ThitareeSarmkasat/iStock via Getty Images

Co-produced by Austin Rogers for High Yield Investor

Whenever an investor hears the phrase “high yield,” whether applied to equity or debt, they should tread carefully. That is because relatively high yields signify the market’s perception of elevated risk.

At the same time, high-yield stocks, as well as high-yield bonds, represent not only risk but also opportunity. The markets are never perfectly efficient, and that creates the conditions for mispricing, either to the upside or the downside.

Many high-yield stocks deserve their low valuations and high yields due to weak balance sheets, poor track records, or misaligned interests between management and shareholders. That is why investors should be cautious with these companies. The last thing an investor wants is to invest in a high-yield stock only to see the dividend cut and the stock price tumble.

One must always keep in mind that, rightly or wrongly, there are always some reasons why the market is valuing high-yield securities cheaply. They are not all temporarily misunderstood, high upside stocks that will make brave value-seeking investors fabulously rich.

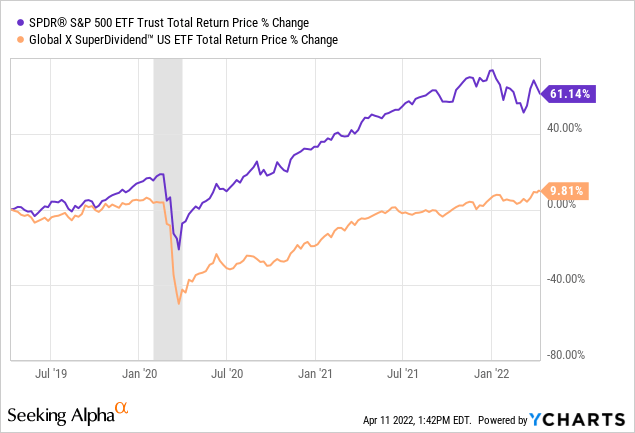

Hence why the high-yielding stocks in the Global X Super Dividend U.S. ETF (DIV) have performed so poorly as a group against the S&P 500 (SPY):

High yielding stocks are cheap (YCharts)

It takes both skill and vigilant monitoring of holdings to manage any high-yield portfolio well. Selectivity is crucial. This is how we at High Yield Investor have managed to significantly outperform high-yield equity index funds since inception.

In what follows, we highlight two interesting high-yield stock ideas that could be good buys right now.

1. AT&T Inc. (T)

Telecommunications giant AT&T has just completed a dramatic simplification of its business by separating the media and entertainment segment by combining its WarnerMedia division with Discovery to form the new Warner Bros. Discovery (WBD).

The newly created media giant owns a variety of scripted, news, and reality TV channels and streaming platforms including HBO Max, CNN, HGTV, TNT, the Travel Channel, and discovery+. It also owns the vast content library and cinema pipeline of Warner Bros., New Line Cinema, and HBO.

But WBD is not going to pay a dividend for the foreseeable future, which is why many legacy AT&T shareholders, many of whom held AT&T shares because of its generous dividend, immediately sold their WBD shares on Monday, April 11th. As of late afternoon on Monday, WBD was down ~2.5%.

Where does that leave AT&T? Well, it leaves AT&T as what most people know it for: a pure-play telecommunications company, very similar to telecom peer Verizon (VZ). Now, AT&T will be able to focus solely on investing for the future of communications, rather than having focus and investment dollars split between telecom infrastructure upgrades and content creation at WarnerMedia. This way, AT&T will be able to compete more effectively against VZ.

Here’s what AT&T CEO John Stankey had to say in an April 11th press release about the company going forward:

“With the close of this transaction, we expect to invest at record levels in our growth areas of 5G and fiber, where we have strong momentum, while we work to become America’s best broadband company. At the same time, we’ll sharpen our focus on returns to shareholders. We expect to invest for growth, strengthen our balance sheet and reduce our debt, all while continuing to pay an attractive dividend that puts us among the top dividend-paying stocks in America.”

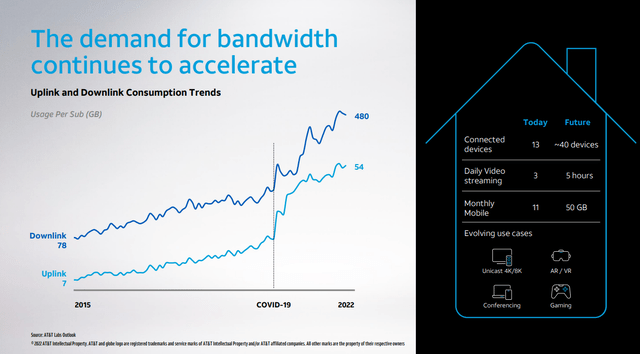

COVID-19 meaningfully accelerated the growth in consumer demand for data due to more time streaming movies, more videoconferencing, more online video gaming, and more Internet-connected devices in the home.

The demand for bandwidth is accelerating (AT&T)

That trend is likely to continue, giving AT&T plenty of opportunities to increase revenue from its growing customer base. In 2021, AT&T captured 34% of net postpaid phone net additions, a leading position among peers. Likewise, AT&T is also taking market share in the realm of fiber, increasing its share from 23% in 2018 to 37% in 2021.

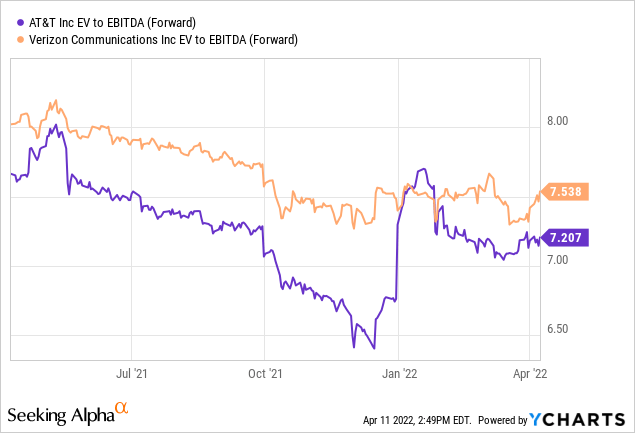

Compared to VZ’s dividend yield of 4.75%, AT&T’s dividend yield based on its rebased annualized dividend of $1.11 is nearly a full point higher: ~5.7%.

AT&T is undervalued relative to peers (YCharts)

And AT&T is also a free cash flow machine. Compared to pro forma (excluding WarnerMedia) AT&T free cash flow of $19.2 billion in 2021, management has guided for around $16 billion in FCF in 2022 due to temporarily high capital investment, then $20 billion in FCF in 2023.

This steady flow of free cash from the business will help AT&T deleverage in the coming years while continuing to pay and, likely, incrementally grow its dividend.

Between the 5.7% dividend yield, low- to mid-single-digit earnings growth, and valuation upside, buyers at today’s price can expect total returns of 10-12% or more from this simplified telecommunications giant.

2. B. Riley Financial (RILY)

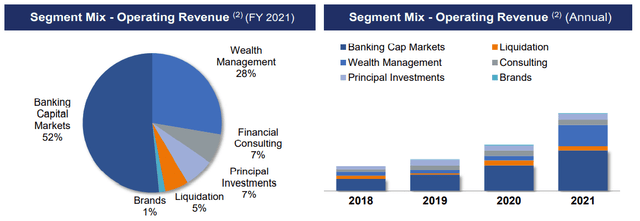

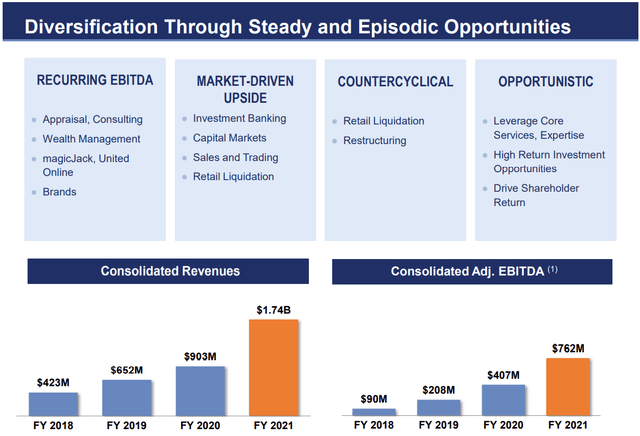

RILY is a diversified financial services firm that derives income from six distinct segments:

- Capital Markets (89% of 2021 operating income)

- Principal Investments (3.6% of operating income)

- Financial Consulting (2.2% of operating income)

- Wealth Management (2.1% of operating income)

- Consumer Brands (1.9% of operating income)

- Auction & Liquidation (1.1% of operating income)

B. Riley Financial business mix (B. Riley Financial )

Most of RILY’s business comes from financial advisory services, investment banking, and public stock analysis, primarily for small cap names.

Particularly attractive about RILY is the company’s mix of segments, some of which provide pro-cyclical income boosts and others of which provide anti-cyclical income boosts. For instance, during strong bull markets, companies engage more heavily in RILY’s advisory services for capital raising. But during recessions, when retailers are going out of business, RILY’s auction & liquidation services are more utilized.

B. Riley Financial business mix (B. Riley Financial )

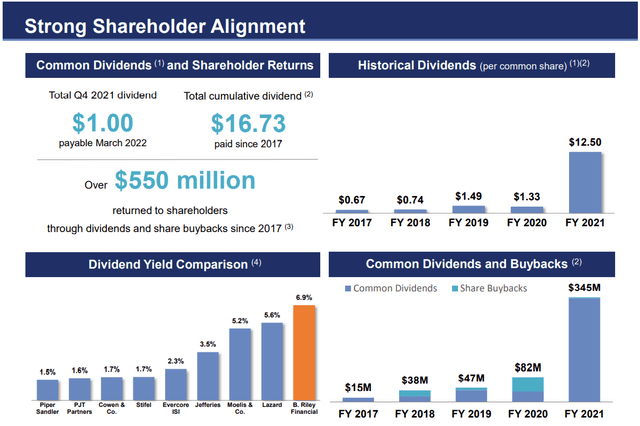

RILY has also displayed an attractive orientation toward shareholder rewards as it has ramped up growth. Over $550 million has been returned to shareholders since 2017, with most of that in the form of dividends.

B. Riley Financial strong shareholder alignment (B. Riley Financial)

But as you can see in the bottom right box, RILY utilizes a smart buyback strategy in which it deploys cash into share buybacks tactically when the stock price is depressed. When the stock price is higher, the company prefers dividends. This is the kind of buyback activity that is ultimately conducive to higher earnings per share and dividends in the future.

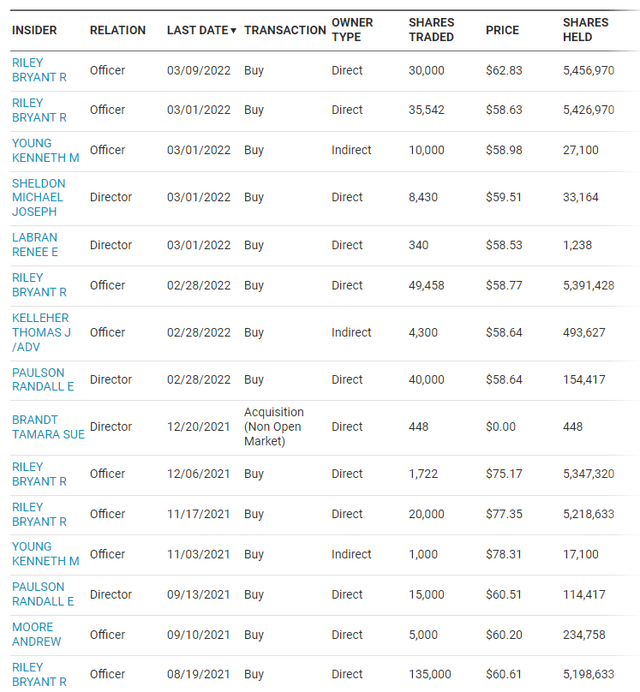

The company is led by founder and co-CEO Bryant Riley, who has purchased hundreds of thousands of shares over the last few years. In recent months, he has purchased tens of thousands of shares at or above the current share price.

B. Riley Financial insider purchases (B. Riley Financial)

Riley now owns a little over $320 million of RILY common stock, which makes him heavily incentivized to act in shareholders’ best interests. Perhaps this is why RILY has been so generous with the dividend and judicious with buybacks.

RILY pays an annualized dividend of $4, which management believes it will be able to maintain going forward. That gives the stock a dividend yield of 6.9%. While it is difficult to forecast growth rates for a diversified company like RILY, this fast-growing company seems like to continue producing double-digit total returns well into the future.

Bottom Line

One should never invest in any stock, especially high-yielding ones, on a whim or after a brief mention on CNBC. One’s initial reaction to a high yield ought to be like seeing a yellow “Caution” sign. It should cause one to slow down, investigate, and tread carefully.

High-yield investing will punish those who don’t do their due diligence.

That said, for those willing to dig in, do some research, and sift through the haystack in search of the proverbial needle, there are attractive high-yield stocks to be found. We at High Yield Investor spend countless hours doing just that.

AT&T and RILY are two interesting prospects worthy of further research for investors interested in high-yield, high-upside stocks.

Be the first to comment