PonyWang/E+ via Getty Images

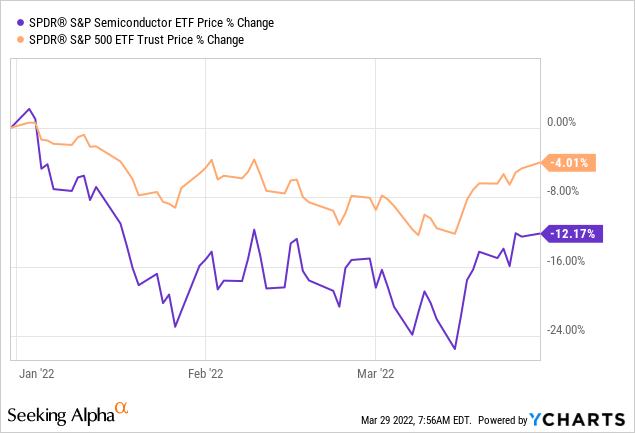

No doubt about it, semiconductor stocks have had a tough start to 2021 and have under-performed the broad S&P500. The narrative appears to be that higher interest rates will inordinately impact the technology sector. However, there is still a global semiconductor shortage and that doesn’t look to be satisfied anytime soon give strong growth in multiple technology sub-sectors. As a result, well-diversified investors who have yet to allocate capital to semiconductors should consider the sector’s recent pull-back as an opportunity to open a starter position and/or add to an existing position. Today I’ll take a closer look at the SPDR S&P Semiconductor ETF (NYSEARCA:XSD), which is down 12% YTD and has significantly under-performed the broad S&P500 as measured by the (SPY) ETF:

Investment Thesis

As most of my followers know, I have been bullish on the semiconductor companies for years due to strong demand across multiple sub-sectors. These include high-speed networking, cloud computing, data centers, the 5G smartphone/mobile and infrastructure build-out, the internet of things (“IoT”), and rising chip-content per vehicle in the fast growing EV space. Indeed, most investors know that all this strong demand for semis, boosted by covid-19’s impact on the market (work-from-home, mobility, supply-chain issues, shutdowns, etc.) has led to a global semiconductor shortage. Indeed, the shortage has been so bad it led to production cuts across the automotive industry: Ford, Toyota, Nissan, and VW are among those that have reduced output. However, it’s not just the carmakers that are having trouble obtaining adequate supply – widespread shortages have been reported across the technology sector and most analysts expect the scarcity issue to last through 2022. That means continued strong profits for semiconductor companies.

Now let’s take a closer look at the XSD ETF to see how it has positioned investors for success.

Top-10 Holdings

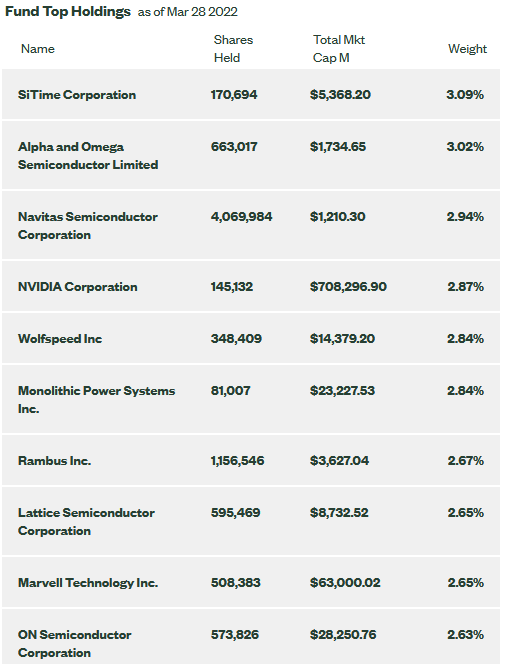

The top-10 holdings in the State Street Global Advisors SPDR S&P Semiconductor ETF are shown below and equate to what I consider to be a well-diversified allocation among the 40-company portfolio:

XSD ETF Top-10 Holdings (State Street Global Advisors)

Right off the bat, seasoned tech investors may be surprised by the portfolio and ask where are some of the typical leading companies like Taiwan Semiconductor, AMD, Qualcomm, and Broadcom? It’s a good question and highlights the fact that the XSD ETF is very differentiated as compared to most semiconductor ETFs and certainly focused on some of the smaller and lessor companies within the sector.

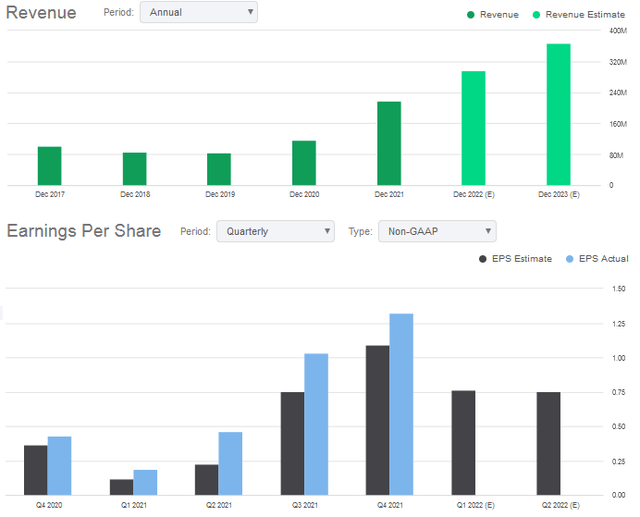

In fact, I would bet that many readers have not even heard of the #1 holding: SiTime Corporation (SITM). SiTime is headquartered in Santa Clara, California and focuses on designing timing systems like resonators, oscillators, and integrated clock circuits. The company is up 157% over the past year while demonstrating strong revenue & earnings growth:

SITM Revenue & Earnings Growth (Seeking Alpha)

The #4 holding with a 2.9% weight is more well-known Nvidia (NVDA), a leading provider of graphics and computing chips. Nvidia has become a leader in AI and recently unveiled a bevy of new products, including its new Hopper H100 GPU architecture – the company’s next generation computing platform. The H100, which has 80 billion transistors, is based on TSMC’s (TSM) high-performance 4 nanometer process. Nvidia CEO Huang said twenty H100’s could handle the entire world’s internet traffic.

Evercore ISI analyst C.J. Muse recently said that Nvidia is the most important tech company on the planet and has a price target of $375. Nvidia closed Monday at $282.

The #9 holding is Marvell Technology (MRVL) with a 2.7% weight. Marvel is the “M” in the new “MANGO” group of semiconductor stocks. MANGO is an acronym created by BofA Securities analyst Vivek Arya and also includes AMD (AMD), Analog Devices (ADI), Broadcom (AVGO), Nvidia, GLOBALFOUNDRIES (GFS), and ON Semiconductor (ON). Arya says:

The structural importance of semis to the rapidly digitizing global economy cannot be overstated.

Arya created MANGO because he prefers semi-companies that operate in the right markets (AI, cloud computing, EVs, enterprise and telecom markets) and that have solid demand visibility. I agree with that assessment, which is one reason I own Broadcom. Broadcom arguably has the best high-speed networking development platform (both hardware and software) on the planet and is always one step ahead of the competition.

The “O” in MANGO stands for ON Semiconductor, which is up 40%+ just since my initial Seeking Alpha BUY recommendation in October of last year (see EVs Are A Primary Growth Catalyst For ON Semi). ON manufacturers relatively low technology sensors and power solutions (think fast-chargers for EVs) among other analog, discrete, module, and integrated semiconductor solutions. While these solutions may be “low-tech”, ON is generating strong and growing profit margins.

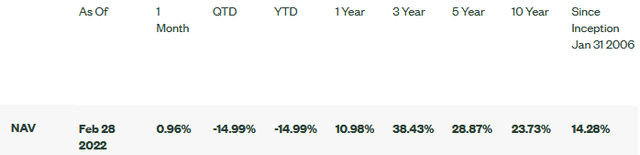

Performance

The XSD ETF has established an excellent long-term track record with an average annual return of 23.7% over the past 10 years:

XSD ETF Performance Record (State Street Global Advisors)

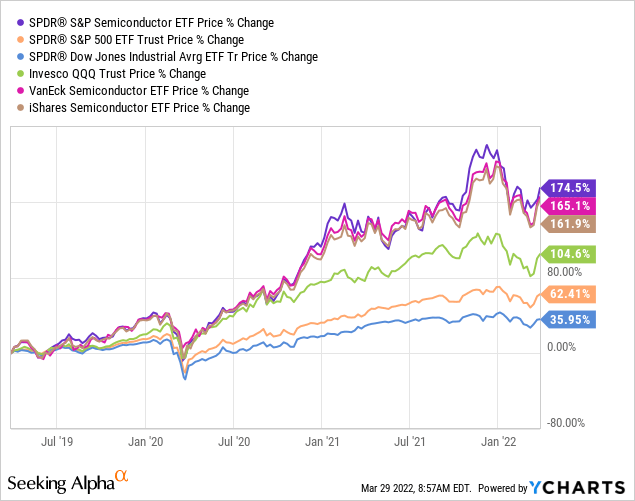

The graphic below compares XSD’s three-year performance against the major market averages of the S&P500, DJIA, and Nasdaq-100 (as represented by the (SPY), (DIA), and (QQQ) ETFs, respectively) as well as some direct competitors in the semiconductor space like the Van Eck Semiconductor ETF (SMH) and the iShares Semiconductor ETF (SOXX):

As can be seen, the semiconductor ETFs have significantly outperformed the broad market average. XSD actually leads the pack over this time frame, and has outperformed my favorite pick in the sector, the SMH ETF, by nearly 10%. However, if I am going to be in semiconductors, I want to own the world’s leading technology – and that is TSMC (it is the top-holding in SMH with a 10% weight). I also like SMH better because I want exposure to the semiconductor equipment makers going forward due to announcements by multiple companies (like TSMC and Intel) for massive capacity expansion programs.

Risks

The common standard market risks all apply to the XSD ETF: covid-19 impacted supply chains and potential factory shut-downs, a higher interest rate environment going forward, and massive geopolitical risks as a result of Putin’s invasion in Ukraine – just to name a few.

In addition, any potential shortages and/or significant price increases for lithium-based batteries could negatively the EV market for which some of the companies held in the XSD ETF rely on for growth.

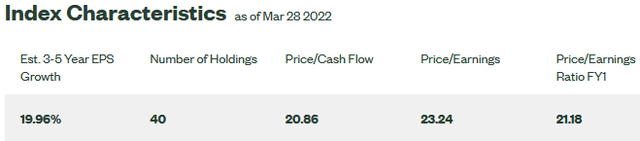

From a valuation perspective, investors might be surprised that the XSD Semiconductor ETF is not overly expensive and actually trades at a discount to the S&P500 (P/E=26.1x):

XSD ETF Valuation Metrics (State Street Global Advisors)

Summary & Conclusion

Although the XSD ETF doesn’t hold many of the companies the average investor thinks of when he or she thinks “semiconductors”, the ETF has established a stellar long-term performance track record and, as they say, you can’t argue with performance. The fund is not overly valued and currently trades at a discount to the S&P500. With an expense ratio of 0.35%, XSD is a reasonably affordable fund given the diversity and the performance it has delivered for investors.

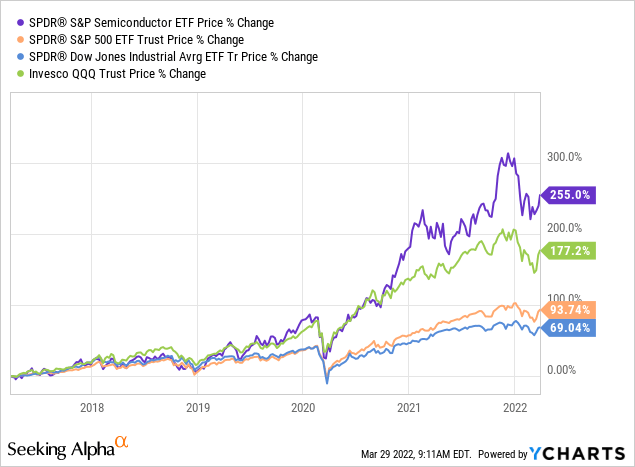

I’ll end with a 5-year comparison of the returns of the XSD ETF versus the broad market averages:

Be the first to comment