Nordroden/iStock via Getty Images

It’s been a rollercoaster ride of a year for investors in the Gold Miners Index (GDX), enjoying a sharp ascent in Q1, followed by what’s been a near-unprecedented decline to follow from a velocity standpoint. This is because the GDX found itself down over 40% in less than 100 trading days from its April high, translating to a ~79% annualized drop, enough to pry shares away from even some of the most battle-hardened gold bulls.

The catalyst for the decline was continued margin compression due to inflationary pressures for many producers, exacerbated by a sudden gold price decline. True to form, Torex Gold (OTCPK:TORXF) has easily managed through the difficult environment, being one of the few miners to report margin expansion in Q2. With the stock down 34% year-to-date despite its solid execution, I see it as a Speculative Buy at US$6.65.

El Limon-Guajes Operations (Company Presentation)

Production & Sales

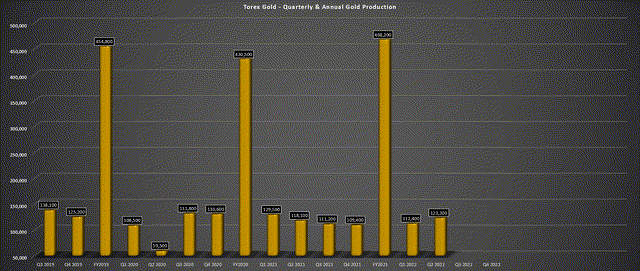

Torex released its Q2 results last month, reporting quarterly production of ~123,200 ounces, a 3% increase from the year-ago period. The increase in output was driven by higher throughput (~1.12 million tonnes) and higher feed grades, with the increase in open-pit grades more than offsetting slightly lower grades underground. That said, record mining rates offset the lower underground grades in Q2, which was more than 10% above the previous record logged in Q2 2021 (1,582 tonnes per day vs. 1,429 tonnes per day).

Torex Gold – Quarterly Production (Company Filings, Author’s Chart) Torex – Underground Mining Rates (Company Presentation)

In Torex’s prepared remarks, the company noted that it expects to maintain these record mining rates in H2, and its long-term target is 2,000 tonnes per day. This sets the company up for a solid second half of the year and should allow it to beat its FY2022 production guidance mid-point of 450,000 ounces. The increase to a mining rate of 2,000 tonnes per day is expected to be helped along by the connection of Portal #3 and the possibility of long-hole stoping in some areas vs. its current cut & fill mining method.

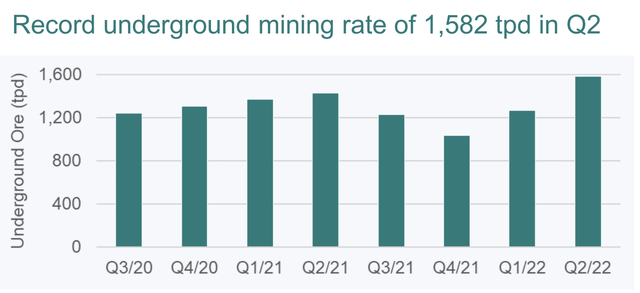

Torex – Gold Production & Revenue (Company Filings, Author’s Chart)

Moving over to sales, Torex sold ~123,400 ounces in Q2, an 11% increase from the year-ago period. Combined with a higher gold price ($1,865/oz vs. $1,816/oz), this translated to a 14% increase in revenue to $235.0 million, while operating cash flow came in at $126.9 million. While some investors might be worried about revenue and cash flow generation in H2 with the gold price continuing to trend lower, it’s worth noting that Torex has hedged 30,000 ounces in Q4 at $1,910/oz, with ~110,000 ounces hedged in 2023 at $1,924/oz.

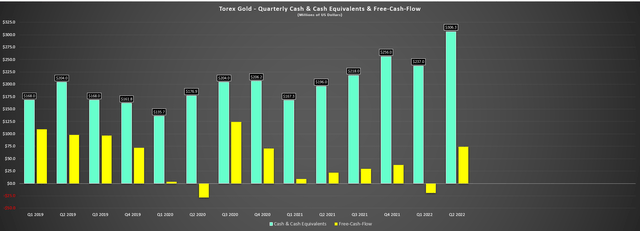

Torex – Quarterly Cash Position & Free Cash Flow (Company Filings, Author’s Chart)

While the lower gold price could pressure margins for other miners, Torex will see a slight offset due to its proactive hedging. The company added these hedges to de-risk its period of increased capital spending with Media Luna construction underway. These hedges should cover roughly 25% of gold production in 2023, with the potential to extend its hedging into 2024. Given the solid free cash flow generation in the period ($74.0 million), Torex ended the quarter with over $306 million in cash, an increase of 56% year-over-year (Q2 2021: $196 million).

Costs & Margins

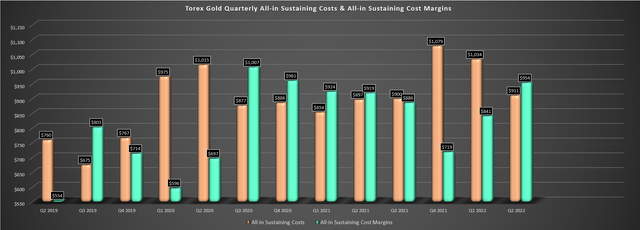

Moving over to costs, the industry has seen a meaningful increase in costs over the past year, impacted by higher prices for labor, power, fuel, and reagents. Torex has not been immune, but the company reported solid cost performance in Q2, with all-in-sustaining costs coming in at $911/oz. This was only a 2% increase over the year-ago period, helped by higher sales volume and reduced cyanide consumption from last year. Torex noted that its underground mining costs were also helped by economies of scale due to the much higher mining rate.

Torex – All-in Sustaining Costs & AISC Margins (Company Filings, Author’s Chart)

This relatively marginal cost increase offset by a higher gold price helped Torex to report higher margins vs. Q2 2021 levels, with AISC margins of $954/oz (Q2 2021: $919/oz). Notably, these margins were well above the industry average AISC margin of ~$600/oz in Q2 2022, and Torex is in great shape to deliver into its FY2022 cost guidance of $980/oz to $1,030/oz. Given that Torex won’t benefit from hedges in Q3, we’ll likely see a shift to margin compression vs. Q3 2021 levels ($886/oz), impacted by the lower gold price. However, post-Q3, Torex should be in better shape than its peers due to its hedges if the gold price stays below $1,800/oz.

Media Luna Development

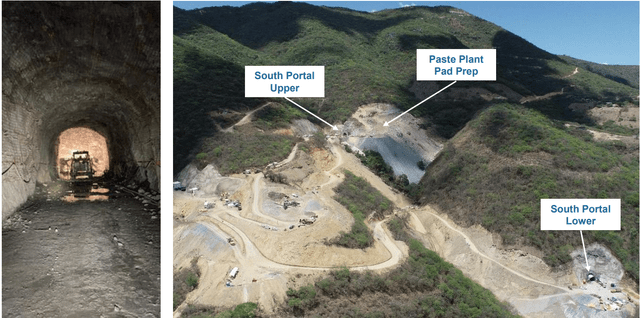

While operations continue to perform smoothly, given the relatively challenging environment (supply chain headwinds, labor tightness) across the industry, Torex is also making solid progress from a development standpoint. This is evidenced by Media Luna construction being 5% complete and the Guajes Tunnel advanced by 2.3 kilometers at the end of July. Just as importantly, Torex has increased its total liquidity to $560 million with an increase in its revolving credit facility ($250 million vs. $150 million), giving the company additional flexibility to fund the project.

Media Luna Development (Company Presentation)

According to Torex, the company spent ~$30 million at Media Luna in Q2 and has ~$840 million in capital remaining on the project. The current liquidity position of $560 million combined with projected FY2023 cash flow of ~$220 million should mostly cover the required capital expenditures. Importantly, expected cash flow generation in FY2023 assumes a lower average realized gold price of 1,725/oz in FY2023. So, unless we see a sustained collapse in the gold price, Torex should be able to fund most of its remaining capital even with its current cash/credit facility and next year’s cash flow.

For those unfamiliar, Media Luna is expected to head into production in 2025 and is 7 kilometers away from its current El Limon-Guajes Mine. The asset offers increased exposure to copper and silver and is expected to produce an average of ~374,000 gold-equivalent ounces per year over its 12-year mine life. Notably, Torex will maintain its industry-leading costs following the transition to Media Luna, with AISC expected to come in below $960/oz. As shown above, the Guajes Tunnel is now one-third complete on its path under the Balsas River to the Media Luna orebody.

Valuation

Based on ~86 million fully diluted shares and a share price of US$6.80, Torex trades at a market cap of ~$585 million, a dirt-cheap valuation for a mid-tier producer. Even based on a more conservative estimated net asset value of ~$1.20 billion based on $1,725/oz gold and $3.75/lb copper and $130 million in corporate G&A, Torex trades at 0.49x P/NAV. This is one of the lowest multiples sector-wide, and it assigns a limited value for exploration upside on a very prospective land package.

These commodity price assumptions may appear less conservative at current prices, but it’s important to note that these figures extend to 2033. Hence, one would have to have a relatively bearish view of gold and copper, with the latter being a key commodity in the recent trend toward electrification, to assume prices won’t average $1,725/oz and $3.75/lb at a bare minimum. To summarize, Torex trades at a deep discount to fair value even with very conservative assumptions, making it a steal if commodity prices return to their highs at some point in the next 18 months.

Summary

While it’s hard to find a cheaper producer than Torex with a spotless track record, the stock does carry higher risk, given that it’s a single-asset producer in Guerrero State, Mexico. While Torex hasn’t had any of the recent headaches Equinox Gold (EQX) has endured at Los Filos (blockades), single-asset producers are riskier, given that any issues can be magnified. So, even if I have high confidence in this team’s abilities, we are in the middle of a critical transition from one mine to another, adding further risk.

That said, I think a lot of this risk is already priced into the stock at 0.49x P/NAV and less than 3x FY2023 cash flow estimates. So, for investors willing to step out a little on the risk curve, I see Torex as a Speculative Buy at US$6.65. Normally, I would avoid single-asset producers entirely. Still, this team has proven it can over-deliver on its promises, making the recent underperformance and worries over Media Luna execution a buying opportunity.

Be the first to comment