DariaRen/iStock via Getty Images

Buying Into The S&P 500 Right Now

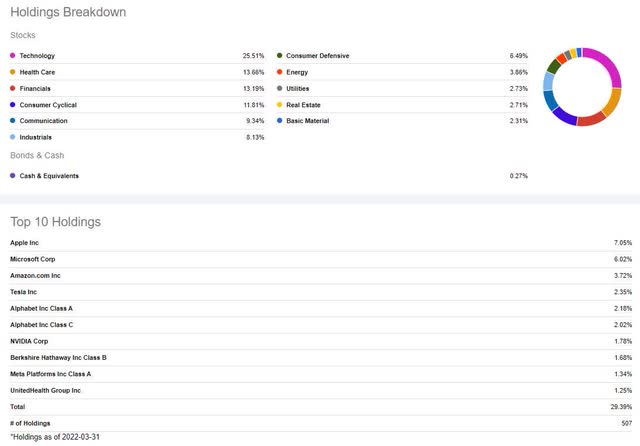

Investible ETFs that passively reflect the S&P 500 hold immense concentration risk. The S&P 500 is a market-cap-weighted index, where each company’s weight is determined by the size of the company relative to others in the index. The top ten companies in the S&P 500 make up approximately 30% of the overall index. Therefore, from a size perspective, smaller companies have relatively negligible allocations within the index. Even if their returns were double or triple relative to the largest companies, that overall return would be minuscule compared to the returns of the top holdings. In my opinion, the Mega-Tech stocks Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), Meta Platforms (FB), and Alphabet (GOOG) (GOOGL) that top the S&P 500 by market capitalization do not offer the best growth opportunities or fundamental valuation framework. Based on our quant rating system, the S&P 500 stocks featured in this article are MPC, MOS, COP, MCK, VLO, and HPQ. The stocks are rated Quant Strong Buys and offer solid fundamentals to help diversify your portfolio.

S&P 500 (SPY) ETF

S&P 500 (SPY) ETF HOLDINGS (Seeking Alpha Premium)

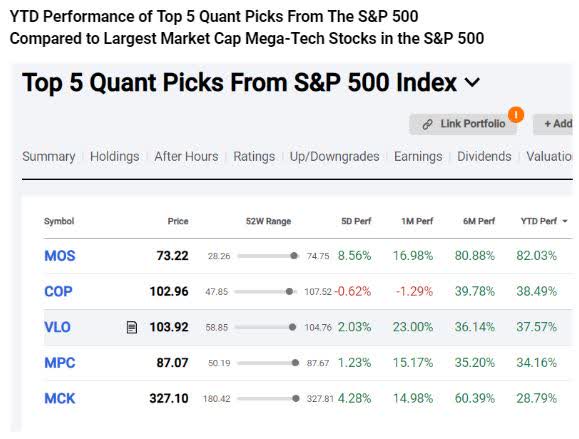

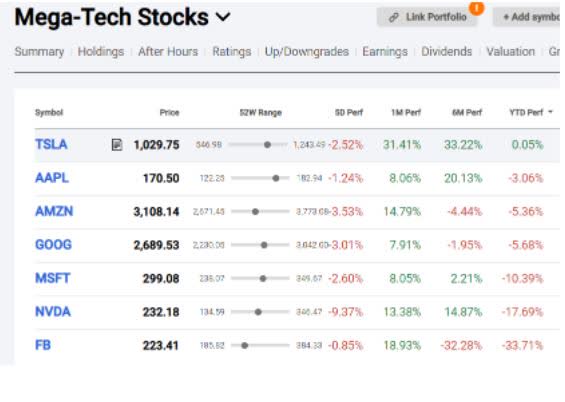

Investing in stocks within the S&P 500 index is a way to gain stock exposure on a relatively less risky basis when compared to buying small- or mid-sized companies. Investors are often disillusioned by buying a market cap weighted S&P 500 index by their true diversification. So, on occasion, they don’t realize they’re mostly buying and getting exposure only to the largest companies within the index, in this case, the top ten holdings that are primarily technology-based. Below, we compare the YTD performance of the top S&P 500 companies’ market cap stocks to my Seeking Alpha (SA) stock picks from the S&P 500. Notably, it would help if you also review the 5-day trend in the performance of the stocks.

YTD Top 5 Quant Picks vs Mega-Tech S&P 500 Picks (Seeking Alpha Premium)

Mega Tech S&P 500 Stocks (Seeking Alpha Premium)

The S&P 500 Index Is Primed To Expand Beyond Mega-Tech Growth Stocks

That brings us to the main point of this article: To make sure you know about concentration risk in the S&P 500 and market-cap-related benchmarked ETFs – and, importantly, to let you know how you can diversify beyond a market-cap-weighted index. Seeking Alpha offers many screens as investment research tools to aid your research process found on the main navigation bar under Top Stocks. For example, Seeking Alpha’s Top Value Stocks screen can instantly display and list Value recommendations from an algorithm that refreshes daily. Seeking Alpha contributor, Lawrence Fuller recommends value stocks in his latest article, Focus On Value. Fuller writes:

-

Value stocks have outperformed on the rebound from this year’s correction lows.

-

That is not the norm, but the outperformance tends to persist when the Fed is raising interest rates.

-

Focus on price-to-earnings and price-to-book ratios that are lower than average for companies that can continue to grow profits.

For growth investors, Seeking Alpha’s Top Growth Stocks offers a quant rank of the best growth stocks. A key aspect of our Value recommendations is that the stocks also offer growth characteristics, as measured by their revenue, cash flow, and earnings growth. Likewise, an essential aspect of our Growth recommendations is that the stocks also offer value characteristics, as measured by their value metrics, and strong cash flow and earnings growth.

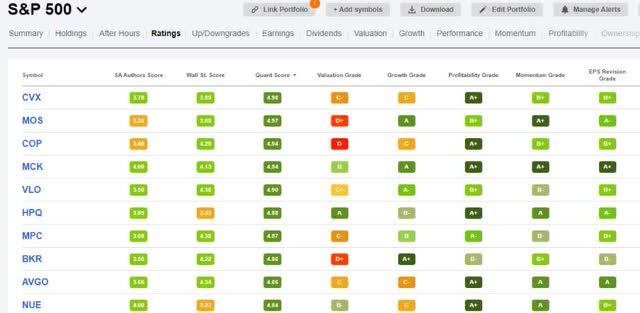

S&P 500-related ETFs provide a passive approach to investing. And these ETFs are not without risk. Instead of managing your asset allocation actively, you can find opportunities to add significant value to other parts of your portfolio. The benefits of actively managing your portfolio can be measured in your ability to diversify sector positions, mix investment styles, focus on income-generating stocks, or get defensive for a bear market or rising interest rate environment. Below, please find the S&P 500 stocks featured in this article MPC, MOS, COP, MCK, HPQ, and VLO, based on our Quant Rating system. These stocks offer strong growth prospects, solid valuation frameworks, and stable profitability metrics.

5 Best S&P 500 Stocks To Invest In

Naturally, equities serve as an inflationary hedge as a whole. To diversify outside of only the largest market cap names and top 10 holdings in the S&P 500, as I mentioned in my recent article 3 FAANG-less Tech Stocks for the Long Haul, smaller companies outside of the FAANG behemoths that can offer great upside. As a result, here are my favorite and top-ranked quant stocks in the S&P 500 index.

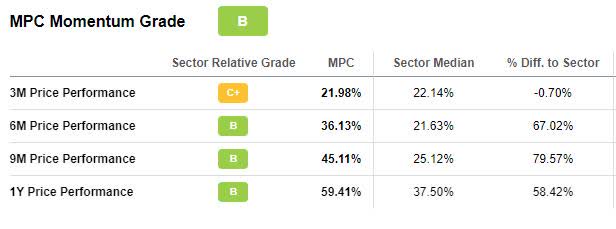

1. Marathon Petroleum Corporation (MPC)

According to our quant rankings, oil and gas refining company Marathon Petroleum Corporation and its subsidiaries are top-ranking energy companies. With a geographically diverse footprint in the midcontinent, Gulf, and West Coast of the U.S., Marathon has been focusing on cutting costs since the pandemic, which has proven fruitful with more than $1B in operating expense reductions.

Marathon has a C- valuation grade at a forward P/E ratio of 14.90x compared to the 9.6x sector median and is trading at a relative discount. At $85/share, Marathon appears to be in a bullish trend.

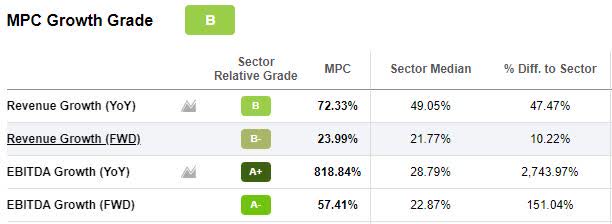

MPC Momentum Grade (Seeking Alpha Premium)

Looking at the momentum grades above and the stock’s price performance over the last year, its momentum is strong, and Marathon is outperforming the sector with gradual increases quarterly. With the energy sector being the top S&P 500 asset class and prices continuing to rise, MPC should continue with an upward momentum on the heels of recent Q4 2021 highlights.

MPC Growth And Profitability

Over the last five quarters, Marathon’s earnings are consistently strong with both top- and bottom-line beats. Q4 2021 EP of $1.30 beat by $0.74; Revenue of $35.61B beat by $9.82B, a near 100% increase YoY.

MPC Growth Grade (Seeking Alpha Premium)

Adjusted EBITDA for the same period was nearly $400M higher than the prior quarter. Cash from operations excluding working capital was $2B, an increase of almost $300M, and is currently sitting at a whopping $4.36B. Marathon’s overall profitability grade is an A-. As we continue to see increased demand for energy, skyrocketing prices and nations impacted by the conflicts in Europe are providing advantages for U.S. energy sources like Marathon. Seeking Alpha Contributor Laura Starks writes, “With the likelihood of more stock price support from 4Q21 buybacks and then several billion more in 2022 buybacks, solid operations as the largest US refiner, and an improved demand environment post-Covid, I recommend buying Marathon Petroleum stock.”

One of its biggest competitors and one of my stock picks, Valero Energy Corporation, is another energy company to consider for your portfolio.

2. Valero Energy Corporation (NYSE:VLO)

Ranked #1 out of 22 compared to its rival Marathon, which is ranked #2 out of 22 according to our Quant Rankings, Valero Energy Corporation is a petrochemical and transportation fuel manufacturer and marketer headquartered in Texas. With a solid valuation and market capitalization of $41.54B, VLO has a solid balance sheet and is trending bullish, and has been outperforming the S&P 500 by more than 20% over the last year.

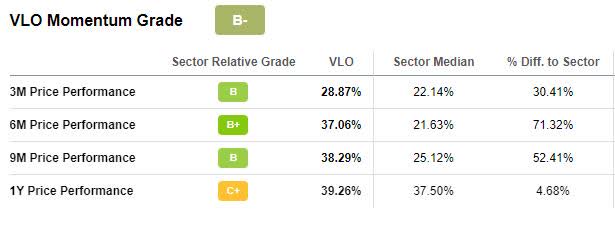

VLO Valuation And Momentum

Despite an average valuation, the stock is still trading at a relative discount with an overall C grade and forward P/E ratio of 12.71x compared to the sector median of 9.6x. As the company’s share price rises, as evidenced by the B- momentum grade, VLO’s price performance is solid.

VLO Momentum Grade (Seeking Alpha Premium)

Shares of VLO are actively being purchased according to the trading volume, which is driving its price higher. As evidenced by the Momentum Grade above, overall price performance for the year is steadily increasing. Year-to-date, VLO has seen a +33% share price increase and +57% over the last five years. High demand for oil products and limited supplies should position VLO well for future growth.

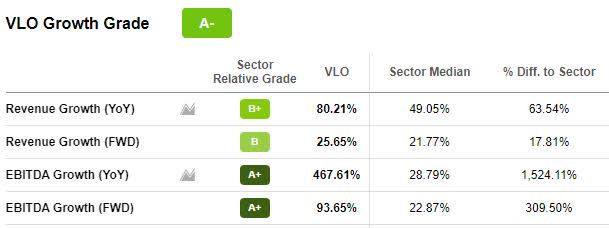

VLO Growth And Profitability

With a solid balance sheet set to pay its shareholders a dividend yield of 3.79%, Valero’s growth and profitability are on the rise on the back of elevated energy prices around the globe.

VLO Growth Grade (Seeking Alpha Premium)

As you can see by the revenue growth grade, VLO is sitting pretty, outperforming its sector peers substantially. Q4 2021 earnings resulted in an EPS of $2.47, beating by $0.63, and revenue of $35.90B, beating by $7.98B. As travel increases to pre-pandemic levels, VLO has benefited from jet fuel recovery, which increased from 60% to 80% at the end of 2021. “We saw a steady recovery in margins throughout the year, particularly for our complex refining system. In regards to our ethanol segment, ethanol prices were near record highs in the quarter, supported by strong demand and low inventories. Strong margins, coupled with solid operational performance across all of our segments, generated record quarterly operating income for our ethanol segment and record overall fourth quarter earnings for Valero,” said Joe Gorder, Valero CEO, during the Q4 Earnings Call.

Energy companies aren’t the only ones in the S&P 500 reaping the benefit of supply chain constraints and increasing prices. Fertilizers and chemical companies involved in agriculture are benefiting tremendously, so I’ve chosen The Mosaic Company as my next top S&P 500 stock to buy now.

3. The Mosaic Company (MOS)

As I wrote in Best Commodity Stocks to Buy Now, the Mosaic Company is one of my top commodity picks for 2022. Through its subsidiaries, Mosaic markets and produces global potash crop nutrients, fertilizers and chemicals for industrial use. Given geopolitical concerns over Russia’s invasion of Ukraine, fertilizers are in short supply and as a Seeking Alpha report highlights, “‘Russia is a major, major exporter across all of the major fertilizers… losing Russian exports is a very big deal,’ says Josh Linville of StoneX Group, noting that the country accounts for 14% of urea, as much as 31% of UAN, 10% of phosphate, and nearly 20% of the global operating potash capacity.”

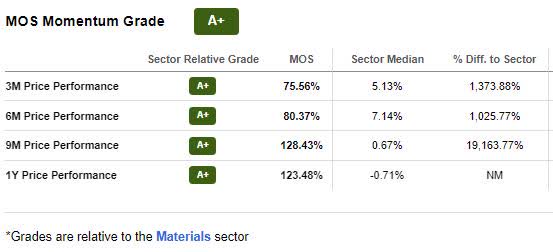

Despite a D+ Valuation grade, Mosaic has excellent momentum, trading near $72/share with stellar price performance. Looking at the A+ Momentum grade below, this stock is a top stock in its sector, outperforming its peers on a quarterly price-performance basis.

MOS Momentum Grade (Seeking Alpha Premium)

Given its bullish outlook, investors are likely to continue paying higher prices for MOS shares, and as we look to the stock’s future, its growth and profitability prospects also show promise.

MOS Growth And Profitability

As a leading producer of potash and phosphate fertilizers, MOS is taking advantage of the strong demand for crops prompting multi-year high agricultural prices. The growing demand for fertilizers and chemicals supplied by MOS should boost crop yields and ultimately profits for MOS.

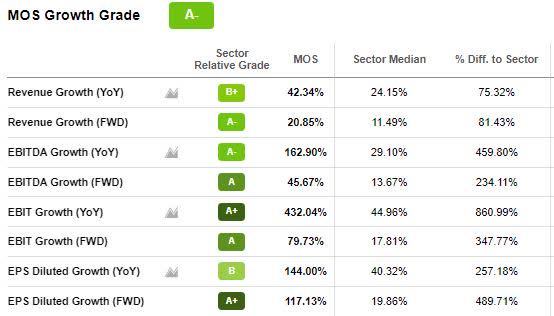

MOS Growth Grade (Seeking Alpha Premium)

As we observe Mosaic’s strong growth and profitability grades, year-over-year revenue is at 42.34% compared to 24.15% for the sector. EBIT Growth for the same period is stellar with an A+ at 432% and significantly trumps its median peers.

MOS Profitability Grade (Seeking Alpha Premium)

MOS has solid profitability numbers, with an overall B+ grade. Increased demand for potash should lead to an increase in MOS’ cash from operations and underlying profitability margins relative to the sector. China and India are in the top five countries that account for more than 75% of potash production, and although they are big producers, from a sales price, China and India are seeing significant price hikes, which benefits U.S. producers like Mosaic.

To emphasize the positive financial impacts, Mosaic President and CEO Joc O’Rourke discussed the financial performance during the Q4 Earnings Call. “For Mosaic Fertilizantes, we expect the business to continue reflecting the favorable market backdrop and our transformation efforts in 2022. Sustained grower demand and improved market positioning should continue to drive results.”

If you’re not sold on fertilizers and chemicals, let us transition back to oil and gas, with one of the bigger names in the industry.

4. ConocoPhillips (NYSE:COP)

Commodity prices prompted a surge in oil and gas exploration and production company ConocoPhillips’ Q4 earnings. With a market capitalization of $127.08B, COP is a global name and one of the largest upstream exploration and production companies. COP, like many other energy companies, is benefiting from increased demand, limited supplies, and ridiculous prices. Despite a natural gas leak at an oil field in Alaska, the company was able to seal the leak and return to business as usual, continuing to benefit from well-timed acquisitions.

Its growth plan targets the Permian Basin putting COP in a unique position. COP increased its footprint in the Permian Basin, allowing its production to increase significantly and aid its balance sheet while limiting the downside risk of falling oil prices. Those assets became the company’s most significant position while offering low-cost gas liquids with higher return potential.

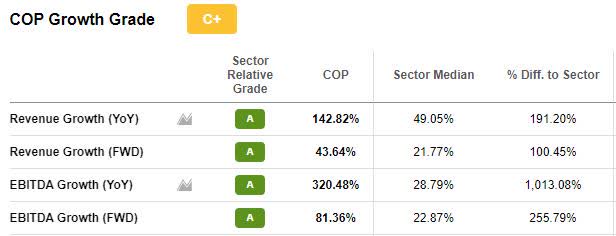

COP Growth Grade (Seeking Alpha Premium)

COP’s growth is solid with a C+ rating, and attractive underlying growth metrics as shared by Ryan Lance, Chairman and CEO of Conoco during the Q4 Earnings Call.

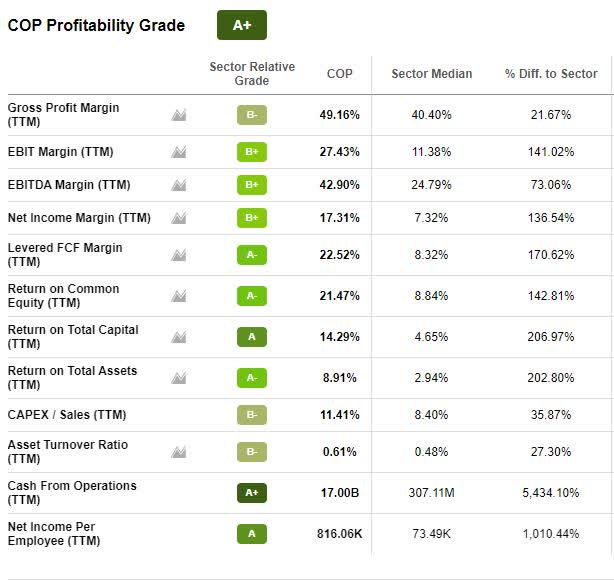

COP Profitability Grade (Seeking Alpha Premium)

“We achieved a 14% full-year return on capital employed or 16% on a cash adjusted basis and generated $15.7 billion in CFO, with over $10 billion in free cash flow. And we returned $6 billion to our shareholders, representing 38% of our cash from operations.”

Reviewing the stellar profitability metrics above, it’s clear why we believe COP is a strong buy for a portfolio. While the company’s D valuation is less than ideal, momentum is strong with continued increases in share price performance. The continued rise in crude oil should allow this stock to perform well, making it a solid investment.

5. McKesson Corporation (NYSE:MCK)

In diversifying my top S&P 500 picks, I want to include a healthcare supply chain management company that ranks #1 in its industry and #3 out of 1059 in its sector according to our quant ranking. McKesson Corporation, a leading U.S. wholesaler of pharmaceutical products is on a tear! Trending upward with a share price of $320.14 which has seen a YTD increase +29%, one-year increase of +65%, and five-year +122%, its bullish trend makes clear why our quant ratings summary lists it as a strong buy.

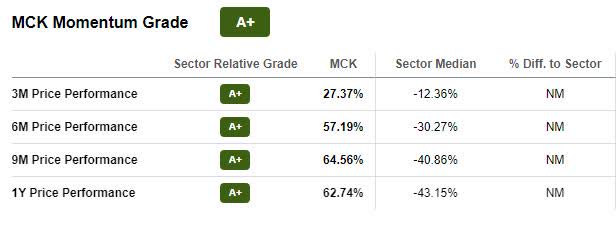

MCK Momentum Grade (Seeking Alpha Premium)

With A+ ratings across momentum metrics and looking at its significant quarterly price performance relative to the sector median, we believe this stock is primed to continue its rally.

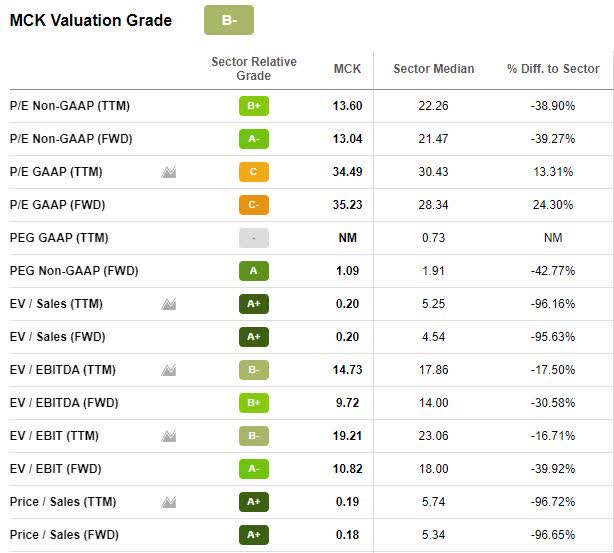

MCK Valuation

To begin 2022, “Analysts expect 12.8% EPS growth this fiscal year and have a consensus Buy rating with an average price target of $280, implying a potential one-year 9% total return. Credit Suisse has a more aggressive $333 price target, citing the recovery in patient/provider interactions, prescription volumes, and general healthcare utilization,” writes Seeking Alpha author Gen Alpha.

MCK Valuation Grade (Seeking Alpha Premium)

With the stock currently trading at $320/share, it has room to meet the consensus targets. In addition, the stock is trading at a significant discount, 39% below the sector with an A- forward P/E ratio of 13.04x and excellent forward PEG ratio of 1.09x, nearly 43% below the sector. As we look at MCK’s growth and profitability, the company reported solid Q3 2022 results, continuing to allow it to be a top pharmacy and healthcare provider.

MCK Growth And Profitability

McKesson provides nearly one-third of the U.S’s pharmaceutical products, resulting in over $180B in annual drug revenue. Q3 Earnings results were excellent with an EPS of $6.15 beating by $0.73; Revenue of $68.61B beat by $1.99B, resulting in 14 FY1 Up revisions in 90 days and an A+ revisions grade.

MCK Revisions Grade (Seeking Alpha Premium)

“We’re pleased to report a strong third quarter…As a result of our performance in the underlying business and the contribution from COVID-19 related items, we’re raising our adjusted earnings per diluted share guidance to $23.55 to $23.95. This is from the previous range of $22.35 to $22.95,” said Brian Tyler, McKesson CEO during the 22Q3 Earnings Call.

McKesson is focusing on exiting the European market to better focus on their financial capital and higher growth and margin areas. The divestiture of European businesses provides a potential of $15B in growth to increase their margin profile, according to Tyler during the same earnings call. Given the company’s size and ability to acquire drugs at lower prices than its competitors, MCK is able to pass along cost savings to customers while still maintaining the lion’s share of the sector.

Bonus Stock Recommendation

As a bonus recommendation, I am suggesting one more stock from the S&P 500 to offer a bit of sector diversification to the list. Recently, this stock had a lot of focus because famed investor Warren Buffett, was building up his position as highlighted in the SA News article, Why did HP Inc. stock go up today? Warren Buffett buys a big stake.

6. HP Inc. (NYSE:HPQ)

I recently wrote about HP Inc. last month in an article titled 3 Dividend Stocks For A Bear Grip or Bull Run. HPQ is a multinational IT company that emphasizes cloud-based solutions and one of a very few top dividend payers in the IT sector. Possessing a great dividend scorecard and great (“FWD”) dividend yield of 2.50%, this is a great bonus stock to add to any portfolio, especially if you’re looking for a steady stream of income to help inflation-proof a portfolio.

HPQ Dividend Scorecard

HPQ Dividend Scorecard (Seeking Alpha Premium)

HPQ has a fantastic track record for paying dividends for more than 32 consecutive years, showcasing its allegiance to shareholders. A stock like HPQ is a great option in preserving capital and aiding investors that want to meet their income goals and our goal is to provide our readers with stocks that we anticipate will prove beneficial in the future. We believe that HPQ is one of those stocks.

To showcase the reliability of our dividend picks, the Seeking Alpha’s Quant team introduced Dividend Grades in 2020 to identify those stocks vulnerable to dividend cuts. Our Dividend Grades Averted 99% of Dividend Cuts since 2010, and in addition to HPQ possessing a solid B dividend safety rating it has a stellar valuation and other fundamentals.

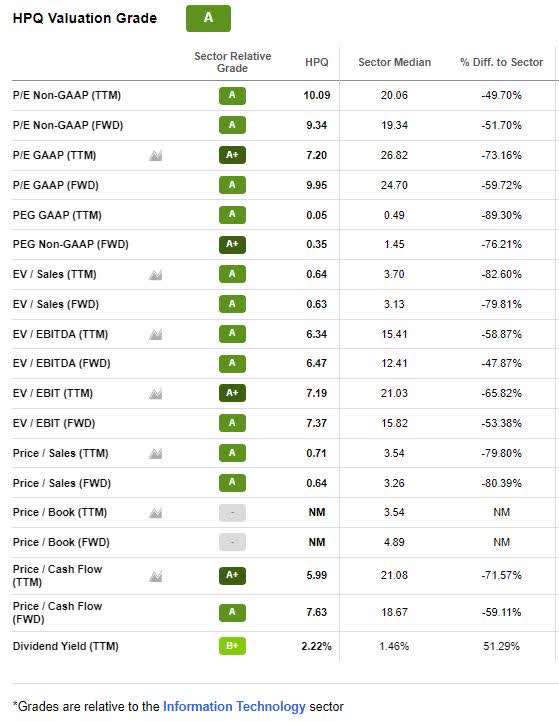

HPQ Valuation

HPQ is trading at quite a discount, especially when compared to its peers in the tech sector. With forward P/E 51% below the sector at 9.34x and PEG ratio 76% below the sector, it’s clear why HPQ has A’s for valuation across the board. Over the past five years, the stock’s share price has seen an increase +122% and over the last year, an increase of nearly 20%.

HPQ Valuation Grade (Seeking Alpha Premium)

With a current share price of $38.63, it’s a great time to buy this stock. HP possesses solid growth, profitability, and momentum factor grades, having capitalized on supply chain disruptions and providing solutions for remote environments.

HPQ Growth And Profitability

As shown in the Factor Grades below, HPQ is on an upward trend and had another excellent earnings season. For Q12022, EPS of $1.10 beat by $0.08; Revenue of $17.03B beat by $504.85M resulting in 16 analyst upward revisions in the last 90 days and a Revisions Grade of A-. After generating $1.4B of Free Cash Flow and returning 127% of it to shareholders through dividend repurchases, Marie Myers, HP Inc. CFO stated, “We expect to aggressively buy back shares of at least $4 billion in FY 2022, and we remain on track to exceed our $16 billion return of capital targets… I am confident in our ability to deliver consistent, long-term sustainable growth.”

HPQ Factor Grades

HPQ Factor Grades (Seeking Alpha Premium)

In addition to solid growth, HPQ possesses an A+ Profitability grade. Maintaining strong free cash flow yield and solid profit margins is an indication that the future of HPQ looks bright. As The Black Sheep writes, “HP is a free cash flow machine, producing ~$4B of free cash flow in 2021 and anticipating $4.5B in 2022.” As we look to the future and the uncertainty of the markets, one thing is for sure, HPQ is a strong buy at its current levels, and a tech stock offering a steady dividend income stream.

As we continue to monitor our stock picks’ performance, we’d like to bring things full circle and show readers how their year-to-date performance compares to some of the S&P 500’s top 10 holdings.

My Stock Picks Vs. S&P 500 YTD Performance

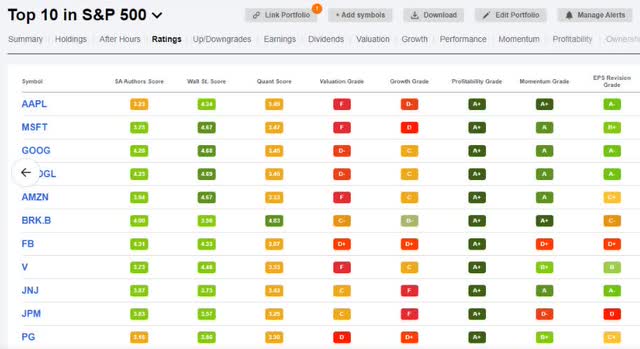

Looking at the top 10 companies in the S&P 500 index, they’re primarily technology-based and, therefore, may be more sensitive to inflation and rising interest rate environments that we are experiencing right now and will continue to experience as the Fed raises rates and tightens monetary policy.

When we compare the quant ratings and factor grades of Seeking Alpha’s top S&P 500 picks, including those mentioned above to the top 10 SPY holdings, you can see in terms of quant score, valuation, and growth grades that the Seeking Alpha picks significantly outperform the SPY picks.

Seeking Alpha’s Screener – Top 10 S&P 500 Holdings

Seeking Alpha’s Screener – Top 10 S&P 500 Holdings (Seeking Alpha Premium)

Mega S&P 500 Holdings (Seeking Alpha Premium)

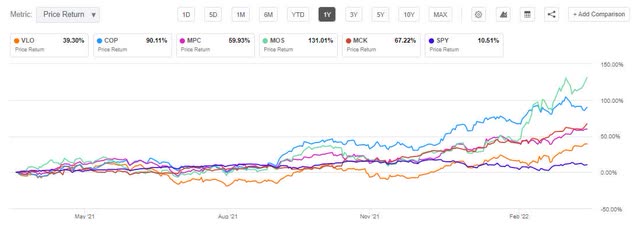

One-year comparison of our top five S&P stock picks versus SPY showcases how our stocks significantly outperform, indicating that investment in some of the smaller S&P 500 companies with solid fundamentals and great quant grades may be excellent considerations for your portfolio.

1yr SPY vs Our Top 5 Stock Picks Comparison (Seeking Alpha Premium)

Conclusion: S&P Stocks Can Be An Opportunity

This article is not encouraging investors to liquidate their mega-tech growth stocks or S&P 500-related ETFs. I’m simply pointing out the concentration risk in S&P 500-related investment vehicles and the over-stretched valuation of the largest market cap stocks in the index need some manual adjustment to offset the risk. In fact, with the Fed on the warpath to tighten monetary policy and raise interest rates, passive index ETF may well be an anchor to ensure diversification in the stock market.

Stocks in the S&P 500 offer diversification and by individually investing in stocks within this index, one can purchase securities in various sectors, whether defensives like utilities, healthcare, consumer staples, or perhaps in cyclical sectors that tend to perform well during periods of inflation or rising rate environments. Strongly consider diversifying into stocks that diminish the Mega-tech stocks’ risk and maximize sector and style diversification. Our top picks are smaller in size and were selected using our Quant System to ensure they have strong fundamentals.

Our investment research tools help ensure you’re furnished with the best resources to make informed investment decisions. Check them out today. The stocks featured here, MPC, MOS, COP, MCK, HPQ, and VLO, may help to diversify your portfolio. We have dozens of Top Rated Stocks, Top Value Stocks, and many more.

Be the first to comment