simonkr

The Williams Companies (NYSE:WMB) is an American energy company with an almost $40 billion market capitalization and a dividend yield of almost 6%. The company handles ~30% of the U.S.’s natural gas and has one of the largest midstream asset portfolios in the country. The company’s reliable cash flow will support substantial shareholder returns.

The Williams Companies’ Asset Overview

The Williams Companies has numerous impressive assets, including the major Transco pipeline.

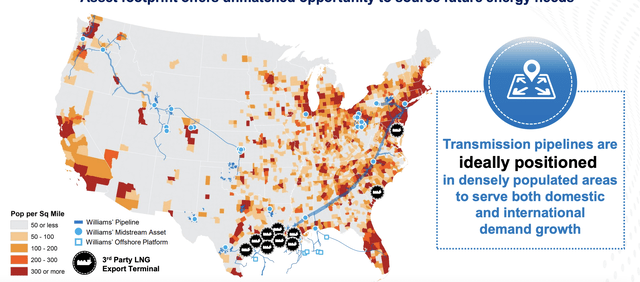

The Williams Companies Assets – The Williams Companies Investor Presentation

The Williams Companies has numerous assets distributed across the country through population centers and 3rd party LNG export terminals. Natural gas remains essential to the market being an affordable and reliant way to transmit power. Especially in regions without easy renewable access, we expect it to remain popular.

The Williams Companies’ Financial History

Financially, The Williams Companies has continued to perform well.

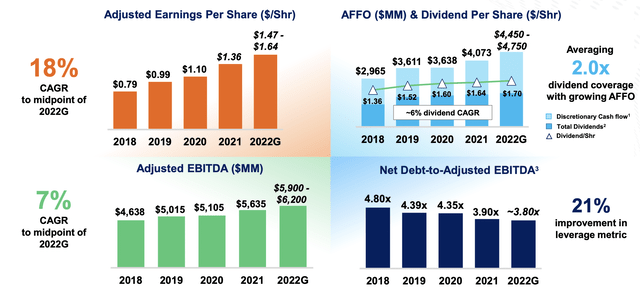

The Williams Companies Financials – The Williams Companies Investor Presentation

The company has grown its earnings per share by 18% over the past few years while adjusted EBITDA has grown at 7% annualized. The company’s AFFO & Dividend per share have grown at roughly 6%, with the company’s 2022 AFFO representing a roughly 12% cash flow yield. That’s impressive for a company with a focus on reliable cash flow.

The company has been reducing its net debt-to-adjusted EBITDA, partially supported as its EBITDA has continued to grow. The company has taken this down to 3.8x a comfortably affordable level. The company has $23 billion in total debt, versus its $38 billion market capitalization, which is a debt level that it can comfortably afford.

The Williams Companies’ Growth Potential

The Williams Companies is continuing to invest in both maintenance and growth.

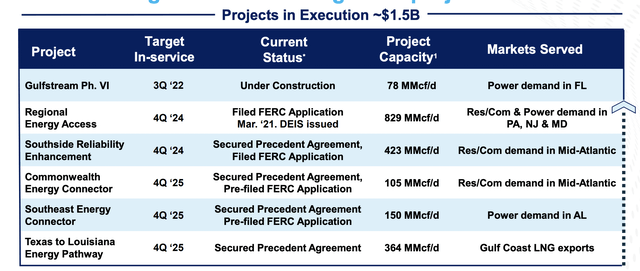

The Williams Companies Growth – The Williams Companies Investor Presentation

The Williams Companies has $1.5 billion of projects in execution. The company sees billions in additional projects going into the end of the decade and the company’s $1.5 billion of projects in execution will be coming online over the next several years, supporting the company’s EBITDA. This incremental EBITDA will support the company’s cash flow.

The company also has potential support from new projects. Growing production especially in deepwater projects will let the company add new bolt-on pipelines from these assets to its existing assets. These will generate multi-decade reliable cash flow, and the company’s existing assets give it some of the lowest costs to bolt on the assets.

This growth potential highlights how the company is a valuable investment.

The Williams Companies’ Financial Potential

Financially, The Williams Companies has a diverse portfolio of assets.

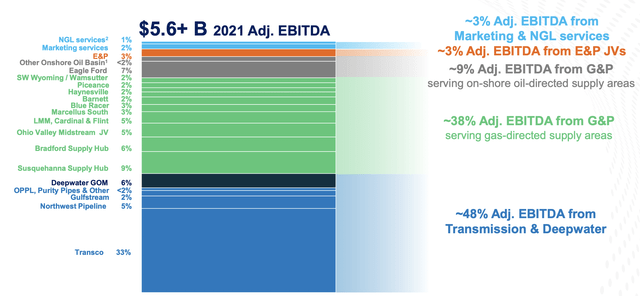

The Williams Companies Financials – The Williams Companies Investor Presentation

The Williams Companies generated more than $5.6 billion in 2021 adjusted EBITDA which the company has been consistently growing. The company generated 33% of its EBITDA from the reliable and diversified Transco pipeline and then had numerous other supply hubs and pipelines that helped to support the company’s earnings profile.

The company earns its EBITDA at every step of the process from gathering and processing to transmission and working with various JVs, etc.

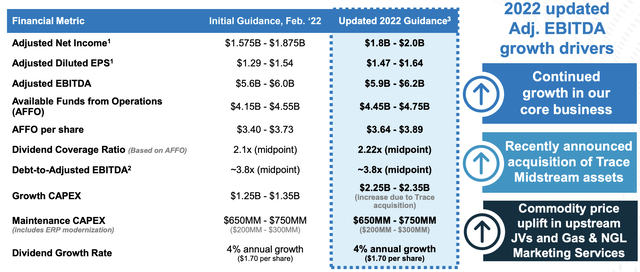

The Williams Companies Guidance – The Williams Companies Investor Presentation

The company’s adjusted net income forecast is $1.9 billion with $6.05 billion in adjusted EBITDA representing like 8% YoY growth. The company is expecting to keep debt-to-adjusted EBITDA at a manageable 3.8x with 2.2x dividend coverage ratio. The company’s guidance for capital spending has increased to roughly $3 billion total for growth + maintenance capex.

The company purchased the Trace acquisition for $900 million covering the growth capex spending. The company’s dividend growth rate for the year is expected to be 4% supporting an almost 6% dividend yield. These financials will support continued shareholder rewards.

Our View

Our view is that the company can generate reliable shareholder returns.

The company is spending $2.25 billion on growth capital spending, which it can comfortably afford, on top of its dividend yield of more than 5%. The company’s overall AFFO generates a double-digit dividend yield for the company. That combination of spending helps highlight how the company can generate valuable returns.

The company has reliable assets that are essential to our lifestyle in the country. Natural gas is a reliable fuel source. Even as its replaced, energy consumption doesn’t disappear, and there are numerous other avenues for the company to chase. The reliance on the company’s assets helps to highlight how it’s a valuable investment.

Thesis Risk

The largest risk to the thesis is production. The company still has substantial gathering and processing assets and if something were to happen to cause volumes to decline that could hurt the company’s ability to continue generating shareholder returns. That risk is worth paying close attention at, given the volatility of capex budgets.

Conclusion

The Williams Companies has a unique portfolio of assets. The company’s assets are essential to our modern standard of living. Natural gas is a fuel source that in many ways is difficult to replace, especially when counting the transmission density. The company’s assets result in the transportation of 30% of the U.S.’s natural gas.

The company is growing its EBITDA to more than $6 billion. It has a dividend yield of almost 6% and a coverage ratio of more than 2x. The company is continuing to invest in growth on top of the dividend, and it can cover both of these while maintaining its 3.8x dividend ratio. That helps make the company a valuable investment.

Be the first to comment