kynny/iStock via Getty Images

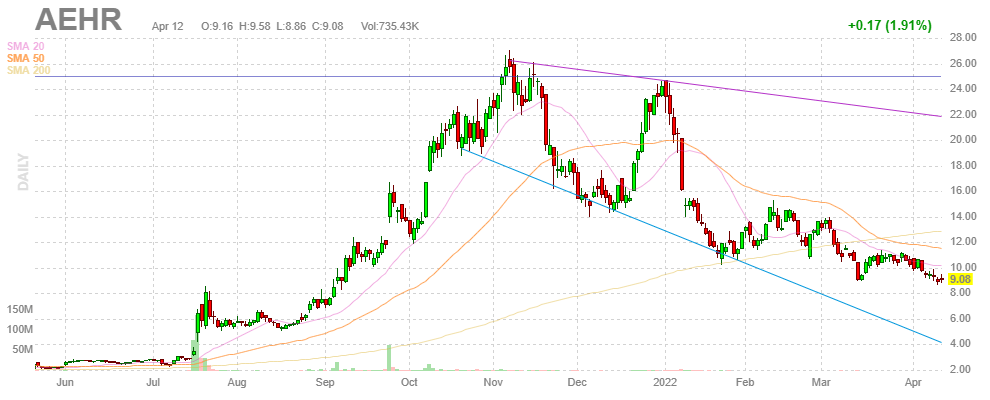

We think that the shares of Aehr Test Systems (NASDAQ:AEHR), which we bought for $2 per share a year and a half ago and then sold some at $17.4, are getting back down to levels where one can start accumulating again, even if timing this market is more art than science.

The company is on a roll on a massive market shift from package testing to more efficient wafer-level testing, most notably in the fast-growing SiC (Silicon Carbide) and SiPh (Silicon Photonics) applications where infant mortality and/or stabilization of key parametric specifications (and hence full stress testing called burn-in) is important. From the Q3CC:

Having devices failed during burn-in at module level, if they’re not burned in at wafer level before being put into the modules is extremely costly and reduces customer overall output capacity. Even a small 1% yield loss can have an 8% yield loss impact on an eight die module. We have seen modules being designed right now with as many as 32 silicon carbide die in them. And it’s very clear to those customers that screening out the failures of the die before they’re put into the module is the only way to go.

The SiC is driven by better power handling in industries like EVs, power conversion and power generation and storage infrastructure, and other power applications. SiPh is driven by 5G, data center infrastructure, and the like with important customers (Q3CC):

If you look at our 10% customers that we have publicly announced due to SEC requirements that includes the likes of Intel, Apple ST, On Semiconductor, TI

The TAM for wafer level testing for the EV market is about $1B and the other segments add another $1B by 2030.

It so happens that the company offers the most comprehensive solution for that, with the FOX-XP system enabling to fully test 18 wafers in parallel, saving time, space, and costs (for more details, see our previous article).

This is why management believes it will take a substantial, if not a predominant market share in these segments.

FinViz

Q3 results

Some notable items:

- Revenue $15.3M (+59% q/q and +190% y/y)

- WaferPak and DiePak revenue of $2.3M (more than doubled the total number shipped in all of the last fiscal year).

- OpEx $4.1M (+9% q/q and +63% y/y) demonstrating great operational leverage.

- Non-GAAP net income was $4.1M ($0.14 EPS) up from a loss of $880K in Q3 2021.

- Bookings $6M.

- Backlog $26.9M at the end of Q3 and rising to $30M+ since.

- Charge of $1M on excess inventory (on legacy, package part burn-in) taking gross margin down to 42% (without it gross margin was 49%).

- The company has been proactive with regard to ordering long-lead time items (>12 months for some ICs for instance) so they have no shortages, but do notice higher prices for parts and shipping (although the latter is coming down, according to management).

- Customers make significant downpayments for system orders.

- Cash and equivalents $32M (down from $35M q/q) and no debt.

- Q4 Guidance $19.5M+ given FY2022 (ending in May 2022) guidance of $50M+ and profitability.

The results are good, but the importance for investors really is the outlook for new clients and orders. Management gave us a number of positive signs on these:

- Four new companies are evaluating FOX-XP machines, including the second of the top four SiC players (another of these is their lead SiC customer).

- Management expects significant additional system and wafer pack purchases from their SiC lead customer over the next several years.

- Management is now even more confident that they will add new customers that will ramp up production by next May.

- Even conversations with customers in their legacy package parts business quickly turned into requests for more information about their wafer testing FOX-XP systems.

From the Q3CC:

This includes another major supplier of silicon carbide devices, who has now committed to an on-wafer benchmark and asked us to put a system on their test floor to demonstrate their capabilities. This is now the second of the top four silicon carbide customers and that’s beyond our current lead silicon carbide considered to be one of the top four to engage with us in what we call on-wafer benchmarking of their actual wafers. We have now made several proposals to customers to place orders to lock in lead times of our FOX systems and wafer packs. And then Aehr will provide on-wafer evaluations and validations for them within the lead time of those systems. In just the last few weeks, we met with multiple companies in both the U.S. and Europe face-to-face and are very encouraged by the positive feedback we received about their forecasts for wafer level burn-in needs and our expectations for winning this capacity with those prospective customers.

While the main driver for growth is undoubtedly the move towards EVs (and related charging infrastructure), there are other sectors in which burn-in testing and/or testing of parametric specifications (the forces that shift the economics in favor of wafer-level testing and hence the FOX-XP) generating demand.

There is of course the SiPh market where the company already has several customers (Q3CC):

Several customers addressing the silicon photonics market have forecast additional FOX system and WaferPaK or DiePak contactor capacity needs from us over the next 12 months.

There are also other sectors that could play a role in the demand for FOX-XP systems and consumables like 3D sensing and LiDARs for automotive ADAS systems. For instance, a current FOX-XP customer ordered proprietary DiePak carriers for a new optical sensor device.

Then there are potentially additional segments where burn-in, like DRAM and microprocessors, don’t look like an immediate market opportunity for Aehr.

Management also provided info about how much consumables (WaferPacks and DiePacks) demand these systems generate. As a FOX-XP system tests 18 wafers at a time they need 18 WaferPacks, which have an average economic life of four years, although the turnover can be higher (Q3CC):

And right now, in silicon carbide, there’s a lot of turnover. People are going to Gen 1, Gen 2, Gen 3, Gen 4 to 150-millimeter, 200-millimeter wafers. And when they do that, they end up with new WaferPaks or probe cards.

Valuation

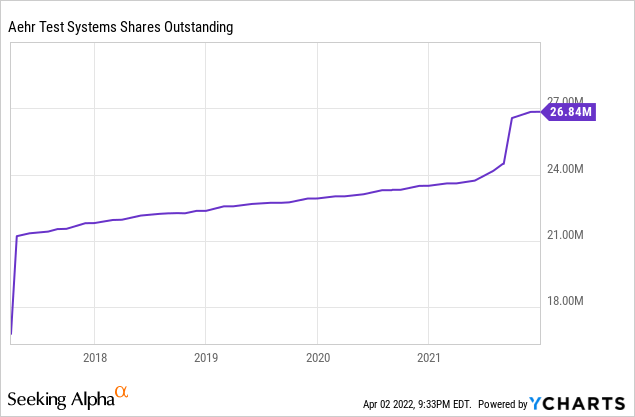

There are another 1.6M shares or so from performance pay so the market capitalization is in the order of $280M and the EV around $250M, meaning the shares are still not cheap trading at 5x EV/S, but FY2023 (which starts in June 2022) will see a significant revenue rise (analysts expect $70.8M but that seems low to us).

On an earnings basis, things look much better, with EPS coming in this year at $0.43 rising to $0.69 next year, producing fairly modest earnings multiples.

Conclusion

We think the shares are attractive here at $10:

- The company is riding several waves, most notably the electrification of transport. It’s benefiting from a shift towards SiC power solutions that suffer from high infant mortality, making burn-in testing compulsory and the economics of FOX-XP is much better not just because it does this on the wafer level, but because it can test 18 wafers in parallel.

- This realization is sinking in widely in the industry and management is increasingly optimistic about landing more customers.

- The increasing installed base of systems generates an increasing stream of demand for consumables.

- The company benefits from considerable operational leverage.

- The company has few if any supply-chain issues, it can scale, and it has a sound balance sheet.

- The shares have given up a lot of their recent gains and are now reasonably priced.

Be the first to comment