fatido/iStock via Getty Images

Oil nears $140 barrel as Putin’s war stirs up the markets, and supply chain disruptions continue to mount as further sanctions and bans are put in play. Gas prices are hitting record highs. Energy stocks hit multi-year highs, which is why I have three value energy stocks, VET, CPG, and BTU, that stand to benefit from increasing energy prices, but also do not appear overvalued.

3 Value Energy Companies to Watch

In this geopolitical environment, energy stocks are poised to continue doing well. When you factor in the risk-off mentality and investors flocking to safe-havens like bonds that are pushing yields lower, our value energy stocks stand to benefit. If you hold energy stocks that are at all-time highs or you are contemplating purchasing energy stocks, consider rotating to some energy stocks that still come at a reasonable price and that are attractively valued.

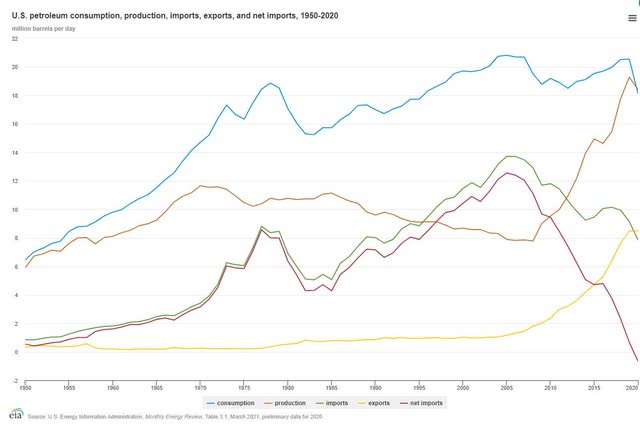

While it’s argued that the U.S. is energy independent, in reality, the odds of this happening are slim to none as the U.S. consumes more oil than it produces. “Sometimes it’s a lot cheaper to get cargo from Rotterdam to the East Coast than to push it from Texas…It can be immensely cheaper to take oil from the Middle East than from our wells in West Texas. In the real world, energy independence doesn’t exist.” oil analyst Dan Dicker of The Energy Word.

U.S. Oil Consumption vs Production (1950-2020)

U.S. Oil Consumption vs Production (1950-2020) (EIA)

There are a number of uncertainties within the global energy market, stock markets, and commodity markets, in general. Two factors are helping to boost energy:

-

The Global fallout and response to Russia’s invasion of Ukraine and the anything but Russia mentality.

-

Although bonds are slightly up for the year, the yield-sensitive nature of energy stocks tends to be inversely correlated to bonds; as yields on bonds fall, the higher yields on high dividend-paying energy stocks tend to attract investors.

Europe is deeply reliant on Russian Energy. 40% of Russia’s supply of natural gas and more than 25% of its crude oil goes directly to Europe. As consumers, businesses, and global economies are feeling the squeeze of surging fuel prices, ABC news gathered “Preliminary data from the U.S. Energy Department (that) shows imports of Russian crude dropped to zero in the last week in February.” While not all economies have adopted the bans given their stark reliance on Russian energy, nations around the world are gearing up to increase production for shipment to Europe and other nations that would need replacement energy. While the energy markets continue to be hot, let’s dive into our first value energy stock.

3 Best Value Energy Stocks

1. Vermilion Energy Inc. (VET)

Oil exploration and its producers are taking advantage of the increase in demand. As valuations rise, a number of standout energy companies continue to trade at attractive valuations, including Vermilion Energy (VET).

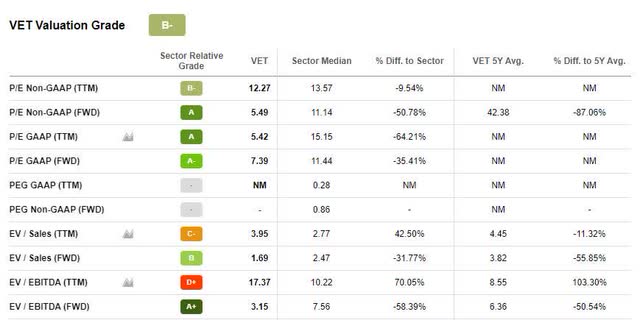

VET Valuation (Seeking Alpha Premium)

Canadian-based energy company VET, along with its subsidiaries, engages in the acquisition, exploration, and production of petroleum and natural gas. At a share price under $25, Vermilion is a great pick. Its forward P/E ratio of 5.49x is trading 50% below the industry sector. It is at a significant discount to its peers.

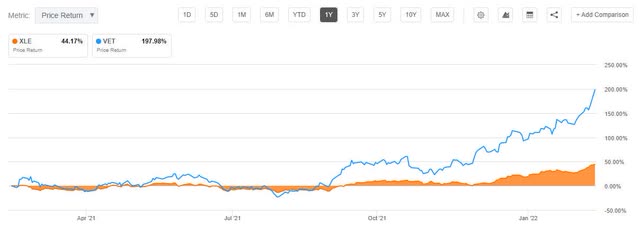

While there are concerns about commodity volatility and VET halted its dividend in 2020 with the downturn experienced from the pandemic, a strong outlook with rising oil and gas prices are providing great tailwinds. Year-to-date, VET has seen a price increase of +75% and a one-year approaching +200%, and we believe this will continue as we see an increase in demand for oil and gas.

Vermilion 1YR Price Return vs Energy Sector (XLE)

Vermilion 1YR Price Return vs Energy Sector (XLE) (Seeking Alpha Premium)

VET Growth & Profitability

Vermilion is in a great position to capitalize on rising oil prices and is a key asset for revenues tied to importers looking for oil exploration and production from nations outside of Russia and Ukraine. With a solid B Growth grade, VET continues to shine. Forward EBITDA Growth is at 50.33%, and top-and bottom-line 21Q4 earnings results were positive; EPS of $1.55 beats by $0.93; Revenue of $597.85M beats by nearly 140% YoY, or $221.60M. Vermilion Energy’s acquisition of Equinor Energy Ireland’s 36.5% equity position in the Corrib gas project has paid off handsomely and continues to reap the pricing benefits brought on by the increase in euro gas prices, with an anticipated payback period of less than two years. “At the time of the deal announcement, we estimated a 2022 free cash flow from this asset at $361 million. However, with the increase in euro gas prices since that time, we now estimate the 2022 free cash flow at approximately $500 million, which represents over 80% of the estimated purchase price,” said Dion Hatcher, VET President.

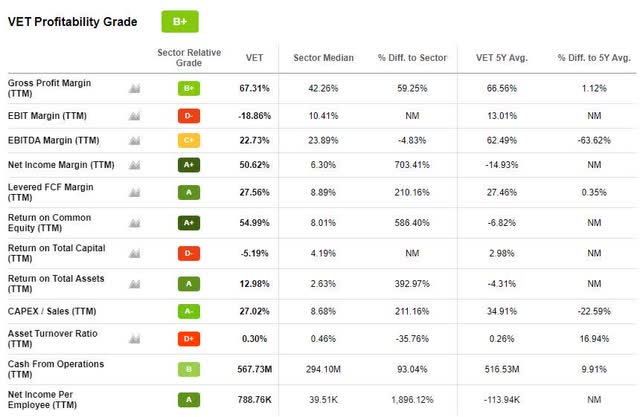

VET Profitability (Seeking Alpha Premium)

VET is doing well from a profitability stance, possessing a B+ overall grade and a B for Cash from Operations sitting on $567.73M. With plans to continue to pay down their debt with the excess cash flow from the surge in fuel prices, there’s a reason we’ve picked VET as one of our top energy companies to watch, and it’s just one of a few other ‘sleeper’ energy stocks we will discuss. Let’s take a look at our next stock pick, Crescent Point Energy Corp.

2. Crescent Point Energy Corp. (CPG)

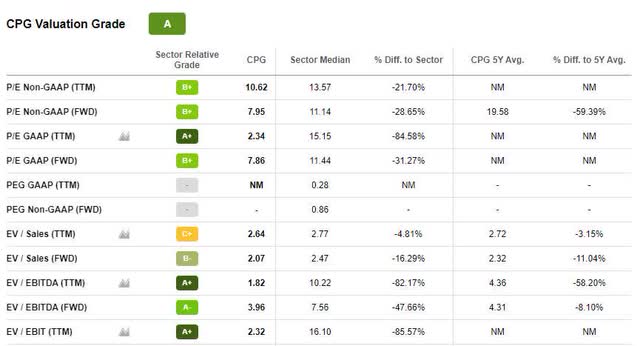

Crescent Point Energy (CPG) is an energy company that produces crude oil and natural gas in western Canada, and the U.S. CPG has a market capitalization of $4.27B and is priced less than $8/share. With an overall A valuation grade, we anticipate you’ll get your money’s worth in this environment. CPG is trading nearly 30% below its sector, with a forward P/E ratio of 7.95x. I chose this stock because it has great potential and strong factor grades, with As across the board.

CPG Factor Grades (Seeking Alpha Premium)

The stock also offers a tremendous valuation framework as can be seen by many of the underlying value metrics. Notably, most P/E ratios and EV ratios really stand out for Crescent Point Energy.

CPG Valuation (Seeking Alpha Premium)

CPG Growth & Profitability

Crescent Point Energy has an overall Growth grade of A, supported by strong year-over-year Revenue Growth (A-), EBITDA Growth YoY (B+), and strong Free Cash Flow (A). The latest Q4 Earnings resulted in Revenue of $710.03M beating by $90.37M, and not only will the company fully repay $670M of debt from its Kaybob acquisition, but the improving financial performance also makes for improved cash flow and margins. “I’m happy to report that we have increased our planned share repurchases from $100 million to $150 million, which is expected to be executed by midyear. This increase reflects the continued improvement in our financial outlook and our commitment to returning capital to our shareholders,” said Craig Bryska, CPG President & CEO.

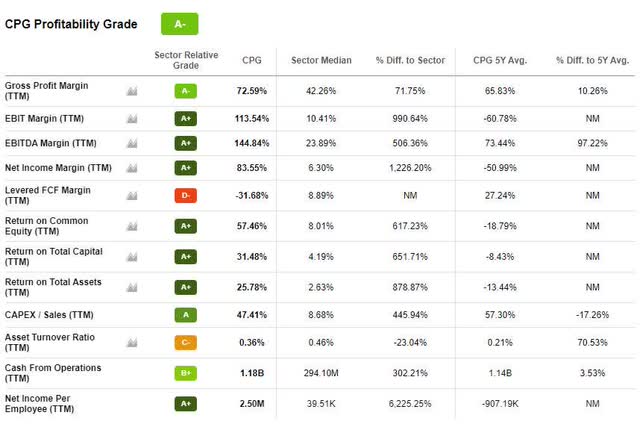

CPG Profitability Grade (Seeking Alpha Premium)

The acquisition of Kaybob (a gas region in Canada) positions the company for greater upside potential, increasing the number of quality wells, drilling locations, and royalty rate. With an A- Profitability grade, the company continues to increase its cash from operations, which is currently sitting at $1.18B, and its EBIT and EBITDA Margins are an A+. Energy prices are not likely to fall in the short term, which is why I like to ride the momentum of stocks like CPG, whose six-month, nine-month, and one-year price performance has outperformed the sector by more than 100%. As trading volume has increased over the last year and year-to-date fluctuations show positive signs, consider this stock, as well as my final energy stock pick.

3. Peabody Energy Corporation (BTU)

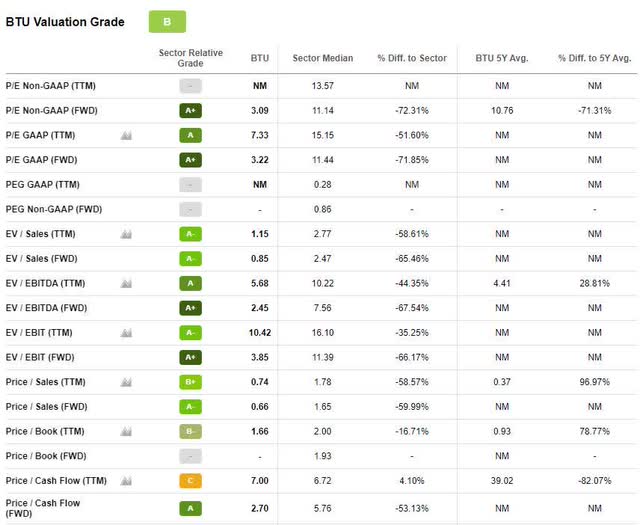

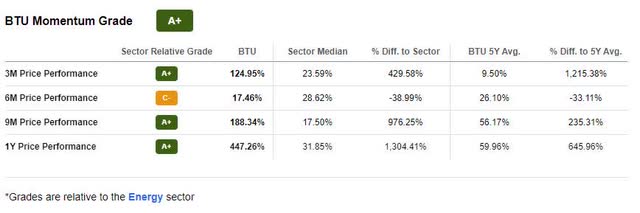

Last but not least, my final value energy stock pick is Peabody Energy Corp (BTU), which engages in coal mining internationally. Like it or not, Coal supplies 40% of the world’s electricity, and while it’s not the cleanest energy source, it’s cheap, and this undervaluation brings me to why this stock is a top pick. Trading under $25/share and an overall B valuation grade, BTU is an optimal pick given its +118% YTD rise in value, and over the last year, its share price has increased +447%. Bans on Russian resources, including coal, may lead to a coal shortage. “Then coal may rise by far more than oil & gas. It should be noted that, unlike oil and gas, coal can be transported more dynamically (without pipeline or complex LNG needs) and is easy to store, making it an attractive source of fuel in Eurasia (which is generally facing immense natural gas supply-chain disruptions),” writes Harrison Schwartz, Seeking Alpha author.

BTU Valuation Grade (Seeking Alpha Premium)

BTU’s forward P/E ratio is an A+ at 3.09x, 72% below the sector median, and the company has a forward EV/EBITDA of 2.45. As we look at its growth and profitability, BTU has continued to put up great numbers.

BTU Growth & Profitability

BTU posted strong Q4 Earnings. EPS of $3.46 beat by $1.79; Revenue of $1.26B beat by $189.10M, an increase of more than 86% from Q3. “We recorded net income attributable to common shareholders of $513 million or $3.93 per share. We recorded adjusted EBITDA of $444 million, a 54% increase over the $289 million recorded in the third quarter, and 4 times the prior year results,” said Mark Spurbeck, Peabody CFO.

With the announcement of Peabody venturing into renewable energy, the stock jumped 3% on March 4th. The growing trend of decarbonizing is increasing and energy companies that are able to capitalize before and after the transition to clean energy stand to make big bucks. Gross profit margins are solid with a C- grade and Cash from Operations are a B, with $420M on-hand. As the company looks to the future, it is evolving with the times and entering the green energy market.

BTU Momentum Grade (Seeking Alpha Premium)

Peabody and the coal industry is uniquely positioned in that, ESG and green energy proponents loathe the resource because it’s dirty. However, as the WTI crude oil price recently hit $139/barrel and global economies consider alternative energy sources, Peabody stands to benefit. KCI Research Ltd. writes, “Through September 30th, 2021, electricity derived from coal generation in the U.S. increased 23% over 2020, and this was with a 3% increase in overall electricity usage. The primary driver of this increase in coal generation was higher natural gas prices in the United States. Given that natural gas prices are substantially higher in the rest of the world,” and will continue to increase on the heels of the Russia-Ukraine crisis, global coal will be in demand, signaling strength in the sector, and Peabody should continue to gain from its production.

Conclusion

Oil and gas prices continue to rise, not only rebounding from pandemic lows, but spurred by a War in an energy-rich region of the world. As energy stocks continue to pass along rising costs to consumers, the stocks discussed today should do well given their Strong Buy scores, growth outlooks, and valuation framework. Buying energy stocks in the current volatile environment is not without risks. This is why we are focusing on energy stocks that still offer growth at a reasonable price. Notably, oil and gas producers outside of Russia and Ukraine provide alternate sources and they can drill and produce more natural gas and resources, but many are already operating at capacity. Keep in mind that expanding facilities takes years and billions of dollars to build.

Several of our value energy stocks are also in the business of exploration, whose production is often fixed for the short-term, and therefore their profits are tied to prices only when they sell. The skepticism and uncertainty surrounding whether price spikes are long-term or temporary can affect energy stocks and prices. Those in exploration and production may not boost production if they do not feel they stand to benefit because the price surges are only short-term. While we believe that the spike in prices is likely to remain elevated for some time, buying energy stocks at the current prices (even if at a value) presents risk. With this in mind, our stock top 3 value energy stock picks possess solid fundamentals.

Our investment research tools help to ensure you’re furnished with the best resources to make informed investment decisions. In this volatile environment, consider using Seeking Alpha’s ‘Ratings Screener’ tool to help you achieve diversification into desired sectors you like, including energy or commodities, using our Quant Rating as an objective, quantitative view of each stock.

Be the first to comment