imaginima

Article Thesis

The Williams Companies (NYSE:WMB) is a quality energy midstream player that offers a solid dividend yield of 5.8% today. We have recommended the company’s shares in the past, but as returns have been strong since then, the opportunity isn’t as great any longer. Some other energy midstream names offer a better combination of yield and upside potential, as we’ll show in this article.

Williams Companies: A High-Quality Midstream Pick

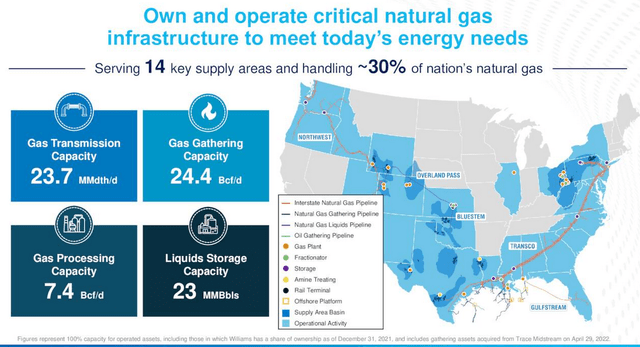

The Williams Companies is a natural gas-focused midstream company that is involved in handling a whopping 30% of US natural gas demand, making Williams one of the most important energy infrastructure players in North America. Its operations include gathering and processing, as well as transportation via pipelines such as the following ones:

Williams Companies presentation

Its pipes connect the Gulf Coast to the Northeast coastal area, a major demand center in the US. It also owns some pipes connecting to Florida and the Northwest. Via its presence on the Gulf Coast, Williams is exposed to the ongoing macro story of growing LNG exports from the US. As Europe and parts of Asia seek to grow their LNG imports, exports from the US are poised to grow. Natural gas needs to be moved to the coasts from where it can be exported for that, which means that demand for assets such as Williams’ Transco will remain high and probably continue to grow.

At the same time, demand for natural gas inside the US will likely grow as well. Not only is natural gas used for heating and cooking, where demand is very resilient versus recessions and other macro crises, but natural gas is also used for electricity generation. Since natural gas is much cleaner than coal and since natural gas plants can be started up quicker than other fossil fuel plants, making them more suitable as a combination with volatile renewable energy assets such as wind and solar, natural gas use for electricity generation will likely grow as well in the foreseeable future.

Overall, this means that Williams has a very solid business outlook. Its assets are highly important as one of the backbones of US energy infrastructure, and the demand outlook for natural gas looks compelling as well, due to both domestic demand growth and growing exports.

Williams Companies is a high-quality dividend payer also. The company currently trades with a dividend yield of 5.8%, which is more than 3x the broad market’s current yield. Williams Companies has increased its dividend regularly in the past and has paid dividends for 32 years. It has not increased its payout during all of those years, however. In fact, there were some dividend cuts in the past, although not in recent years. Over the last five years, Williams Companies has increased its dividend at an annual rate of 7.5%. If maintained, that would make for a compelling dividend growth investment when coupled with Williams’ dividend yield of 5.8%. It is likely that the dividend growth will slow down over time, however, as WMB will likely not grow its distributable cash flow per share at a high-single-digit pace. Over time, we thus expect that Williams’ dividend growth rate will slow down to a level that is more in line with its cash flow growth rate, probably somewhere in the mid-single digits range.

At current levels, Williams Companies’ dividend costs the company $2.1 billion per year, which is equal to a little less than half of Williams’ cash flow from operations ($2.2 billion in H1, or $4.4 billion annualized). Williams has to pay for maintenance capital expenditures with its operating cash flow, thus not all of those $4.4 billion (annualized) are available for dividends. Still, the coverage ratio looks very solid and we believe that there is little risk of a dividend cut with the dividend being where it is today.

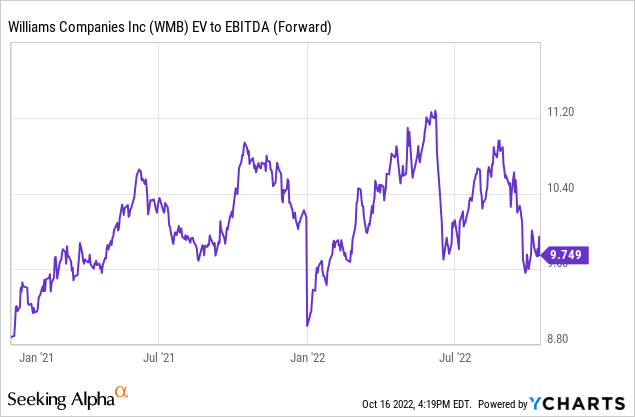

Looking at Williams Companies’ valuation, we see the following:

Right now, Williams Companies trades with an enterprise value to EBITDA multiple of 9.7. This accounts for Williams’ debt usage and cash on its balance sheet already. That’s not a high valuation at all, but it also is not an ultra-low valuation, either. Shares are trading relatively in line with the average over the last two years at the current level.

So all in all, what’s wrong with Williams Companies? Basically nothing. It’s a solid, resilient company trading at a reasonable valuation and offering a considerable dividend yield of close to 6%. I don’t recommend it because I think that other midstream players are even more attractive, not because I think that WMB is a bad pick. We recommended WMB in the past, about 2.5 years ago. Since then, Williams Companies has returned more than 140%, dividends included, which is quite attractive, considering the market has delivered returns of 40% in that same time frame — WMB delivered total returns that were 3.5x as high as what the S&P 500 did in that time frame.

Enterprise Products Partners Could Be Better

Enterprise Products Partners (EPD) is one of the midstream players that I believe could be a better pick than Williams right here. Enterprise Product Partners is one of the largest midstream players in North America, being active in all kinds of segments of that market. It owns natural gas, product, and crude oil pipelines, terminals, and storage facilities, as well as deepwater ports and similar infrastructure. On top of that, the company owns some chemical assets, which are highly advantaged versus competitors in Europe and Asia thanks to the (comparatively) low energy cost in North America.

At current prices, Enterprise Product Partners trades with a dividend yield of 7.6%, close to 200 base points more compared to what Williams is trading at right now. On top of that, EPD has one of the cleanest balance sheets in the industry, with a leverage ratio (net debt to EBITDA) of just 3.1. Williams Companies’ leverage ratio is 3.6, which is far from bad, but not as excellent as the industry-leading leverage ratio of EPD.

And yet, Enterprise Products trades at a discount compared to how Williams is valued. Based on annualized H1 cash flows from operations, EPD is trading at a cash flow multiple of 6.3, which translates into a 15.9% cash flow yield. Williams’ cash flow yield is 12.2%, which is pretty solid as well, but again, not quite as good as the valuation on EPD’s shares.

The same holds true when we look at the enterprise value to EBITDA multiple EPD trades at. The reading is 9.1, around 10% lower than the valuation for WMB. When we consider that EPD is even more diversified than Williams, that it has a better balance sheet, a better dividend growth track record — EPD has raised its dividend for 22 years in a row — and a significantly higher dividend yield, it looks like the better choice compared to Williams as long as it can be bought at a lower valuation, I believe.

Energy Transfer Could Be Better

Energy Transfer (ET) is a somewhat controversial pick, as some investors still have hard feelings due to ET’s dividend cut a couple of years ago. But at current valuations, the company’s shares look pretty attractive, I believe, mainly due to an ultra-low valuation and hefty near-term dividend growth potential.

Energy Transfer owns a large and diversified asset base with pipelines, terminals, storage facilities, and LNG export assets in North America. It is one of the largest midstream/energy infrastructure companies in the world.

Energy Transfer has generated operating cash flows of $4.7 billion during the first half of the year, which translates into $9.4 billion on an annualized basis. With the company being valued at $35 billion today, shares are trading at just 3.7x cash flow, which equates to a cash flow yield of 26.9%. That is more than twice as high as Williams’ cash flow yield. Even when we look at distributable cash flows, where maintenance capital expenditures are already accounted for, the cash flow yield of Energy Transfer is very high, at 22.5%. In other words, the company could theoretically pay a distribution yielding 20% and it would still be fully covered by its cash flow.

In reality, the company pays out less than that, as it uses some of its cash flows for other purposes, such as debt reduction and growth capital spending. But nevertheless, Energy Transfer offers a pretty high dividend yield of 8.0% at current prices — and due to a DCF coverage of 2.8x, that dividend looks very sustainable. Over the last year, Energy Transfer has raised its dividend by more than 50%. And since management has stated that its main goal is to bring the payout to the pre-pandemic level of $1.22 per share, investors can expect another 30%+ dividend increase over the next 1-2 years, I believe. That’s not guaranteed, of course, but the regular and sizeable dividend increases over the last couple of quarters suggest that management will likely deliver on that strategy.

ET isn’t an ultra-high quality pick like EPD as it has a weaker balance sheet and since its dividend track record isn’t as pristine. But shares are very inexpensive and there’s potential for the company to deliver a 10%+ dividend yield on current prices in the foreseeable future, making ET an interesting pick for enterprising investors.

Takeaway

Williams Companies is a solid company offering a sizeable dividend yield, and it trades at a fair price. But other midstream companies are even more attractive, which is why I believe that WMB is not among the best picks at its current share price. EPD is stronger, cheaper, and offers a higher yield, while ET is ultra-cheap and has hefty near-term dividend growth potential. This makes these two companies look more attractive than WMB at current valuation levels.

Be the first to comment