Townsquare Media is no longer an old timey radio broadcaster. The company’s Digital segment should drive revenue growth moving forward and help the company become less of a radio company and more of an advertising and ad-tech focused company. maodesign/E+ via Getty Images

As many of our readers know, we have spent the better part of 2022 optimizing our portfolios in order to be positioned to benefit during a recovery while also being able to weather any economic issues that may present themselves. We have focused on companies with sound businesses, a focus on dividends or paying down debt, and the potential to potentially grow their underlying businesses or significantly cut costs in the years ahead. Today we are going to point out another special situation that we want to bring to readers’ attention which is a name we will begin to nibble at in our own portfolios.

The Stock

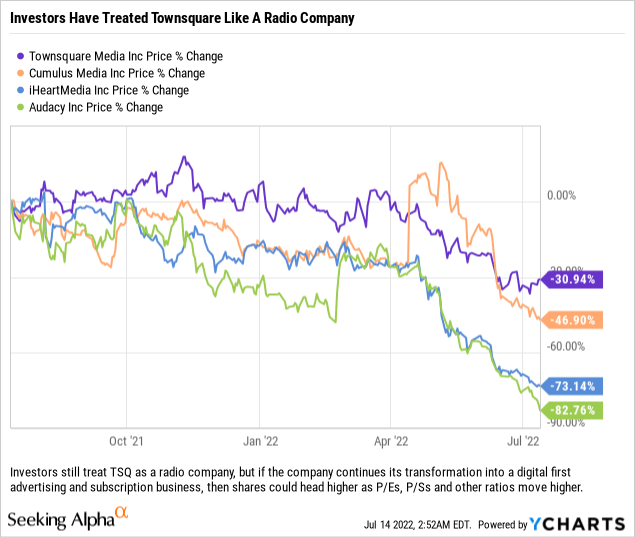

Townsquare Media (NYSE:TSQ) is known by most as a terrestrial radio company whose focus is on stations outside the 50 largest markets in the United States. The company owns 321 local terrestrial radio stations in 67 markets in the United States. While many still remember this as a radio operator (and we would point out that the Wall Street analysts who cover the stock are analysts who cover that sector/industry), the company also owns some intriguing digital assets.

The Thesis

It appears that Townsquare Media may hold some hidden value that the market is failing to recognize. This is somewhat common in small caps, especially those which are launching new business lines that differ from historical ones. For those who have not been following this stock over the last few years, Townsquare has been growing its digital media and digital marketing segments during that time and has created what we believe to be an exciting opportunity for investors.

The Details

Townsquare of course owns the radio stations and their associated media assets (think websites, social media and live events). This gave way to the creation of Townsquare Interactive, which the company describes as “a digital marketing services business that provides website design, creation and hosting, search engine optimization, social media and online reputation management as well as other digital media services” and Townsquare Ignite which manages the company’s owned and operated digital brands while running a digital programmatic technology platform and providing data analytics.

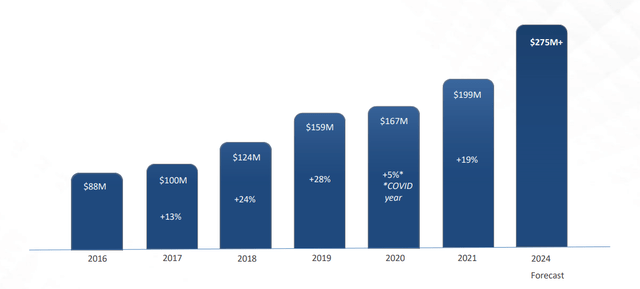

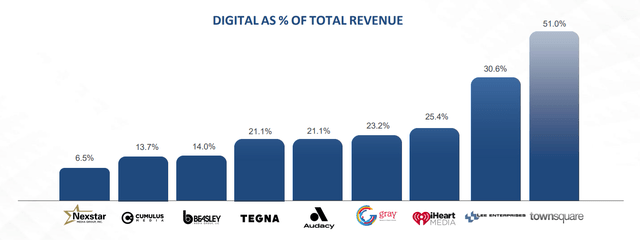

While the broadcasting segment (which includes live events, etc.) historically delivered the majority of Townsquare’s revenue, the digital side of the business (Townsquare Interactive and Townsquare Ignite), which has grown strongly over the years, became the majority contributor to revenue (with 51%) in Q1 of 2022. The digital business has been growing strongly since 2016 and FY2022 should be the year when Digital provides the majority of Townsquare Media’s revenues (ex-political ads), even with the Cherry Creek acquisition on the Broadcast side.

Townsquare Digital Revenues have steadily increased since 2016, even rising in 2020 with COVID headwinds. (Townsquare Investor Presentation)

Speaking of the Cherry Creek station group acquisition, management discussed on last quarter’s conference call how they believed that acquisitions such as this made sense as they are initially accretive to EPS and allow Townsquare to bring its Digital team in and not only improve margins on current digital revenues, but also increase digital revenues to the company’s industry leading levels.

Townsquare, like Lee Enterprises, has had to grow their digital businesses out of necessity. Townsquare is now a leading player in the industry and not only is the company growing revenue at a healthy rate, but they are also matching margins from the cash generating broadcast business. (Townsquare Media Investor Presentation)

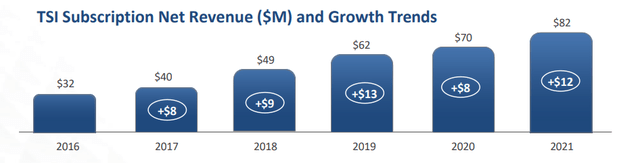

We recognize that it would be easy for someone to argue that the company is just shifting ad dollars from radio to interactive, but we think that misses the transformation that has occurred. Townsquare Interactive generated $82 million in subscription revenues with a $25 million subscription profit for FY2021. The subscription business has grown strongly over the years, and still grew over 10% in 2020 with the company having to deal with headwinds from COVID. Subscription businesses historically do well over time (they also perform well during recessions) and because of their steady revenue streams they tend to carry a higher multiple. And while the Broadcast business could very well be impacted by a downturn, we suspect that businesses will continue to pay for digital performance and keep their websites and web presence going – even if the economy contracts further.

The subscription model is already helping to drive earnings higher, but could also lessen any blow to the Broadcast businesses during a recession. (Townsquare Media Investor Relations)

Townsquare’s management team believes that the company has a potential $30 billion+ addressable market for their Digital business which dwarfs the opportunity for their Broadcast business. The company is opening up its second Digital office in Phoenix, Arizona (currently, the only Digital office is in Charlotte, NC) and looking to expand their sales teams and drive higher penetration among the Western United States. It is our opinion that the opportunity for investors lies here and that over time, as Digital revenues continue to grow (both in total $ and relative to the Broadcast segment), that the market will be forced to stop treating Townsquare Media as a radio company, and valuing it as such, and instead treat it as a subscription and/or advertising entity (which would carry a higher multiple).

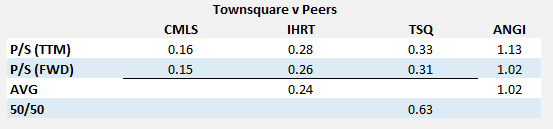

We think that the market has already begun to do this somewhat, especially when looking at basic metrics such as price-to-sales (P/S) but has not even come close to pricing in the differences on revenue composition (broadcast v. digital) in a meaningful way which is a bit more obvious when looking at more detailed metrics. The following table looks at the price-to-sales metric, showing the average for radio companies, and then what Townsquare could be valued at (using the P/S ratio) if investors assigned the same valuation as Angi (ANGI) to 50% of Townsquare’s revenues.

Townsquare could see significant upside if investors treated its Digital business like that of competitor ANGI. (Seeking Alpha)

We would also point out that the company used to pay a dividend each quarter until they discontinued it due to COVID. The company used to pay $0.075/share per quarter, or $0.30/share on an annual basis. We would hope that management will take a look at implementing a dividend for shareholders in the next year, especially with net leverage ratios expected to be as low as they ever have been for the company.

Risks

We noticed that management decided to purchase $5 million in Bitcoin (BTC-USD) during FY2022 Q1. That purchase is underwater at this time and not something that we believe the company needed to get involved in. Speculating on cryptocurrencies with the company treasury does not fit this business model and was a misfire by management, in our opinion. If management really wanted to get exposure to crypto, we think they could have run an advertising campaign with a crypto partner and taken payment in Bitcoin. That probably would have satisfied all parties and led to an interesting advertising campaign across the broadcast radio station portfolio but instead the company spent money earned from other ads on something that has nothing to do with the core business.

This did not come up on the last conference call, but we suspect that there will be a decent adjustment this quarter due to Bitcoin’s pullback so we hope that an analyst will bring it up on the conference call.

How We Will Trade

We will begin to purchase, initially in small quantities (due to our current concerns about Bitcoin and management potentially adding to those holdings), shares in Townsquare Media starting Thursday, July 15, 2022. We believe that this is a long-term play and that there are many ways for the investment to pay off. Investors could assign higher multiples to the stock as they stop valuing the company as a radio broadcaster, multiples could stay the same, but the company’s revenues could grow overall due to digital growth, or management could move to split the company once digital revenues reach a level to sustain a standalone entity.

Our initial price target on Townsquare Media is $11/share.

Be the first to comment