monsitj/iStock via Getty Images

Investment Thesis

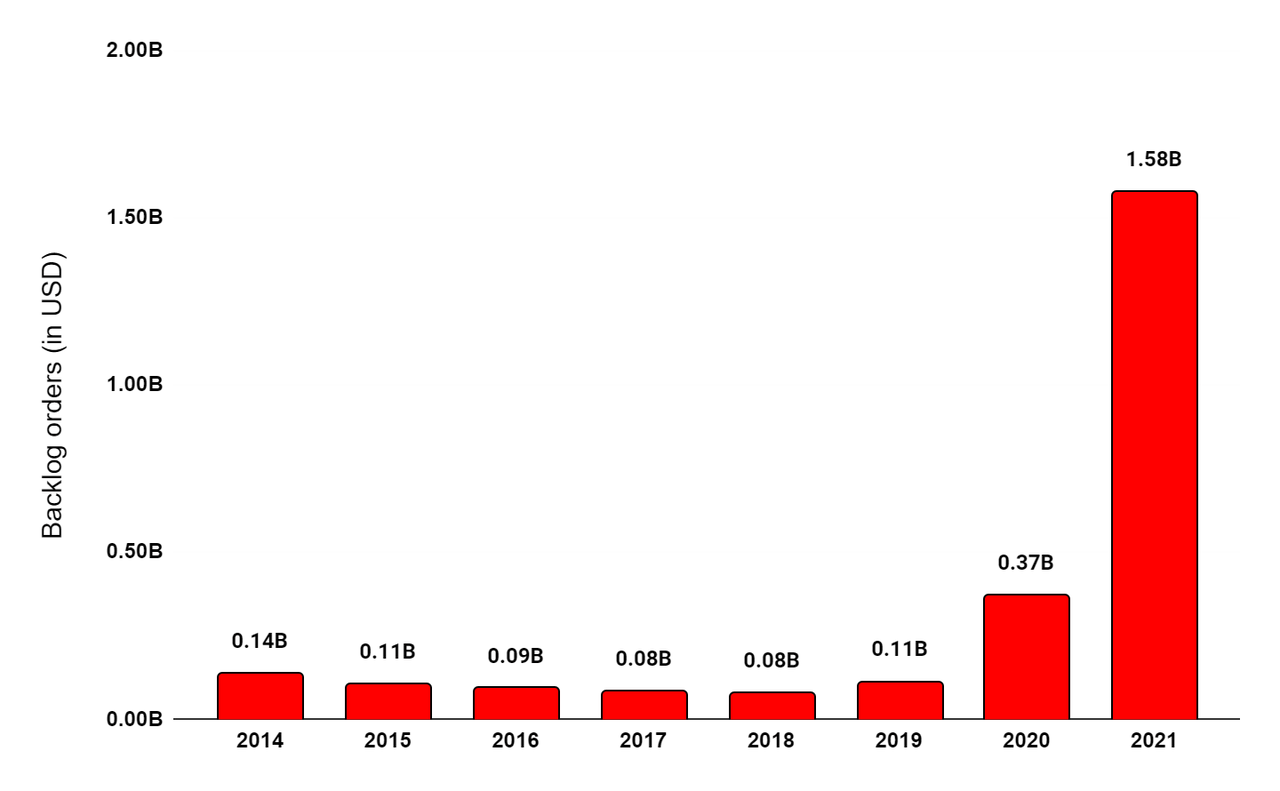

The Toro Company (NYSE:TTC) experienced strong demand which drove the sales order, outpacing its production capacity in FY21. This led to a higher than the normal backlog of ~$1.58 bn at the end of the fiscal year 2021. However, in the first half of FY22, the company’s volume growth was hampered due to supply chain constraints. In the recent quarter, the company experienced some improvement in the supply chain which should be beneficial for the company’s volume growth in the second half of FY22. To offset the current inflationary costs in the market, the company started increasing prices across its product line which contributed to sales growth in Q2 FY22 along with the incremental revenue from the acquisition of the Intimidator Group. The company’s sales growth in the second half of FY22 should be driven by higher price realization, strong backlog, and revenue from the recent acquisition. Because of inflationary costs and the acquisition of the Intimidator Group at a lower initial gross margin, the company’s Y/Y margin growth is expected to be impacted. However, in the long run, the company intends to improve its capacity and create synergies across its business portfolio to bring its margins back to historical levels.

TTC Last Quarter Earnings

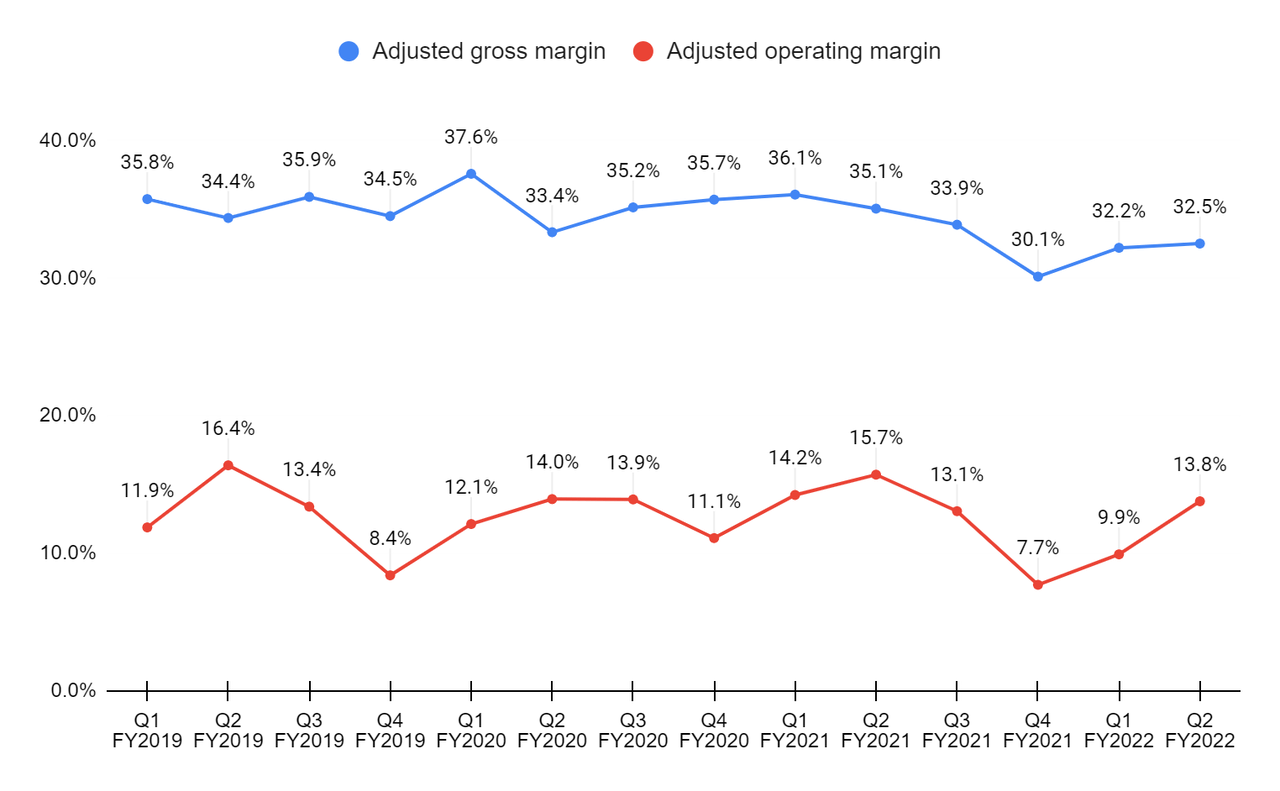

Earlier this month, The Toro Company reported mixed Q2 FY22 financial results with lower-than-expected sales and better-than-expected earnings. Sales in the quarter were $1.25 bn (up 8.7% Y/Y), lower than the consensus estimate of $1.27 bn. The adjusted EPS in the quarter was down 5% Y/Y at $1.25 (vs. the consensus estimate of $1.23). The growth in the top line was driven by net price realization across both the Professional and Residential segments, partially offset by lower volumes. The acquisition of Intimidator in January contributed $60.5 mn to the net sales in the quarter. The adjusted operating margin in the quarter was down 190 bps at 13.7% due to higher material and manufacturing costs, and higher indirect marketing expenses, partially offset by increased price realization and productivity improvements. These headwinds led to a 5% Y/Y decline in adjusted EPS during the quarter.

Revenue Growth Prospects

In FY21, the company experienced unprecedented demand within its Professional and Residential segment which reduced the field inventory levels and drove the sales order that outpaced the production capacity of TTC. Furthermore, the supply chain constraints hampered the production capacity of the company. This resulted in a backlog order of ~$1.58 bn at the end of FY21 compared to $370.9 mn in FY20. The backlog order was higher than the company’s normal backlog. However, due to the supply chain constraints in the first half of FY22, the company’s volume growth was affected. The company is experiencing some improvement in the supply chain which should benefit the company’s sales growth in the second half of FY22.

The Toro Company backlog growth (Company data, GS Analytics Research)

In Q2 FY22, the Professional segment’s net sales grew by 11.8% Y/Y to $925.8 mn, driven by net price realization and incremental revenue of $60.5 mn from the acquisition of Intimidator Group in Q1 FY22. This growth was partially offset by lower volume in certain product categories due to product availability constraints. The Residential segment net sales was up 1.5% Y/Y to $319.7 mn due to net price realization and higher shipments of zero-turn riding mowers. This growth was partially offset by lower sales of walk power mowers and portable power products, primarily due to the delayed spring weather patterns across many parts of the U.S.

Within the Professional segment, the company is anticipating the demand in the underground construction market to grow stronger as public and private infrastructure investments are getting prioritized across the world. Also, the golf market is strengthening which should support the sales growth in the Professional segment. As the demand across the end markets strengthens, the order book of the segment should start improving. The company is also making investments to inorganically grow its business. The recent acquisition of the Intimidator Group in Q1 FY22 gives TTC an opportunity to expand its product line and geographic reach. The company is integrating the Intimidator Group with its zero-turn mower space, as the Intimidator Group designs and manufacturers Spartan Mowers which is a professional line of zero-turn mowers. Other than this the company is implementing price hikes across its business portfolio to offset the current inflation in the market. The high price realization in Q2 FY22 drove the net sales of the company. The improved volume, incremental sales revenue from the Intimidator Group, and higher price realization should drive the revenue growth of the Professional segment in the second half of FY22.

The sales of the Residential segment were impacted in Q2 FY22 due to the late spring as the retail demand for the walk power mowers and portable power products declined. However, the company plans to regain the lost sales in the third quarter of FY22 as the seasonably warmer weather in North America has arrived. Additionally, the pre-season bookings for products related to the winter season should provide momentum in Q3 FY22.

In brief, the company’s volume growth is expected to increase due to the higher backlog order, strong demand, and ease in the supply chain constraints. The improvement in the sales volume along with high price realization is expected to drive the net sales growth of the company in the second half of FY22. As a result of this, management has raised its net sales guidance for FY22 from 12%-14% to 14%-16%.

The company launched its three-year employee initiative “Drive for Five” in Q4 FY21 to align and engage its workforce across the enterprise in order to achieve common goals. The goal of this initiative is to increase annual net sales to $5 billion through organic growth while improving profitability by the end of FY24. One thing to keep in mind is that this is an employee initiative, which means it is a set of internal goals rather than guidance. However, it provides us with information about the company’s future plans. The company is working to increase sales and margins both organically by investing in manufacturing capacity and improving efficiencies and inorganically. Also, the company has made a step to bring new innovations within its Residential segment by launching its robotic, battery-powered mower in May 2022 which is expected to be available to consumers in spring 2023.

Margins to Improve Sequentially

The adjusted gross margin of the company dropped 260 basis points Y/Y to 32.5% in Q2 FY22. The decrease was primarily driven by higher material, freight, and manufacturing costs. Additionally, the acquisition of the Intimidator Group in Q1 FY22 at a lower initial gross margin relative to the company’s average further drove the margins lower. However, this decline was partially offset by increased price realization and productivity improvements. This resulted in a 30 basis point increase in gross margin, which was better than the company’s forecast of a flat gross margin for the quarter. The adjusted operating margin in the quarter dropped 190 bps Y/Y to 13.8% due to the gross margin pressure and higher indirect marketing expenses, partially offset by net sales leverage and lower incentive expense.

TTC Adjusted gross margin and Adjusted operating margin (Company data, GS Analytics Research)

Looking forward, the company’s gross margin in the second half of FY22 is expected to be greater than the first half due to higher price realization. Also, the company is working on improving its internal operational productivity which should underpin the margin improvement in the near term as well as the long term. This should somewhat offset the impact of the inclusion of the Intimidator Group at a lower initial gross margin. However, given the inflationary cost environment and the acquisition of the lower margin Intimidator Group, the company is expecting the adjusted gross margin to be below FY21 and the adjusted operating margin to be in line with FY21. In the longer run, the company is working on bringing its profitability to historical averages by improving manufacturing efficiency, driving additional productivity, and through synergy benefits across the organization.

Valuation & Conclusion

TTC’s stock is currently trading at 19.32x FY22 consensus EPS estimate of $4.09 and 16.39x FY23 consensus EPS estimate of $4.82. This is lower than its five-year historical forward P/E of 25.08x. In the near term, the company’s sales growth is expected to benefit from the strong backlog in orders, easing supply chain constraints, and higher price realization. While the margins in the near term are expected to be under pressure due to inflationary costs and the lower initial margin of the Intimidator Group, they should improve sequentially in 2H FY22 versus 1H FY22. Also, the margins should improve in the long run as the company is working on improving its manufacturing efficiency, driving additional productivity, and realizing synergy benefits. The cheaper valuation and the growth prospects of the company make The Toro Company a good buy.

Be the first to comment