JJ Gouin/iStock via Getty Images

Intro

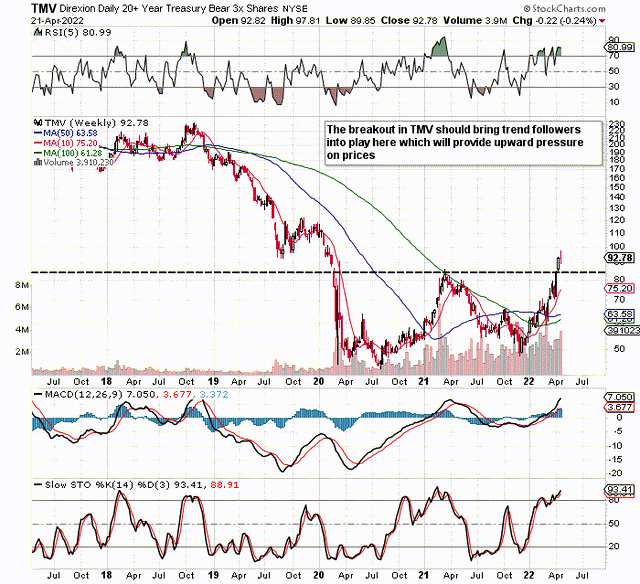

The weekly chart of Direxion Daily 20+ Year Treasury Bear 3X Shares ETF (NYSEARCA:TMV) definitely brings opportunity to the table, especially to those of the trend-following fraternity. As we can see below, shares recently broke above their respect 2021 highs, which means we have a clear breakout in play if indeed price can remain above this level. The breakout has taken place alongside a move by the weekly MACD into positive territory, so it will be interesting to see if TMV can push on here and start to make meaningful gains going forward.

TMV Weekly Breakout (Stockcharts.com)

Leveraged ETF Risk

Many investors tend to steer clear of leveraged investments, and it is easy to understand why. Concerning TMV, the ETF is invested in long-term US Treasuries (20-year minimum) on the short side, where the objective is to seek 300% of the inverse of the daily performance of the ICE U.S. Treasury 20+ Year Bond Index. In order to achieve this objective, the ETF needs to use financial instruments such as the likes of short-term option contracts, futures contracts, and swap agreements to attain the needed leverage required. Short-term derivatives, for example (when one is buying theta), are a very poor investment strategy when the underlying is not moving to the upside significantly.

Suffice it to say, there is huge “decay” in leveraged funds, and this decay really becomes more noticeable in trendless markets. TMV’s short-ratio, for example, at present comes in at almost 4%, which is almost triple the asset class median. Although not a high number by any stretch of the imagination, highly leveraged instruments do attract short sellers due to the afore-mentioned “natural fall” in the investment due to its decay. Nevertheless, we maintain the positives of a long investment in TMV at present outweigh the drawbacks for the following reasons.

Momentum

TMV’s return of over 22% over the past 12 months alone demonstrates the strong momentum in the fund at present. The IMF’s recent comments on inflation are bullish for TMV, but trend followers do not preoccupy themselves with the reasoning behind a trending move. Trend followers believe that the market discounts everything, which means that everything which can affect this specific market has already been reflected in the share-price action on the technical chart.

Assets Under Management

Another key area that is positively affecting TMV’s share-price action is the fund’s assets under management. AUM over the past year has grown by 100%, whereas growth comes in at approximately 9% over the past month alone. The average daily share volume (3 months) has now risen to 681k, so volume and AUM growth are correlating nicely with the bullish trend we are seeing on the technical chart.

Trend Following

Many investors believe that one must buy low and sell high consistently in the markets to make money. However, the strongest market moves actually commence from fresh highs (breakouts) which we have presently in TMV. Furthermore, now that shares have repeatedly made fresh weekly highs for many weeks now, TMV’s current trend in motion is more likely to continue than reverse. This, in essence, is the entire trend-following approach, which is to ride the prevailing trend until a clear sell signal is given at the tail-end of the move.

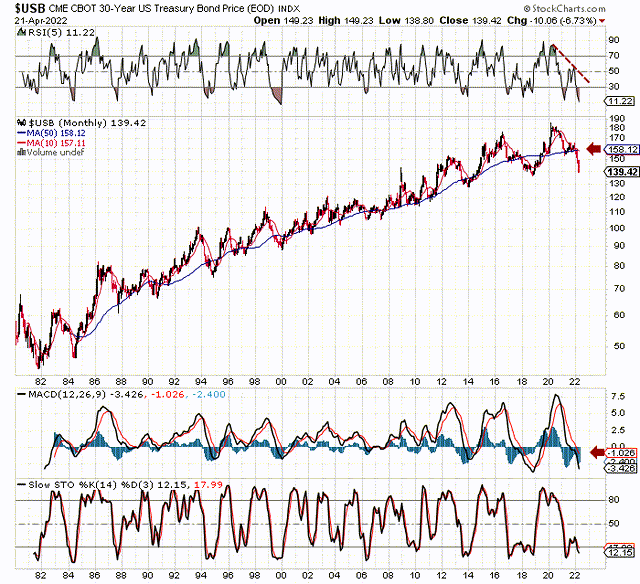

Further evidence is given on the long-term US 30-year bond chart below, which constitutes more than 40-years of information. As we can see below, the prevailing share price is trading at levels below its 50-month moving average that we have rarely seen before. Divergences are present in momentum and the MACD is now firmly in negative territory. Suffice it to say, the bears remain firmly in control of US bond markets.

30-Year US Bonds (Stockcharts.com)

Conclusion

Although risks are certainly apparent in the Direxion Daily 20+ Year Treasury Bear 3X Shares ETF, we continue to believe a long play here outweighs the drawbacks by some margin. The ETF has confirmed a new bullish trend (Which will bring trend-followers into the picture) as assets under management growth continue to power shares forward. Traders can use the recent breakout level as a position to place protective stops. We look forward to continuing coverage.

Be the first to comment