Nikolay Tsuguliev/iStock via Getty Images

Company Background

It is hard to be enthused about an adventure so vehemently met with social opposition. With access to capital markets freezing over, risk premiums have exploded, yields on debt have mooned, and capital has evaporated following some recent notable corporate bankruptcies.

Despite an offshore mining lease showcasing lucrative project economics, I remain bearish on TMC the metals company’s (NASDAQ:TMC) prospects.

TMC the metals company is a swashbuckling Deepsea exploration venture focused on seabed mining of polymetallic nodules destined for EV batteries. The untried enterprise aims to be an industry first, by successfully marketing and distributing precious metals primed for the green revolution.

From depths of 4,500m and beyond, the adventurous firm, once pushing an eye-watering $2.9B post-SPAC price tag, may revolutionize natural resource extraction.

Or it could simply be another SPAC shipwreck.

Zero sales, mammoth expenses, and egregious stock-based compensation all signal red flags for a commercial adventure whose financials looked poised to take on water. The jury remains out.

Opponents of deep-sea mining highlight the damage to the seabed, the loss of biodiversity, and functioning ecosystems. To date, Google, BMW, and Volvo have excluded the use of ocean-mined materials until the risks are better understood.

Germany has recently called time on negotiations over the management of deep-sea resources, suspending support for seabed mineral resource extraction.

Biologists, oceanographers, and environmentalists alike have been calling for a halt to the irreversible marine damage caused by seabed mining, with 653 marine scientists and policy experts across 44 countries calling for its shelving.

The firm’s past appears checkered with green virtue signaling and sustainability branding perchance a ploy to amass capital. That may have misfired following a $200M liquidity crunch in 2021 when private equity backers failed to cough up promised funds. Since then, legal wrangling has ensued, and everything has been essentially on a shoestring.

The company’s buccaneering CEO Gerard Barron has previously been entangled in corporate busts and capital destruction, with another SPAC company, the Nautilus going underwater following a failed Papua New Guinea seabed mining campaign.

Mr. Barron cashed out, making $30M and left before the enterprise went belly up. With funds depleted before the company could begin production, creditors seized its boat, the Papua New Guinea government wrote off a $120M investment and two other investors, one from Qatar and one from Russia, acquired the company’s assets.

Short seller, Bonitas Research has weighed in on prospects for the current underwater mining outfit, claiming the ground-breaking ultra-deep miner overpaid for key assets and pumped-up exploration spending, providing “a false scale of operations.” A lot of risk remains unknown, despite plausible impacts on marine biodiversity.

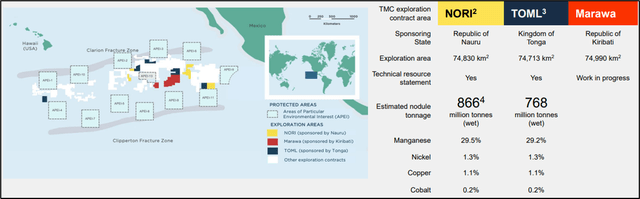

The company claims 866m wet tons of nodules in Nori2 and 768m wet tons in Toml3.

The firm showcases two exploration areas in the Clarion-Clipperton Zone of the Pacific Ocean, backed by several Pacific Island governments, and allegedly touts enough resource firepower to charge 280m electric vehicles. Its backers include Glencore, Maersk, Allseas, and Hatch, who all hold equity in the enterprise.

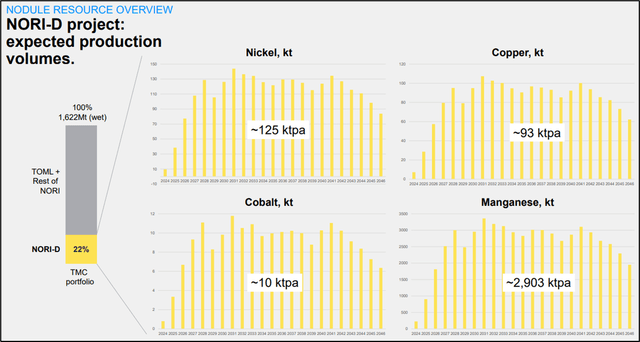

The NORI-D project presently forecasts 125k tons of nickel production from around 2027, 93k tons of copper, 10k tons of cobalt, and 2.9M tons of manganese.

Projections do not however detail extraction, logistics, and transformation costs that are likely to be sizably higher than conventional mining operations. Only a fraction of the forecast volume is projected for production sometime around 2024 if the project ever gets off the ground.

The company projects consistent volumes towards the end of the decade without detailing how onerous production, logistics and transformation costs will be.

Financials

With the firm’s activities still in their infancy, there is not a lot of financial data to go over. Since inception, the stock has tanked -91% with a current market cap of roughly $227M.

The company employs a team of 31 with little to show nor in the way of revenues or future upside. Year to date, equity in the organization has tanked -76%, but there is surprisingly little in terms of short interest (1.44%) in the firm.

The venture continues to haemorrhage cash as it pursues exploration and project development works. With $104M in cash and marketable securities, TMC the metals company probably has enough money to last another year without recourse to credit markets or another equity issuance diluting present shareholders. For the first three quarters of the year, operating expenses have tallied around $90M.

Most of the cash and cash equivalents were raised during the SPAC merger, saving the company from an expensive capital raise on conventional debt markets.

Stock-based compensation, which was $33.6M over the last 12 months, appears excessive. Common stock issuances in Q3 2022 ($47M) have thrown the firm a lifeline, securing the cash to continue pursuing its onerous, complex, and risky offshore mining initiative. The company is burning between $20M-$30M every quarter.

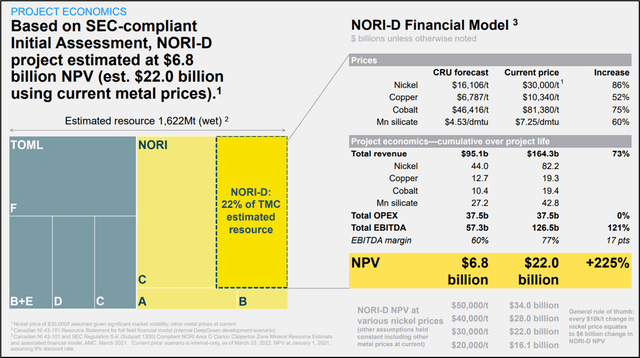

The project posts eye-watering project economics but fails to detail how the company meets capital requirements beyond the end of 2023 to keep the project afloat.

There is little information on the capital expenditures required to get the project off the ground, nor whether it is economically viable given additional onshore projects coming online, and offshore production and logistics costs meaningfully higher.

Risk

TMC the metals company is jam-packed with risk. With $100M on the books keeping the firm afloat for another year while it navigates an industry niche with little alignment or regulation regarding deep water mining leases.

A lot of the biological impacts remain unknown yet increasingly, governments are starting to shy away from the benefits of deep-sea mining. A lot remains to be explained regarding project financials, with little indication of future capital expenditure requirements.

If the project does not meet with increased regulatory scrutiny, it appears it will run out of cash before it sets sail.

Key Takeaways

In an environment which has witnessed risk capital navigate a roller coaster ride, it is difficult to get excited about a fledgling firm trying to pioneer a niche when cheaper onshore assets to develop battery metals remain unexploited.

Fortune possibly favors the brave but to a backdrop of bigger risk premiums, more wary investors, and a range of investment scandals, raising additional capital may be this venture’s Achilles heel.

Be the first to comment