bluecinema/E+ via Getty Images

Co-produced with Treading Softly

When it comes to the “essentials” of life, we often view them simply as an expense and nothing more.

I need gas in my car.

I need power to my home.

I need food on my table.

I need my cell phone plan.

Yet, the savvy income investor sees routes to generate long-term reliable income from every one of those sources.

Cellphone plans? Invest in REITs that own the towers, or even telecoms like AT&T (T) or Verizon (VZ).

Food? Consider buying consumer staple companies like Kellogg (K).

Power to your home? Utilities. I prefer to buy a utility fund like Reaves Utility Fund (UTG).

Today, I want to focus on the avenue of gas for one’s car. Gasoline demand is historically extremely inelastic. It’s been called the “commuter tax” because commuters need to buy gasoline to get to work regardless of the price. They buck up and pay it.

Few will cancel a family vacation over a few extra dollars to cover the gas bill. This is evidenced by the recent earnings of those important companies that transport fuel.

This sector is dominated by three large fuel distribution companies: Sunoco LP (SUN), CrossAmerica Partners (CAPL), and Global Partners (GLP).

Note: GPL, SUN, and CAPL are partnerships that issue a K-1 tax form.

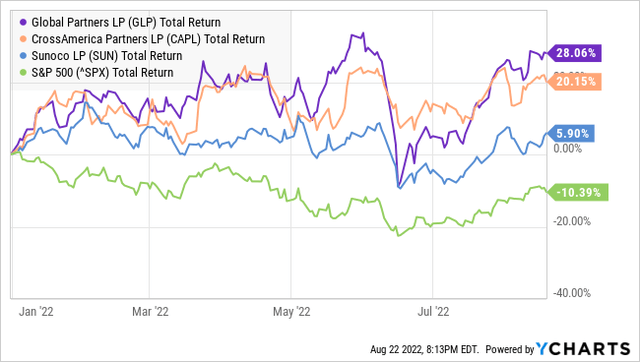

YCharts

So far this year, all three have strongly outperformed the S&P 500. GLP and CAPL have been performing even stronger than SUN so far this year.

SUN has an attractive and highly covered distribution yielding 8.1%, which is nothing to scoff at. However, they have been moving into more traditional midstream assets over the last 12 months. They purchased fuel terminals from NuStar Energy (NS) and entered into a joint venture on a pipeline with their parent organization Energy Transfer (ET). While diversifying their revenue streams, these moves make SUN more of a traditional midstream and less focused on fuel distribution.

CAPL and GLP have remained focused on fuel distribution and convenience store operation. Both have large amounts of real estate holdings and enjoy a profit margin between wholesale prices and what consumers pay. This margin is only pennies on the gallon, but it adds up when you move billions of gallons.

Let’s look at these two prime fuel distributors.

Pick #1: GLP – Yield 8.7%

Global Partners LP (GLP) gave us another distribution raise this quarter and the earnings told us why. DCF (distributable cash flow) has covered the distribution 2.5x after backing out proceeds from asset sales.

If you’ve been to a gas station recently, this should come as no surprise. It is a great time to be in the gasoline business. Q2 was unusually high, so it is important that they had that very large cushion because we can expect lower numbers in Q3 as prices come down.

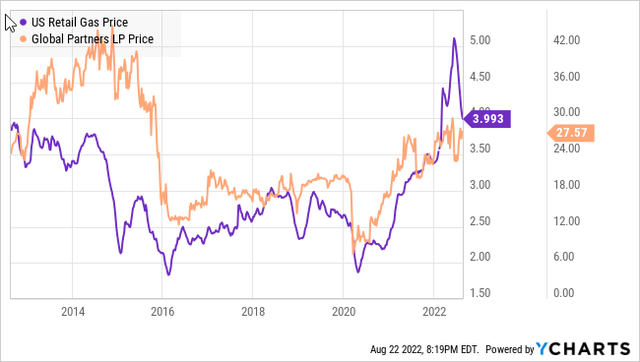

YCharts

However, they are “coming down” to prices that are still much higher than in the past decade.

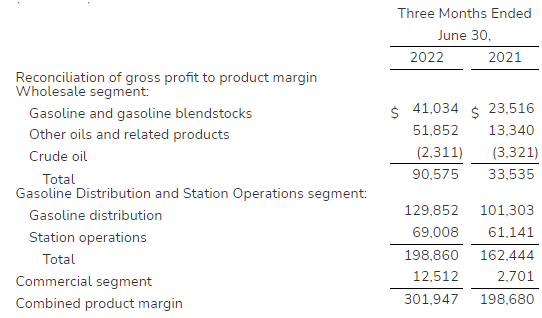

In Q2, GLP outperformed in every segment:

GLP Q2

From wholesale to distribution, station operations, and commercial, GDP realized higher gross profits across the board. A benefit to being vertically integrated is that outperformance in one segment can offset declines in another. When everything is hitting the ball out of the park you have very strong earnings like Q2.

GLP is putting its cash to work, expanding its portfolio even further, announcing the acquisition of another 15 gas stations and convenience stores that are expected to close in Q3.

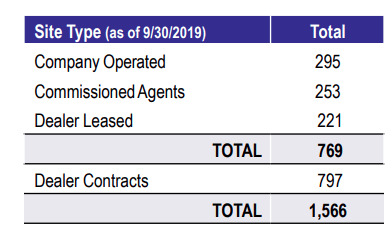

Currently, GLP’s portfolio consists of 1,683 sites comprised of 343 company-operated sites, 292 commission agents, 196 leasing dealers, and 852 contract dealers.

This is about a 7% increase in total sites from 2019, with company-operated sites growing the fastest. (Source: GLP Investor Presentation)

Q3 2019 Investor Presentation

Gas prices are high, and they aren’t likely to see the $2’s anytime soon. A lot of people get distressed over that, and I have to hide my smile. When I see those gas prices, I know my tank is getting filled with distributions!

Note: GLP is a partnership and issues a K-1.

Pick #2: CAPL – Yield 10.1%

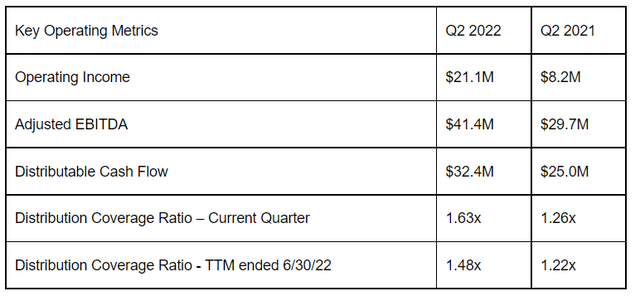

CrossAmerica Partners LP (CAPL) had a strong Q2 with a distributable cash flow of $32.4 million. This gave them a coverage ratio of 1.63x for this quarter and a trailing 12-month coverage of 1.48x.

CAPL saw a significant increase in all of its key metrics year over year:

CAPL Earning Release

This is largely due to their absorption and closing of the final leg of the Seven-Eleven locations – raising the CAPL-owned and operated locations from 150 to 254. This increased their revenue and expenses in regard to operation. However, profit margins remained strong in CAPL-operated locations, and their cents per gallon fuel margin rose from 9.2 CPG to 11.8 CPG for fuel distributed to non-CAPL-Operated locations.

CAPL is rebranding these new locations, adding EV charging locations, and remodeling them as needed. These are short-term CAPEX expenses that CAPL is using its excess free cash flow to complete.

Q2 and Q3 are historically the strongest quarters for fuel distributors as they are the yearly “travel season” where families pick up and travel. We see seasonally stronger profit margins and move fuel purchased during this timeframe compared to Q1 and Q4, when weather and school often keep consumers closer to home.

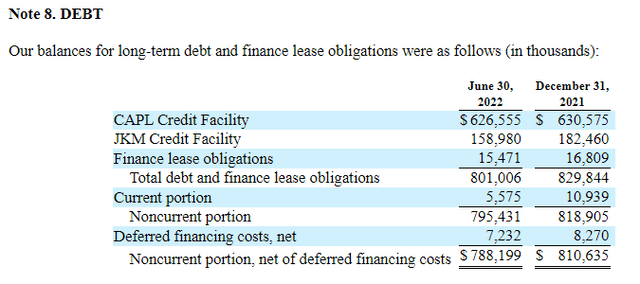

CAPL 10-Q

When we last covered CAPL, we highlighted the importance of their absorbing the Circle K locations and reducing their overall debt levels. The last time we covered CAPL, we noted that their blended leverage ratio dropped and hit 4.9x. This quarter it dropped again to 4.85x. This steady drop is exactly what we want to see from them.

With CAPL, we’re here for the high levels of immediate income and watching for management to continue to reduce their debt levels. CAPL is an attractive tag-team investment with GLP.

Note: CAPL is a partnership and issues a K-1.

Getty

Conclusion

When it comes to everyday expenses, gasoline is something you need to buy. So why not flip the script and make it something that richly rewards you as well? Benefit from the reality that other people need to buy it. In retirement, the best sources of income are the necessities of life. If someone else is forced to pay for it, you should find a way to make it pay you.

Today we looked at two excellent fuel distributors who supply a highly in-demand product to the public. Unlike other investments, consumers are forced to purchase fuel to commute to work, and workplaces continue to require their employees to come to the office, warehouse, or factory.

My retirement is benefiting from every person who fills up at the pump.

That’s an excellent income source to add to my dozens of other income sources. Each stock holding is a small stream of income that becomes a tributary to the river of dividends my portfolio produces every month. That’s the benefit of income investing.

Be the first to comment