Alessandro Biascioli/iStock via Getty Images

Introduction

Biotech is one of the trickiest industries in the market – I think. As an outsider, it’s often hard to understand the industry dynamics and the theories behind new, complex medication techniques or drugs. However, I’ve had my eye on the industry for a while now for one major reason: it’s a rate play. In this article, I want to focus on what I consider to be the single-best ETF for biotech stocks.

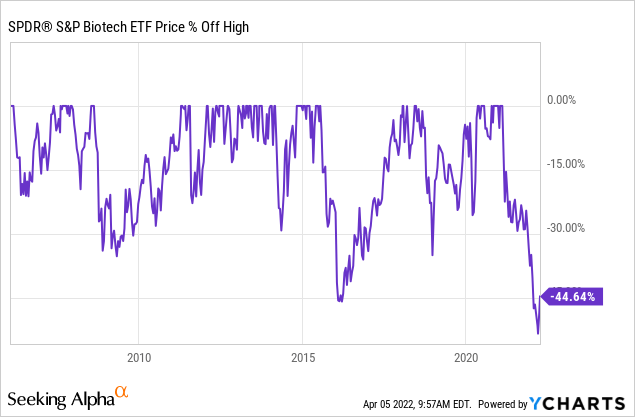

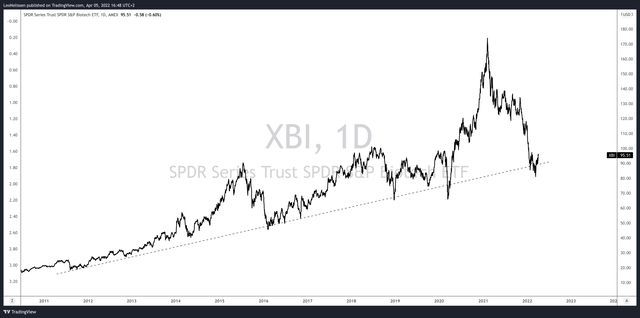

The SPDR S&P Biotech ETF (NYSEARCA:XBI) is an equal-weight ETF that lets investors buy (or short) an entire industry without having to deal with single-company risk. In this business, I consider that to be key as single biotech companies come with significant approval and financial risks involving funding and related. In this case, the bull case for biotech is getting better. The ETF is more than 40% below its all-time high as a result of rising rates. Now, investors might come back as the industry is cheap and because we could see a wave of M&A announcements if rates come down again.

Now, let’s look at the details!

What’s XBI?

State Street, the owner of SPDR ETFs, says the following with regard to its ETF.

The SPDR® S&P® Biotech ETF seeks to provide investment results that, before fees and expenses, correspond generally to the total return performance of the S&P® Biotechnology Select IndustryTM

[…] Seeks to track a modified equal weighted index which provides the potential for unconcentrated industry exposure across large, mid and small cap stocks

As of April 4, 2022, the ETF has $7.7 billion worth of assets under management. Incepted in 2006, this ETF has become the go-to place for investors looking to get balanced exposure to the industry.

Trading on NYSE Arca, the fund has 157 holdings, with an average market cap of $9.8 billion.

The gross expense ratio is 0.35%, which I believe is fair. 0.35% is usually what I consider the limit for ETFs that do not follow an index like the S&P 500, Nasdaq, or Dow Jones. Additionally, more often than not, people do not hold ETFs like this one on a long-term basis. These investors often pick healthcare dividend (growth) stocks like AbbVie (ABBV), which I own in my dividend growth portfolio.

In this case, the equal weight characteristic makes sense, even though it’s not perfectly balanced. As the table below shows, the ETF perfectly follows the S&P biotech index. The largest holding has only 1.14% exposure.

At this point, I want to show you the XBI graph. However, I’m going to do that in the next section.

XBI Is A Rates Play

Biotech stocks are complex for a number of reasons. A typical biotech stock (and I’m painting with a very broad brush) does not generate free cash flow. Money received from the IPO goes straight into research & development. Additional stock offerings are then used to maintain R&D, which often results in rapid stock dilution. At some point, the FDA approves a drug, which then ends up in positive free cash flow. A lot of companies are acquired before approval, but I get to that later.

Moreover, this means that risks include financial (funding) risks as well as approval risks. After all, if a company does not achieve its goal of finding a drug against certain cancers, viruses, or something else, the stock gets sold off hard.

These risks and the fact that I have zero medical background are the reason why I do not publicly cover biotech stocks.

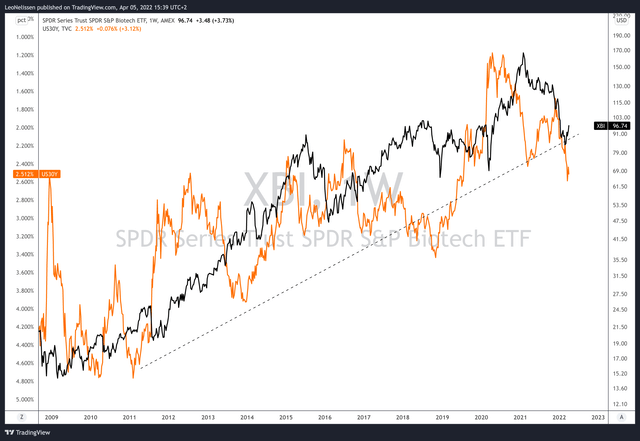

With that in mind, the following graph shows two lines. The black line displays the XBI price. I used a logarithmic scale. The orange line shows the 10-year US government bond yield. In this case, I used an inverted scale. In other words, if the orange line falls, yields rise.

The two charts do not move in lockstep as every economic environment is different. Prior to 2014, biotech stocks ignored the 2012/2013 surge in yields as biotech was in the midst of a big M&A cycle. Also, the recession wasn’t that long ago. People wanted to deploy capital and bought into above-average risky industries.

In general, declines in yield have a much bigger (positive) impact on biotech than declines that have negative impacts on biotech. In this case, however, we’re dealing with multi-decade high inflation. This is a new scenario for most and it’s totally different from the rising inflation periods between the Great Financial Crisis and the pandemic.

In general, rising rates have a negative impact on investors’ willingness to take risks. Especially when it comes to “tech” or “growth” stocks. This has everything to do with discounting growth. Just like biotech companies, “growth” stocks are expected to make money sometime in the future. “Waiting” for these profits makes only sense when rates and inflation are low. If that is not the case, investors invest in value stocks that deliver value now instead of many years from now – with additional risks.

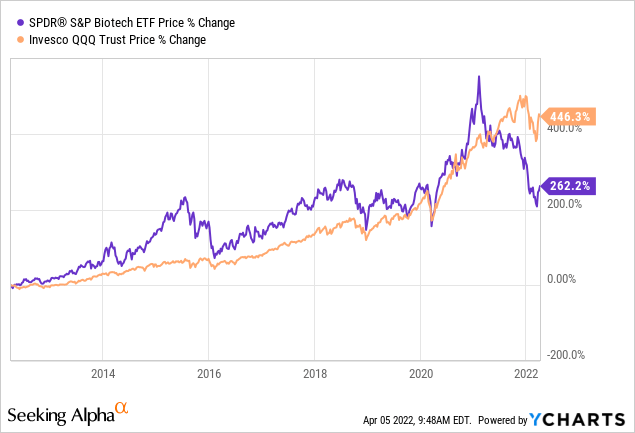

One of the most well-known tech-heavy ETFs is the Invesco QQQ Trust (QQQ). This ETF also has suffered. However, the performance on a long-term basis is much better than the performance of XBI. I’m also bringing this up because the chart shows that XBI is highly correlated to QQQ. That’s important as the XBI ETF is not moving “randomly” but in line with other risk assets. That’s the point, as we want to avoid single-biotech company risk.

While I just made the case that XBI is not a suitable long-term investment because of better alternatives, XBI is a great trading vehicle whenever it drops – in this case, more than 40% below its all-time high.

A Bull Case Beyond Rates

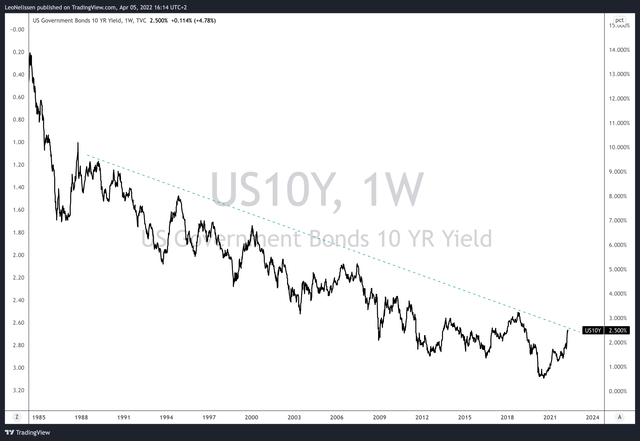

The biggest bull case we need is lower rates. I believe that the 10-year yield has room to run to 2.80%. At that point, Fed hikes will likely steepen the yield curve again, resulting in lower yields as the pressure on the economy grows a bit.

Moreover, as reported by the Wall Street Journal, more biotechs than ever started trading during the pandemic – meaning they went public.

In 2020, 90 companies raised $14.8 billion, surpassing the previous inflation-adjusted peak of $9 billion raised by 67 biotechs in 2000, according to data compiled by Biogen Inc. Chairman and former Cowen & Co. Vice Chairman Stelios Papadopoulos. In 2021, 112 biotechs raised $16.5 billion, a record.

What this means is that an increasing number of companies started chasing a falling amount of money.

Additionally, the industry has been hit by a number of big sell-offs. Especially (smaller) companies that worked on COVID-19 vaccines sold off hard when the market started to price in post-COVID.

However, now we’re seeing possibilities that come with cheaper biotech stocks. In 2021, most biotechs were simply too expensive for M&A activities. This seems to be changing according to the same WSJ article:

The 14 largest pharmaceutical companies by market cap, including Pfizer Inc. and Johnson & Johnson, face the loss of tens of billions of dollars in revenue over the next decade from patent expirations on branded drugs, and have a combined $650.5 billion in capacity to do deals this year, according to Ronny Gal, a Bernstein & Co. analyst.

“The big pharma companies all have big holes in their pipelines and are looking to fill them” with acquisitions, said Mr. Gal. “When pharma begins to pull the trigger, you should see the biotechs begin to turn” upward again.

Takeaway

Biotech stocks are in a tough place. The equal-weight ETF XBI has dropped more than 40% from its all-time high as investors have moved away from rate-sensitive investments and into value. M&A expectations came down due to high prices in 2021 and because of some disappointing COVID-related results.

Now, the situation is changing. While rates could move a bit higher due to the ongoing surge in inflation, we see that “big pharma” has a big war chest waiting to engage in new deals at better prices to maintain a filled drug pipeline.

I do not believe that biotech stocks will start a sudden uptrend. However, I do like the risk/reward at current levels. I think the bottom will be in the $85-$95 region. That is a somewhat wide range, but we could see a move lower in case rates continue to spike. Yet, because of the aforementioned risk/reward, I think most of the damage has already been done.

On a side note, only traders should consider adding XBI. There’s no need for long-term investors to buy XBI. There are better long-term alternatives like the QQQ ETF, which also benefits when rates come down.

It’s only a trading idea on the side based on the massive underperformance of biotech stocks, the surge in rates, as well as the need for big pharma to boost M&A at better prices.

The only reason why I will not be disclosing an XBI position is that the EU has banned non-UCITS ETFs, which means I cannot buy XBI.

And, last but not least, as this is a trading idea with above-average volatility, keep your positions very small if you decide that this is a trade that fits your portfolio.

(Dis)agree? Let me know in the comments!

Be the first to comment