PeopleImages

Recently, TPI Composites (NASDAQ:TPIC) discussed large agreements with potential revenue of $2.7 billion, and lowered its expected 2022 capex. I believe that most investors are not fully aware of the TPI’s implied valuation. Under my discounted cash flow model with conservative assumptions, TPI Composites could be worth around $22 per share. Yes, I dislike the concentration of clients and potential changes in demand that is typical in the industry. With that, in my opinion, the current stock valuation is too low.

TPI Composites: Significant Incoming Revenue

Headquartered in Scottsdale, Arizona, TPI Composites manufactures composite wind blades for the wind energy market. We are talking about a globally diversified business model with facilities throughout the U.S., China, Mexico, Turkey, and India along with development centers in Denmark and Germany.

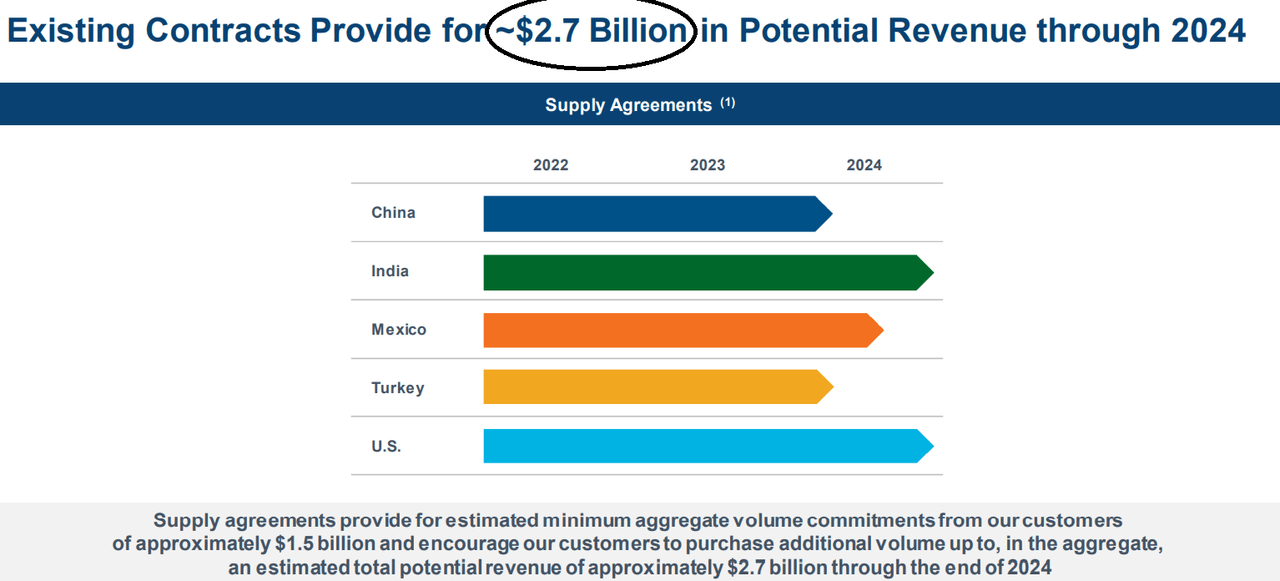

The most remarkable slide from the quarterly presentation is shown below. Management noted $2.7 billion in revenue from existing contracts through 2024. If we take into account that the current market capitalization does not exceed $670 million, TPI Composites becomes an interesting object of study.

Presentation

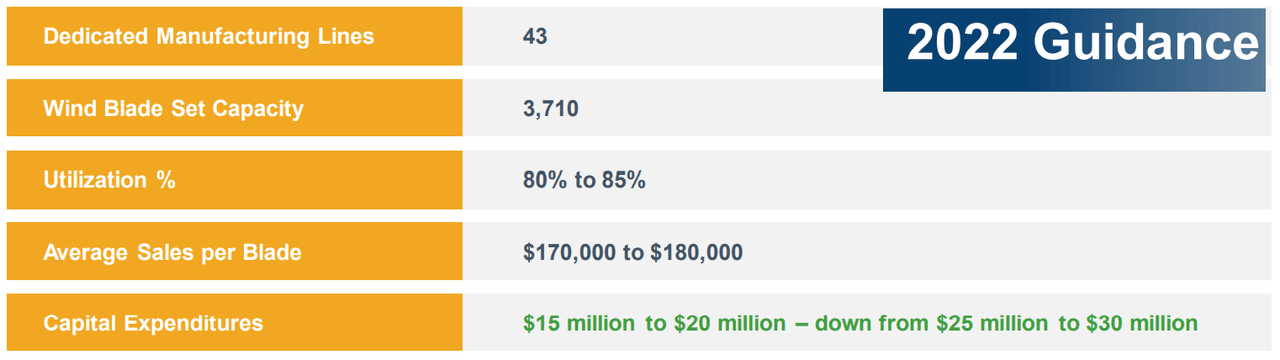

Besides, it is worth noting that TPI Composites expects 2022 to offer 80%-85% utilization and lower capital expenditures than initially expected. If things continue in the same direction, lower capex and more utilization will likely bring free cash flow up.

Presentation

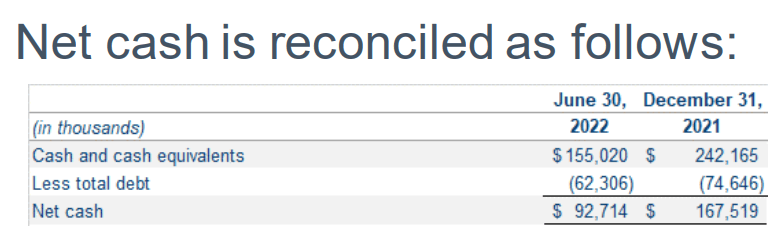

Beneficial Analysts Expectations And Positive Free Cash Flow Expected From 2023

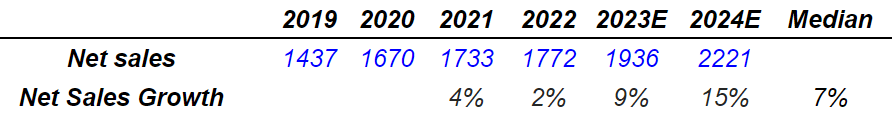

Analysts expect TPI Composites to deliver 9% sales growth in 2023 and double digit sales growth in 2024. The median sales growth is expected to be close to 7% for TPI Composites, which I believe is impressive given the sector in which TPI operates.

Marketscreener.com

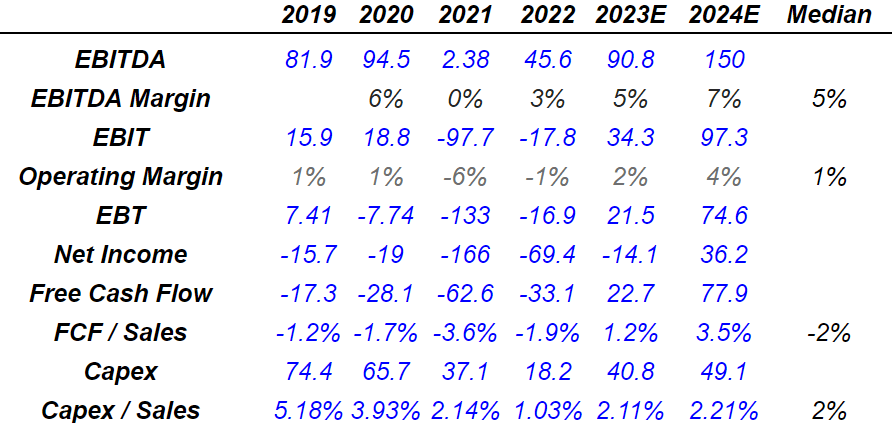

It is also worth noting that the company’s EBITDA is expected to increase to up to 7% in 2024. Analysts also expect positive net income from 2024 and positive free cash flow from 2023. In my opinion, as soon as more investors notice the incoming results, the demand for the stock will likely increase.

Marketscreener.com

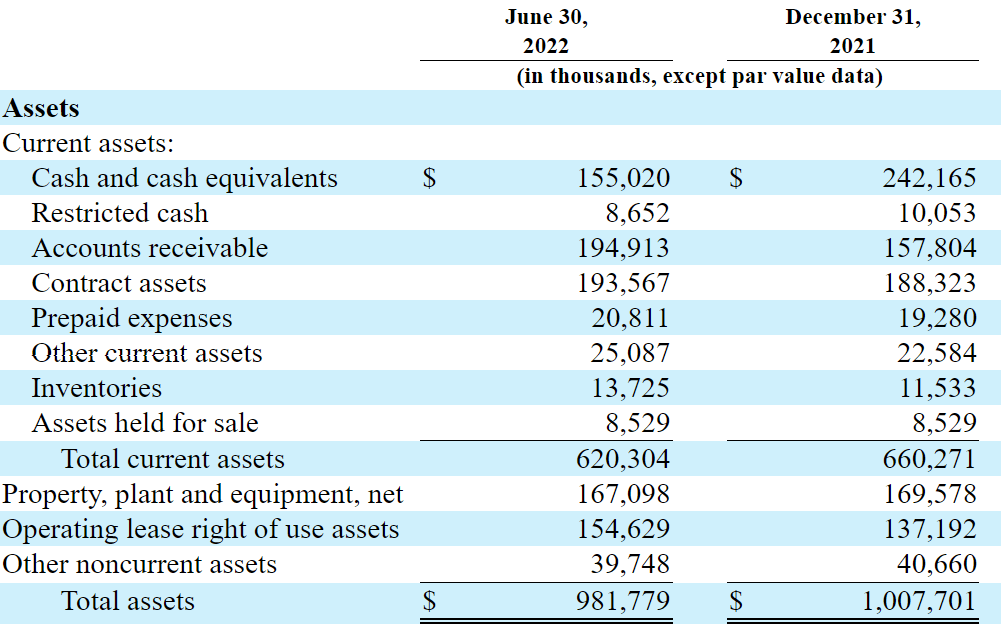

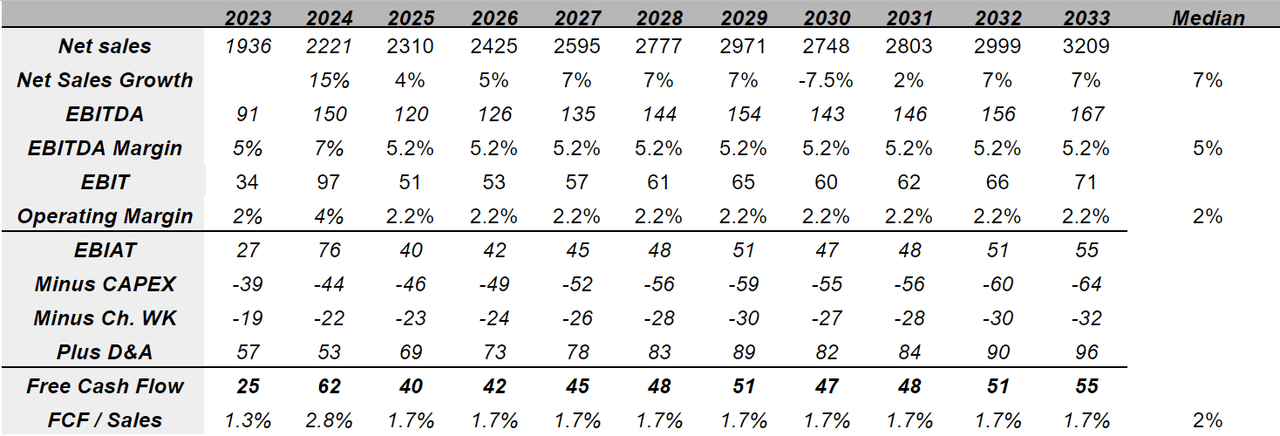

Balance Sheet: Almost No Debt

As of June 30, 2022, TPI Composites reported cash worth $155.2 million, total assets worth $981 million, and $586 million in total liabilities. In my view, the current balance sheet proves that the company’s financial situation is in good shape.

10-Q

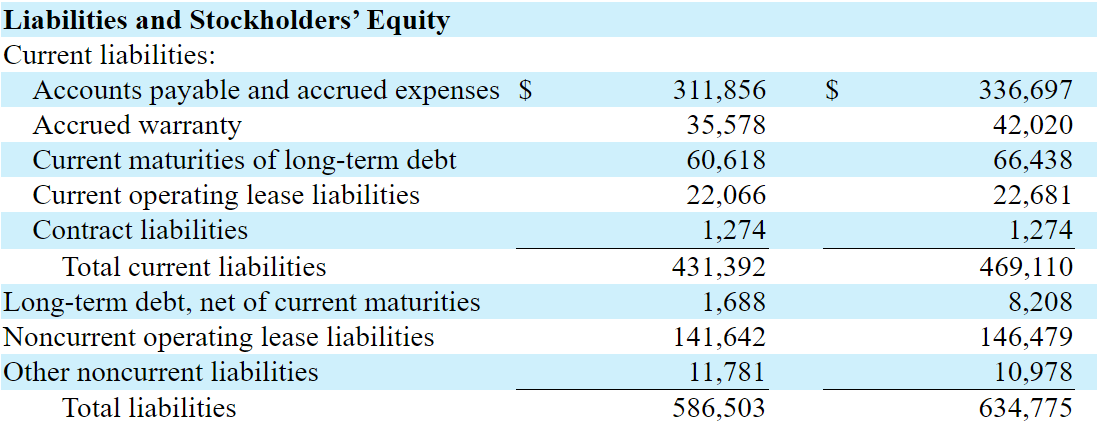

The total amount of debt is small. Hence, investors will not have to worry about increases in the interest rates in the market. The company’s net debt is negative, equal to -$92 million. Besides, in my view, TPI could receive debt financing if necessary.

10-Q Presentation

My Base Case Scenario Implied A Valuation Of $22.3 Per Share

TPI Composites is overall well positioned to benefit from the decarbonization of the electric sector. The U.S. and Europe are also enforcing demand for wind energy. In my view, if clients receive financing from governments, TPI’s revenue will likely trend up.

We expect global demand for renewable energy, and wind energy in particular, will continue to grow in the long term due to a multitude of factors, including: increased cost competitiveness of wind energy compared to fossil fuel generated electricity; increased demand from corporations and utility providers for renewable energy; and recent international policy initiatives designed to promote the growth of renewable energy. Source: 10-k

Besides, I believe that further wind and transportation supply agreements and sufficient communication about the agreements already signed will bring stock demand. In the last 10-k, the company noted agreements worth $3.5 billion through the end of 2024:

As of February 24, 2022, our wind and transportation supply agreements provide for minimum aggregate volume commitments from our customers of approximately $2.2 billion and encourage our customers to purchase additional volume up to, in the aggregate, a total contract value of approximately $3.5 billion through the end of 2024. Source: 10-k

Finally, under this scenario, I would also expect further investments in the growing offshore wind market, perhaps some acquisitions, and more partnerships. In my view, bankers would most likely support any acquisitions considering the current balance sheet.

Leverage our footprint in large and growing wind markets, capitalize on the continuing outsourcing trend, evaluate building wind blades for the growing offshore wind market and evaluate strategic acquisitions. Source: 10-k

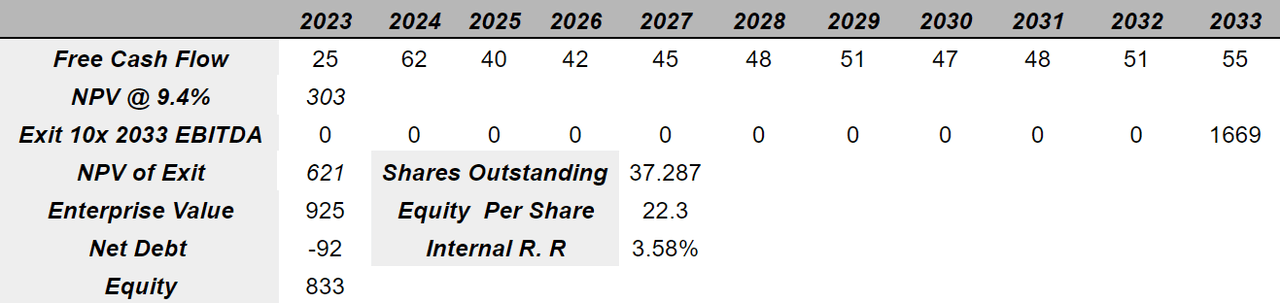

Under conservative conditions, I believe that a median sales growth of 7% from 2024 to 2033 would make sense. I also assumed an EBITDA margin of around 7%-5.2% with an operating margin around 2%. The results include free cash flow ranging from $24 million to $62 million and FCF/Sales around 1.7%.

Arie’s DCF Model

In my opinion, most investors out there would be using a discount close to 9.4% for TPI Composites. I would not be very different. I also assumed an exit multiple of 10x EBITDA, which is close to the median in the industry and lower than the TPI’s current EV/EBITDA multiple. With these numbers, I obtained an equity valuation of $833 million and an equity per share of $22.3.

Arie’s DCF Model

Worst Case Scenario

In my view, investors need to be prepared for changes in demand, which is typical in the wind industry. Changes in the oil price, the price of energy, or environmental law changes could bring TPI’s revenue and FCF/Sales margin down. The company did discuss some of these risks in the past:

We currently expect to have manufacturing lines in transition during 2022 which could adversely affect our revenue and profitability in 2022. We typically share transition costs with the customer in connection with these changing customer demands, but any sharing is usually the subject of negotiation and the amount is not always contractually defined. Source: 10-k

With regards to new actions from governments, management noted recently that unsubsidized, auction-based tenders could lead to diminishing prices and more competition. As a result, in my view, in the long-term, TPI could suffer from declining EBITDA margins or even declines in revenue. In the worst case scenario, detrimental results could lead to stock price declines:

Many governments are shifting from feed-in tariffs, which typically provide producers of wind energy with favorable prices for wind generated electricity, to unsubsidized, auction-based tenders as a means of promoting the development and growth of renewable energy sources such as wind energy. As a result of this shift, our wind turbine OEM customers are experiencing intense pricing pressure with respect to the sale of their turbines. Source: 10-k

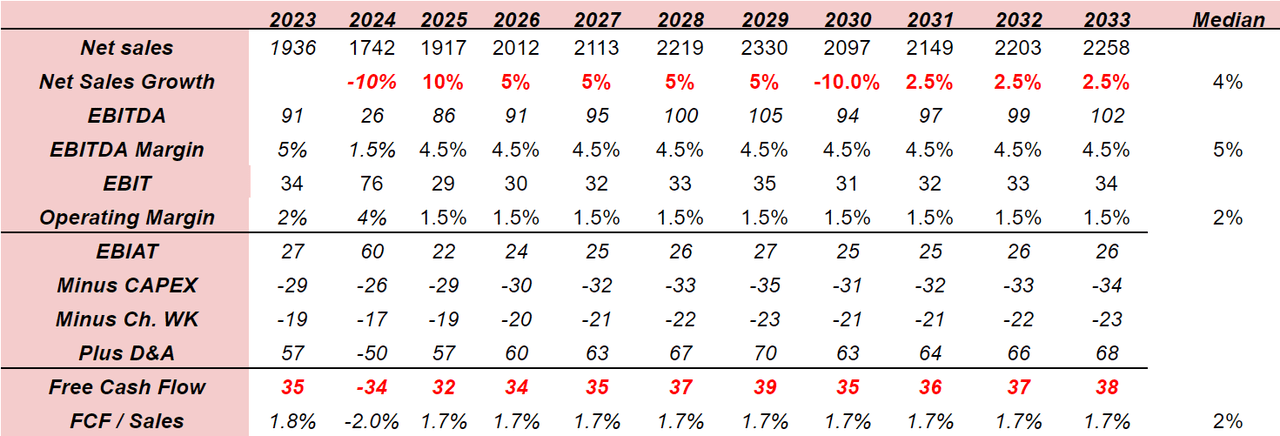

Under bearish conditions, I assumed a decline of 10% in 2024 and 2030 as well as a median sales growth of 4%. Also with an EBITDA margin close to 4.5% and operating margin of 1.5%, 2033 EBIAT would stand at close to $25 million.

If we also assume capital expenditures of around $35 million and $30 million, the FCF would be around $35 million per year. The FCF/Sales would stand at around 1.5% and 1.75%. I believe that my numbers could be reported by TPI.

Arie’s DCF Model

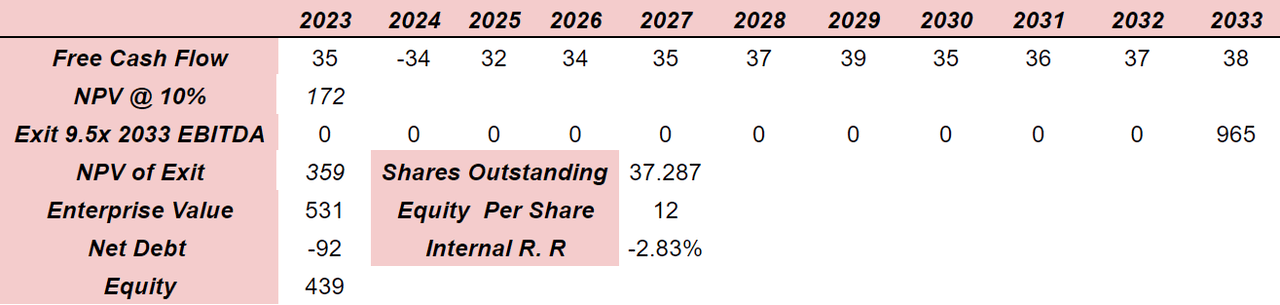

If we sum future free cash flow at a discount of 10%, the net present value stands at $172.5 million. With an exit multiple of 9.5x, the total enterprise value would stand at $531 million. Now, if we divide by around 37.25 million shares outstanding, the fair price would be close to $12.2 per share.

Arie’s DCF Model

Risks From Concentration Of Clients And Wind Blade Failures

TPI mainly serves products to three large companies, which I believe is a significant risk. In my view, these companies may be able to negotiate TPI’s prices and reduce TPI’s free cash flow margins. Keep in mind that management does not seem to have many clients to sell its products.

Substantially all of our revenues are derived from three wind blade customers. Vestas (OTCPK:VWDRY), GE Wind (GE) and Nordex (OTCPK:NRDXF) accounted for 40.4%, 24.7% and 22.4%, respectively, of our total net sales for the year ended December 31, 2021, and 49.7%, 23.4% and 15.3%, respectively, of our total net sales for the year ended December 31, 2020, and 46.1%, 25.7% and 16.1%, respectively, of our total net sales for the year ended December 31, 2019. Source: 10-k

In the past, the company did suffer product defects, so it may happen in the future. In my view, further wind blade failures could damage TPI’s reputation. Management may lose contracts with potential clients, or lose existing clients. As a result, future free cash flow expectations could decline, which may drive the stock price down.

Any wind blade failures or other product defects in the future could materially harm our existing and prospective customer relationships. Specifically, negative publicity about the quality of the wind blades we manufacture or defects in the wind blades supplied to our customers could result in a reduction in wind blade orders, increased warranty claims, product liability claims and other damages or termination of our supply agreements or business relationships with current or new customers. Any of the foregoing could materially harm our business, operating results and financial condition. Source: 10-k

Conclusion

Considering the total amount of potential revenue from existing contracts through 2024, TPI Composites is an interesting investment play. I don’t think most market participants are fully aware of the FCF acceleration that is coming from 2023. Assuming conservative sales growth and the fact that TPI benefits from the decarbonization of the electric sector, I obtained a valuation of more than $22 per share. In my opinion, even considering risks from concentration of customers, changes in governmental regulations, or changes in demand, the stock price is too low at its current market price.

Be the first to comment