Pascal Le Segretain

Investment Thesis: Thomson Reuters could see longer-term upside on the basis of continued revenue growth and a decrease in long-term debt to total assets.

In a previous article back in August, I made the argument that I continued to take a bullish view on Thomson Reuters Corporation (NYSE:TRI) on the basis that the company could see further growth across multiple business segments – including the Legal Professionals segment.

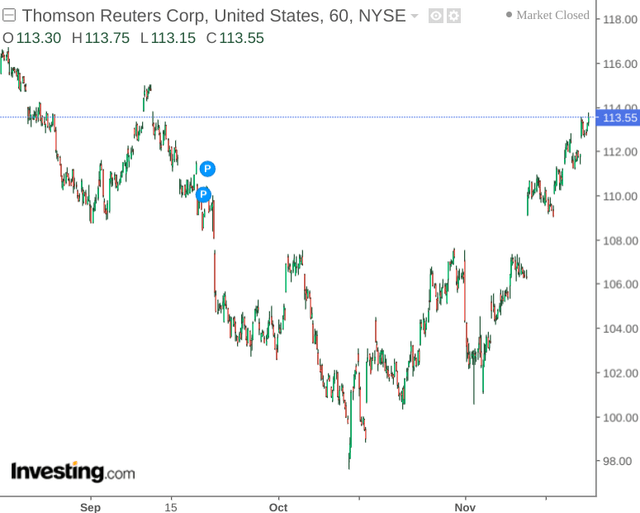

While the stock saw short-term downside in the interim – Thomson Reuters is trading near the same level as that of last August:

The purpose of this article is to assess whether my prior case for Thomson Reuters Corporation upside still holds – particularly taking recent quarterly performance into consideration.

Performance

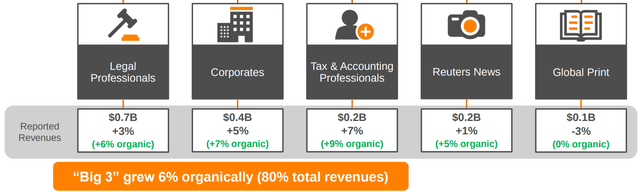

For Q3 2022, we can see that the Tax & Accounting Professionals segment saw the most growth on a percentage basis – up by 9% on an organic basis. The largest segment, Legal Professionals, saw growth of 6% on an organic basis:

Thomson Reuters: Third Quarter 2022 Highlights

In particular, the company’s Legal Professionals segment got a significant boost from the launch of Westlaw Precision in mid-September, which is a legal research tool that aims to make searching of legal topics for professionals in the industry more efficient.

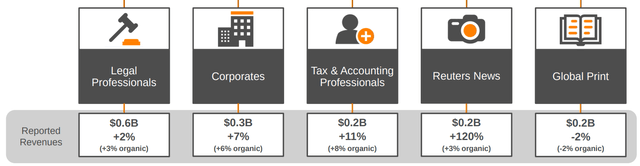

Additionally, it is also interesting to note that when compared to Q3 2019 revenue growth – all segments with the exception of Reuters News saw lower organic growth as compared to the present:

Thomson Reuters: Third Quarter 2019 Highlights

From this standpoint, performance across the company’s business segments continues to remain strong and has not shown signs of plateauing as compared to 2019.

From a balance sheet perspective, we can see that the company’s quick ratio has decreased from 1.43 in September 2019 to 0.54 in September 2022.

| Sep 2019 | Sep 2022 | |

| Cash and cash equivalents | 1,147 | 459 |

| Trade and other receivables | 1,112 | 949 |

| Prepaid expenses and other current assets | 554 | 429 |

| Current liabilities | 1,970 | 3,420 |

| Quick ratio | 1.43 | 0.54 |

Source: Figures sourced from Thomson Reuters Q3 2019 and Q3 2022 Financial Results and provided in millions of U.S. dollars, except the quick ratio. Quick ratio calculated by author (cash and cash equivalents plus trade and other receivables plus prepaid expenses and other current assets all over current liabilities).

Given that the quick ratio has fallen below 1, this means that Thomson Reuters is less able to meet its current liabilities with its existing liquid assets. While revenue growth has been encouraging – this has yet to translate to growth in cash flow as the company has had to invest existing cash reserves into funding new initiatives across its business segments. As a case in point, the company will spend $500 million in cash to acquire SurePrep, a tax automation software company, which is expected to yield $60 million in revenue this year as well as growth in excess of 20% per year over the next few years.

With that being said, we can also see that the company’s long-term debt to total assets has decreased slightly since 2019 – indicating that the company has not had to increase its long-term debt load relative to assets to fund new initiatives:

| Sep 2019 | Sep 2022 | |

| Long-term indebtedness | 3,229 | 3,700 |

| Total assets | 15,984 | 21,162 |

| Long-term debt to total assets ratio | 0.20 | 0.17 |

Source: Thomson Reuters Q3 2019 and Q3 2022 Financial Results and provided in millions of U.S. dollars, except the long-term debt to total assets ratio. Long-term debt to total assets ratio calculated by author.

Looking Forward

Going forward, Thomson Reuters has clearly been continuing to see revenue growth across its business segments, and I see little risk to that growth in the short to medium-term.

As we have seen, the company has seen a significant decrease in cash and cash equivalents as Thomson Reuters has continued to fund new initiatives across its business segments.

However, I take the view that should long-term debt to total assets continue to decrease – then investors are likely to continue to reward revenue growth in the short to medium-term.

Conclusion

To conclude, Thomson Reuters has seen significant revenue growth, and notwithstanding the drop in the quick ratio since 2019 – the company’s long-term balance sheet still seems to be solid.

In this regard, I take the view that Thomson Reuters has the potential to see a further recovery from here.

Be the first to comment