niphon/iStock via Getty Images

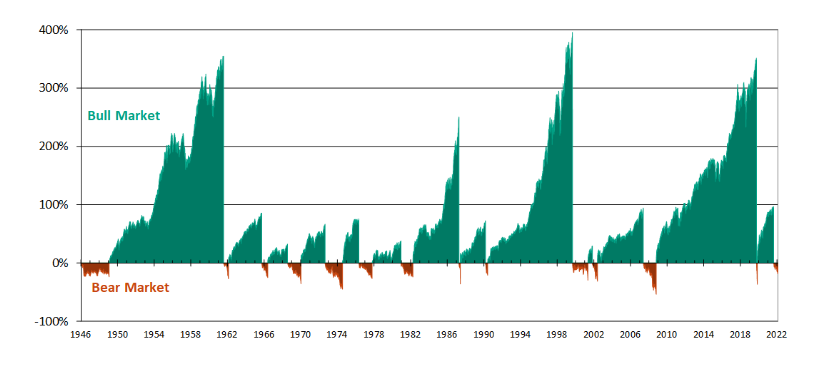

The best thing about the first half this year is that it is finally over, and if historical precedent holds, it also means that the second half should be a whole lot better. The bottoming process for stocks after a bear market is no fun, but it presents far more long-term investment opportunities for astute investors than at any other time in a market cycle. I am reminded of the fact that the stock market is the only market where consumers are inclined to buy more as prices go up, but when they fall, they have no interest in buying at all. That doesn’t make much sense, but buying stocks is a lot more emotional for most than buying a car or home or appliance. I think if we focus on investing in businesses that are well positioned to grow over the coming 2-3 year period rather than simply buying stocks, it removes the emotion and greatly improves the chances of success.

Edward Jones

We still have to be cognizant of the dismal macroeconomic backdrop, which is reflected in some of the worst consumer and investor sentiment numbers on record, but it is also reflected in the market prices we see today. It does not tell us where prices will be six months from now any more than January’s far more optimistic picture told us where we would be six months later.

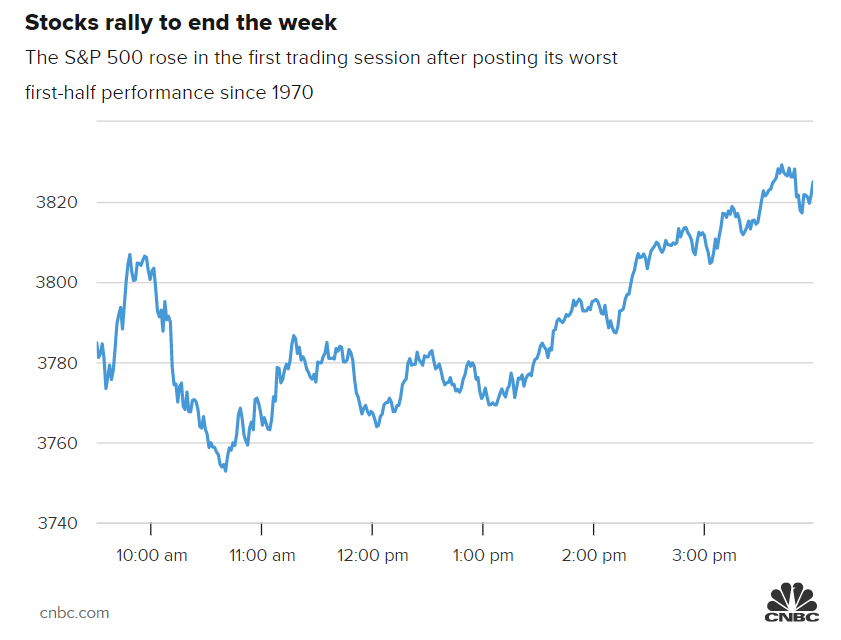

stock rally

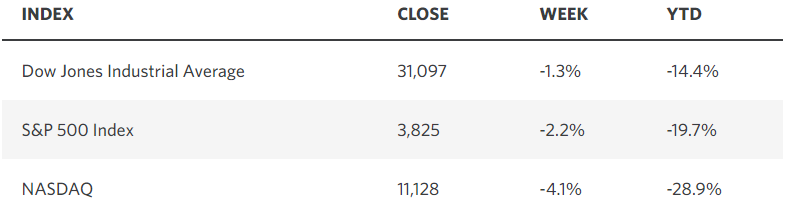

On the second trading day of this year the S&P 500 reached its all-time high. The consensus of investors were ebullient and happy to pay exorbitant valuations for growth stocks at that time. Today, the consensus is licking wounds and dumping the same stocks at less than half their valuations. This has been going on for months, but what made June different is that the good stocks, bad stocks, and everything in between took a beating.

Investors always sell the lowest quality and highest risk names first when speculation is wrung out of an overvalued market. Eventually, investors start selling the highest quality and lowest risk names to protect what profits they might have left and raise cash for fear of even lower prices. Typically, when that happens, the broad market decline is nearing its end. Near the end is also when the news is at its worst and the bear’s growl is the most ferocious. The turning point usually comes when rates of change start to move in a more favorable direction, which is what I have started to see happen on the inflation front. It does not mean that things go from bad to good, but bad to less bad. That is typically when stocks bottom and start to turn up, discounting the good that will eventually come.

Following Russia’s invasion of Ukraine, panic spread over the surge in prices for key commodities like wheat and the global food crisis that might result. Russia and Ukraine are two of the world’s top-five exporters. Yet the price has now fallen to its pre-invasion level, but there has been very little focus on this development. This is an example of a bad situation that has improved markedly. The invasion of Ukraine combined with the supply chain disruptions in China caused by Covid led to inflationary shocks that I see as no different than the deflationary shocks that followed the onset of the pandemic in early 2020. Over the coming year we should see a return to a new normal.

Finviz

That does not suggest that we will see the rate of inflation fall to 2% within the next year, but it is moving in the right direction. If half of the 8.6% rate is the result of these two shocks to the global economy, as I surmise, then the other half is a result of the excessive monetary and fiscal stimulus that followed the pandemic. The Fed should have been withdrawing liquidity and more gradually normalizing interest rates when the federal government was distributing checks to American households. Instead, it threw gas on the fire, which helped fuel that surge in speculation that has been largely eradicated by the extremely rapid tightening of financial conditions this year. Now inflation fears have turned to recession fears. I say, so what.

Even if we do have a recession this year, it is not likely to be a deep contraction or prolonged, and it could be over if the second quarter results in a negative GDP print. Some prognosticators are sounding the alarm for another downturn like we saw in 2008 and 2001, but the facts on the ground do not support that. Recessions are healthy exercises whereby the economy rids itself of the excesses that built up during the expansion just ended. We don’t have a lot of excesses in the real economy today. The current situation is better characterized by constraints and limits. I think the excesses were confined to our financial markets as a result of monetary policy largesse. We have come a long way in eliminating those.

Edward Jones

That process clears the way for the next bull market, which is something that always follows a bear market. No one will disagree with that. My base case continues to be that the rate of inflation comes down faster than the consensus expects, while consumers fuel the economic expansion, allowing the Fed to ease off the brakes during the second half of this year. After the Fed raises short-term rates by another 75 basis points at this month’s meeting, resulting in a target rate of 2.25%, we should start to see data that convinces the Fed that inflation is abating. That will lower consensus expectations for the target rate by year end, lift investor sentiment, and unpin the recovery in the broad market.

Be the first to comment