tang90246/iStock via Getty Images

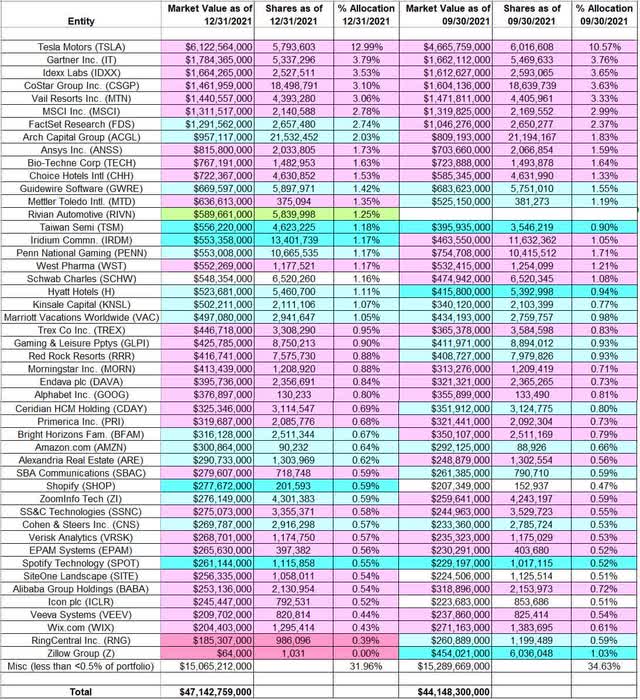

This article is part of a series that provides an ongoing analysis of the changes made to BAMCO Inc.’s 13F stock portfolio on a quarterly basis. It is based on Ron Baron’s regulatory 13F Form filed on 2/14/2022. The 13F portfolio value increased ~7% from $44.15B to $47.14B this quarter. The holdings are diversified with recent 13F reports showing around 400 positions. There are 48 securities that are significantly large (more than ~0.5% of the portfolio each) and they are the focus of this article. The largest five stakes are Tesla Motors, Gartner Inc, IDEXX Labs, CoStar Group, and Vail Resorts. They add up to ~27% of the portfolio. Please visit our Tracking Ron Baron’s BAMCO Portfolio series to get an idea of their investment philosophy and our last update for the fund’s moves during Q3 2021.

Baron Capital currently has ~$60B under management. The assets are distributed among several mutual funds with the common theme of long-term research-driven growth investment solutions. Their flagship mutual funds are Barron Asset Fund (MUTF:BARIX) incepted in 1987 and Baron Partners Fund (MUTF:BPTIX) incepted in 1992. Both funds have produced significant alpha over their lifetimes – 12.52% annualized for Baron Asset Fund compared to 11.08% for the Russell Midcap Growth and 17% annualized for Baron Partners Fund compared to 10.91% for the Russell Midcap Growth.

New Stakes:

Rivian Automotive (RIVN): RIVN had an IPO last November. Shares started trading at ~$100 and currently goes for $46.16. Baron Capital’s stake goes back to a funding round in July 2020 at a valuation of ~$10B. This is compared to current valuation of ~$43B.

Stake Increases:

FactSet Research (FDS): FDS is a 2.74% long-term stake first purchased in 2006. The next two years saw a 4.7M share stake built at prices between $34 and $69. The position has since been reduced through minor selling almost every quarter. The stake is now at ~2.7M shares and the stock is at ~$414. They are harvesting gains. Last five quarters saw marginal trimming while this quarter there was a marginal increase.

Note: Baron Capital owns ~7% of FactSet Research.

Arch Capital Group (ACGL): ACGL is a ~2% of the portfolio stake first purchased in 2007 at prices between ~$7 and ~$8.25. The position remained relatively steady over the next three years. 2011 saw a ~17% stake increase at prices between ~$9.50 and ~$12.50 and that was followed with a similar increase in 2018 at prices between ~$25.50 and ~$31. Since then, the activity has been minor. The stock is now at $47.67.

Note: Baron Capital owns 5.6% of Arch Capital Group.

Guidewire Software (GWRE): Guidewire had an IPO in January 2012. The 1.42% GWRE position was purchased in the 2012-2013 timeframe at prices between ~$20 and ~$49. 2017 also saw a ~25% stake increase at prices between ~$51 and ~$83. Since then, the activity has been minor. The stock currently trades at $91.85.

Note: Baron Capital owns ~7% of Guidewire Software.

Taiwan Semiconductor (TSM): A very small position in TSM was established in 2013 at prices between ~$16 and ~$20. Since then, every year had seen consistent buying. Recent activity follows: 2018 saw a ~30% stake increase at prices between ~$35 and ~$46 and that was followed with a ~12% further increase next year at prices between ~$35 and ~$59. There was a ~25% reduction over the first three quarters of last year at prices between ~$44 and ~$86. Last two quarters have seen a ~55% stake increase at prices between ~$108 and ~$125. The stock currently trades at ~$108 and the stake is at 1.18% of the portfolio.

Iridium Communications (IRDM): IRDM is a 1.17% of the portfolio position first purchased in 2014 at prices between ~$6 and ~$10. The position had remained relatively steady since. H1 2019 saw a one-third stake increase at prices between ~$18.50 and ~$28 and that was followed with minor increases over the next two quarters. This quarter saw another ~15% stake increase at prices between ~$37 and ~$43. The stock currently trades at $40.68.

Note: Baron Capital owns ~9% of Iridium Communications.

Penn National Gaming (PENN): PENN is a 1.17% of the portfolio stake that has been in the portfolio since 2005. Recent activity follows: the two years through Q2 2020 saw a ~50% stake increase at prices between ~$4.50 and ~$74. The stock is currently at $41.52. There was a ~14% trimming in the last five quarters while this quarter saw a ~2% stake increase.

Note: Baron Capital owns ~6.3% of Penn National Gaming.

Hyatt Hotels (H): The 1.11% Hyatt stake was established in the high-20s price range in 2009 following their IPO that November. The next five years saw the position almost doubled at prices between ~$29 and ~$64. 2016 saw a ~30% selling at prices between ~$37 and ~$58. Since then, the stake had remained relatively steady although adjustments were made every quarter. There was a ~15% stake increase last quarter at prices between ~$69 and ~$81. The stock currently trades at $95.18. This quarter also saw a marginal increase.

Note: Baron Capital owns ~10% of Hyatt Hotels.

Kinsale Capital (KNSL): KNSL is a ~1% of the portfolio stake. A very small position was established in 2016 following Kinsale’s IPO. Most of the current position was built next year at prices between ~$28 and ~$45. The six quarters through Q2 2020 had seen a ~30% stake increase at prices between ~$58 and ~$157. The stock currently trades at ~$232. There was a ~13% increase over the last four quarters.

Note: Baron Capital owns 9.3% of Kinsale Capital.

Marriott Vacations Worldwide (VAC): VAC is a ~1% portfolio position. A minutely small stake was purchased in 2012 and the following two years saw the position built to a ~2M share position at prices between ~$42 and ~$75. 2018 also saw a ~50% increase at prices between ~$62.50 and ~$152. The four quarters through Q1 2021 had seen a ~15% trimming while the last three quarters have seen minor increases. The stock is now at ~$156.

Note: Baron Capital owns ~7% of Marriott Vacations Worldwide.

Alexandria Real Estate (ARE), Amazon (AMZN), Bright Horizons Family Solutions (BFAM), Cohen & Steers (CNS), Shopify (SHOP), Spotify Technology (SPOT), and ZoomInfo Technologies (ZI): These very small (less than ~1% of the portfolio each) positions were increased during the quarter.

Note: They own ~6% of Cohen & Steers.

Stake Decreases:

Tesla, Inc. (TSLA): TSLA was a minutely small stake first purchased in 2012. The current position was built from 2014 at an average cost of ~$43 per share. The three quarters through Q1 2021 had seen a ~25% selling at prices between ~$445 and ~$883. The stock currently trades at ~$1011 and is now the largest 13F position at ~13% of the portfolio. There was minor trimming in the last three quarters.

Note 1: In a CNBC interview last October, it was revealed that their TSLA cost-basis is $42.88. They are still very bullish and expect to hold it for a decade.

Note 2: The prices quoted above are adjusted for the 5-for-1 stock split last August.

Gartner, Inc. (IT): IT is a 3.79% of the portfolio position first purchased in 2007 at prices between ~$16 and ~$28. The next three years saw consistent buying as the original position was increased by ~50% at prices between ~$9 and ~$28. The 2014-2015 timeframe saw a ~22% reduction at prices between ~$66 and ~$93. Recent activity follows: the seven quarters through Q3 2020 saw a ~20% selling at prices between ~$83 and ~$171. The stock currently trades at ~$295. Last few quarters have also seen minor trimming.

Note: Baron Capital owns ~6% of Gartner Inc.

Idexx Labs (IDXX): IDXX is a top three 3.53% of the portfolio stake first purchased in 2005. The next three years saw a large stake build-up at prices between ~$15 and ~$30. Since then, the position had remained relatively steady although adjustments were made every quarter. Last eleven quarters have seen a ~47% selling. The stock currently trades at ~$539. They are harvesting gains.

CoStar Group (CSGP): CSGP is a top five stake at 3.63% of the portfolio. It is a very long-term position that has been in the portfolio for two decades. The stake was first purchased in 2000 and the position remained very small for the next three years. The bulk of the current position was built in the 2003-2004 timeframe at prices between ~$1.75 and ~$4.70. 2014 also saw a ~45% stake increase at prices between $14.20 and $21.20. Since then, the position had remained relatively steady although adjustments were made in most quarters. Recent activity follows. Last two years saw a ~22% selling at prices between ~$29.50 and ~$94. The stock currently trades at $67.56. Last four quarters have seen only minor adjustments.

Note: Baron Capital owns ~5% of CoStar Group. The prices quoted above are adjusted for the 10-for-1 stock-split in June.

Vail Resorts (MTN): MTN is a top-five ~3% very long-term stake. During their first 13F filing in Q1 1999, the position was already very large at 11.6M shares. That original stake was sold down by around two-thirds in the 2003-2004 timeframe at prices between ~$11.50 and ~$23. Since then, there has only been minor activity. The two years through 2020 saw a ~10% trimming. The stock currently trades at ~$258. Last four quarters have seen only minor adjustments.

Note: Baron Capital owns ~11% of Vail Resorts.

MSCI Inc. (MSCI): MSCI is a 2.78% of the portfolio position established in 2007. Next year saw the stake built to a ~9.9M share position at prices between ~$12.50 and ~$36. The 2012-2014 timeframe saw the position reduced by ~75% at prices between ~$26 and ~$50. Since then, the stake has remained relatively steady. Q1 2020 saw a ~5% stake increase while there was minor trimming over the next three quarters. The stock currently trades at ~$490. Last four quarters have seen only minor adjustments.

ANSYS, Inc. (ANSS): The bulk of the 1.73% ANSS position was purchased in 2009 at prices between ~$20 and ~$43. The stake was increased by ~15% over the next two years but was reduced since. The four years through 2018 saw a ~25% selling at prices between ~$143 and ~$190. The two years through 2020 had seen a ~10% trimming. The stock currently trades at ~$309. Last four quarters also saw a ~14% trimming.

Bio-Techne Corporation (TECH): The 1.63% of the portfolio TECH stake goes back to 2014 when it was acquired at a cost-basis of ~$90 per share. By 2018, the stake was built from ~1M shares to ~1.5M shares at prices up to ~$200. Since then, there has only been minor activity. The stock is currently at ~$435.

Choice Hotels (CHH): CHH was already a huge 19.4M share position in their first 13F filing in Q1 1999. That original stake was reduced by ~90% to a ~1.9M share stake by 2004 at prices between ~$3 and $22. 2007 saw a ~70% stake increase at prices between ~$26.50 and ~$34. Since then, the position was relatively steady till 2014. The five years through 2019 had seen minor trimming most quarters – overall, there was a ~15% selling during that period at prices between ~$42 and ~$105. The stock currently trades at ~$143. Last six quarters saw marginal trimming.

Note: Baron Capital owns ~8.2% of Choice Hotels.

Mettler-Toledo International (MTD): MTD is a 1.35% of the portfolio position established in 2008 at prices between ~$68 and ~$110. Next year saw a ~150% stake increase at prices between ~$47 and ~$100. Since 2009, the position has seen consistent selling: ~85% reduction at prices between ~$100 and ~$1700. The stock is now at ~$1388. They are harvesting long-term gains.

Alibaba Group Holding (BABA), Alphabet Inc. (GOOG), Ceridian HCM Holding (CDAY), Endava plc (DAVA), EPAM Systems (EPAM), Gaming and Leisure Properties (GLPI), ICON plc (ICLR), Morningstar, Inc. (MORN), Primerica, Inc. (PRI), Red Rock Resorts (RRR), RingCentral (RNG), SBA Communications (SBAC), SS&C Technologies (SSNC), SiteOne Landscape (SITE), Trex Company, Inc. (TREX), Verisk Analytics (VRSK), Veeva Systems (VEEV), Wix.com (WIX), West Pharmaceutical (WST), and Zillow Group (Z): These very small (less than ~1% of the portfolio each) stakes were reduced this quarter.

Note 1: Baron Capital had owned ~12% of Zillow Group as of last quarter. The position was reduced to a minutely small stake this quarter.

Note 2: Baron Capital owns significant ownership stakes in the following businesses: Endava plc, Primerica, and Red Rock Resorts.

Note 3: Although the positions as a percentage of the portfolio are very small, Baron Capital has significant ownership stakes in the following businesses: Afya Limited (AFYA), BRP Group (BRP), Clearwater Analytics (CWAN), ForgeRock (FORG), Grid Dynamics (GDYN), Installed Building Products (IBP), Indie Semi (INDI), Manchester United (MANU), MaxCyte (MXCT), Repay Holdings (RPAY), Sarissa Capital Acquisition (SRSA), and Utz Brands (UTZ).

The spreadsheet below highlights changes to Ron Barron’s US stock holdings in Q4 2021:

Ron Baron – BAMCO – Baron Capital’s Q4 2021 13F Report Q/Q Comparison (John Vincent (author))

Be the first to comment