aeduard

It’s been a rough couple of months for investors in the Gold Miners Index (GDX), which has capped off what’s been a brutal 22-month span. This is because they had to endure a cyclical bear market for 18 months but have found themselves thrown from the frying pan into the fire in this recent leg down to new correction lows. Despite Torex Gold’s (OTCPK:TORXF) operational excellence, the stock has been unable to buck the trend, nearing its Q1 2020 lows even with a much higher gold price. The decline has left Torex at a dirt-cheap valuation, making it a solid bet for investors with a high risk tolerance.

El Limon Guajes Operations (Company Website)

Just over a month ago, I wrote on Torex Gold (“Torex”), noting that I saw better opportunities elsewhere in the sector but that further weakness should present a buying opportunity. Further weakness has certainly materialized, with Torex plunging 20% since, breaking support at US$9.15. However, it’s important to note that this is not company-specific. In fact, Torex has an operational and safety track record that it could put up against any producer in the sector, with its CEO Judy Kuzenko leading the team through another solid quarter. This was evidenced by the company reporting strong production at El-Limon Guajes [ELG] while simultaneously developing a new mine south of the Balsas River. Let’s take a closer look below:

Q2 Production

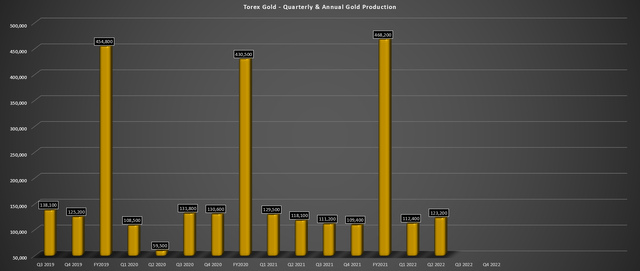

Torex released its preliminary Q2 results this week, reporting quarterly production of ~123,200 ounces of gold, a more than 4% increase from the year-ago period. This was driven by higher grades from the ELG pits as well as record ore production from ELG underground. In fact, underground ore production hit a record high of 1,580 tonnes per day, a more than 10% improvement from the previous record of 1,430 tonnes per day reached in Q2 2021. The solid performance has placed the company well on track to meet and potentially beat its guidance mid-point of 450,000 ounces for FY2022.

Torex – Quarterly & Annual Gold Production (Company Filings & Author’s Chart)

Looking at the chart above, we can see that despite dealing with supply chain headwinds from the pandemic and COVID-19-related exclusions, Torex is one of the few producers that continues to post higher production vs. pre-COVID-19 levels. Just as importantly, the company’s safety performance has been phenomenal, notching another 10 million hours worked without a lost time injury. Based on ~235,600 ounces produced year-to-date, Torex should be able to beat guidance yet again this year, an impressive feat given that some producers are looking like they might struggle to meet guidance after a weak Q1 due to Omicron and labor tightness for several names.

So, what’s caused the weakness in the stock?

Commodity Prices

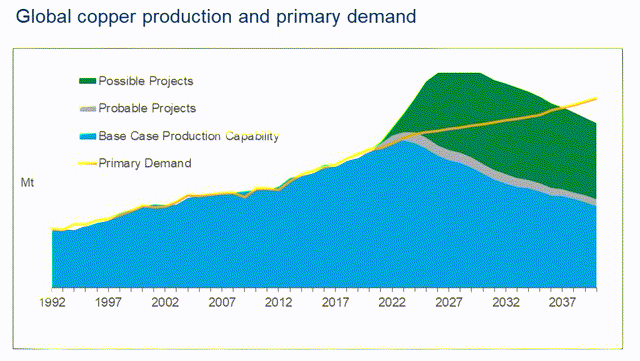

Outside of a weak gold price that has punished the sector, Torex’s next mine, Media Luna, happens to have a copper component, with an annual payable copper output of ~34 million pounds. So, like Barrick (GOLD), Torex has got hit with a double whammy, with the drop in gold and copper affecting the stock, even if it’s not mining copper yet with a Media Luna start-up of 2024. The good news is that the project had a near $500 million After-Tax NPV (5%) at conservative metal pricing ($1,600/oz gold, $3.50/lb copper, $21.00/oz silver). However, some investors might believe that after the recent decline in commodity prices, the latter two prices are looking a little less conservative.

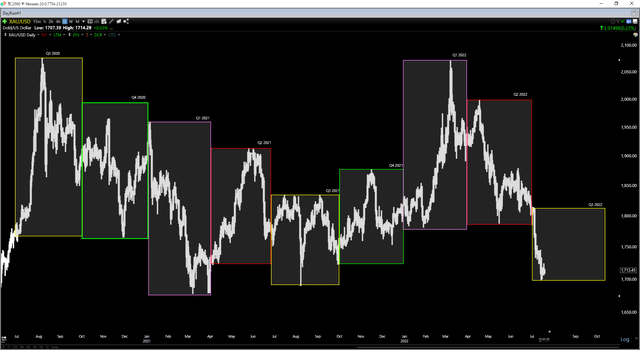

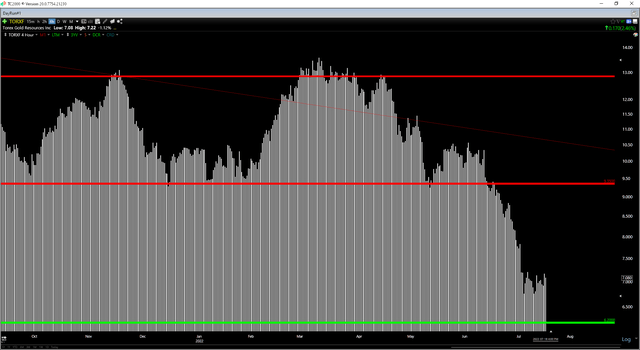

Gold Futures Price (TC2000.com)

Although this is a reasonable assumption to make with silver below $19.00/oz and copper below $3.50/lb, it’s important to note that these are the life of mine price assumptions from 2022-2033. So, while these assumptions may look high for Q3 2022 on silver and copper, these prices appear very conservative from 2022-2033. This is because if this trend towards electrification persists, silver and copper are going to be in much higher demand, and there simply isn’t the supply to meet this demand. Therefore, in my view, Torex is being unfairly punished by the recent dip in commodity prices.

Copper – Supply/Demand Picture (Wood Mackenzie – Copper Outlook)

That said, upfront capex for Media Luna did come in well above my estimates at ~$850 million, which was a result of inflationary pressures, degrading the After-Tax NPV (5%) of the project. So, while I believe the most recent leg down in the stock was unjustified, I was not overly surprised to see the stock lose the US$11.00 level following the release of its updated Morelos Technical Report (higher than anticipated cost figures). The good news is that despite the capex increase, Torex should have no issue funding the project, with over $400 million in liquidity and plans for up to $300 million in debt as well as cash flow from its existing operations.

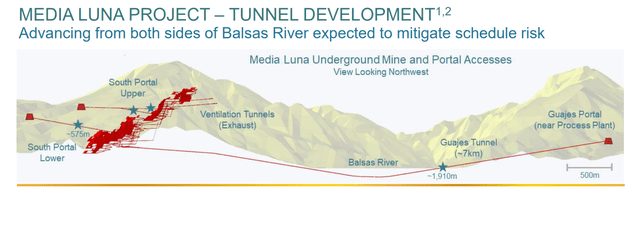

Media Luna

Torex plans to shift from mining at its current El-Limon Guajes Mine to Media Luna, a gold-copper project south of the Balsas River. The company has de-risked this transition with a layback at ELG to buy the company more time to tunnel under the river, but one worry earlier this year was that development rates were coming in a little below planned levels. Fortunately, this seems to be correcting itself, with the company having advanced the Guajes Tunnel to 2,100 meters, with development rates improving to 6.7 meters per day in June.

Torex Tunnel Development (Company Presentation)

Meanwhile, advance rates at the South Portal Lower Tunnel have improved considerably after experiencing challenging ground conditions in March/April. Fortunately, the tunnel has now been advanced by 700 meters, which represents an advance rate closer to 4.0 meters per day, well above the 2.3-meter per day advance rate as of the previous update, which was tracking 50% below planned levels (4.5 – 5.0 meters). Given these recent improvements, investors can be a little more comfortable that there won’t be any major hiccups in the transition from mining at ELG to Media Luna. Let’s take a look at the valuation:

Valuation & Technical Picture

Based on Torex’s 85 million shares outstanding and a share price of US$7.10, the stock currently trades at a market cap of ~$604 million. This is a dirt-cheap valuation for a 400,000-ounce per annum producer, especially when some juniors are trading at higher valuations without financing in place. In fact, this valuation leaves Torex trading at 0.48x, vs. an estimated net asset value of ~$1.28 billion. So, for investors comfy with a single-asset producer in a riskier state in Mexico (Guerrero), Torex is arguably one of the cheapest producers sector-wide. If the company were in a better jurisdiction, I would not be surprised to see the company taken over, but the list of major gold companies looking to add operations in Guerrero State is likely very small.

Based on what I believe to be a more conservative multiple of 0.90x P/NAV, I see a fair value for the stock of US$13.55 (18-month target price). This points to an 89% upside from current levels, suggesting that the risk of transitioning from one mine to another appears more than priced into the stock. Hence, from strictly a valuation standpoint, Torex is in a low-risk buy zone at US$7.10. However, I see it as a medium-term swing-trading vehicle only, given that it’s a single-asset producer, and I prefer not to hold these companies long-term. An acquisition by Torex would fix this, but I don’t see one as likely until at least 2025.

TORXF Daily Chart (Company Filings, Author’s Chart)

Unfortunately, while the stock is cheap from a valuation standpoint, the stock doesn’t quite meet low-risk buying criteria from a technical standpoint. This is because previous support is likely to become new resistance at US$9.35, potentially putting a medium-term ceiling on the stock at this level. Meanwhile, the next strong support level doesn’t come in until US$6.20, which translates to a reward/risk ratio of 2.50 to 1.0, which is based on $0.90 in potential downside to support and $2.25 in potential upside to resistance.

Generally, I prefer a minimum reward/risk ratio of 5.0 to 1.0 for single-asset producers, requiring a dip below US$6.70 per share for the stock to enter a low-risk buy zone. This doesn’t mean that Torex must head lower, but given that the fundamental and technical buy zones don’t line up, I wouldn’t rule out some further downside. Still, from a valuation standpoint, Torex has rarely ever been this attractive, and I see a high probability of the company meeting its objectives in this transition period under Kuzenko’s impressive leadership, which has been a consistent track record of over-delivering.

Summary

Torex had a great start to the year and is in rare air, tracking ahead of its guidance mid-point as it heads into the back half of 2022. Unfortunately, this was overshadowed by commodity price weakness, and the recent break of support has left the possibility on the table that the stock could test its March 2020 lows near US$6.20. At a valuation of less than 0.50x P/NAV, Torex is arguably one of the cheapest producers sector-wide, making this a low-risk entry point for patient investors with a high-risk tolerance. However, I am remaining on the sidelines for now with a Neutral rating, given that I see more attractive ways to get exposure to the sector, like Alamos Gold (AGI).

Be the first to comment