Scharfsinn86/iStock via Getty Images

After a bruising 2020 with a substantial change in energy demands and a dip in Brent price (which went as low as $20), TotalEnergies SE (NYSE:TTE) announced a reinvention: over the 2020-30 decade, the company will reorganize into two pillars: (1) LNG and (2) Renewables & Electricity. Furthermore, over the decade, oil products’ contribution to sales will be brought down to 30% from 55%.

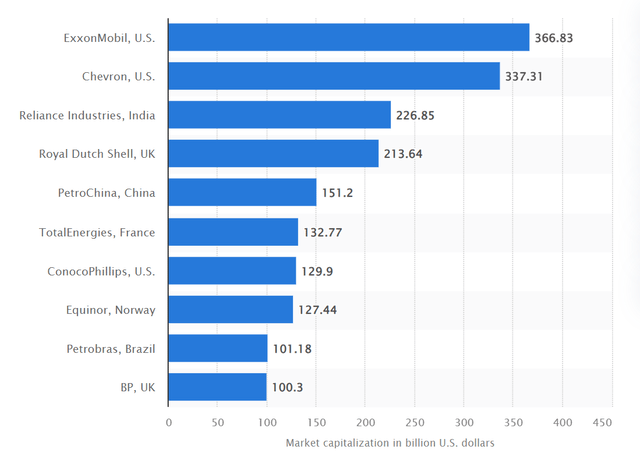

This is no small feat for a company which ranked as the world’s sixth-largest oil and gas company as of April 2022:

Leading Oil & Gas Companies by Market Capitalization, April 2022 (Source: Statista)

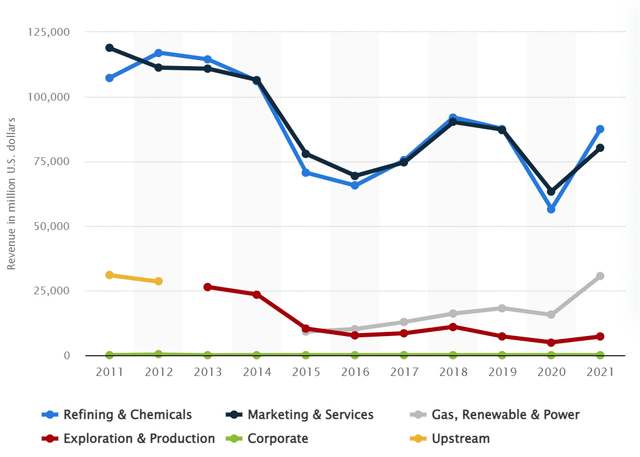

In 2021, refining, marketing and renewables were, in order, the company’s best-performing business segments in terms of revenues. Exploration and Production (E&P), on the other hand, has been in decline for nearly a decade now.

TotalEnergies Revenues by Segment, 2011-2021 (Source: Statista)

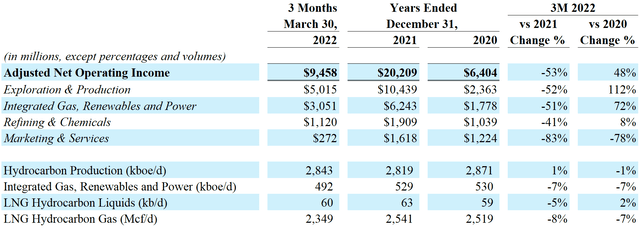

In terms of operating income, however, E&P has been a major contributor to the company’s turnaround in 2021 as well as in Q1 of this year:

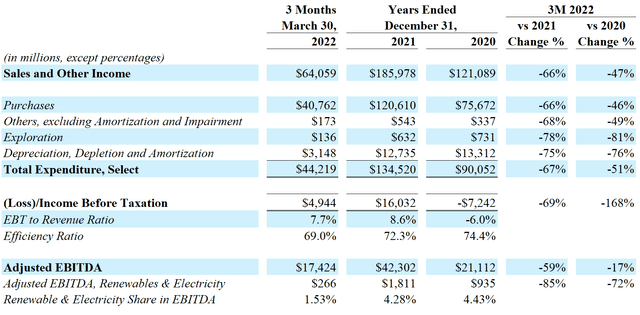

Source: TotalEnergies Financial Statements

Given that hydrocarbon production didn’t have an enormous amount of variance (around 1 to 9% across both liquids and gas), this stellar performance is significantly attributable to rising energy costs both in the past year and the first quarter of this year. It bears noting, at this point, that the company’s first half/second quarter results are scheduled to be announced in a month.

If trends from the first quarter were to continue over into the second quarter, production of hydrocarbons could end up a little over twice that of the entire first half of 2022. However, after the Russian Federation’s “special military operation” in Ukraine, the company – after weeks of refusing to halt operations – had announced that it will halt oil purchases in the Federation by the end of the year and had taken a $4 billion writedown on its Russian gas project in April.

Renewables: Present and Future

Power Production from Renewables

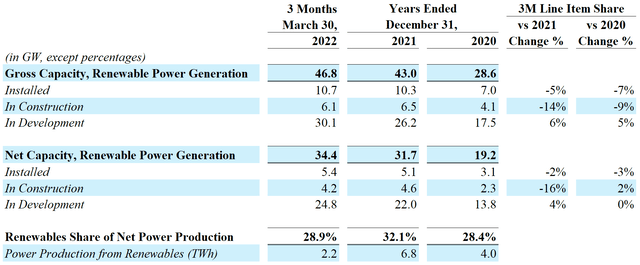

The company’s renewable power generation capacity has grown to above a 1:3 ratio between “installed” and “expected”:

Source: TotalEnergies Financial Statements

Considering the steady increase in projects “in development”, it can be expected that the renewables share in net power production will ramp up over the years and will likely end the Financial Year with a slightly larger share at least somewhere between the highs of 2021 and the baseline at 2020.

An examination of the trends seen in key line items over the years and into the past quarter, however, provides a faint hint of the true cost of going green (at least at the moment):

Source: TotalEnergies Financial Statements

The comparison of select (i.e. major) expenses versus sales reveals a solid level of line item discipline. However, the dip in renewables share in contribution to EBITDA is an indicator of continued investment in this sector. However, it also highlights the sheer value that its existing hydrocarbon business brings to the table.

Green Hydrogen Initiative

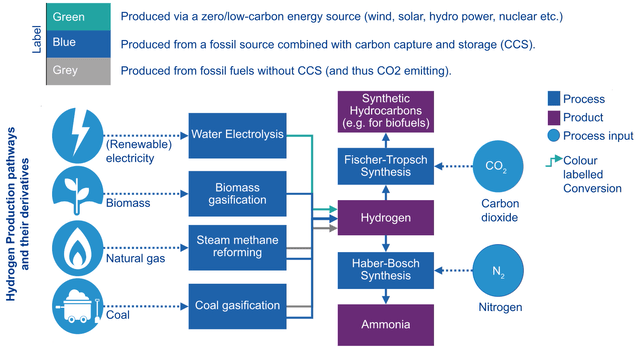

A comparatively nascent initiative has been in the development of hydrogen fuel as an alternative to existing fossil fuels. Given that the utilization of hydrogen as a fuel results in no carbon dioxide emissions, this is a promising alternative fuel for the future, particularly when it comes to heavy transport.

The company has a growing number of hydrogen refuelling stations across Germany, the Netherlands, Belgium and France while developing numerous new projects to prepare the consumer market for broader adoption.

The problem with hydrogen fuel production, however, is that the vast majority of the output is derived from fossil fuels with a high production of emissions (referred to as “grey hydrogen” manufacturing).

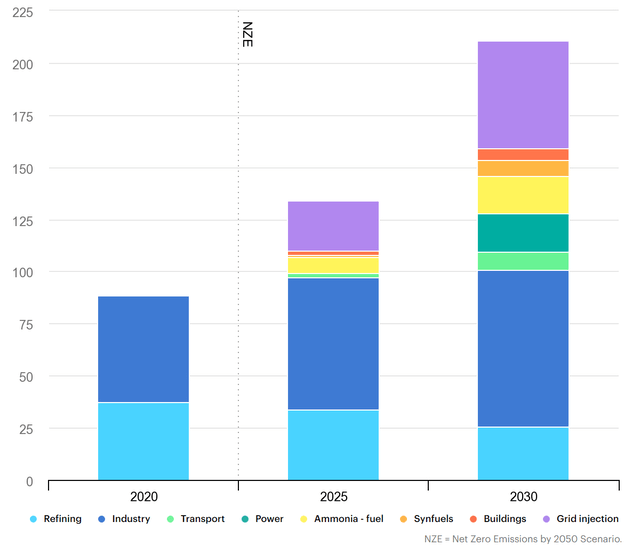

Relative to 2020, the International Energy Agency (IEA) estimates that hydrogen demand will go up by more than 2.5X by the end of the decade. Industry demands will form the bulk of this increase.

PricewaterhouseCoopers enunciates the challenges with meeting growing hydrogen demand for hydrogen vis-à-vis an environmentally sustainable framework in accordance with Paris climate targets thus:

Proposed plants have larger electrolyser capacities of 100MW or more, but those are still small compared to current grey hydrogen production plants. Second, building the infrastructure for large scale hydrogen use, such as pipelines or export/import terminals, will take many years—it takes seven to twelve years to plan and build a pipeline, for example. Ideally, the required infrastructure will be built in parallel to growing hydrogen demand at falling costs to ensure that by 2030 hydrogen can be traded and transported in necessary quantities.

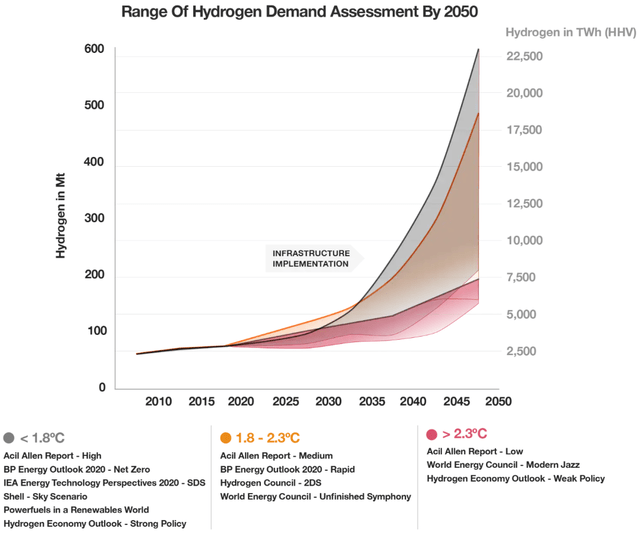

All medium and high ambition scenarios see a stronger hydrogen demand from 2030 and another strong increase from 2035 onwards. To meet the Paris climate targets, planning for infrastructure has to begin now.

Under all scenarios, the consulting firm foresees a massive increase in hydrogen demand by 2050:

And concluded “many large countries — such as the US, Canada, Russia, China, India and Australia — have regions for both competitive and non-competitive hydrogen production.”

Note: “competitive” hydrogen production requires renewable resources as well as sufficient land to scale up production. A facility in a densely populated area, despite access to renewable resources, ends up being “non-competitive” since production can’t be scaled up.

The company, a well-established manufacturer of “grey hydrogen” seeks to transition to “blue” and “green” forms of hydrogen production. Towards that end, it has taken significant steps.

In the first step, the company has entered into a partnership to develop France’s largest renewable hydrogen production site at Châteauneuf-les-Martigues in the Provence-Alpes-Côte d’Azur South region. In its first phase, expected to go into production next year, the facility’s 40 MW electrolyser will produce 5 tons of hydrogen per day. With additional renewable farms, the electrolyser has the potential to triple that output.

By no means is this the largest electrolyser in the world: a Norwegian-Middle Eastern consortium is building a 100-MW facility in Egypt (due to be completed by November), Plug Power (PLUG) is planning to build a 100-MW electrolyser at the Port of Antwerp-Bruges in Belgium and Chinese chemical manufacturer Ningxia Baofeng Energy Group has commissioned a 150-MW alkaline electrolyser in China’s Ningxia Autonomous Region this February.

However, the company isn’t just working on this goal alone: the company has a long-standing relationship with India’s Adani Group, which extends to a 20% ownership of the latter’s Adani Green Energy Limited (AGEL), among the world’s largest solar developers. The company has acquired a 25% interest in Adani New Industries Limited (ANIL) which aims to produce one million tons of green hydrogen per year by 2030, while supported by around 30 gigawatts (GW) of new renewable power generation capacity, and kickstart a green hydrogen ecosystem with the flexibility to attain both a distinct first-mover advantage within India and facilitate consumption abroad via exports.

Ratios and Price Trajectories

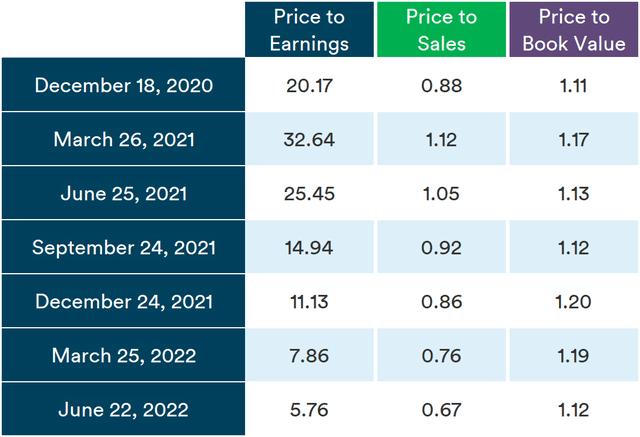

An analysis of the 3 ratios similar to that executed in recent articles indicates a rather interesting present-day picture vis-à-vis the past:

When considering the Price to Sales (P/S) and Price to Book Value Ratios, the stock is currently as close to a “market efficiency” proponent’s dreams as is possible in the real world. The stock’s Price to Earnings (P/E) Ratio is quite attractive too from a price-sizing perspective.

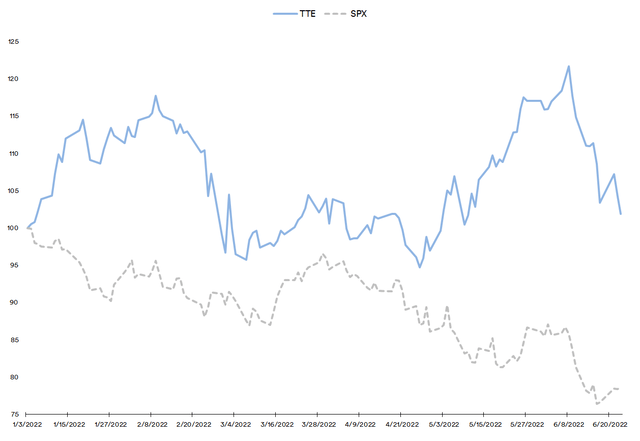

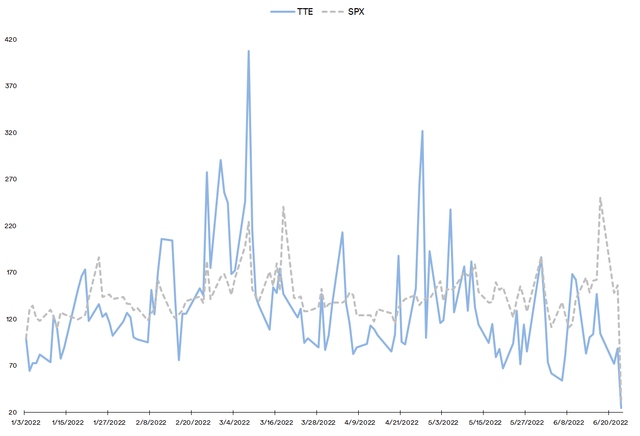

Given the long decline in the P/E Ratio, it should come as no surprise that the stock price has been falling. When the normalized YTD performance of the stock is compared against the benchmark S&P 500 (SPX), another facet of the picture is revealed:

Source: Created by Sandeep G. Rao using data from Yahoo!

At the present, in terms of performance, the stock’s performance has been reset, essentially wiping out all gains for the year till date (YTD).

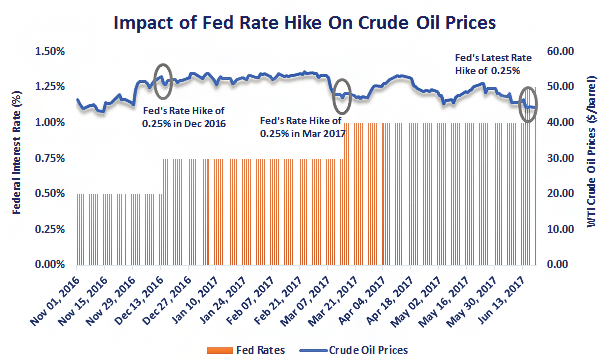

The dominant factor behind the rise and fall of the stock can be explained thus: owing to the company’s relationship with crude oil, the stock had soared. Now, oil prices rise when the supply-demand gap is tilted towards higher demand. However, the Fed rate hike tends to provide an impetus for all economic participants to spend less and save more. This, in turn, imparts higher cost of business for companies in the face of fewer transactions. With lessening business, a lessening demand for oil is implied. Thus, oil prices take a dip.

Over the past several rate hikes, this paradigm has certainly manifested itself repeatedly:

Source: Trefis

In the present scenario, with no effective inflation-adjusted wage increases to stave off the effect of increased energy prices, there is now a downward pressure being implied on consumption that also influences the oil price trajectory.

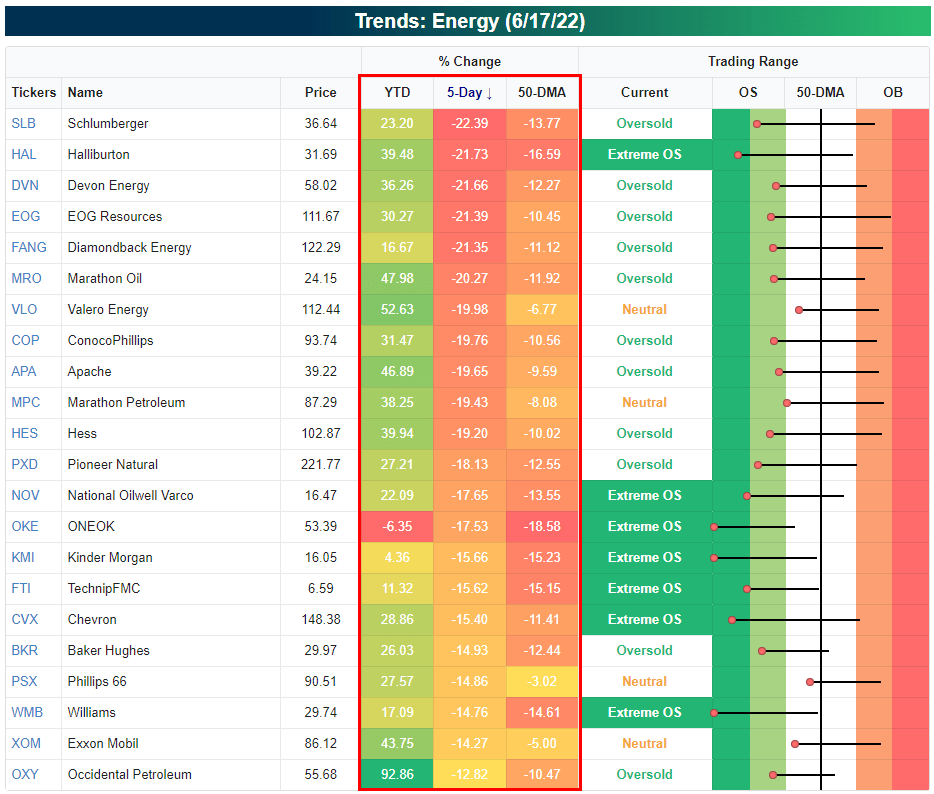

Furthermore, it’s standard wisdom (by now) that energy and financials stocks generally tend to do comparatively well during an inflationary environment and attract higher investor interest. However, when said environment doesn’t get addressed effectively or soon enough, these stocks venture into “oversold” territory. As Federal Reserve Chairman Jerome Powell testified on the 22nd, the signs of inflation were evident long before Russia’s actions in Ukraine.

As of last week, it has been reported that most major U.S. energy stocks were “oversold”:

Source: Bespoke Investment Group

Thus, it should come as no surprise that the stock’s traded volume is currently well below that seen in the starting days of the YTD:

Source: Created by Sandeep G. Rao using data from Yahoo!

Summary and Recommendation

It’s a tough time to make an investment decision. So recommendations will be expounded upon in terms of investor preferences.

For long-term investors currently holding the stock, the recommendation is thus: the company is quite stable and well-led, has an established market in current-generation fuels, has taken initiative in establishing a strong foothold in next-generation fuels and paradigms, builds strong partnerships with powerful players with meaningful synergies, is reasonably cash-rich and – for what it’s worth – pays a dividend. The “green” initiatives are also quite likely to attract state subsidies that will help rationalize some of its expenditure in new directions. As far as current-generation fuels are concerned, a new LNG deal signed in Qatar will likely secure the raw material needed for its current market and its partnerships. It’s entirely reasonable to continue holding the stock. In fact, “Hold” is the rating being given to the stock.

For investors not holding the stock but interested in long-term holdings: as ratios indicate, this is as close to a “rational market price” that one can get. Given the factors in favour of holding outlined for current stockholders, it’s an interesting moment to consider buying in.

For investors not holding the stock and looking for inflation-busting gains by the end of the year: recovery from inflationary pressures is a long game and there’s no telling if stock performance would parry that by the end of the year. If one must invest, this company is certainly not a bad bet but an inflation-busting performance cannot be assured in good conscience; for one, it’s uncertain if inflationary pressures will even subside anytime soon.

Be the first to comment