adamkaz/iStock via Getty Images

I’ve been fairly active these days on Twitter, Inc. (TWTR) lately.

I figured it was time for me to explore this platform, to gain more followers, in an effort to connect with the Gen Z crowd.

To be clear, according to Harvard University, I’m part of the Gen X group, who was born between 1965 and 1984, and researchers use the late 1990s as starting birth years and the early 2010s as ending birth years for Gen Z.

This means that Gen Zs are now between 12 and 24, and in the same age range as four out of five of my kids.

Last week on Twitter I got a message in chat from a 20-year-old who asked me to list the top 10 REITs for a 20-year-old.

With over 100,000 followers on Seeking Alpha, I know that many reading this article fit into the Gen Z classification.

While I’m not sure how many 20-year-olds follow me, I do know that I have gained a number of followers as I guest lecture at universities such as New York University, Cornell, Georgetown, Penn State, and John Hopkins.

So, as a father of five, I suppose I have a good grasp on twenty-year-olds, and given my vast experience (at parenting) I thought it would be useful to provide a few basic facts with regard to investing.

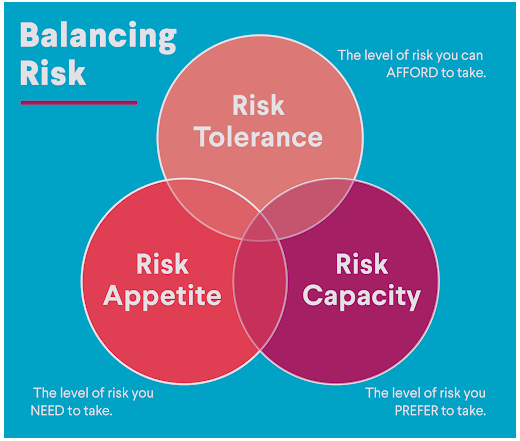

The first basic fact applies to all investors, and that is to always understand your own risk tolerance profile.

When I was in my 20’s, I took substantial risks, and perhaps I’ll write an entire article on the lessons I learned in my younger days.

It’s actually normal to take elevated risks in your 20s, because your time horizon is much longer, which means volatility has more time to recover. However, a word of caution here, as principal preservation should always be top of mind.

As I told often remind my kids, money simply does not grow on trees, and that’s where earnings (having a job to support yourself) is critical to understanding the concept of investing.

SoFi

Another important lesson for all investors, including 20-year-olds, is to always diversify. I just can’t stress the importance of this rule.

I’m sure many 20-year-olds are sick right now because they bet the farm on crypto. Fortunately, I didn’t invest in dot-com stocks in my early years, but I was highly concentrated with one real estate partnership, which served as my near bankruptcy experience.

My son did bet the farm on crypto, and he was not diversified, so he’s now learning the first rule referenced above – know your risk profile.

The next rule is a powerful one, and once again, it applies to all investors, but especially those in their 20’s.

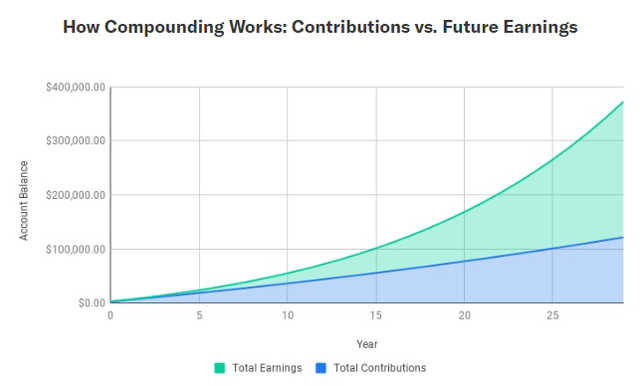

The power of compounding is easy to explain, but it’s much more difficult to execute in real life because humans are wired to seek instant gratification. As you can see below, very little growth occurs when you’re just starting out.

The graph below shows what happens over 30 years if you save $250/month in today’s dollars and earn a 7% rate of return. By the end you’ll have over $372,000!

The final tip, and this one is taken from the legendary value investor Benjamin Graham,

“Know what you are doing – know your business.”

Graham believed that in order to be successful, the operator of a business must know the value of the goods it’s selling – in order to set a correct price – and the value of raw inputs – in order to pay a fair price.

Of course, thanks in large part to technology, and web sites like Seeking Alpha, an investor can learn a lot about a prospective stock by the click of a button.

By the way, I would also recommend that all younger investors read two very important books: (1) The Intelligent Investor by Ben Graham; and (2) The Intelligent REIT Investor Guide by yours truly (yes, a little plug for this best-selling book).

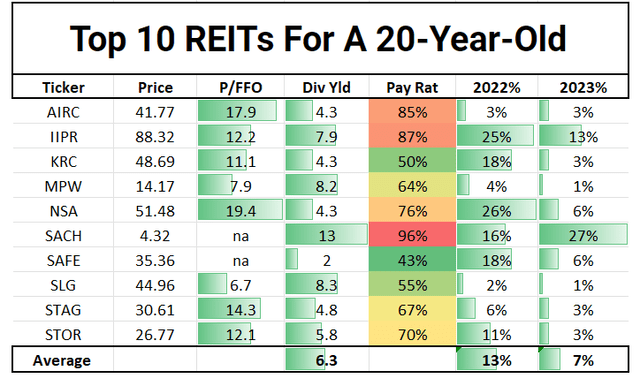

Now, I’m sure you’re interested in my Top 10 real estate investment trusts (“REITs”) for a 20-year-old, so in Gen Z lingo, here’s some “dank” REITs…

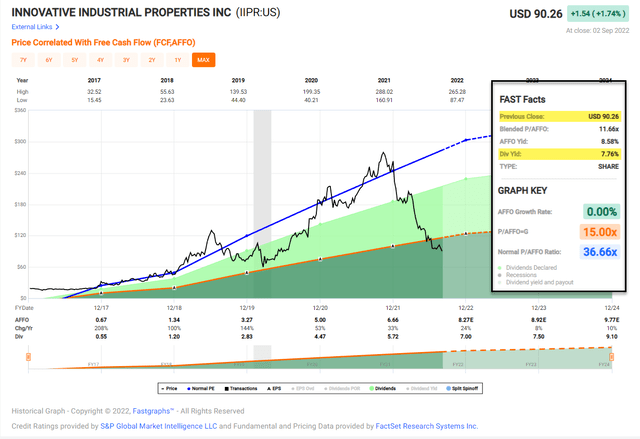

Gen Z Pick #1: Innovative Industrial Properties, Inc. (IIPR)

This cannabis REIT is perfect for the Gen Z crowd, and while I’m not promoting the use of weed here on Seeking Alpha, I do recognize the demand of that industry, which is expected to grow at 14.9% CAGR until 2030.

We just published a deep dive at iREIT on Alpha, and we consider this beaten down REIT a high conviction that’s trading at a very attractive valuation.

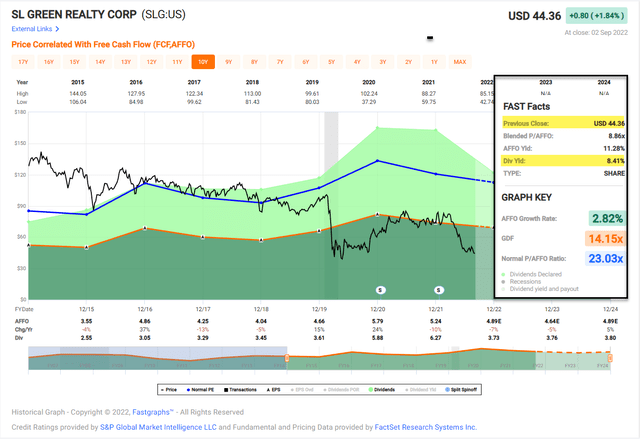

Gen Z Pick #2: SL Green Realty Corp. (SLG)

This New York-focused office REIT has dropped in price by 40% YTD, while the company has maintained strong fundamentals. Solid Q2 results and pays an 8.4% yield with a very conservative 55% payout ratio.

From a cash flow per share perspective, which is one of the best ways to measure any REIT’s value, SLG is among the absolute best.

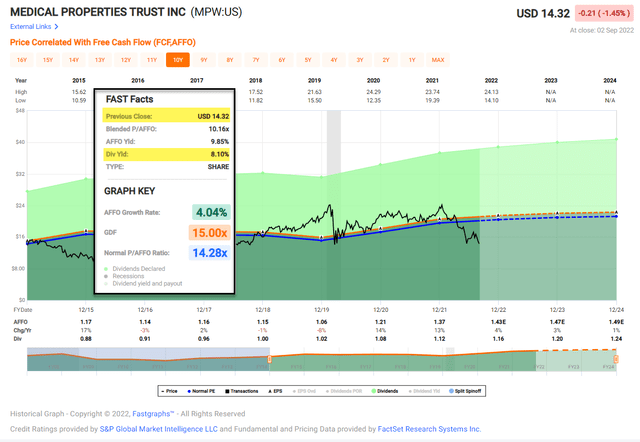

Gen Z Pick #3: Medical Properties Trust, Inc. (MPW)

The pure play hospital REIT has been the victim of a short campaign, yet we believe investors will be the victors. We have debunked the bears with our research, proving that even a Steward bankruptcy would not severely impact MPW.

At the essence, our thesis is that hospitals are mission critical and valuable infrastructure to cities, towns, and communities.

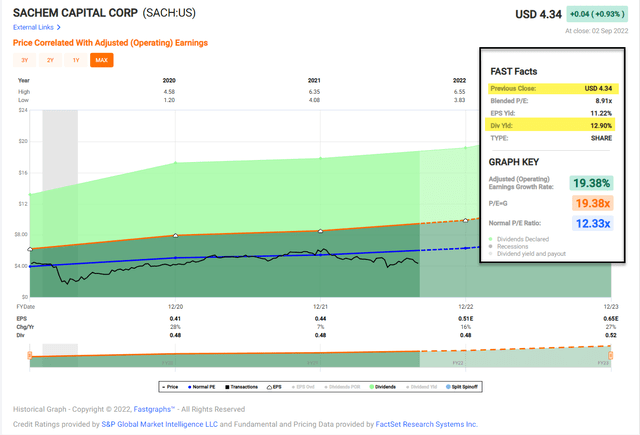

Gen Z Pick #4: Sachem Capital Corp. (SACH)

This small cap mREIT has “something special.” While shares are down by around 25% YTD, the dividend keeps growing.

More recently the company bumped the dividend by 17% and analysts are forecasting EPS to grow by 27% in 2023. The dividend yield is now a juicy 12.9%, most Gen Z-ers could sink their teeth into that.

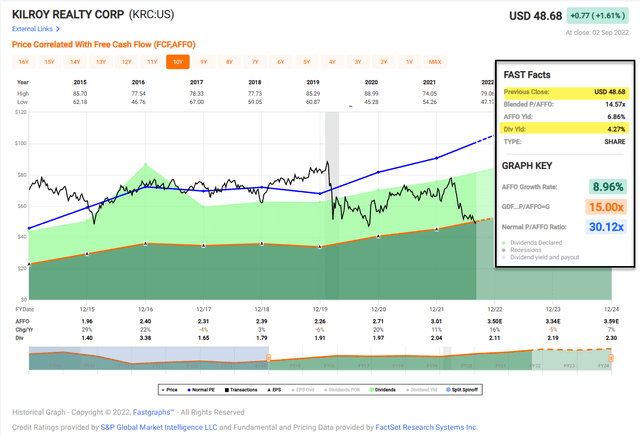

Gen Z Pick #5: Kilroy Realty Corporation (KRC)

This office REIT is another perfect Gen Z pick, as the office portfolio is comprised of many familiar Gen Z names such as Amazon (AMZN), Stripe (STRIP), LinkedIn, Adobe (ADBE), salesforce, DoorDash (DASH), DIRECTV, Netflix (NFLX), Boc (BOC), Snyopsys (SNPS), and Riot Games (RIOT).

In addition, KRD has tapped into the Life Science sector with a portfolio of ~3.2 M SF of existing, redevelopment and under construction projects and ~2.2 M SF of future entitled land pipeline. Shares are a bargain right now, trading at a 50% discount to normal valuation metrics.

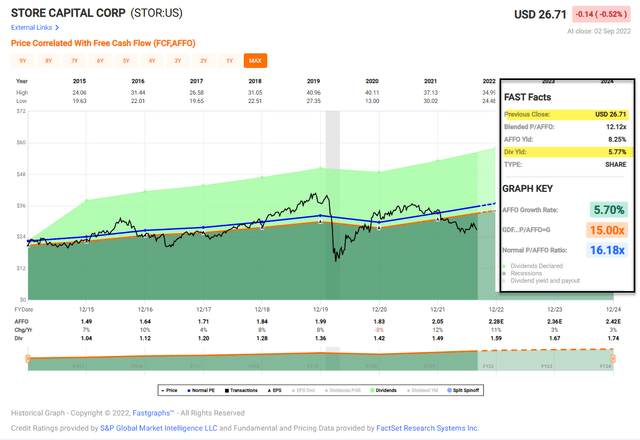

Gen Z Pick #6: STORE Capital Corporation (STOR)

This net lease REIT has been beaten down by over 22% YTD and while Berkshire Hathaway (BRK.A, BRK.B) has unloaded some of its shares, Gen Z-ers may want to take the opposite trade.

STOR has proven that it can manage its dividend by allocating capital judiciously and delivering own scale. Nothing wrong with the 5.8% dividend yield, either.

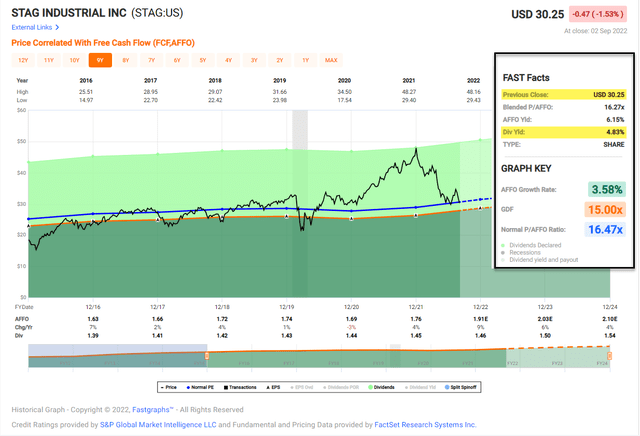

Gen Z Pick #7: STAG Industrial, Inc. (STAG)

STAG is another terrific Gen-Z pick, as the company has proven it can master the art of scale. With 559 buildings in 40 states, STAG has become widely diversified across geography, tenancy, industry, and lease maturity.

STAG has continued to grow its dividend, while also lowering its payout ratio – a feat that many can’t accomplish. Shares have pulled back to attractive levels, making this industrial a perfect sleep-well-at-night (“SWAN”) for the Gen Z investor.

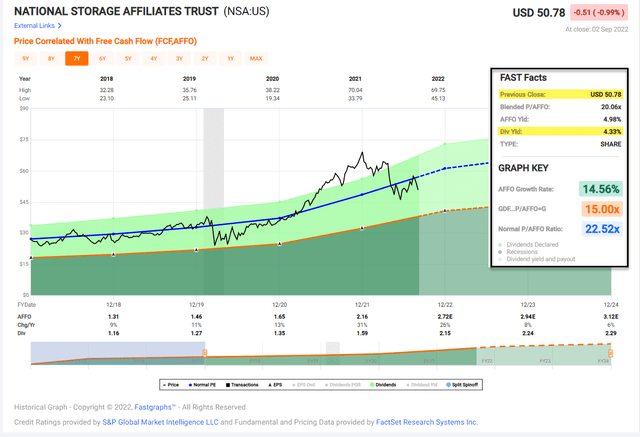

Gen Z Pick #8: National Storage Affiliates Trust (NSA)

Most Gen Z-ers understand storage, and if they don’t, they will soon. Many are delaying home purchases, and travel has become an everyday part of life. We consider NSA a solid BUY that has become cheap, based on all valuation metrics.

NSA has grown its dividend successfully, while maintaining a sound payout ratio. Growth also looks solid, based on analyst estimates of 26% (in 2022) and 8% (in 2023).

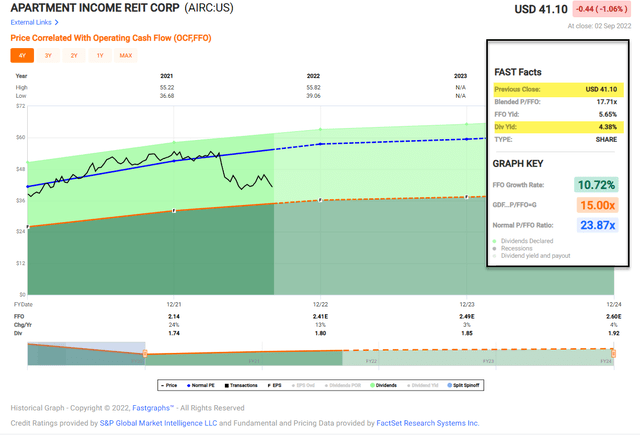

Gen Z Pick #9: Apartment Income REIT Corp. (AIRC)

Speaking of rentals, AIRC has a great value proposition as the portfolio includes a mix of quality, averaging B+ and the portfolio is roughly 65% suburban/35% urban.

AIRC is the cheapest multifamily REIT in our coverage spectrum based on its P/FFO multiple of 17.7x (and dividend yield of 4.4%). We consider shares attractive, as there appears to be multiple expansion potential given wider than historical average spreads and improving core and earnings growth.

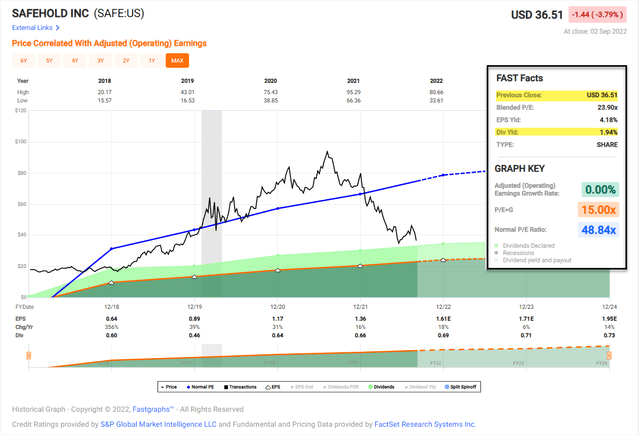

Gen Z Pick #10: Safehold Inc. (SAFE)

The final Gen Z is SAFE, and while this boring-as-it-sounds ground lease REIT may not be the yield chasing instrument you’re seeking, you just can’t ignore the deep-rooted cheapness of the shares.

YTD this mysterious REIT is down over 55%, and in addition to getting over $5.5 ground leases (at cost) you also get unrealized capital gains, under the “CARAT” platform. Plus, SAFE in internalizing as it merges operations with iStar (STAR).

In Closing…

Did you find this article “drip” (means cool or sexy)?

Hopefully now you’re “living rent-free” in your head (that means you can’t stop thinking about it).

So, now for a “vibe check” (to check someone’s energy or mood) …

And one more thing…

NFTs ARE NOT REAL ESTATE! (I’ll save that for another article)…

I’d love to hear your comments…

And by the way, get ready for another Twitter request,

Be the first to comment