chaofann

The stock market is down heavily over the past few weeks.

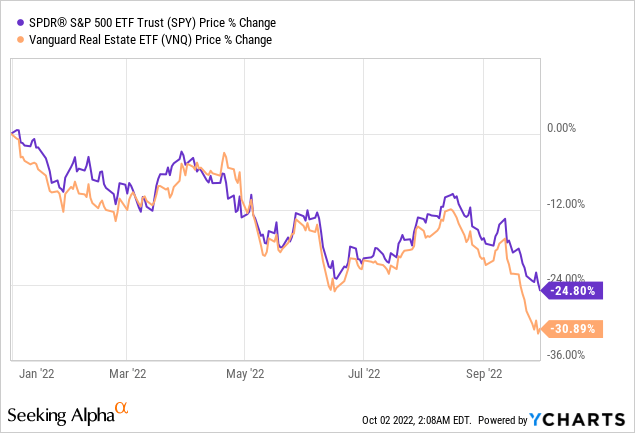

The S&P500 (SPY) has officially dipped into a bear market, down 25% year-to-date, and I am down even more than that since I am mainly invested in REITs, which are down over 30%:

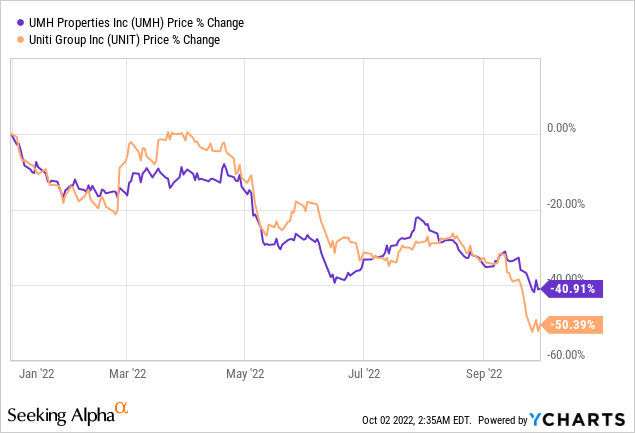

I invest mainly in smaller and lesser-known REITs which in some cases have dropped closer to 40 or even 50%. Some good examples include UMH Properties (UMH) and Uniti Group (UNIT):

Some of you would probably lose sleep over this, but I am genuinely happy about it. In fact, as I write this article, it made me smile just thinking about it.

How could this be?

Believe me, I am not a masochist. I just like seeing prices come down when my investment theses remain intact because it only means that my future gains will be even greater as I accumulate larger positions at opportunistic prices.

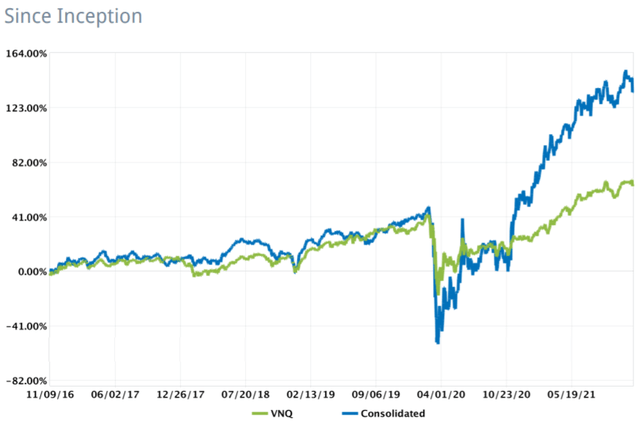

The last time I went through a comparable sell-off was in early 2020 when the market crashed due to the pandemic and here are the results of my REIT portfolio in the following year:

The crash was painful at first, but I am so glad that it happened because the extreme market volatility led to some historic buying opportunities.

The market is the least efficient when it is volatile and so not surprisingly, this is also when active investing is the most rewarding.

To give you an example: STORE Capital (STOR) dropped as low as $15 per share in early 2020, which was a small fraction of its fair value. We built a large position at High Yield Landlord and recently, it was bought out at $32.25 per share.

The point here is that market sell-offs are typically a case of short-term pain for long-term gain, and if you have a long time horizon, you should be glad to see prices come down.

Such sell-offs lead to extreme mispricings because most investors are short-term-oriented and quick to panic.

Today, the market is dropping because it is worried about rising interest rates, high inflation, and a near-term recession. It may feel as if we have never experienced anything like it in the past. Many investors are already claiming that “this time is different” (the four most expensive words of an investor!) and that you should sell because the market is only heading lower.

Yet, in reality, that’s just their emotions talking for them. You cannot know what stocks will do tomorrow, next week, next month, or even next year because timing the market simply isn’t possible. The big players who dedicate their lives to trying to time the market based on macro themes cannot do it and significantly underperform the market, so can you really expect to do better than them?

There are two kinds of forecasters: those who don’t know, and those who don’t know they don’t know. – John Kenneth Galbraith

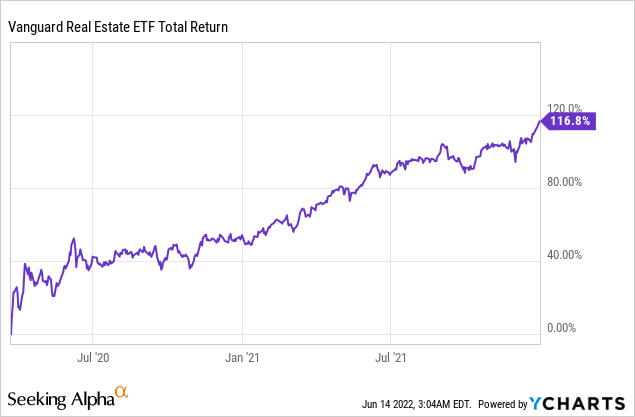

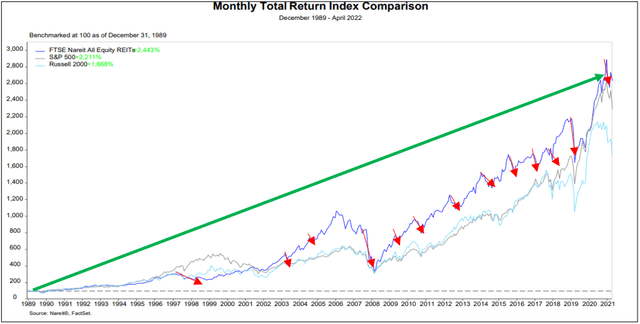

But what we know based on history is that the market always eventually recovers, regardless of the severity of the crisis. In the 20th century, the United States went through two world wars and other traumatic military conflicts, the depression, many recessions and financial crises, a flu epidemic, the resignation of a president, a global pandemic, and greater inflation than today. Yet, the Dow still rose from 66 to over 30,000, and REITs have done even better in the modern REIT area:

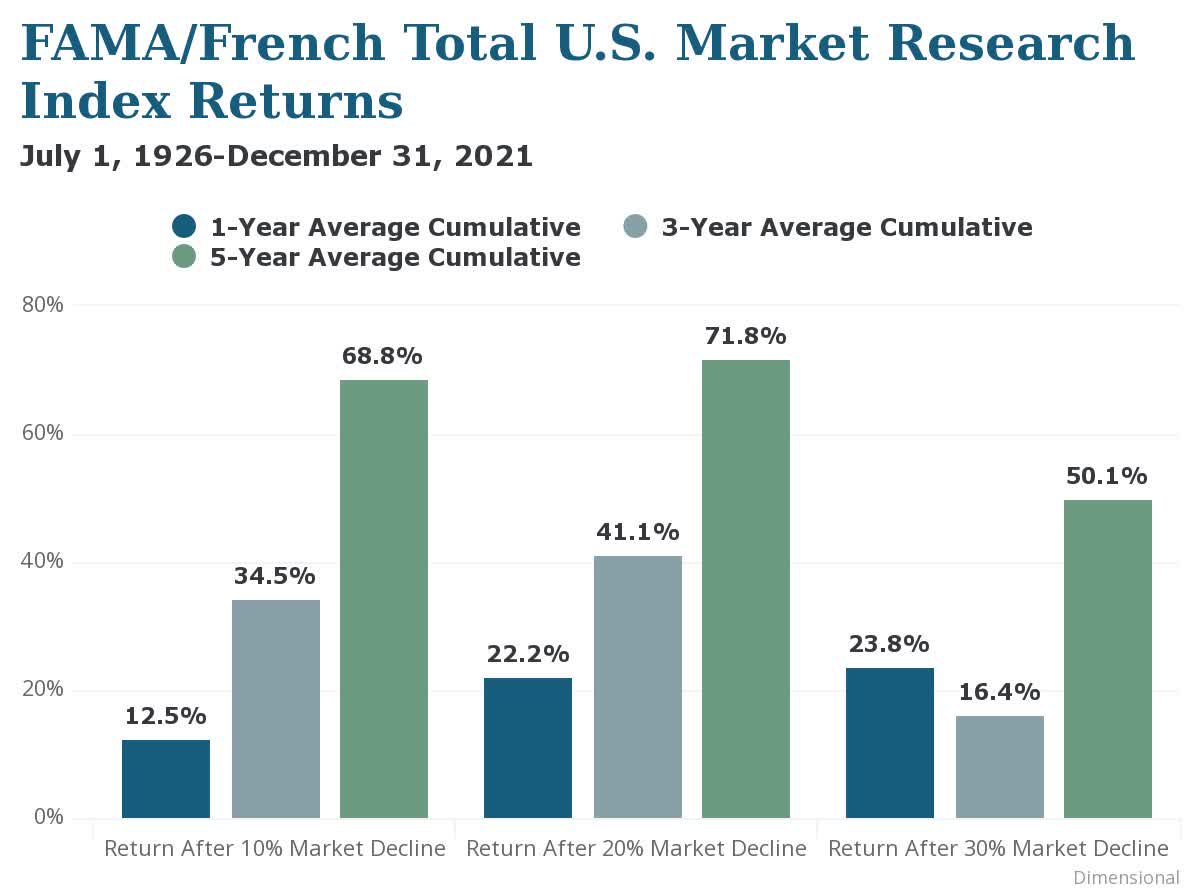

So there is a 100% chance of an eventual recovery based on history, and beyond that, the returns have typically been abnormally high in the periods following a crash. The average cumulative return over the next 3 years after a 20% drop has historically been 41%, and over a 5-year period, it has been 71%:

Dimensional

So to recap:

- You cannot time the market.

- But the market always eventually recovers.

- And the returns are typically above average in the periods following a crash.

Based on that, would you rather be a buyer or seller today?

I think that the answer is simple: you want to be a buyer. Valuations are historically low after the recent sell-off, and while some near-term pain is expected, it is very likely that the returns will now be above average in the coming years.

“But This Time is Different!”

Interest rates a rising, inflation is high, and we will likely face a recession in the near term.

But so what? This is nothing that we haven’t seen in the past. As we noted earlier, we have faced far worse crises in the past and always made it to the other side.

Sure, we might face some pain in the next 1-2 years, but does that really justify a 30, 40, or even 50% crash?

In most cases, it doesn’t. Businesses and real estate should be valued based on decades of expected future cash flow and therefore, the impact of one or two years of disappointing results should be small on the long-term fair value of a company.

Yet, investors always still repeat the same mistake. They panic when uncertainty gets high, sell their stocks, and try to time a bottom, claiming that stocks will go lower, when in reality, it is impossible to make such predictions.

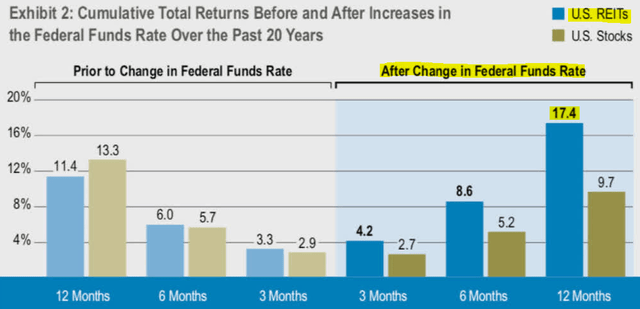

Today, I see many make the claim that interest rates will rise further and therefore, you should stay out of the market. But they appear to ignore the very basic fact that the market is a forward-looking machine and therefore, this consensus view is already likely priced in. If it was really that simple to predict the market, we would all be billionaires, and yet, here we are. REITs have historically actually risen more often than not following interest rate hikes:

Does this mean that everything is worth buying?

Of course not. Some stocks were overpriced prior to the sell-off. Tech stocks (QQQ) like DocuSign (DOCU) and PayPal (PYPL) are good examples of that. Other stocks are highly cyclical and some are heavily leveraged.

But REITs are a different story.

They were very reasonably valued prior to the sell-off, and yet, they dropped a lot more than the rest of the market.

They are not materially affected by the rising rates because their balance sheets are the strongest in history with low leverage (35% LTV on average) and long maturities (8 years on average).

Their cash flow is largely protected by long-term leases that provide steady income even during recessions.

And inflation benefits REITs as it results in growing rents and higher property values, even as their debt is inflated away.

Despite that, the REIT sector sold off particularly hard and as a result, a lot of REITs are now priced at exceptionally low valuations that remind us of early 2020. That’s the last time this occurred, and REITs then proceeded to more than double our money in the following year.

YCHARTS

So this is why I am smiling.

I know that the fair value of most of my holdings has not changed materially and their long-term prospects are more or less the same.

But they are now priced at bargain valuations, which will allow me to earn exceptional returns in the coming years as valuations return to normal. As Bruce Flatt recently said:

Every crisis we have is always the worst crisis we’ve ever had. If you a long-term plan, these things come and go. You can capitalize on these situations. – Bruce Flatt, CEO of Brookfield (BAM)

If you missed the buying opportunities of early 2020, you are today essentially given a second chance. Don’t make the mistake of thinking that you can time a bottom and miss these opportunities.

Be the first to comment