Editor’s note: Seeking Alpha is proud to welcome BehavioralSync as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

choochart choochaikupt/iStock via Getty Images

Investment Thesis

Titan International (NYSE:TWI) is a strong buy opportunity in the long term. The company is facing massive industrial growth that is not expected to slow down any time soon. There are few competitors of comparable scale in the industry, and, uniquely, Titan is the only company that is largely unaffected by, and therefore benefitting from, the manufacturing disruptions in China and the sanctions on Russia. Most importantly, Titan is significantly undervalued on the stock market.

Company Background

Titan primarily produces off-the-road (OTR) tires for agricultural, construction, military, and earth-moving use. The company’s tires are designed to reduce soil compaction as well as prevent vehicles from sinking into soft earth. This affords clients the leeway to drive onto sensitive patches of arable land that would otherwise only be accessible on foot.

Titan manufactures tires for a diverse set of high-profile customers including John Deere, Caterpillar, and Kubota. The company operates through multiple subsidiaries, the most prominent being Titan Tires Corporation and Goodyear Farm Tires (Goodyear (GT) sold its farm tire division to Titan in 2006).

Analysis

Industry

According to Precedence Research, the OTR tire industry is projected to grow at a CAGR of 7.3% up to 2030. This growth is driven by growing demand in emerging markets – Latin America and Asia in particular. International demand is set to rise as countries, anticipating further breakdowns in economic diplomacy, push for import-substitution industry growth in the agricultural sector. This means that as agricultural production decentralizes, individual economies will require their own agricultural and earth-moving equipment to meet consumer demand.

Additionally, due to industry-wide transformations caused by shifting commodity prices and the push for decarbonization, raw material alternatives derived from sustainable sources are providing opportunities for cheaper production and higher margins. Titan is leading the industry with its recycling and sustainability initiatives, which are elaborated on in the ‘Risks’ section of this article.

Financials

Titan reported a net consolidated revenue of $1.78 billion in FY21, significantly outperforming pre-pandemic figures. The company’s growth during and after the pandemic is attributable to the filling of new gaps in the North American and global markets, which occurred as a result of competitors falling behind on supplies due to an industry-wide dependency on Chinese manufacturing. Signaling continued upward momentum, in the first half of FY22 (H1-22), the company earned a revenue of $1.13 billion, which is, year-over-year (YOY), 34% higher than H1-21.

The company reported a gross profit of $237.5 million in FY21, an astounding 108% increase from FY20 and an 84% increase from the pre-pandemic gross profit in FY19. The surge in profit is largely due to lower production costs and higher margins. This was achieved through a mix of U.S.-based manufacturing, diversified supply chains (7 production plants in North America, 3 in South America, 11 in Europe, 1 in China, and 9 in Australia), and the switch to cheap synthetic rubber alternatives — part of Titan’s aggressive streamlining strategy. This is reflected in the company’s gross profit margin, which has steadily increased over the last year and currently stands just below 20%.

As of H1-22, the company’s YTD EBITDA margin stands at 12.1%, which is considered healthy and marginally higher than the industry average calculated by CSImarket. This EBITDA margin is also significantly higher than in FY21, where it stood at 7.4%.

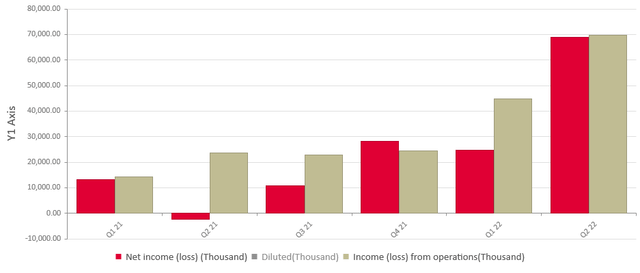

Titan earned a net income of $50 million in FY21, ending a multi-year streak of losses that amounted to $60 million and $50 million in FY20 and FY19 respectively. This resulted in a positive diluted EPS of 0.79 in FY21. In Q1-22, the company earned a net profit of $24.6 million, a 77% increase YOY. Remarkably, in Q2-22, Titan earned a net profit of $69 million, beating Q1 by 207%.

Quarterly net income trajectory (titan-intl.com)

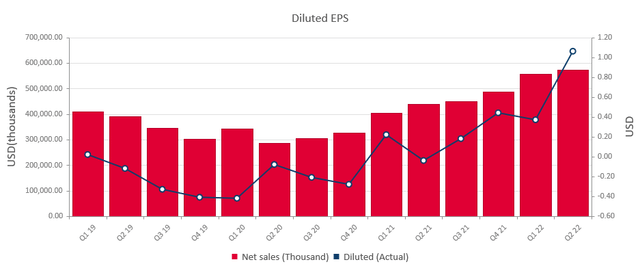

In Q2-22, Titan exceeded expectations by reporting a diluted EPS of 1.06, a 20% surprise. This past quarter was also the company’s highest earnings call in over three years. The market responded positively, boosting the company’s market valuation by over 1000% since May 2020. However, Titan’s valuation has not surpassed its peak in 2008.

Quarterly diluted EPS trajectory (titan-intl.com)

Signaling a decision to further streamline operations and increase margins, in Q1-22, Titan sold its Australian wheels business, repatriating $17.5 million in cash and gross proceeds while offloading all associated liabilities.

Concerning the fundamentals of future growth, Titan increased its expenditure on R&D by $1 million in FY21. At the same time, the company significantly reduced its CAPEX, going from $38.8 million in Q4-21 to $7.6 million in Q1-22. This is a strategic decision to preserve cash and avoid bulky investments during times of economic uncertainty.

Risks

Uncertainty in the commodities market is a concern for Titan. The company has offset this risk through the early adoption of recycled raw material alternatives. In particular, Titan has made an industry-first transition to raw material substrates derived from the “end-waste” of automotive manufacturing. Currently, the company is supplying a small portion of its materials from one such plant in Spain. This is an environmentally conscious decision that has the effect of reducing the company’s net reportable carbon footprint while also reducing the cost of production.

Titan’s gradual transition away from volatile commodities such as soybean oil and corn oil serves to diversify the company’s supply chains – an important survival strategy in an uncertain multipolar world. From an Environment, Social, Governance (ESG) perspective, Titan remains in the green due to its sustainability efforts and active avoidance of disruptions caused by looming regulatory restrictions in the form of carbon credits and import tariffs.

External Impacts

Disruptions related to the COVID-19 pandemic were less prominent in FY22, however, there are ongoing uncertainties in the Chinese markets due to the government’s zero-tolerance COVID-19 measures. This has had a positive impact on Titan as it is the only major OTR tire producer with localized production plants in the U.S. — unlike competitors such as Toyota (TM) and Goodyear, who heavily outsource manufacturing to China.

The Russia-Ukraine Military conflict poses a minor concern because Titan owns 64.3% of the Russian entity, Voltyre-Prom, which is one of the largest producers of OTR tires in Russia, holding about 40% of the Russian market share. It is important to note that trading in tires and undercarriage components in Russia is not a violation of OFAC sanctions. While Titan has not divested from the country, the company has halted any further investments for the time being. Nonetheless, Titan’s continued operation in Russia has invited public scrutiny. In the face of scrutiny, Titan has shown commitment to its shareholders by remaining neutral and prioritizing business interests. Voltyre-Prom represents 6-7% of Titan’s consolidated assets and contributes around 5-6% of the company’s consolidated sales revenue. The ongoing conflict opens up opportunities for sales growth as Russia is rapidly implementing import substitution industrialization, thus desaturating the domestic market and making room for local producers like Voltyre-Prom.

Valuation

Valuating Titan is tricky because the company’s growth rate is highly inconsistent. For example, in Q2-22, Titan’s net income grew by over 2,500% YOY. To paint a more sober picture of the company’s trajectory, it’s better to use the quarterly revenue growth rate, which over the last year averages 44% — still unrealistically high as a projection metric.

As one of the only OTR companies with the logistical scale to meet rising demand during the pandemic, Titan’s sales growth was partially driven by manufacturing delays affecting competitors. Over the next five years, Titan’s growth rate will likely slow down as the market normalizes. Nonetheless, organic demand did increase overall and the company has locked-in additional recurring revenue from selling parts, servicing, and maintenance to its new customers. It is reasonable to expect steady revenue growth at a rate that might peter out at around 15-20% in the coming years.

In Q2-22, Titan’s profit margin was up over 2,000% YOY. As the company’s streamlining strategy continues, along with its increased use of recycled iron, rubber, and synthetic rubber alternatives, Titan is on track to deliver improved EPS in the coming years.

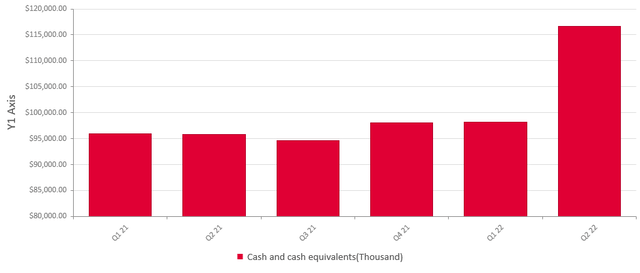

In the past, the company’s debt has been a cause for concern. Bulky investments contributed to losses in FY19. However, as part of its offloading strategy, the company’s debt ratio stands at around 0.41 and is set to drop further. This is well below the industry average debt ratio of 0.58. Furthermore, Titan’s cash portfolio amounts to approximately $116.7 million. The strategic build of liquidity will help maintain a healthy debt ratio and indicates a cautious readiness to deploy capital as unpredictable opportunities for investment arise.

Quarterly cash and equivalents (titan-intl.com)

The company’s current market cap is around $948 million while its total value is estimated to be at least double that figure. According to a discounted cash flow calculation by SimpleWallSt, the company’s fair value stands at $2.1 billion. Adjusting for a significant slowdown in future revenue growth and accounting for the company’s profit margins, debt ratio, cash build-up, and cost-cutting strategy, it is safe to conclude that Titan is undervalued.

Conclusion

The company displayed competence in navigating adverse market conditions and turned unforeseeable circumstances into opportunities for growth and streamlining. In a display of fiduciary discipline, Titan has remained politically neutral in favor of shareholder interests – a welcome reassurance that the company’s governance structure is dedicated to the bottom line.

In addition to operating in a growing industry and enjoying relative insulation from major supply chain shocks, Titan has solid financial fundamentals. Moving further into FY22, the company should continue on its trend of growth and profitability. While the surge in growth from FY21 cannot be sustained at the same rate, a slowdown merely represents the normalization of operations in a new environment and should not deter investors from purchasing this undervalued stock as a long-term buy.

Be the first to comment