Maria Korneeva

Around a month ago, Vogue magazine ran an article titled “Is My Body About To Go Out of Style?”, which refers to a backslide in the recent trend towards inclusivity and body acceptance. Besides noting punishing celebrity diets and the lack of diversity at the New York Fashion Week, it provides interesting business insight into this too, essentially indicating that plus-size fashion is still a relatively recent niche, which involves the expensive business of customer acquisition as opposed to catering to the tried and tested market. I would think breaking new ground might be particularly challenging right now in the context of a difficult macroeconomic situation. Less competition, however, also presents an opportunity for companies like the plus-size women’s fashion retailer Torrid Holdings (NYSE:CURV), which points out in a recent presentation that it only has a 4% penetration in its target market. The question then is – Is CURV in a position to expand its reach and make it a good investment?

This is important to consider at present, going by the fact that since its public listing over a year ago, the stock has fallen by 81%. Even if we account for the broader stock market pullback this year, it has fallen much more by 56.1% compared to the 22.5% fall in the S&P 500 (SP500) year-to-date. Since it functions in the cyclical consumer discretionary segment, which tends to be sensitive to macroeconomic conditions, there has also likely been added pressure on the stock. In light of this, here I look at its recent performance to assess how bad the damage to its financials is, followed by a longer-term look at the company to assess what its potential might be in more normal times. Finally, the analysis takes a closer look at its market valuations to assess whether there’s a case to buy the stock at a fraction of its listing price.

Demand weakness

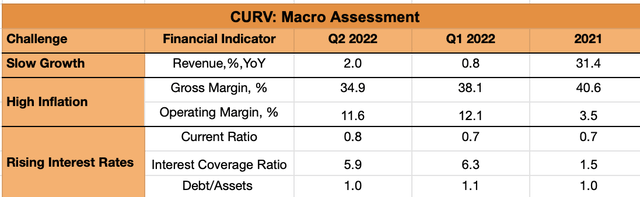

In assessing its present situation, this analysis takes a look at three key macro challenges right now – slowing growth, high inflation and rising interest rates. It then compares how CURV’s numbers measure up in this scenario. First the bad. There’s no denying that the company is seeing weakness in demand. Its revenues grew by just 2% in the second quarter of this fiscal year (Q2 fiscal year 2022, May-July). This is a slight improvement over the 0.8% growth seen in Q1, but still a huge drop from the 31.4% rise seen in the fiscal year 2021 (February 2021-January 2022). The increase last year was on the low-base of the COVID-19 ridden 2020, which is worth bearing in mind. Then again, even compared to 2019, its revenue growth was 23%.

Sources: Torrid Holdings, Seeking Alpha

Uncomfortable debt situation

The second challenge for Torrid is its liquidity and debt situation, which doesn’t look particularly healthy at a time of rising interest rates. For instance, its current ratio at 0.8x is a bit uncomfortable, since it indicates relatively high current liabilities compared to current assets. Its debt-to-assets ratio is also at 1, which is just about acceptable. Both ratios together show that the company has limited leeway if the demand situation were to worsen, since both ratios show that it’s in a somewhat precarious situation. If we were headed for better times, it would be less of a concern. But considering that the slowdown is expected to get a whole lot worse next year, these are numbers to be watched. That said, its interest coverage ratio looks quite healthy at 5.9x, in fact, it’s an improvement over the relatively muted number seen for 2021 as a whole.

Healthy Margins

The company’s margins aren’t too bad, either. The gross margin has fallen to ~35% in Q2 fiscal year 2022 from 40.6% in 2021, but on its own, this is an alright figure. Notably, its operating margin at 11.6% in Q2 is actually a whole lot better than the 3.5% seen in 2021 as its operating expenses actually have been on the decline this year. It’s interesting to note, that the company’s cost of revenues has seen double-digit increases in both the first and second quarters of the current financial year. In its earnings release, Torrid doesn’t mention what’s really going on with its operating expenses, but if I were to read between the lines, I’d think that it has cut down on these expenses to balance out the rise in the cost of revenues. This looks like a step in the right direction at a time of high inflation.

Encouraging past performance

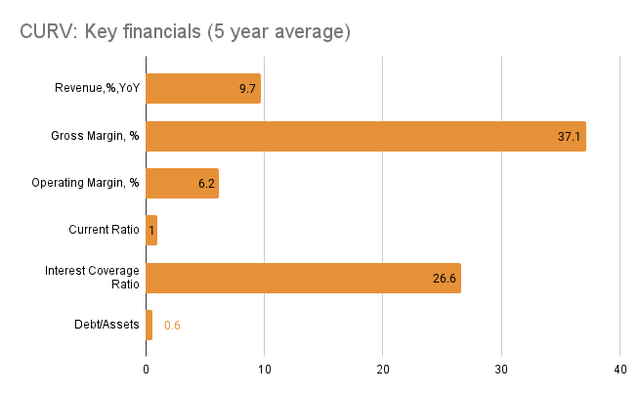

Its financials over the past five years also look much better than where they are now. Its revenue growth has seen a CAGR of almost 10%. The company also says that it’s the largest and among the fastest-growing brands for plus-size women. The fact that 63% of its sales are digital is promising too, going by the continued expected growth in the segment. It has also sustained its gross margins over the years, and though its operating margins have been less consistent, it has managed to clock an operating income each year. Encouragingly, its current ratio and debt-to-assets ratio also look better over a longer time period (see chart below).

Source: Seeking Alpha, Author’s Estimates

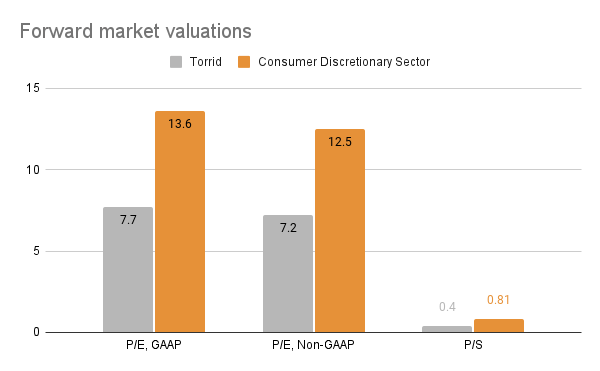

Muted outlook

While this is encouraging from a long-term perspective, its muted outlook for the current financial year pulls us right back into the now. It recently revised its fiscal year 2022 outlook downwards. It expects its revenue to show a maximum growth of 1.6%, but it could also decline by as much as 1.5%. This doesn’t sound positive, even going by its weak performance lately. It also expects its adjusted EBITDA to decline by at least 29%. This isn’t hard to understand, considering a recession is possible next year. It also offers a possible explanation for CURV’s low forward market valuations are lower than those for the consumer discretionary sector (see chart below). To put it another way, the reason it’s valued lower has likely to do with the dim outlook for the remainder of the year.

Source: Seeking Alpha

What next?

In the latest market uptick, there could be some upside to beaten-down stocks like Torrid. But I’m not sure how far it can continue until there are signs of improvement in its fundamentals. I think there’s potential in its market, especially going by its past performance. But it might be a good idea to wait until next year to see how it pulls through before buying the stock.

Be the first to comment