV households in 2022. This massive reach makes the platform extremely attractive for advertisers.

Unlike walled gardens like Facebook (META) and Google (GOOGL) who command the majority of the market share in both social and search, there is no one dominant player in TV:

There is no one dominant player in TV as there is in search or social. TV is a much more fragmented market and the cost of content development means that a single dominant player is very unlikely to emerge…CTV will be the Trojan Horse that eventually forces all walled gardens to change course. And no company is better positioned than TTD to grab share from the $200 billion linear TV worldwide market as it moves to digital.

TTD is reaping its fruits of labor, and this would not have been possible without the vision and execution of CEO Green to capitalize on the move from linear TV to CTV.

Financials

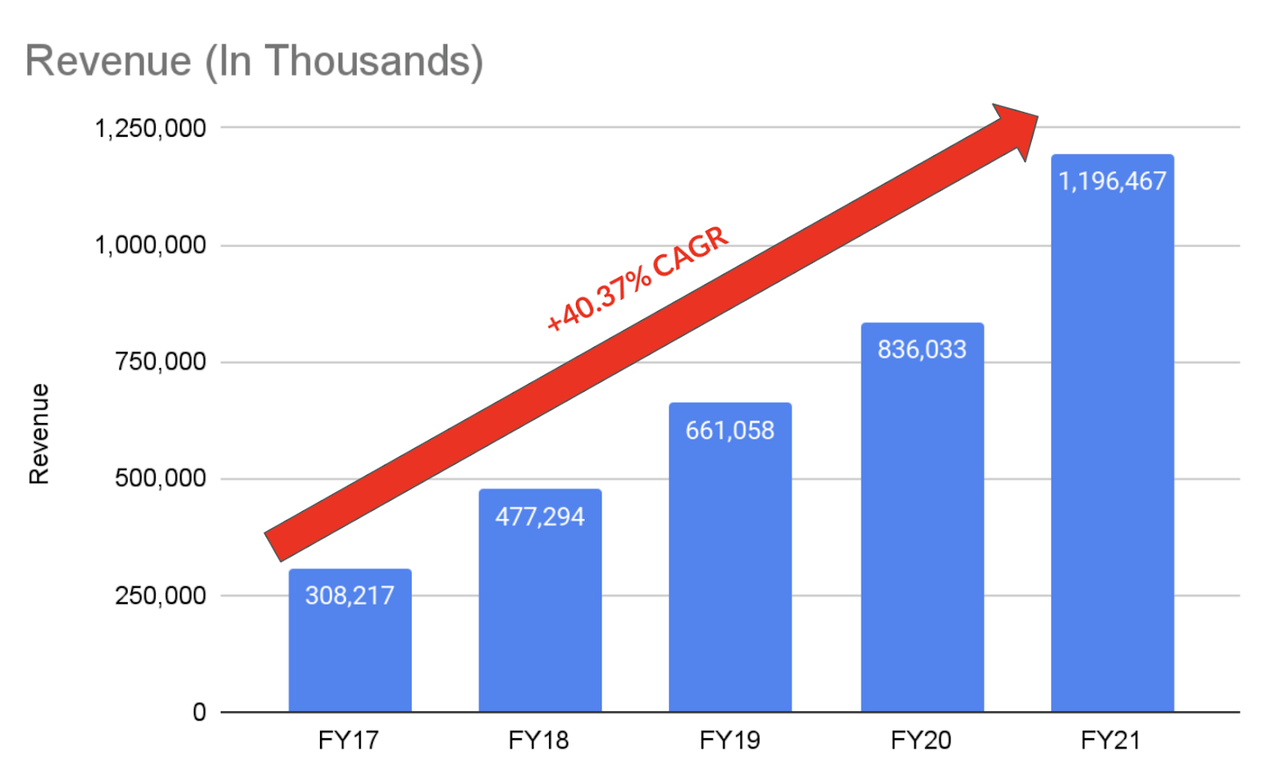

(Source: TTD IR)

Turning to the company’s financials, let’s take a look at its revenue growth.

From FY17, its revenue has been growing at an impressive CAGR of 40.37% to $1.19 billion, equivalent to about 4x growth. We believe this is because TTD is a self-service platform, which makes it easier to onboard advertisers and easy for them to learn to use it. This greatly speeds up the sales cycle for the company. There was also the shift from upfront advertising to data-driven advertising as the industry became increasingly aware of the benefits, as well as the rapidly growing channels like mobile and video (including CTV).

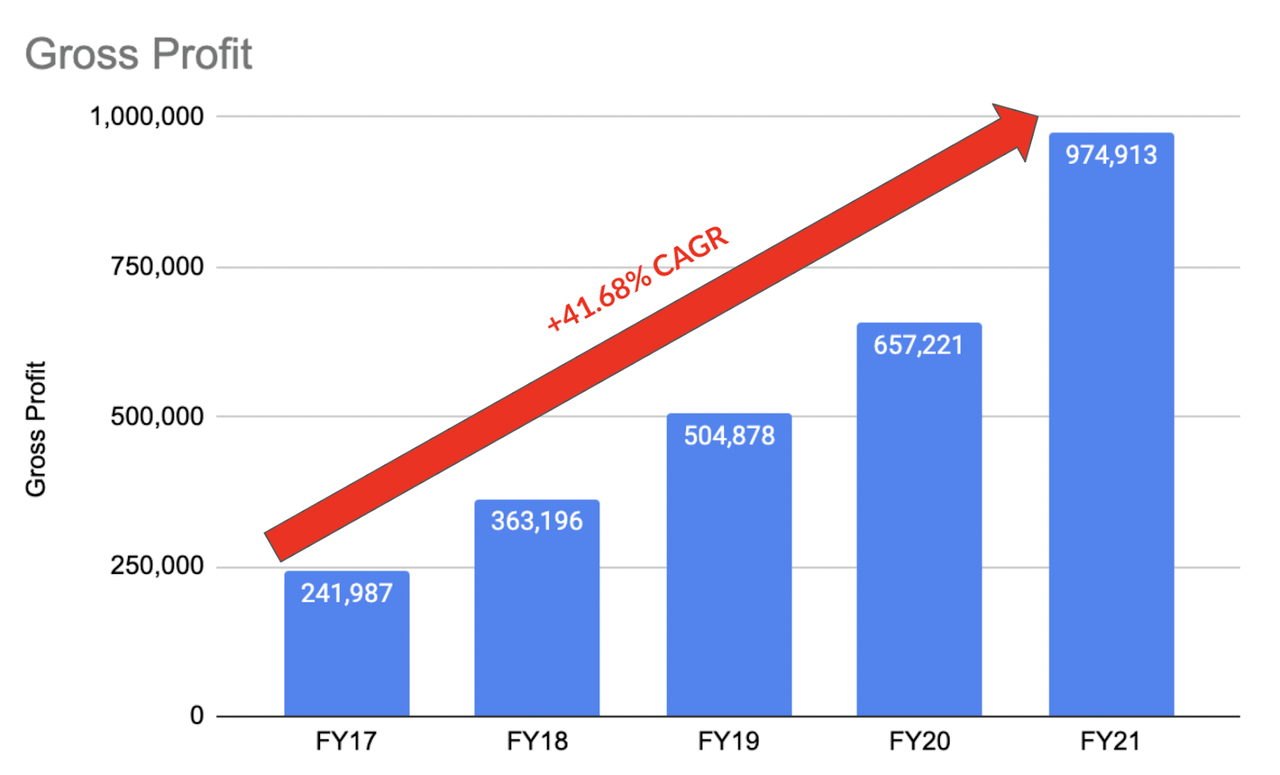

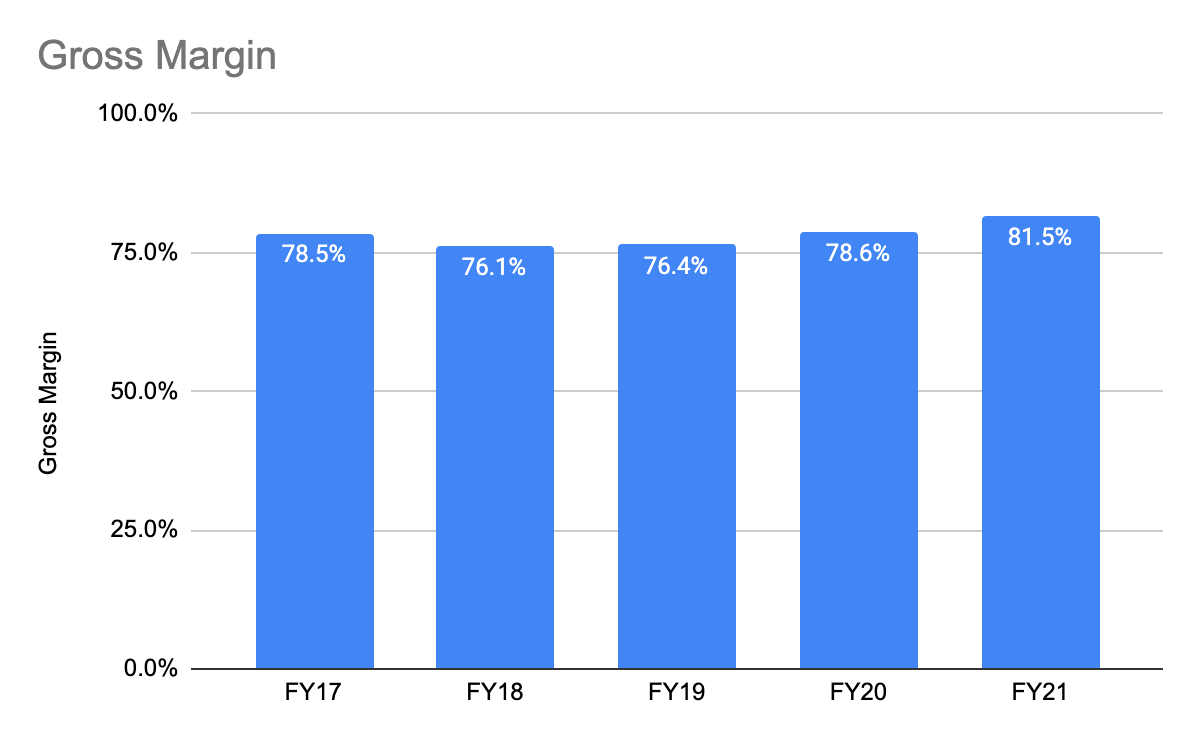

(Source: TTD IR) (Source: TTD IR)

Its gross profit has been growing at a slightly faster pace of 41.68% CAGR and its high gross margin has also expanded over time in FY21.

It is not surprising to see such high gross margin software businesses tend to be less capital intensive. The larger it grows, the lower it can reduce its hosting costs.

(Source: TTD IR) (Source: TTD IR)

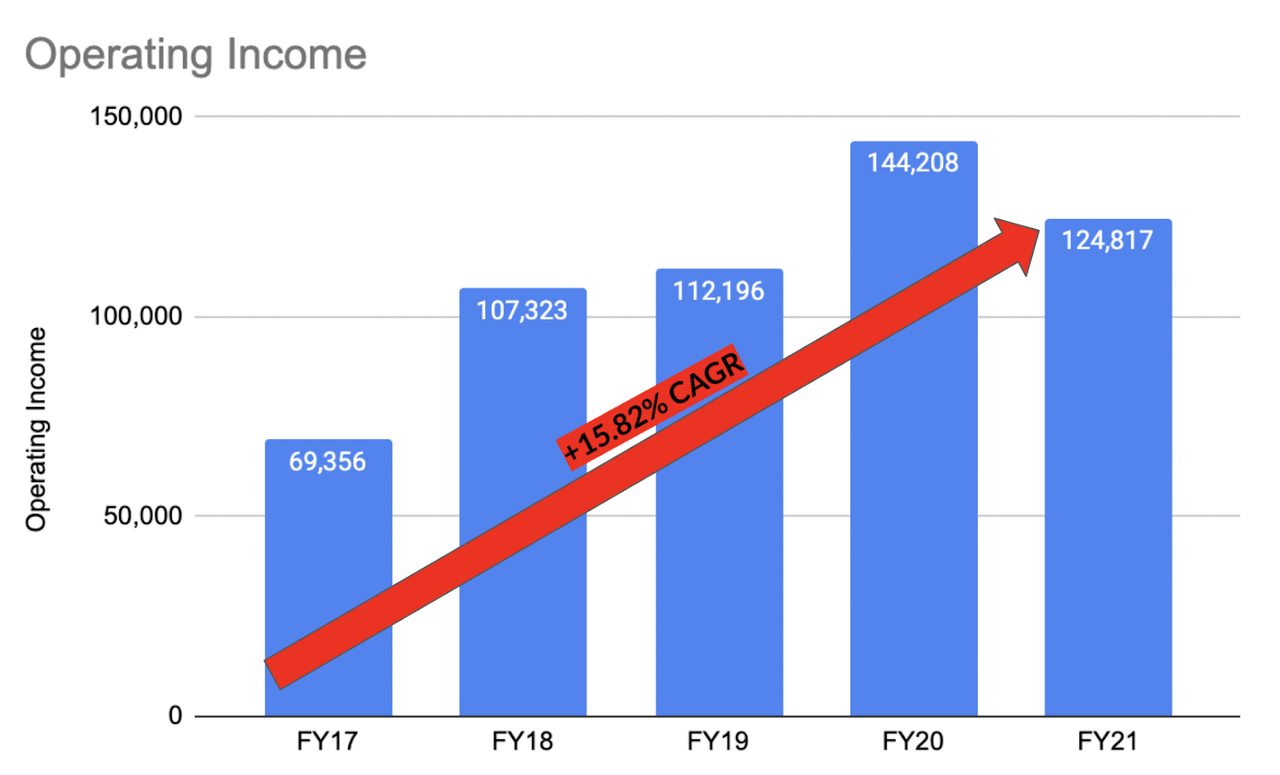

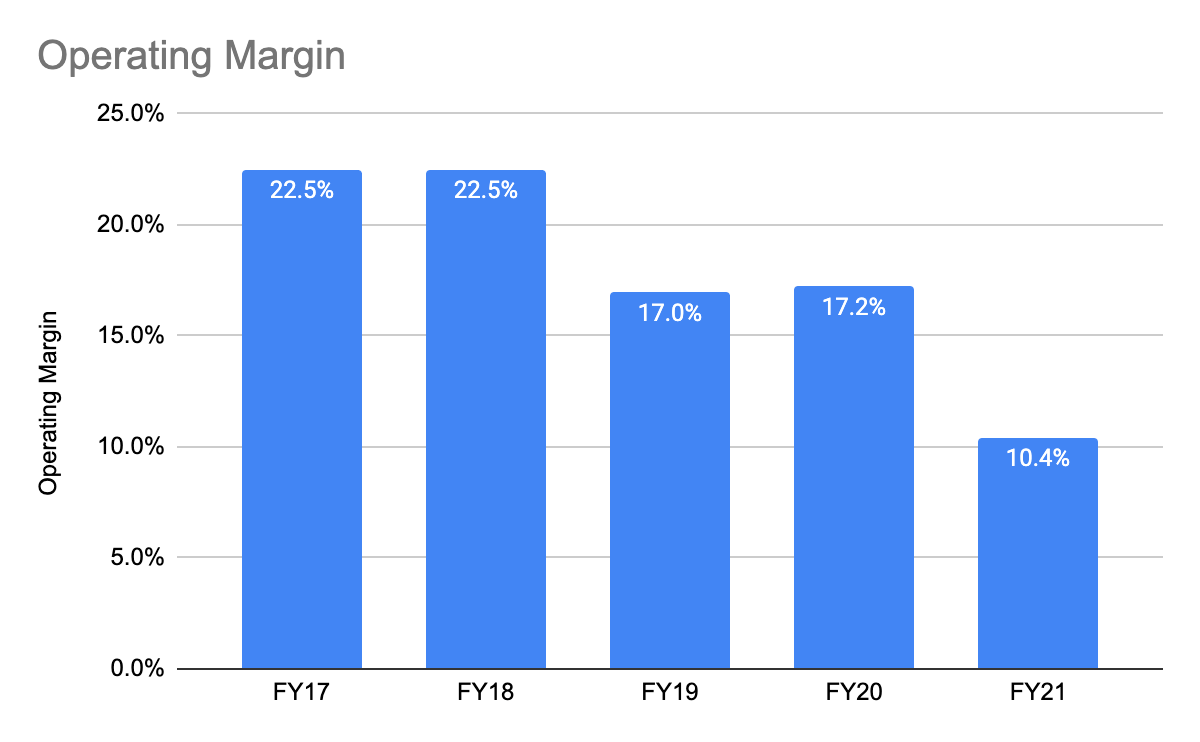

On the other hand, its operating profit (“EBIT”) has been growing at a slower pace of 15.82% CAGR, and its EBIT margin has declined drastically in FY21.

At first look, many investors would be concerned by this and shun away. However, we believe an investment thesis should not be concluded just by purely looking at the numbers without understanding the full picture. Hence, we dive in deeper to find out if this decline is because of a fundamental flaw in the business or if there is a specific temporal reason for it.

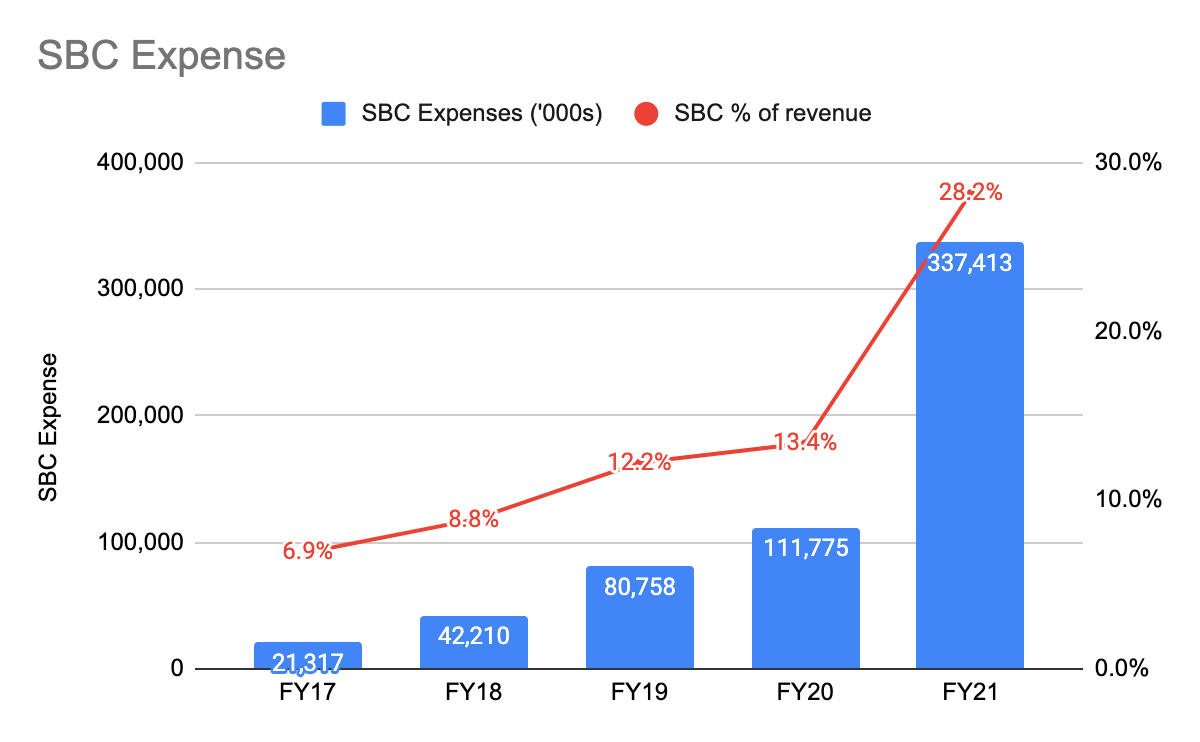

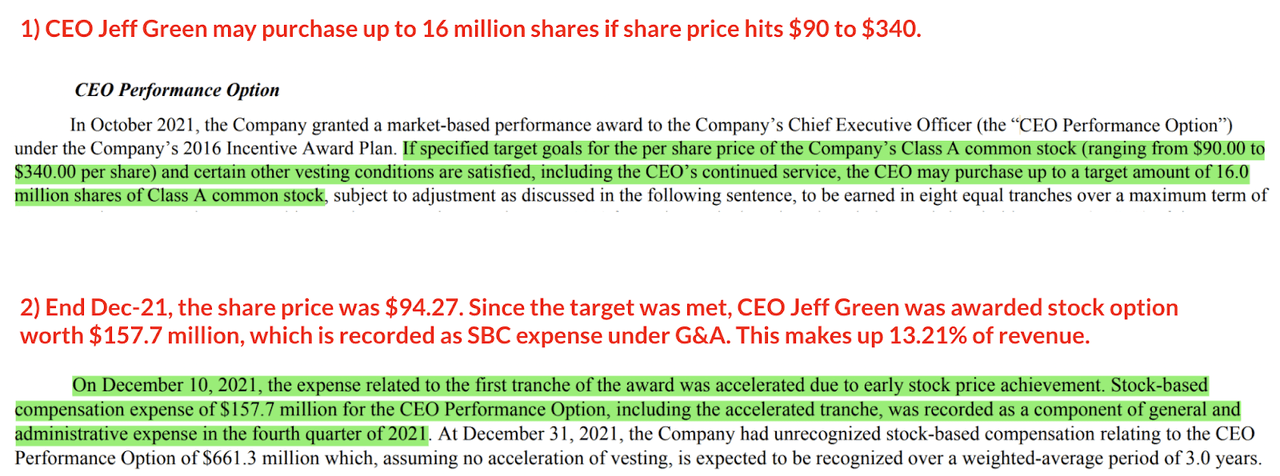

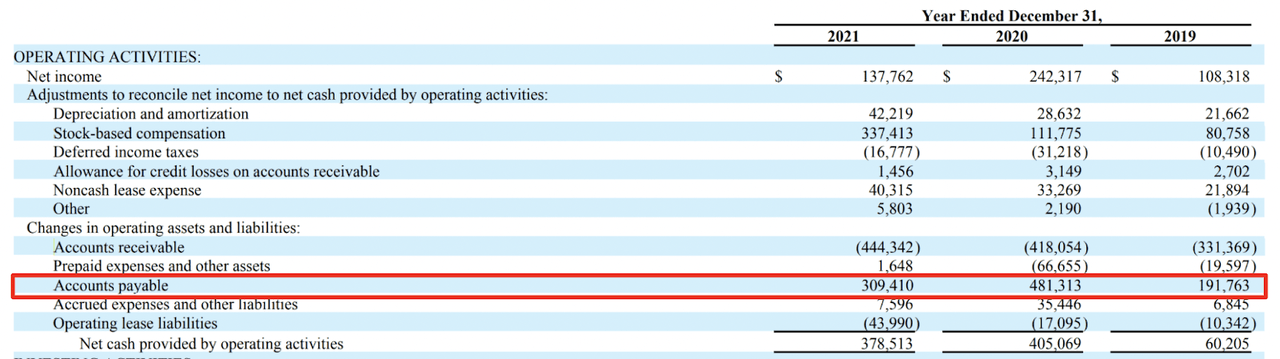

(Source: TTD IR)

The main culprit for the lower EBIT was due to its high stock-based compensation (“SBC”) expense. In FY21, it makes up 28.2% of its revenue.

After looking at its FY21 10-K, here is why.

(Source: TTD FY21 10-K)

To find out the true profitability nature of the business, we are adding back the SBC because (1) this is a non-cash expense, and (2) this is not a business operating expense. This gives us an adjusted EBIT of $274 million, a 41% CAGR from FY17. And in terms of adjusted EBIT margin is 22.9%.

This is a highly profitable business which is masked by the non-recurring CEO compensation.

Valuation

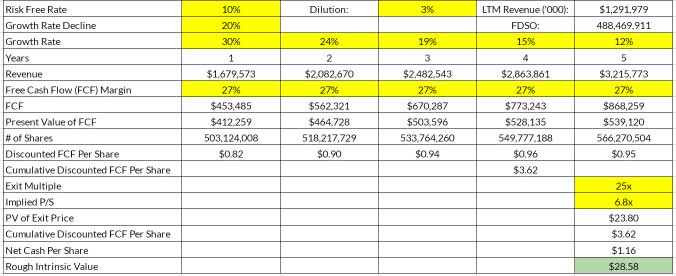

(Source: Author’s Estimates)

We used the discounted cash flow method to estimate TTD’s valuation. Similar to the companies we had covered, we are using a 10% risk-free rate (“RFR”), and the reason is we are benchmarking against the S&P500 average annual return.

We are estimating a 30% forward revenue, followed by a 20% growth decline for the remaining years. This gives us $3.68 billion in revenue by year 5.

What’s the rationale behind our estimation?

TTD’s revenue is highly predictable and recurring because it signs long-term contract agreements with its customers. Revenue is expected not to decline that quickly due to its huge and long runway, however, we are factoring in that advertisers may pull back on their spending to a certain extent in a recessionary environment.

(Source: TTD IR)

In FY21 and FY20, it has a free cash flow (“FCF”) margin of 26.6% and 38.9%, respectively.

The reason is its higher account payables amounted in FY20, and this is affected by the timing of its payments to its suppliers. In 1Q22, its margin was 43.2%. We do expect this figure to fluctuate over time, and staying on the safer side, we are maintaining a margin of ~27% in the next 5 years. That being said, we will not be surprised if the actual annual margins came in higher than our estimated figure.

Then, after factoring in the 10% RFR and shares outstanding with 3% dilution, this gives us discounted FCF per share for each year.

In terms of exit multiple, given that this is a high-quality business with high profitability, and has a strong market leadership, we are implying a 25x EV/FCF. We also take into account peers with similar margins, such as Alphabet and PubMatic (PUBM). After adding in the cumulative discounted FCF per share and net cash per share, the intrinsic value is $28.58. As of 25 Jul 2022, the share price was $46.49.

It is not surprising, however, to see that it is overvalued.

During a downturn, investors tend to lean on companies with more certainty like TTD, which has clear profitability, is highly resilient, and has predictable revenue growth. These are largely priced in by the market.

Risks

Possibility of Recession

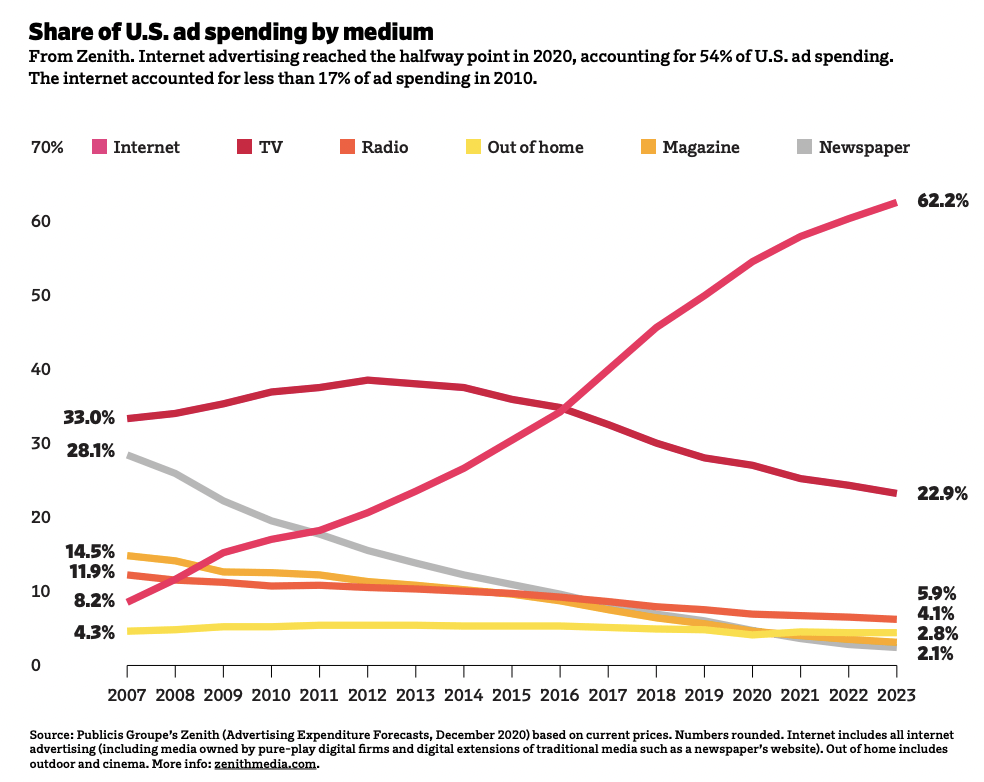

(Source: Ad Age Marketing Fact Pack 2021)

During a recession, advertisers tend to cut back on spending as there is lesser demand from consumers.

Companies with ad-related revenue are likely to experience slower revenue growth. Advertisers are forced to measure and be more careful about where they are allocating their capital to yield the best possible returns. TTD as the largest independent DSP is likely to be the preferred ad platform for advertisers due to the massive reach and scale of its inventories.

To quote CEO Green during the 1Q22 earnings call:

…CMOs and marketers get very deliberate about where they’re going to spend money, and they become very data-driven in the choices that they’re making…that means they’re spending more with us…in the 2H20 when we saw that as people needed to be more deliberate, they were focusing on the areas of investment that have the highest ROI, then they were consulting with us, and it worked out actually quite well in our favor.

In 4Q21, TTD also signed an increasing number of long-term commitments with some of the world’s largest brand advertisers. This speaks a lot about the desire to partner up with TTD. In a recessionary period, this makes TTD extremely resilient.

Digital Advertising Act & How It May Affect TTD’s OpenPath?

This year, a group of senators introduced a bill to crack down on the companies generating more than (1) $20 billion or (2) $5 billion in gross spending. For (1), this applies to Google, Facebook, and Amazon, and for (2), it applies to TTD.

Quoting from the bill:

Digital advertising is dominated by Google and Facebook. Google, in particular, is the leading or dominant player in every part of the ad tech stack: buy-side, sell-side, and the exchange that connects them…If enacted into law, this bill would most likely require Google and Facebook to divest significant portions of their advertising businesses—business units that account for or facilitate a large portion of their ad revenue.

Breaking up Google and Facebook’s advertising business allowed platforms like Digital Turbine (APPS) and TTD to grow, but this posed another trouble for OpenPath once it reached the $20 billion gross spend threshold as it allowed advertisers to reach publishers directly without the need for SSPs. The bill states that DSPs are not allowed to operate as SSPs, and vice versa.

So, the question is — is TTD considered an SSP? If so, they might have violated the rules if the bill passes through.

Conclusion

TTD is a highly intelligent and largest DSP that enables advertisers to access the world’s most premium inventories across different channels. Armed with its AI and ML capabilities, it helps advertisers significantly improve their match rates. This makes them the preferred platform for advertisers.

We also talked about UID 2.0, an upgrade alternative to 3P cookies that are seeing accelerating adoption. We believe UID 2.0 will be instrumental as the industry prepares for a better internet.

Next, due to the vision of CEO Green and the investments made in CTV in the early days, their CTV inventories are growing, and now they are reaching over 80 million households in the U.S.

This is a highly profitable and fast-growing business, growing its revenue, gross profit, and operating profit at 40% CAGR in the last 4 years. Despite the size of the company today, they are still reinvesting heavily to capture market share in what’s worth a $1 trillion TAM.

Lastly, we mentioned the risks including how advertisers are likely to cut back on spending during a recession, and how OpenPath may violate the digital advertising act if it is successfully passed through.

What are your thoughts on the company? Do let us know in the comments section below.

Be the first to comment