Tractor Supply (TSCO) has benefited from the COVID-19 outbreak, at least for the time being, as in the beginning of March sales of consumable and usable items substantially increased, once people build up a stock of items related to the ongoing pandemic.

The company has just provided a preliminary Q1 2020 update with top line and earnings surpassing estimations, but has also withdrawn fiscal 2020 guidance, given current uncertainties. Despite this scenario, I see Tractor Supply as a core name in the discretionary sector, as it is likely to be less affected in the short term and still should be able to stick to its long-term business targets once the economy recovers.

Preliminary Q1 2020 Update Highlights and Outlook

Tractor Supply saw net sales totaling $1.92 billion, which was 3.7% above estimations and represents a growth of 7.5% over a year ago. Comparable store sales increased 4.3% over a year ago, boosted by a remarkable growth of 12% in March alone, as a result of the pandemic-driven sales. This move in March was so strong that key consumable items were up more than 20%, offsetting a decline in cold-weather seasonal categories in January and February, due to the warmer weather in that period. As a consequence of this top line growth, dilute EPS is expected to stay in the range of $0.69 to $0.71 in the quarter versus a consensus of $0.63.

As the company goes through the second quarter of 2020, all stores remain open and comparable store sales keep growing, driven by seasonally key categories. Meanwhile, the management team forecasts an incremental cost around $30 to $50 million in the quarter due to the pandemic.

Despite the management team withdrawing fiscal 2020 guidance, current estimations by analysts still point to revenue growth of 5.7% at $8.83 billion, in the middle of the original guidance, while EPS is expected at $4.73, in line with last year but below the original range of $4.90 to $5.10. Longer term, analysts expect revenue growth in the mid single-digits in 2021 and 2022, and EPS growth in the high single-digit to low double-digit range in the same period. While these figures are slightly lower than previous forecasts released by analysts three months ago, they are still relatively close to Tractor Supply’s long-term financial targets.

Although the year 2020 is going to be tough to the overall economy, I believe that Tractor Supply’s consumable business is expected to continue to drive growth through the year, offsetting the potential decline of more cyclical categories. Once the economy starts to recover, Tractor Supply should take advantage of ongoing initiatives to drive growth, such as new store openings (nearly 90 stores planned for 2020), expansion of product assortment and exclusive brands. In addition, the Neighbor’s Club program underway is driving loyalty, customer engagement, greater sales frequency and higher average ticket sales.

Financial Analysis and Valuation

I am going to compare Tractor Supply’s financial and valuation metrics with companies in the consumer discretionary sector using as a reference the XLY – Consumer Discretionary Select Sector SPDR Fund.

Looking at the earnings quality, according to the table below, Tractor Supply has showed lower gross profit and EBITDA margins than the peer group. On the other hand, both metrics and also revenue have increased faster than peers over the past 5 years, as many apparel and multiline retails have delivered sluggish growth, which averaged down the bench market.

The return on invested capital has also scored above the average, as the company is increasingly focusing on growth-oriented capital allocation targets, such as new and relocated stores, while plateauing some investments not directly related to growth like in IT area.

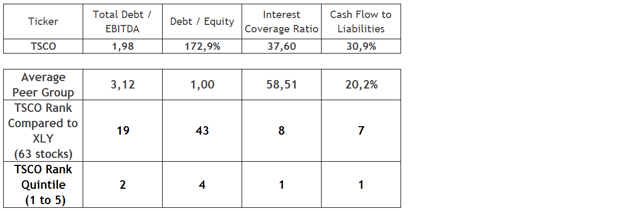

Source: Data from Finbox, consolidated by the author

Shifting to the financial health, Tractor Supply is well positioned relative to the peer group, with most of its debt at a very low fixed rate, according to Q4 2019 earnings call in January/2020. As a further step to secure capital flexibility during this difficult period, the company has also announced that it has suspended its share repurchase program and deferring some investments. In the meantime, the company is investing in some initiatives due to new environment caused by COVID-19 pandemic, such as increasing the delivery options and the number of mobile point of sale and also implementing contactless curbside delivery.

Source: Data from Finbox, consolidated by the author

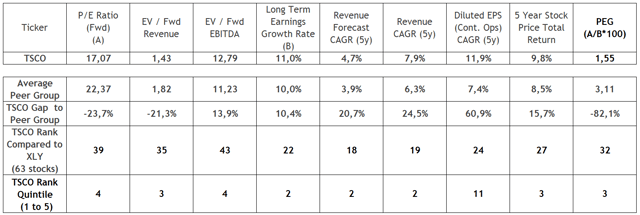

Moving to the valuation analysis, looking at the table below, we see Tractor Supply trading at a lower P/E compared to the peer group. In addition, while showing a slightly higher EV/EBITDA multiple, Tractor Supply also shows higher long-term earnings and revenue growth forecasts than the average, which is consistent with historical growth rates also showed below. As a result, its PEG ratio is also lower than peers, which is indicative that Tractor Supply is trading at a discount to the consumer discretionary sector.

Source: Data from Finbox, consolidated by the author

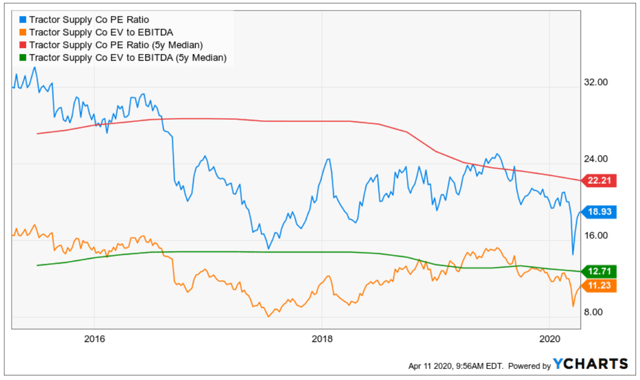

Furthermore, according to the chart below, Tractor Supply’s current P/E and EV/EBITDA multiples are also trading below the 5 years average, despite its consistent EPS annual growth of near 12% during the same period (table above). This scenario also suggests potential upside ahead once these multiples will eventually come back to the mean in the long run.

Source: YChart

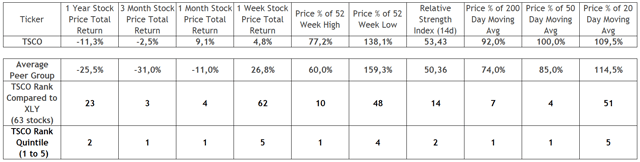

Shares of Tractor Supply have held better compared to most peers during the broader market crash in the past months. The resilience of Tractor Supply’s stock prices is also illustrated by its RSI staying above 50 and current prices that are above its 20-day moving average and have just crossed its 50-day moving average. This picture clearly signals a more balanced stock prices momentum for the time being.

Source: Data from Finbox, consolidated by the author

Takeaway

As consumable categories can hold well during this economic downturn, Tractor Supply should not be so affected as opposed to many other companies in the year 2020. On the other hand, assuming the company’s future growth is attainable as soon as the economy recover, I consider that Tractor Supply offers great value to shareholders, given its fundamentals but also due to its reasonable valuation and upside potential.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment