http://www.fotogestoeber.de

Toast (NYSE:TOST) is an enterprise proxy play on the restaurant industry and has been limited due to its industry concentration and lack of profitability. However, we view the industry focus as a strength given the dynamics of the market and the likely profitability in the near term as triggers for a significant re-rating in valuation multiples, which can provide over 60% returns to shareholders.

Business

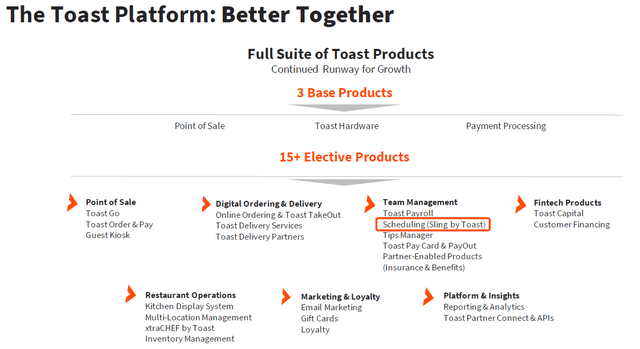

Toast provides operating system solutions across the restaurant ecosystem. The company covers the back office and front end through Toast’s seven portfolio categories of point of sale, restaurant operations, digital ordering & delivery, marketing & loyalty, team management, financial technology solutions, and platform & insights.

The company has four primary revenue verticals:

- Subscription services: SaaS fee income for the use of Toast’s software, based on a combination of the restaurant location, employees, transaction volume, hardware and software purchased.

- Financial technology (or fintech) solutions: Revenue from the commission on transactions, fees from marketing and collecting working capital loans.

- Hardware: Revenue from the sale of terminals, tablets, handhelds, and related devices and accessories.

- Professional services: Income from setup services and training.

Subscription and financial technology are recurring revenue streams, while the other two are one-time.

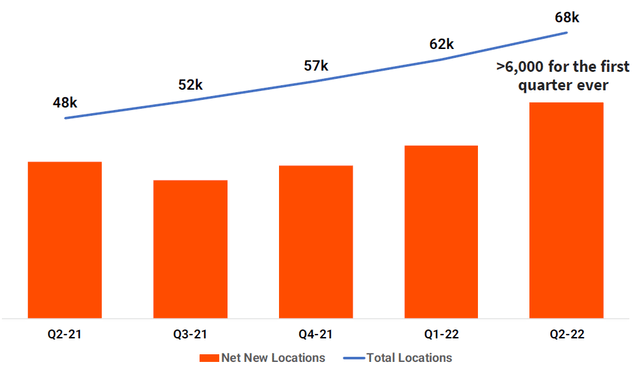

In addition to the pricing in subscription services or the commission (also called pricing or take rate) in the fintech solutions segment, an essential component is the locations. While pricing or ARPU indicates strong demand, location growth is an excellent proxy for the expected volume growth.

After adding over 5,000 net new restaurant locations in a quarter for the first time in Q1, we now exceeded 6,000 net new restaurant locations in Q2, just incredible growth that is being driven by our strong bookings pipeline as well as continued low churn.

Source: Q2 2022 Toast Earnings Call

The location growth has been accompanied by sustained uptake in the number of products.

As of December 31, 2021, approximately 59% of Toast locations used four or more core products, on top of our integrated point of sale, or POS, and payments solution, up from approximately 48% as of December 31, 2020 and approximately 37% as of December 31, 2019.

Source: 10-K – 2021

Q2 2022 has seen this trend continue with record ARPU growth.

As of the end of Q2, 61% of our Toast locations use four or more products on top of our integrated POS and payment solution, but even a higher percentage of new live customers join the platform with four or more products.

Total ARPU eclipsed 11,000 for the first time driven by strong growth in both our recurring revenue stream, SaaS and payments. Subscription services revenue increased 100% year-over-year in the second quarter.

Source: Q2 2022 Toast Earnings Call

The volume and pricing growth gives credibility to management confidence around a near-term profitability breakeven.

And so as we think about margins, you should see a steady improvement over time and a commitment from this management team to get to breakeven and profitability over the near term.

Source: Q2 2022 Toast Earnings Call

The momentum in the business has led to the management upping its full-year 2022 guidance:

- Revenue: $2.62-2.66 billion (up from $2.5-2.55 billion)

- Adjusted EBITDA: -$160 to -140 million (up from -$195 million to -$175 million)

The positive trajectory of all the major KPIs (ARR, locations, etc.) points toward a possible re-rating in the stock. However, a few questions about Toast’s business model must be understood before deciding in either direction.

Investment Thesis

The major question is on the vertical concentration: Can a restaurant only focus work?

Let us understand some broad contours of the industry, per the 2022 State of the Restaurant industry report from the National Restaurant Association:

- Annual sales for the restaurant industry are expected to increase 12% to $898 billion from $800 billion in 2021, making it one of the fastest-growing industries.

- The restaurant industry workforce is expected to add 400k jobs to reach 14.9 million.

- Industry costs are expected to remain elevated, impacting margins throughout 2022; supply chain issues seen in 2021 are also likely to persist in 2022.

- More than 50% (which is higher than the pre-pandemic levels) of the adult population says that they are not eating at restaurants as frequently as they would want to.

Despite many people not eating out, the industry is still expected to grow by 12%. In addition to indicating strong potential, the downside risk is also somewhat mitigated – the 51% population not able to eat out was only 45% before the pandemic.

Also, the additional workforce is only 2.7% vs the 12% growth, which implies improving realization per employee. Of course, the impact of inflation and the supply chain will need to be managed to alleviate the pressure on margins.

Toast combines Salesforce (CRM) and Shopify (SHOP)-like capabilities for the restaurant industry. Some use cases of Toast’s offerings are:

- Helping restaurants understand their menu profitability by ascertaining optimal pricing and food costs.

- Better customer engagement through text updates on the food status, mobile order and pick-up, ability to add to orders, etc.

- Processing of invoices by clicking using phones, which also gives access to customer data and thus the ability to further marketing initiatives.

Toast essentially provides a unified digital platform / operating system that integrates the various front and back-office activities, giving a bird’s eye view of operations, helping drive same-store sales, operational efficiency, staff productivity and automation.

In the same breath, it is notable that warm months, especially Q2, are seasonally the strongest for the company, which then dips in Q3 before clawing back in Q4. Moreover, since the listing in Q3 last year, 2022 is the first year the company has showcased its Q2.

Financials

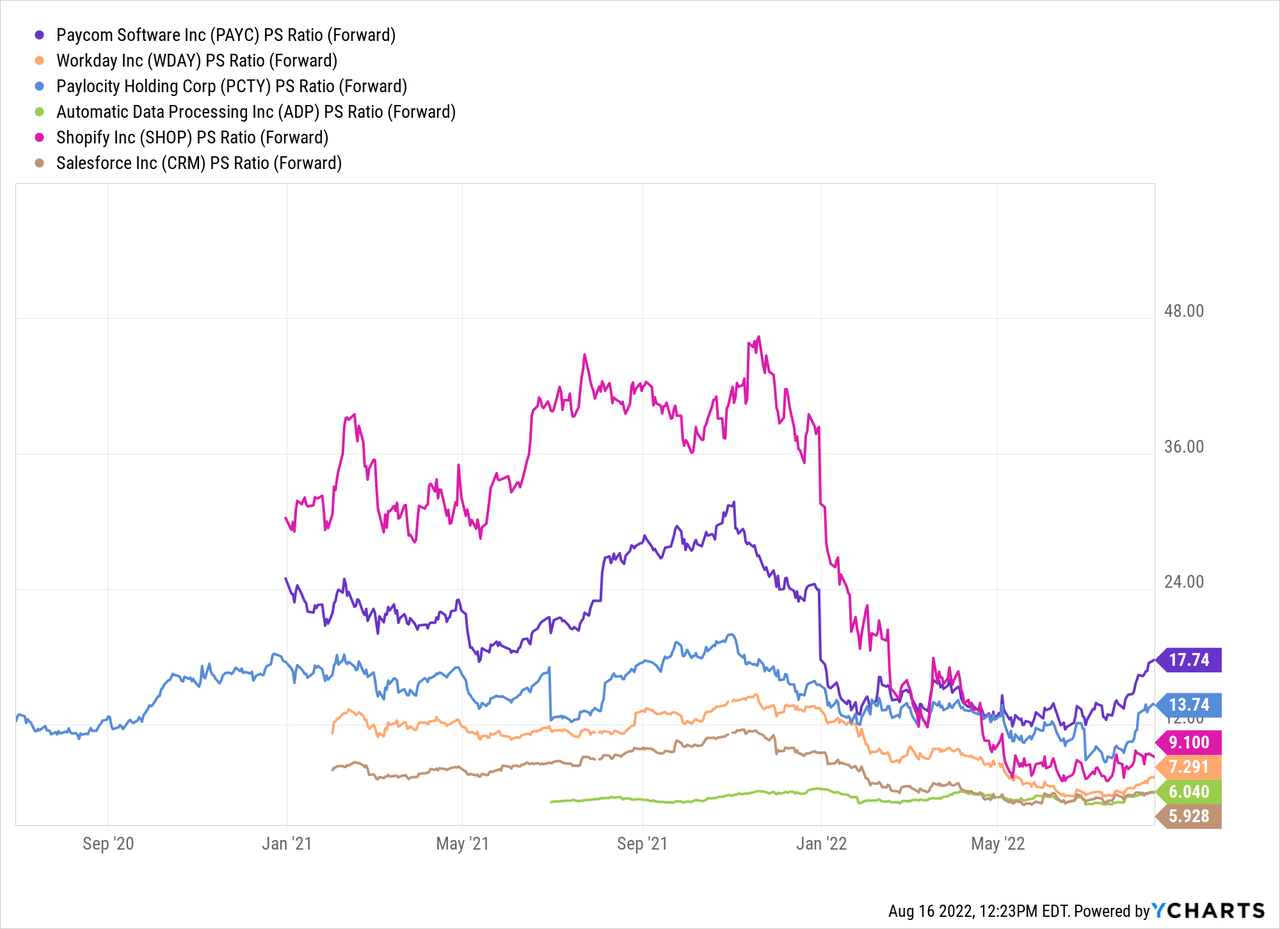

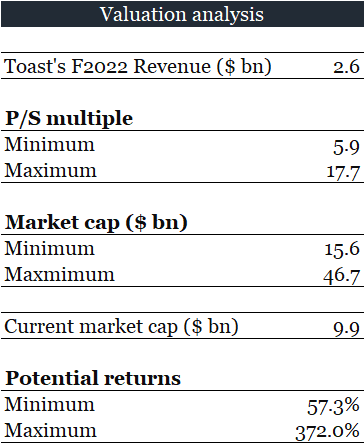

We take the mid-point of the management’s 2022 revenue guidance to arrive at $2.64 billion (55% growth y/y). For 2023, we think another 30+% is not unlikely given the momentum in location additions and product adoption, which implies revenue of $3.4 billion. Despite the current negative EBITDA and FCF, the strong revenue trajectory and Toast’s offering set (enterprise software and payments enablement) make it comparable to the likes of Paycom (PAYC), Workday (WDAY), Paylocity (PCTY), Automatic Data Processing (ADP), Salesforce and Shopify.

These companies trade in a range of 5.9x to 17.7x, which gives us the following valuation range.

Company filings, Seeking Alpha, Author’s analysis

Toast trades at sub four times F2022 revenue. Considering the range of peers, we think there is scope for a significant upside between 60-350%. However, Toast’s reward profile is balanced by the company’s risk profile.

Risks

- Vertical focus: The biggest challenge for a multiple re-rating continues to be the investor perception of a relatively concentrated client base by Toast’s focus on the restaurant industry. However, as shown above, the US restaurant market is relatively healthy, and Toast is well positioned to benefit from the dynamics of the industry.

- Seasonality: Since Q2 is the strongest quarter for the company, Q3 may be a bit of a disappointment vs the stellar Q2. Any sentiment-driven weakness post Q3 may be an excellent opportunity to buy.

- Execution risk: The thesis on Toast is that the company is likely to turn profitable soon. Any deviation in KPIs from the growth trajectory towards becoming profitable is likely to be a significant dampener for the stock. However, we feel the volume and pricing momentum is unlikely to die down soon.

- Lockdowns: Any further challenge from mandates to reduce physical activity could negatively impact the restaurant industry, further reducing the adult population’s wiliness to eat out and thus the pricing ability or ARPU for Toast.

Conclusion

Toast is a high-risk and high-reward potential investment. The company has shown tremendous revenue growth but lacks profitability. However, the management has reinforced confidence around turning cash flow positive, with the operational KPIs and results supporting the management assertion. We think structurally, Toast’s vertical focus is relatively rare and deserves to be considered. Given the possible upside running into triple digits (even discounting for limited vertical exposure/industry concentration) makes the Toast stock worth owning.

Be the first to comment