da-kuk

Investment Thesis

I have written before about Topicus.com (OTCPK:TOITF), or Topicus, when I compared it to Constellation Software (OTCPK:CNSWF), or Constellation. In that analysis I deemed Topicus to be fairly valued, however a possible sound investment if the market would present such opportunity. The unfortunate global situation and subsequent market turmoil did just that. Since then, Topicus has become 5% of my portfolio, and in an indirect way I am still adding to this position. Not being ignorant to increased risk aversion, I have updated my analysis including assumptions of higher risk of operating in Europe. Also, reading through materials on Constellation Software investor relations page and further still through historical reports of Topicus, I have also updated my expectations on future developments of value risk drives.

Business overview

Topicus.com Inc. is a company that acquires, manages, and further develops vertical market software business, with current focus on the developed European market. It follows the same approach that turned Constellation to one of the best and least known investment companies in the recent history.

Topicus acquires small IT companies that provide only a limited portfolio of services to one or few clients. These companies usually develop their software solutions designed specifically to cater the needs of their clients, and that cannot be easily applied to other similar clients. Every software solution is unique to the properties of the customer, and once established in the customer’s IT infrastructure, its replacement costs only increase.

Currently, it operates in 25 countries (mostly in Europe) and has acquired 126 smaller vertical software companies so far.

Overview of Topicus operations (Company website)

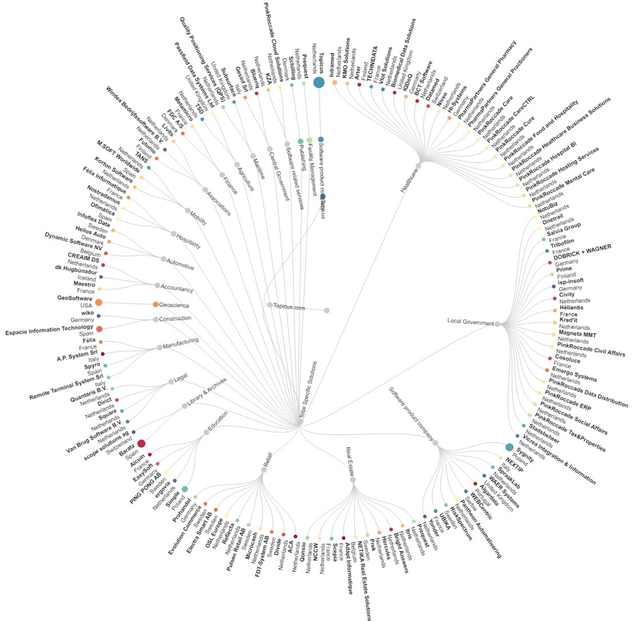

To grasp a complexity of Topicus, its organizational structure could be shown like this:

Topicus organisation structure (Author’s Calculations)

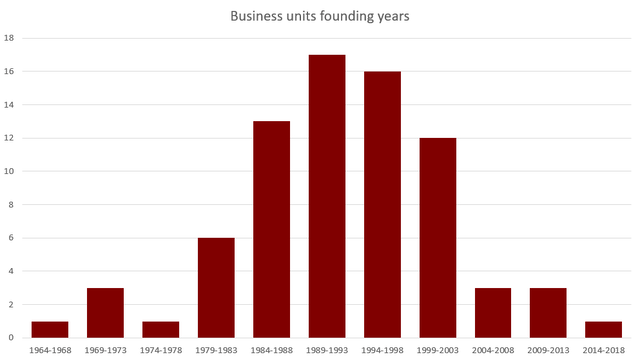

As visible, Topicus is an organization diversified across many industries and countries. After going through the offerings of each of them, I am quite convinced that as far as diversification goes, Topicus is one-of-a-kind company. None of the business units under its wing carry significant concentration in income generation, and on average they were founded more than 30 years ago (note that data is not available for all).

Age distribution of business units (Author’s Calculations)

This goes in line with rare occurrence of goodwill impairments in Topicus financial statements. Businesses it acquires may not be the high growing in its nature but are able to be adapted to ever changing customer needs. In an eternal trade of between adaptable mediocre business vs. growth oriented and non-adaptable, I give preference to adaptability.

Recent developments

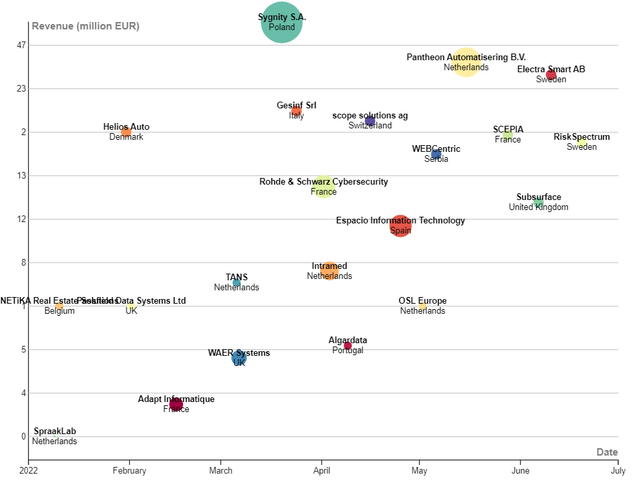

Topicus had an aggressive acquisition year so far. In total 21 acquisitions have been announced to date, increasing the count of business units for almost 20%. Little information is provided on the size of the acquired companies, however, for some, public information on revenues can be found in local business registries or simply by estimating them based on the number of employees. Figure below shows the timeline of 2022 acquisitions and their assumed sizes expressed through revenue. While it’s generally risky to assume anything about acquired business cash flow generating capability solely based on revenues, the underlying assumption for Topicus acquisitions is that they will follow a Constellation acquisition rule book and return their initial investment value within 5 to 7 years. Basic premise for all investments by Topicus is strong due diligence on their side, and strict adherence to their set hurdle rates.

Topicus acquisitions in 2022 by announcement dates (Author’s calculations)

Out of these acquisitions, Sygnity SA stands out by two properties. First, it is by far one of the largest acquisitions, currently owned 72.68% by Topicus. Furthermore, local media is reporting that it might continue to do acquisitions on its own in Poland, serving as a local acquisition hub. This by itself is not a new concept within Topicus, nor Constellation Software, however it is a rare case of a publicly listed company operating under the Constellation and Topicus patronage.

In worth to mention that expansions to two new markets were made. Namely, acquisition of WEB Centric in Serbia, and Algardata in Portugal.

In addition, several acquisitions of parts of existing companies, like SubsurfaceRiskSpectrum, Electra Smart AB, were also acquired. These are particular interesting since these tend to be acquired at lower prices than standalone companies, especially in difficult macroeconomic times.

In total, my estimate is that close to EUR 120 million of revenue generation was acquired through these companies, EUR 82 should appear in books with fiscal 2022 end, securing close to 16% acquired revenue growth within the first two thirds of fiscal 2022. Even with limited acquisitions throughout the year, and assuming 5% organic revenue growth, a significant increase in revenue generation can be expected.

Regarding operational results of the whole group, we are finally able to look at the figures unaffected by the conversion of preferred shares. For more details on this financial construction, please refer to my previous article.

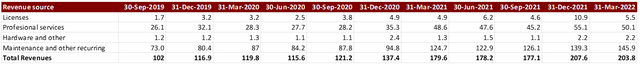

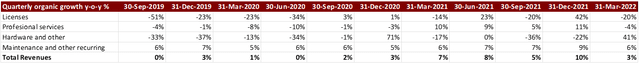

Looking at the quarterly figures, for available two and a half years of data, promising results are observed.

Topicus revenue streams (Company quarterly reports) Topicus revenue stream growth rates (Company quarterly reports)

Topicus will always be compared to Constellation, as hopes and dreams of all investors are relying on history repeating and Topicus developing as Constellation since year 2014.

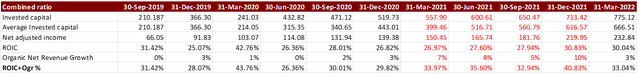

In order to have a comparison measure, I decided to recalculate so called “combined ratio” used previously by Constellation itself for monitoring and managing the overall company. This ratio, which sums up return on invested capital and organic growth rate and uses it as a proxy for theoretical growth in intrinsic value of the business.

Using the description provided by Constellation and eliminating the effects of the revaluation of preferred shares on the net result and retained earnings, the following values are obtained (highlighted values were modified):

Rolling trailing 12 month combined ratio (Author’s Calculations)

The above values are comparable to years of the strongest growth of Constellation.

As a side note, I am not relying on these numbers to do my own DCF, however they serve as an objective measure of comparison between Topicus and Constellation.

Changes in assumptions

The most relevant changes in my assumptions from previous analysis are:

1. It’s been clarified to me that loss occurred due to conversion of preferred shares to ordinary units is not a taxable event. This in turn reduces free cash flow in my analysis since higher taxes will cause cash outflows.

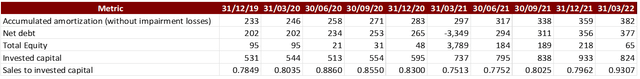

2. I have treated amortization of intangible assets as a non-cash expense and increased my assumptions for the free cash flow to the firm. Treating goodwill amortization has multiple impacts on my valuation. First, it increases free cash flow to the firm (FCFF) assumptions for the full amount of amortization. At the same time, tax benefits of expensing amortization are still preserved. Secondly, since I am including goodwill amortization in my FCFF assumptions, I should also account for it in the capital base used by Topicus. Since carry value of goodwill in financial statements is gross value of goodwill reduced for accumulated amortization of intangible assets, I increased the value of the capital to this amount. I consider a sum of total equity, total interest-bearing debt and leases reduced for cash and cash equivalents, and accumulated amortization of intangible assets to be the invested capital base of Topicus.

Sales to invested capital (Author’s Calculations)

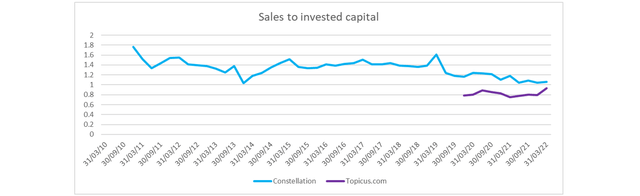

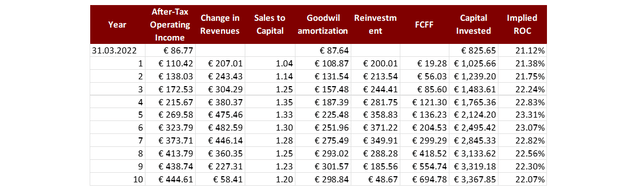

At the end, this will affect my reinvestment assumptions for inorganic growth, as per these values, Topicus would have to invest 1 EUR to generate additional EUR 0.93 of revenue. Note that I assume that growing depreciation costs and R&D expenses are also cash expense of the period, further invested into growth, however these will be included in my reinvestment assumptions through operating income assumptions. Calculating the sales to capital for Constellation, for the period between 2014 and 2019, which would correspond to the current stage of development of Topicus, would result in a sales to invested capital ratio of 1.35. For my midterm assumptions, I would assume that sales to invested capital for Topicus will also approach these values and follow Constellation development after that.

3. My expectation for the short and midterm revenue growth has been increased following aggressive acquisition campaign in 2022 so far. Assuming 5% organic growth until March 2023, attribution revenue of 2022 acquisitions, and second half of 2021 acquisitions, and potential new acquisition, I see 27% increase in revenue in next 12 months as a reasonable target. This is actually the basic reason why investing in Topicus and Constellation could yield high returns for investors. Their growth assumptions always seem unreasonably high, and it’s prudent to assume that growth will slow down at some point. However, each year of continued growth pushes forward our expectations for midterm and delays the slowdown. For as long as this is happening, share prices of Topicus and Constellation will grow. Once the slowdown is observed, prudence in valuation will give some time to reassess the investment case. This is what Mark Leonard, CEO of Constellation, called a special case of value investing in one of his shareholder letters.

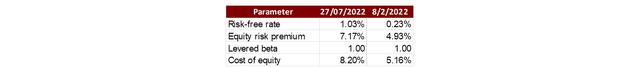

4. Inflation and global uncertainties have affected my valuation. The effects of inflation show up first as higher risk-free rates and next in the higher risk premiums, with both equity risk premiums and default spreads rising.

A higher equity risk premium for Western Europe (7.17 % in July 2022, compared to 4.92% in February 2022) and a higher risk-free rate in EUR (1.03% in July 2022, compared to 0.47% in February 2021) together increase the cost of capital for Topicus by about 2 – 2.5% since my last valuation.

Intrinsic Valuation Assumptions and Considerations

For details behind unchanged assumptions, please refer to my previous article. However, for the sake of transparency, the following changes in value drivers were applied.

Revenue growth and target operating margins

After analyzing in more depth the efficiency of Topicus as a business, I am more convinced now that it will be able to replicate the growth of Constellation revenues between 2014 and 2019. Hence, for the next five years, I would assume that they will grow 25% annually.

My assumptions for operating margins remain unchanged at 15%.

Reinvestment assumptions

I adjusted how I measure reinvestment needed for inorganic growth for both Topicus and Constellation. In case of Topicus, accounting figures still show the ratio of sales to invested capital to be significantly lower than in case of Constellation. However, this has to with a fact that part of Topicus.com operations belong to Topicus (separate daughter entity) which operates in parallel with TSS, entity responsible for all acquisitions executed. Since growth potential of Topicus as a whole is dependent on execution of Constellation’s acquisitions strategy by TSS, I used values of sales to invested capital derived from Constellation historical values.

Sales to invested capital – Constellation vs Topicus.com (Author’s Calculations)

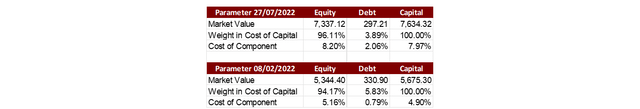

Due to increase in global risks, or even more risks of pure existence in Europe, expected risk premium, credit spreads and risk-free rates are higher in my analysis now. Although, over time, I would still expect them to return to some normal levels. As with all crises, this too shall pass. Changes are shown in the table below:

Cost of equity (Author’s Calculations)

Along with cost of equity, cost of capital also reflected changes in the macroeconomic environment.

Cost of capital estimation (Author’s Calculation)

Terminal cash flow value

As mentioned, we live in the riskiest version of Europe since 1968, and this is now reflected in my assumptions for the future. Time of rationality and decades of peace is gone. Hopefully not permanently. My updated assumptions assume that Topicus will slow down its growth to the level of risk-free rate in the future. Value produced after that period will be produced by its competitive advantage and size on the European market.

Terminal cash flow value assumptions (Author’s Calculations)

Valuation results

As I mentioned, over time, the period of high growth will end as the company enters a more mature stage of its corporate lifecycle. It would be easy to argue that Constellation had a much longer period of large annual revenue growth, however this is the assumption I would be willing to change in the future and be positively surprised, once more evidence is provided that such high growth is maintainable in a longer period.

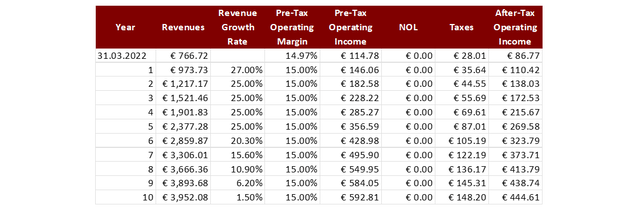

Note also that my previous assumption of Topicus being exempt from taxes is now eliminated.

After Tax Operating Income Forecast (Author’s Calculations)

Assuming that they maintain the level of sales to capital ratio close to 1.3, after tax operating income can be translated to free cash flow to equity as shown below.

Free Cash Flow to the Firm Forecast (Author’s Calculations)

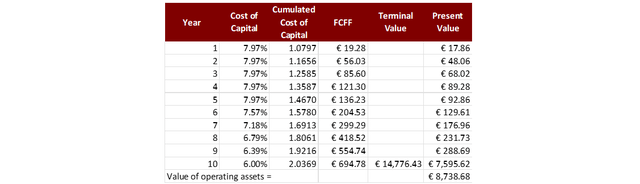

Having the FCFF forecasted, and by discounting it with the cost of capital we obtain the total value of the operating assets.

Discounted Cash Flows (Author’s Calculation)

From this value I then subtracted my estimated of the value of debt of EUR 283.67 million and minority interest belonging to 60% stake in Geosoftware of EUR 29.29 million, and I added back available cash of EUR 217.05 million. This results in the remaining value of equity of EUR 8,642.77 million. Divided with fully diluted number of shares of 129.84 million, this results in fair value per share of EUR 66.56, or using the July 27, 2022 EUR CAD exchange rate of 0.7648, CAD 87.04. The stock was trading at CAD 73.89. This translates to an internal rate of return of just below 8.5%, which is 15% more than my estimate for the average cost of capital over the next 10 years.

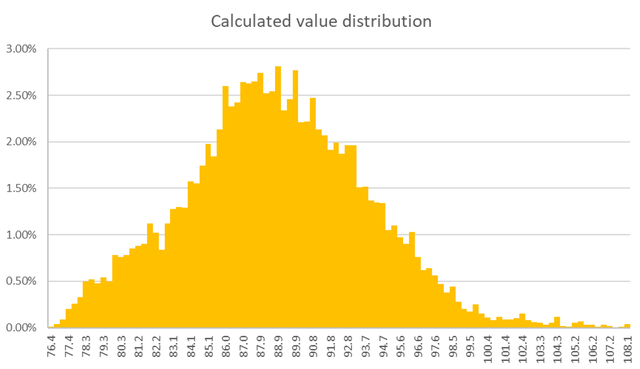

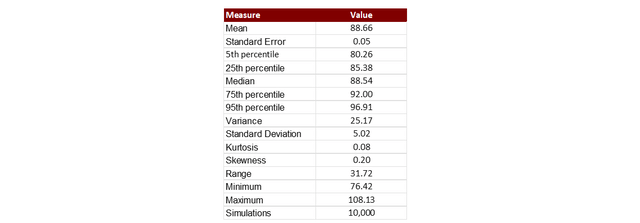

In order to mitigate the risk of dependence on one scenario only, I then ran 10,000 simulations varying two of my assumptions with most impact on the final value. I varied my expected revenue growth in the next five years and EUR CAD exchange rate. EUR lost almost 10% of its value compared to CAD since the beginning of the year. Effectively, this reduced the fair value of the Topicus measured in CAD, since almost all of its revenue is generated in EUR or currencies effectively pegged to EUR. Due to EUR losing value, controlling the FX rate at the moment of purchase is crucial. Alternatively, one should hedge against volatile FX movement. In case of revenue, I used normal distribution dispersed around my assumption of 25% midterm growths with 2% standard deviation. In case of EUR CAD FX rate, I assumed that EUR is more likely to gain back some of its lost ground in the future, and that it might vary between 0.72 to 0.78. FX is not a real value driver for Topicus, however for short time horizon, acquiring shares of Topicus at depressed EUR levels, might reduce future shareholder returns.

For convenience reasons, I converted the simulation results to CAD.

Simulation results (Author’s Calculations)

This results in a median present value per one share of CAD 88.66 with current price being some 10% even the 5th percentile of my valuations.

Simulation results (Author’s Calculations)

Compared to my previous analysis, two major changes occurred. On one hand, I am more certain that Topicus can achieve the high growth rates projected. Especially in the environment where a lot of other diversified businesses might consider selling some of their vertical software operations. On the other hand, we are living in a world with far more uncertainties, where even diversifiable risks can only be taken with a higher risk premium.

Out of curiosity, I applied equity risk premium and cost of debt values valid before this crisis. Value per share I obtain is EUR 76.88 and CAD 100.53 per share. If you hold belief that those times could easily return, your upside is even bigger. Personally, I would rather keep more modest expectations.

Risks

I mentioned some of the risk previously, but after further studying the company, and given today environment, few more are relevant. Most relevant is the risk of doing business in Europe. There are no guaranties that recession and inflation in Europe will not affect Topicus and its business units, or even force it to leave some of the markets in worse case. These are systematic risks controlled for through higher cost of equity.

However, there is one more risk specific to Topicus itself. Currently, it is the only operating group within Constellation that is publicly listed, and that property has to exist for a reason. Potential raising of capital in equity markets, or acquisitions of companies through share issuance, remain a possibility. This would lead to further dilution of ownership. If these are used with prudence and proceeds of such actions are invested with high hurdle rates, the effect will be neutral on the share price. However, if used unreasonably, they could depress the share price while keeping the value of the company at roughly the same level. On a positive side, public listing also gives Topicus an option to return the capital back to the shareholders if acquisitions targets are not found, reducing the pressure to invest at all costs.

Summary

I own Topicus now, and I have great hopes for it. It is close to 5% of my portfolio, and this is as much as I am willing to invest in it. It is a pure growth investment relying on hopes of the extraordinary growth story. Furthermore, it is also a risky investment since lack of ability to grow will suddenly reduce its value. However, when compared with opportunity cost of investing in a broader market index, I find that the current margin of safety provides adequate protection from any unexpected events.

Call For Comments

What is your view on the future development of Topicus? Do you think it can outgrow its parent, or do you think that the EU market is more saturated than the North American market at the time Constellation grew fast? Express your opinion, provide alternative assumptions and different opinions in the comment section below, and I will rerun my analysis using your inputs.

Be the first to comment