Kemter

Investment thesis

We downgrade our rating from buy to a sell for Tomra Systems (OTCPK:TMRAY) based on 1) inflationary pressures remaining for the medium term dampening revenue growth and limiting improvements in profitability, and 2) current market expectations appearing too high when looking at consensus forecasts, with operating margin increases baked in for the next two years.

Quick primer

Tomra Systems is the world’s pioneer in recycling plastic bottles with its reverse vending machines. It also provides sorting and recycling machines for mining and waste management sectors, and sorting machines for the wholesale food sector for fresh fruits (e.g. blueberry, cherry, and kiwi) and processed food (Tomra has an 80% global share in French fries sorting machines). Core geographic markets are Europe (Scandinavia and Germany) and North America.

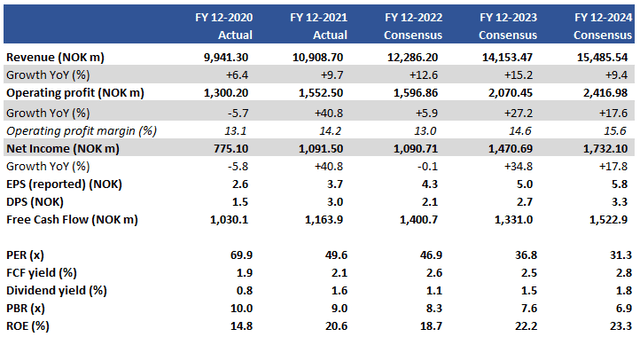

Key financials with consensus forecasts

Key financials with consensus forecasts (Company, Refinitiv)

Key objectives

We review our buy rating issued on March 30, 2022 based on long-term sustainable growth prospects for an ESG-themed investment, with the shares falling 32% since the recommendation. In this update we want to investigate the following:

- recent trading reported in H1 FY12/2022 results, and the outlook for the business.

- the potential impact of a global recessionary environment on ESG.

We will take each one in turn.

Cost inflation points to unrealistic market expectations

H1 FY12/2022 results showed currency-adjusted revenue growth of 10% YoY, driven primarily by demand from North America particularly for the Collection business (material recovery such as bottles and cans at grocery stores), and for Recycling (material recovery plants, scrap dealers and metal shredder operator) in Europe. Although growth was evident, its rate was not particularly robust given low hurdles YoY.

What is noticeable is the company’s comments over falling gross margins YoY (from 44% to 41%), driven by cost inflation and supply chain challenges (page 2). There was also evidence of pressure in operating costs which grew 8% YoY currency-adjusted. The resultant EBITA for the half-year fell 4% YoY.

With Tomra reporting in Norwegian Krona which has depreciated by 25% over the US dollar YoY, this tailwind for booking revenues will be in place into H2 FY12/2022. Cost inflation is dampening profitability, but we note that it is having a positive impact on demand for Tomra’s metal recycling machines with orders growing 19% YoY as commodity prices remain at elevated levels. However, as this segment made up 21% of the total H1 FY12/2022 EBITA, the impact on earnings remains relatively light. The situation is similar for the Food sorting business with record levels of quarterly orders, but with margins historically lower than the mainstay Collection business, any resultant impact on profits is again limited.

This backdrop puts Tomra’s outlook in a difficult position versus current market expectations. Consensus forecasts (see Key financials above) point to stable revenue growth for the medium term, with steadily improving operating margins. This looks unrealistic given that both cost inflation is unlikely to dissipate in the medium term, even in inflation does peak in the next 6-12 months. We conclude that there is a downside risk to Tomra’s shares.

ESG facing a crucial test

Tomra has been a visible flag bearer for the ESG investment community, which has provided a valuation premium for the shares. Some believe that a recessionary environment is good for ESG investments, and others feel that the world’s growing complications make such investments less appealing and relevant than before.

Economic turbulence has a negative influence on both consumer spending as well as capex. There will be flat to falling volumes for beverage demand worldwide resulting in less recycling collection, and there will be delays and postponements for industrial capex such as food sorters and recycling machines. We believe that unfortunately, ESG-related businesses will not be immune to a downturn, particularly if they are essentially capital goods companies.

Tomra remains well positioned in structural themes such as recycling, food production, and urbanization for the longer term. However, these will still be influenced by cost inflation and rising financing costs, and hence earnings visibility for Tomra remains low for the near term.

The simple caveat here is regulation, whereby public bodies mandate the use of recycling services resulting in compulsory investment. Tomra has a top market share in all its activities and a solid track record, making it an attractive partner for new customers. However, priority given to ‘green’ initiatives may be focused more on clean energy supply as opposed to recycling in the short term, and fiscal spending plans are likely to focus on supporting people over the rising standards of living crisis.

Valuations

On current consensus forecasts, the shares are trading on PER FY12/2023 36.8x with a free cash flow yield of 2.5%. Valuation multiples for Tomra have fallen with the share price performance, but taking the view that consensus forecasts look too bullish, we believe the shares could prove to be expensive. With a prospective dividend yield of 1.5%, this is a fairly low return offering limited downside protection especially given rising fixed income yields.

Risks

Upside risk comes from a major policy change in major Western markets that boost the adoption of green and recycling initiatives, prompting massive investment in Tomra-related products and services. Another upside risk stems from cost deflation as input and operating costs begin to normalize to recent historical levels.

Downside risk comes from earnings results missing consensus forecasts, particularly for not displaying improvements in profitability. We also believe that a sudden strengthening of the Norweigian Krona against the US dollar will be detrimental to revenue growth optics.

Conclusion

We downgrade our rating of Tomra from buy to sell, based on the company’s limited earnings visibility, particularly in contrast to market expectations currently priced in robust consensus forecasts. Our view may be seen as too short-term, but our take is that cost management will remain a key challenge in the medium term. Despite ESG credentials Tomra is a capital goods business and has limited leeway to mitigate these negatives.

Be the first to comment