Moussa81

Introduction

The Toronto-based Torex Gold Resources Inc. (OTCPK:TORXF) owns the Morelos Gold property in Southern Mexico, comprising its El Limon Guajes mining complex – ELG for short – and the Media Luna deposit, where it holds 100% interest. It is called the Morelos Complex.

Note: This article is a quarterly update of my preceding article, published on August 8, 2022. I have followed TORXF on Seeking Alpha since March 2021.

TORXF Map Presentation (TORXF Presentation)

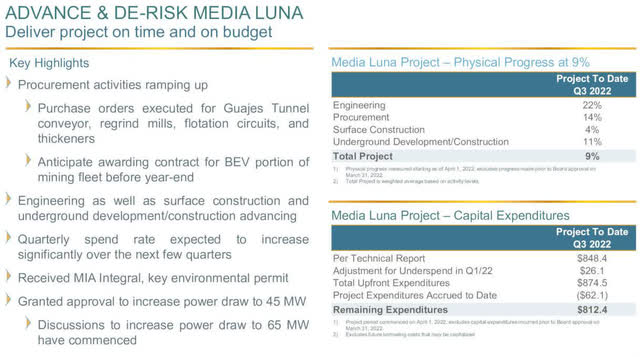

Note: The Media Luna deposit is one substantial ongoing expansion for the company. The remaining CapEx is now $812.4 million.

The Media Luna’s first production is expected in 2024. This production will be added to the 2024 outlook after the company releases the Media Luna Technical Report, which tripled the LOM to 11.75 years.

CEO Jody Kuzenko said in the conference call:

Opening highlights include the process plants. We had the second highest milling rates on record and established a new record on gold recoveries. Underground mining rates achieved more than 1,550 tonnes per day, maintaining the momentum on the record mining rates achieved last quarter.

TORXF Media Luna 3Q22 (TORXF Presentation)

Note: TORXF received approval from Mexico’s Secretariat of Environmental and Natural Resources (“SEMARNAT”) for the Key Media Luna Environmental Permit late in the third quarter culminating environmental permit for the Project (the “MIA Integral”), which allows for operations to begin.

1 – 3Q22 Results Snapshot

On August 6, 2022, the company released its third-quarter 2022 results.

The company posted revenue of $209.3 million, up % compared to the same quarter a year ago, with an income of $43.9 million, or $0.51 per diluted share. The adjusted net earnings of $ million or $0. per share on a diluted basis.

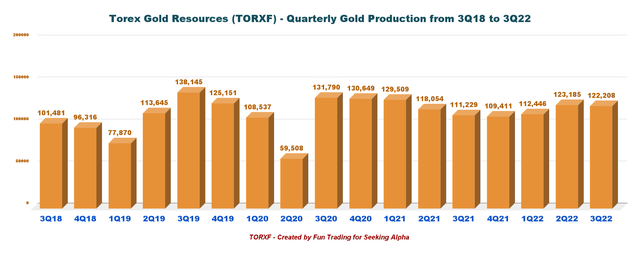

Torex Gold produced 122,208 Au ounces in the quarter.

CEO Jody Kuzenko said in the conference call:

You can see we produced over 122,000 ounces of gold in the quarter, which was driven by record gold recoveries and the second highest milling throughput rate on record. The strong mill performance helped offset a slight decline in process grades relative to the higher levels we experienced in Q2.

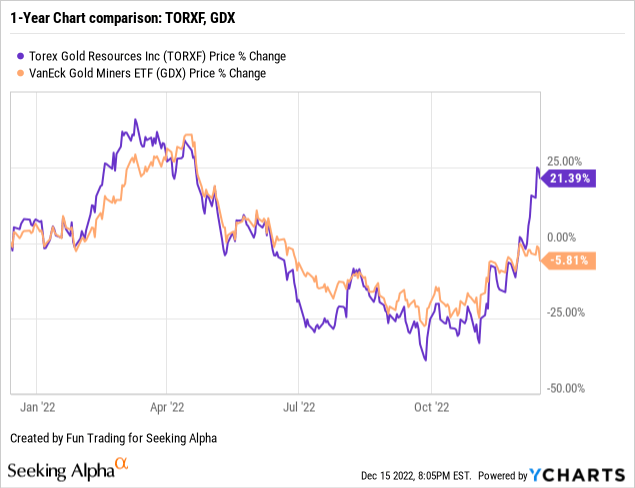

2 – Stock Performance

The company’s performance turned around in early November, as shown in a one-year basis chart. The stock is up 22%, outperforming the VanEck Vectors Gold Miners ETF (GDX). We can see a Cup & handle bullish formation here.

TORXF – Financial Snapshot 3Q22 and Gold production: The Raw Numbers

| Torex Gold | 3Q21 | 4Q21 | 1Q22 | 2Q22 | 3Q22 |

| Total Revenues $ million | 216.7 | 202.0 | 207.7 | 235.0 | 209.3 |

| Quarterly Earnings in $ million | 36.5 | -0.5 | 40.0 | 70.3 | 43.9 |

| EBITDA $ million | 119.7 | 61.5 | 102.8 | 156.3 | 128.7 |

| EPS (diluted) $ per share | 0.41 | -0.01 | 0.46 | 0.80 | 0.51 |

| Operating Cash Flow in $ million | 87.8 | 94.6 | 46.7 | 126.9 | 102.4 |

| CapEx in $ million | 58.0 | 56.9 | 65.3 | 52.5 | 68.6 |

| Free Cash Flow in $ million | 29.8 | 37.7 | -18.6 | 74.4 | 33.8 |

| Total Cash in $ million | 221.6 | 255.7 | 237.0 | 310.7 | 339.2 |

| Total LT Debt in $ million | 0 | 0 | 0 | 0 | 0 |

| Shares Outstanding (diluted) in million | 86.0 | 86.2 | 86.09 | 86.12 | 86.04 |

| TORXF Production | 3Q21 | 4Q21 | 1Q22 | 2Q22 | 3Q22 |

| Quarterly Production Oz | 111,229 | 109,411 | 112,446 | 123,185 | 122,208 |

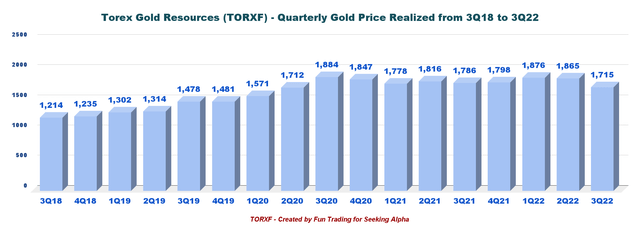

| Gold Price in $/Oz | 1,786 | 1,798 | 1,876 | 1,865 | 1,715 |

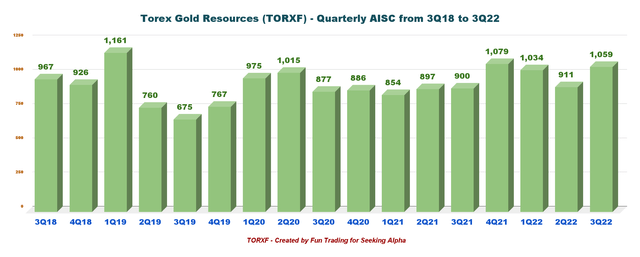

| AISC in $/Oz | 900 | 1,079 | 1,034 | 911 | 1,059 |

Source: Company MD&A

Torex Gold Resources – Gold Production and Balance Sheet Details

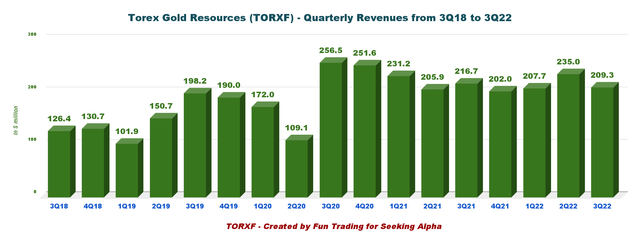

1 – Revenues and Trends: Revenues were $209.3 million in 3Q22

TORXF Quarterly Revenues history (Fun Trading) Torex Gold posted $209.3 million in revenues this quarter compared with the $216.7 million indicated in 3Q21. The net income was $43.9 million this quarter from an income of $36.5 million last year. TORXF posted adjusted net earnings of $34.60 million or $0.40 per share on a diluted basis. The net income includes an unrealized derivative gain of $20.0 million (YTD – $28.8 million) related to gold forward contracts entered into during 1Q22 to reduce downside price risk during the construction of the Media Luna Project (approximately 25% of production between October 2022 to December 2023 at a weighted average price of $1,921 per oz). The adjusted EBITDA was $107.8 million in 3Q22.

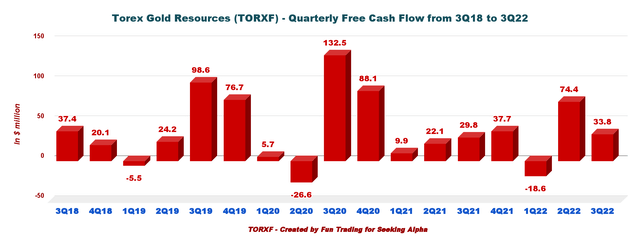

2 – Free Cash Flow was $33.8 million in 3Q22

TORXF Quarterly Free cash flow history (Fun Trading) Note: Generic free cash flow is the Cash from operations minus CapEx. Torex has a slightly different calculation and deducts the interest paid.

Trailing 12-month free cash flow was $123.3 million, and the free cash flow for the second quarter was $74.4 million, contrasted with a loss of $18.6 million in the preceding quarter.

The company had a CapEx of $52.5 million in 2Q22.

CFO Andrew Snowden said in the conference call:

I want to point out, and we’ve been signaling this for some time, that we expect quarterly free cash flow to decline in Q4 and then run negative through 2023 as spending on Media Luna increases in line with development activities.

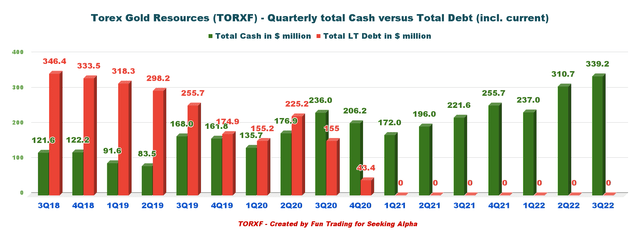

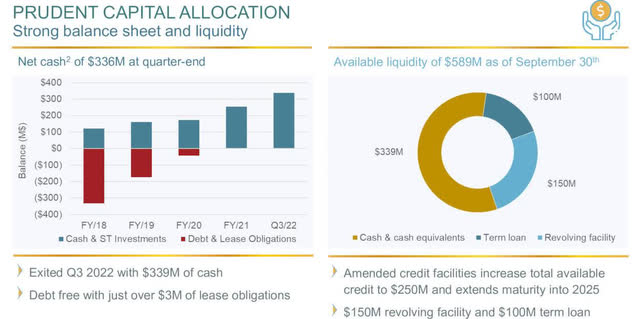

3 – Torex Gold’s Excellent Position. The Company is Net Debt-free

TORXF Quarterly Cash versus Debt history (Fun Trading) Total Cash was $339.2 million at the end of September 2022 compared to $221.6 million in the same quarter a year ago. Available liquidity is $589 million in 3Q22. The company is debt free, which is a great plus. TORXF Balance sheet (TORXF Presentation) TORXF Quarterly Gold production history (Fun Trading) Solid Gold production this quarter with 122,208 Au Oz, down slightly from 2Q21. The company sold 119,834 Au Oz at a gold price of $1,715 per ounce. Gold production is on track to meet full-year production guidance of 430K to 470K Au oz. TORXF Quarterly Gold price history (Fun Trading) One extra positive is that the AISC per ounce is $1,059 per ounce, which is reasonable. TORXF Quarterly AISC history (Fun Trading)

4 – Gold Production Details: TORXF Produced 122,208 Au Oz and Sold 119,834 Au Oz in 3Q22

CFO Andrew Snowden said in the conference call:

On costs, we saw all-in sustaining costs increased in Q3, and this was primarily driven by lower grades and higher strip ratio in the quarter as we caught up on stripping from Q2. You’ll recall on the Q2 earnings call, I referenced the equipment availability constraints that we saw last quarter. Also, as I noted during the second quarter call, we are seeing and continue to see inflationary pressures in certain areas of our cost base, primarily in inputs into our processing plants with ongoing cost pressures being seen, particularly in cyanide and other reagents.

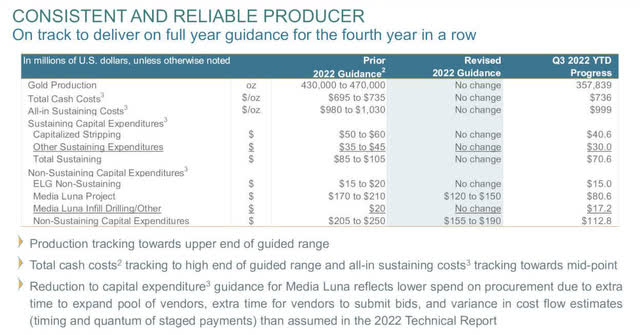

5 – 2022 Guidance – The Cost of the Media Luna Project is Expected to be lower

The company expects gold production of 430K to 470K AuEq ounces in 2022 at an AISC between $980 and $1,030 per ounce. The Media Luna project CapEx is $155 to $190 million in 2022, down from $205 million to $250 million.

TORXF 2022 Guidance (TORXF Presentation)

Technical Analysis (Short Term) And Commentary

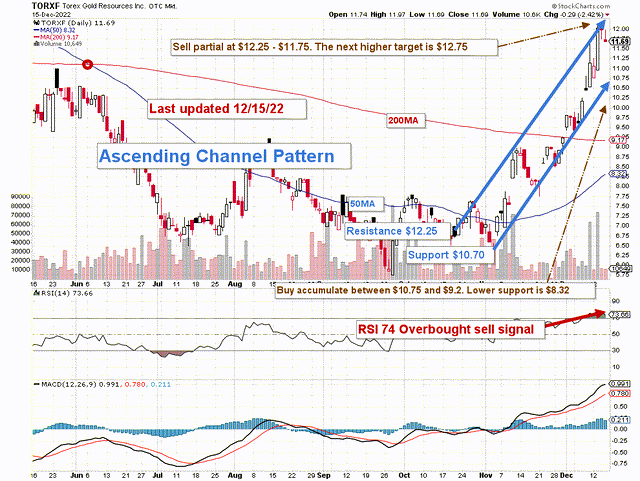

TORXF TA Chart short-term (Fun Trading StocksCharts)

TORXF forms an ascending channel pattern, with resistance at $12.25 and support at $10.70.

Ascending channel patterns or rising channels are short-term bullish in that a stock moves higher within an ascending channel, but these patterns often form within longer-term downtrends as continuation patterns. The ascending channel pattern is often followed by lower prices, but only after a downside penetration of the lower trend line.

The strategy has not changed, and it is what I suggest in my marketplace, “The Gold and Oil corner.” The short-term trading strategy is to trade LIFO about 50%-60% of your position and keep a core long-term amount for a much higher payday at around $13.6-$14.

I suggest selling LIFO between $12.25 and $11.75, with possible higher resistance at $12.75, and waiting for a retracement between $10.75 and $9.20, with possible lower support at $8.32 (50MA).

TORXF could experience a breakdown if the gold price loses momentum and cross the $1,750 per ounce support. In this case, TORXF could retest the lower support at around $8.32 and lower.

Conversely, if the gold price trades back above $1,800-$1,850 per ounce in early 2023, TORXF could reach $12.75-$13.50 (200MA) and eventually cross $14.

Watch the gold price like a hawk.

Warning: The TA chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Author’s note: If you find value in this article and would like to encourage such continued efforts, please click the “Like” button below as a vote of support. Thanks.

Be the first to comment