Motortion/iStock via Getty Images

Investment Overview

TherapeuticsMD (NASDAQ:TXMD), a women’s health specialist company based in Boca Raton, Fla., appears to be a troubled company that is loss making, and has mounting debts. In spite of this, shareholders recently opted against agreeing to a $10 per share buyout offer from Athene Merger Inc. – a subsidiary of the Venture Capital firm EW Healthcare Partners – to acquire the company and take it private.

That seems like a surprising choice given that TherapeuticsMD stock traded at just over $2 per share immediately prior to the offer being made, meaning the buyout deal would have been at a near 400% premium to traded price.

Perhaps investors felt confident that the company could recapture former share price highs of $22 – the price the stock traded at in late March this year, or $38, its price in November 2021, or even its July 2020 price of >$100.

These prices are misleading however since TherapeuticsMD completed a 1-for-50 reverse stock split in May – the stock did not trade at the above prices, but it did trade at a price 50x higher than its low of $2. Current traded price is $5.5, and there are ~9.5m shares outstanding.

Were shareholders right to refuse the deal, and what are the chances MDTherapeutics can turn its current situation around?

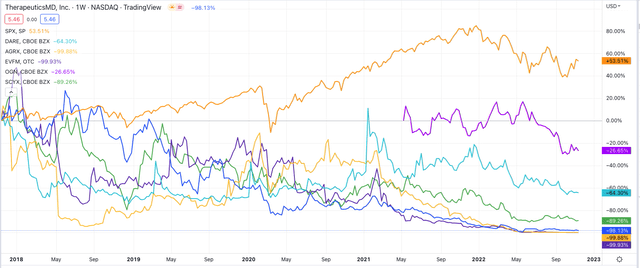

Women’s health appears to be a difficult sector in which to succeed, based on the performance of listed companies operating in this space.

Performance of listed Women’s Health specialists – past 5 years (TradingView)

Dare Biosciences (DARE), for example – established to address the lack of innovation in women’s health – has seen its share price fall in value by 64% over the past five years. Agile Therapeutics (AGRX) – developer of the Twirla contraception patch – currently trades at $0.22. Evofem (OTCQB:EVFM) – developer of the hormone-free vaginal gel Phexxi, trades at a price of $0.08. Scynexis – developer of antibiotics to treat vaginal infections – has seen its stock price fall by 71% across the past year, and the share price of new entity Organon – a spinout of Pharma giant Merck’s (MRK) women’s health, legacy brands and biosimilars division – is down 27%. Meanwhile, in 2020, Nasdaq listed AMAG Pharmaceuticals was taken private by Apollo Global after seeing its stock fall from $70, to >$10, over a five-year period.

I have no explanation for why women’s health specialists have not been able to capitalise on a significant market and area of unmet need – even AbbVie’s once substantial women’s health division is no longer even included in the company’s financial reporting – but it underline the risk that TherapeuticsMD shareholders seem to be taking by pinning their hopes on a turnaround.

How Did TherapeuticsMD Wind Up Here?

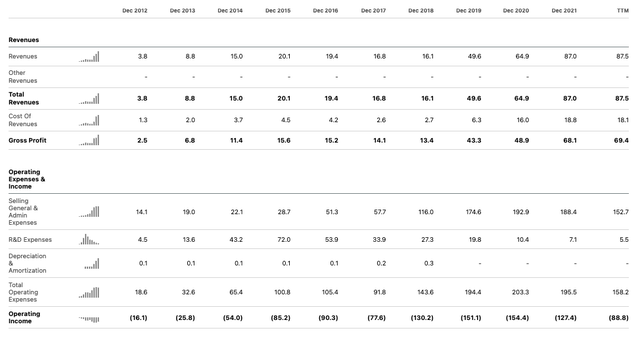

To answer that question the first place to look is probably at the company’s financials.

TherapeuticsMD financials (Seeking Alpha)

As we can see above the company has successfully grown its revenues from just $3.8m in 2012, to $87m in 2021, taking in an uplisting to the Nasdaq in 2017. The growth could be considered impressive were it not for the losses incurred in every year, and especially since the Nasdaq listing. By my calculation, TherapeuticsMD lost $641m in five years between 2017 and 2021. According to its Q322 10Q submission, its accumulated deficit now stands at >$1bn.

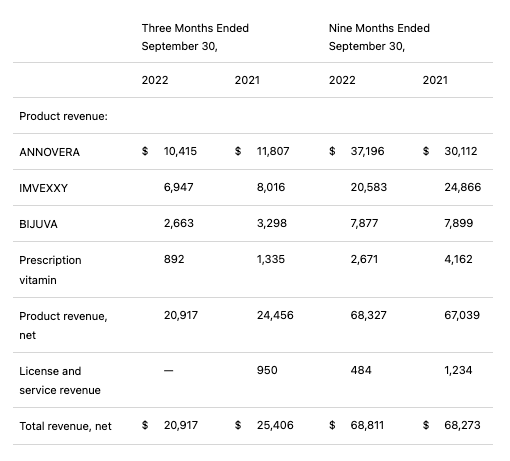

TherapeuticsMD Product sales Q3 2022 (TherapeuticsMD press release)

As we can see above TherapeuticsMD sells four different products. Annovera is a one-year, ring-shaped, contraceptive vaginal system (“CVS”), Imvexxy is a vaginal insert indicated for treatment of moderate-to-severe dyspareunia, Bijuva a hormone therapy combination of estradiol and progesterone, and the vitamins are sold under the brand name BocaGreenMD Prena1.

Together these products have earned revenues of $68.8m across the first three quarters of 2022 – nearly the same as in the prior year period – and TherapeuticsMD has narrowed its losses – from ($104m) for the 9m period in 2021, to ($66m) this year. Thanks to the sale of its VitaCare prescription filling technology platform to GoodRx in March, for the sum of $143m, the company has reported net income of $34m for the 9m to September 2022.

Financial Woes Ongoing After Takeover Rejected

With that said, TherapeuticsMD reported total current assets of $87.5m as of Q322, with cash of just $27m, and current liabilities of $174m, including $93.6m of near-term debt. The numbers make for uncomfortable reading given the net loss in Q322 was $29m.

Management did manage to raise $7m from Rubric Capital Management during the quarter. That’s surely not enough to keep the business afloat, although in its press release the company stated that:

Our Board of Directors and management team continue to actively assess strategic alternatives to strengthen the Company’s long-term financial position.

TherapeuticsMD’s CEO Hugh O’Dowd left the company in September this year, having only been appointed in August 2021 with Dr. Brian Bernick, the company’s co-founder and Chief Scientific Officer, and Mark Glickman, Chief Business Officer stepping into interim co-Chief Executive roles.

Before he departed O’Dowd must have believed that the EW takeover would complete. The offer was unanimously accepted by the Board of Directors and O’Dowd commented in a press release:

We are very pleased to enter into this agreement with EW Healthcare Partners. Together, we will continue empowering women of all ages through a therapeutic focus in family planning, reproductive health, and menopause management. We have a deep appreciation for EW Healthcare Partners’s depth of expertise and track record and know they will bring an incredible value of knowledge and strategic guidance.

The deal valued TherapeuticsMD at $177m – 3.4x its current market cap valuation of $52m (at the time of writing), but despite extending the tender offer period, only 30% of shares were tendered, which fell short of the required amount, and the merger was terminated.

What Happens Now?

The simple equation is that TherapeuticsMD products earned $21m of revenues in Q322, while the company spent $19.1m on selling and marketing, $17.6m on general and administrative costs, and $1.1m on R&D. These numbers do not add up to a successful business, and with revenues falling by nearly $4m year-on-year, it’s not possible to make the case for organic growth.

With debt obligations to meet and not enough cash to meet them, there’s seemingly no chance that TherapeuticsMD can buy its way out of trouble, and without profitability the best it can do is attempt to lose money less quickly.

As the situation becomes more desperate it’s hard to imagine another venture capital or private equity company making a better offer than EW did, and if TherapeuticsMD files for bankruptcy, then shareholders are unlikely to receive anything back from their investment.

Perhaps there’s some hope in the fact that the female contraceptives market is estimated to be worth ~$8.7bn by 2027, having been valued at $6.3bn in 2017? That may be so, but with the likes of Organon (OGN) – which has billions to spend on R&D and is prioritizing women’s health – and AbbVie (ABBV) as rivals, it’s hard to see how TherapeuticsMD can innovate on a ~$1 – $2m per annum R&D budget.

Perhaps Organon could be persuaded to purchase Annovera, Imvexxy, or Bijuva, but that would leave TherapeuticsMD with nothing to sell.

Rubric To The Rescue?

One angle that may be worth considering is the ability of TherapeuticsMD creditor Rubric Capital Management, which has built a sizable stake in the company – calculated to be >18% by MarketBeat – and has a member of its staff – Justin H. Roberts – on the Board of Directors – to source a better buyout deal for the company.

Another angle is a complete restructuring of the business that would presumably involve wide-scale staff layoffs. This was in fact discussed on the Q222 earnings call in response to an analysts question – with the former CEO commenting:

I just wish to acknowledge that our employees have really been fighting through a very fair amount of ambiguity given that we had a number of key events occur in the quarter inclusive of the tender process. So I think it’s just clear to acknowledge that reality. Having said that, I think we remain confident in our team.

Perhaps it is possible that TherapeuticsMD could attempt to switch to a “nonpersonal digital model” as another distressed company I recently wrote about, Assertio Holdings (ASRT), has done, with some success. After all, MDTherapeutics’ products do sell in reasonably large volumes – the problem has always been cost of sales.

Conclusion – Who’s Hand Will End Up On The Tiller?

By refusing to tender their shares to EW Healthcare for $10 each, it’s clear that TherapeuticsMD shareholders at least have confidence that the company can complete an unlikely turnaround, even if management does not.

Perhaps the fact that the company’s co-founder is leading it once again on an interim basis means that there will be a greater will to keep the company going as opposed to selling, but with that said, perhaps Rubric is propping the company up with capital while they attempt to find a buyer.

As such, the future of TherapeuticsMD may be determined by whoever has their hand on the tiller, i.e. has the most influence. Retail shareholders seem to believe the company’s assets are strong enough to drive growth, narrow losses, and one day drive profitability.

Past management saw a sale as the only way to stave off bankruptcy, but present management may be more hopeful of success. Institutional owners may be frustrated the EW deal did not go through or hopeful of a more lucrative sale.

A cold assessment of the history of the company, its financials, its share price performance, and its market suggests that any investor other than a contrarian would be very unwise to buy TherapeuticsMD shares, and that the decision not to accept the EW deal could prove a costly one. By the time TherapeuticsMD comes to report its next set of earnings, a best guess may be that the business will either have been sold, or be bankrupt.

Be the first to comment