FrozenShutter

After the market closes on November 8th, the management team at The Walt Disney Company (NYSE:DIS) is expected to report financial results covering the final quarter of the company’s 2022 fiscal year. While the market has been challenged this year amidst fears associated with mounting inflation and rising interest rates, some companies have been hit harder than others. This particular firm is a great example of that, as evidenced by the fact that shares are down 35.7% year to date as of this writing. Needless to say, investors could use a win. From a purely fundamental perspective, The Walt Disney Company has been delivering nicely this year. But of course, that picture could change from quarter to quarter. And leading up to the fourth quarter earnings release, there are a few items that investors should pay particular attention to. Although it’s possible the market could ignore robust performance just like it has for most of this year, eventually the tide should change for the better so long as strength persists.

Keep an eye out on streaming

Although The Walt Disney Company is a true entertainment conglomerate, with many large enterprises under its umbrella, there is no denying that the most important part of the firm right now is the streaming portion of the enterprise. This has been a source of significant growth for the company and it has the potential, eventually, to generate strong recurring cash flows for the business. Because of this, investors would be wise to pay attention to what kind of subscriber numbers and other data the company reports when earnings do come out.

In general, the streaming space has also faced some challenges this year. For instance, streaming giant Netflix (NFLX) reported subscriber declines in two different quarters this year before posting strong results recently. With consumers stretched by high costs and a smorgasbord of streaming services, there has been substantial doubt about the ability of certain streaming providers to meet their long-term objectives. Even The Walt Disney Company has been impacted by this. When the company reported results for the third quarter this year, it said that it was reducing its 2024 target for the global Disney+ subscriber count to between 215 million and 245 million compared to the prior expected range of between 230 million and 260 million.

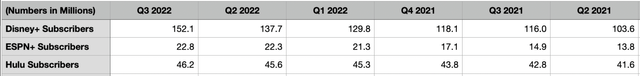

While this might be disappointing, it is worth noting that it still would imply significant growth over the next several quarters. At the end of the third quarter this year, Disney+ had 152.1 million subscribers. That was up 14.4 million, or 10.5%, compared to the 137.7 million that were on its roster just one quarter earlier. It would be incredibly interesting to see if the platform can achieve continued strong growth given that economic conditions seem to be worse now than they were three months ago. But it’s not just Disney+ that investors should be paying attention to. ESPN+ is another one of the company’s streaming services. In the latest quarter, the service had 22.8 million subscribers. That was 500,000 higher than what was reported in the second quarter of this year. Meanwhile, Hulu reported 46.2 million, an increase of 600,000 compared to the 45.6 million reported only one quarter earlier.

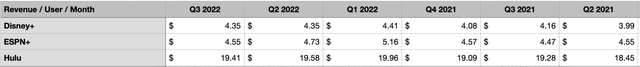

The number of subscribers reported by the company is unbelievably important. But it’s not the only thing that investors should be keeping an eye out for. They should also be paying attention to the amount of revenue per user per month generated by each service. In the third quarter of this year, for instance, Disney+ garnered $4.35 per user per month. That was flat sequentially and up from the $4.16 per user per month reported one year earlier. ESPN+ saw pricing of $4.55 per user per month. That’s a decrease from the $4.73 per month reported just one quarter earlier. And Hulu saw pricing fall from $19.58 per user per month in the second quarter of this year to $19.41 per user per month in the third quarter. What will be really interesting is how all this stacks up when you consider that, as part of its third quarter earnings release, The Walt Disney Company announced plans to increase costs on its offerings. For instance, the ad-free version of Disney+ rose from $7.99 per month to $10.99 per month in the US. The company also introduced an ad-supported version of $7.99 per month. There were significant other changes announced as well, with plans to introduce said changes over time. Add on top of this continued international expansion into markets that generally have lower price points than what more developed markets have, and it remains to be seen what kind of pricing and subscriber growth the company’s various platforms can achieve.

Recovery is important

As I mentioned already, I view the streaming portion of the business to be the most vital at this time. Having said that, there are portions of the enterprise that, as of the third quarter of this year, were still recovering from the COVID-19 pandemic. The trajectory of recovery for these various portions of the company will go a long way to determining if the company is back to full health and, if not, how long getting back to full health might take.

When talking about the areas most affected, the first thing that comes to mind is the Parks & Experiences portion of the company. In the third quarter of this year, the company’s parks saw traffic increases 69% relative to the same time a year earlier. Domestically, that number was far higher at 93% while the international operations of the firm totaled only 17%. The occupancy rate of domestic hotels at the parks was at 90% compared to 50% seeing only one year earlier, while in international markets it stood at 61% compared to 20% a year before. It’s safe to say that some meaningful disparity between domestic and international operations will still exist from an admittance perspective. I say this largely because of the recent development of Shanghai Disneyland being forced into lockdown because of COVID.

In what might be a good sign for shareholders, management did announce price hikes earlier this year for its domestic parks, including on October 11th. While the lower end of the price range of $104 for Disneyland has remained unchanged since 2019, there have become fewer and fewer days where this price has been made available. By comparison, a single-day ticket in California that allows entry to one park during a busy season like Christmas has jumped from $164 to $179. If you want to add the ability to hop between Disneyland and Disney California Adventure, that costs an extra $65 compared to the extra $60 it used to cost. These are just some of the examples of price changes that the news has pointed out. While certainly painful to those wanting to visit, I say this could be a positive because it could be in response to robust attendance figures.

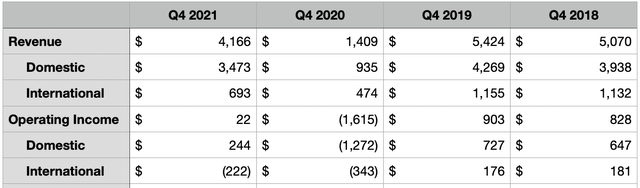

It will be very interesting to see how the financial side of the picture turns out. To put this in perspective, consider that in the third quarter of this year the company’s Parks & Experiences operations saw revenue of $6.21 billion. That was up from the $3.18 billion reported one year earlier and from the $329 million reported in the third quarter of 2020. It was even higher than the pre-pandemic 2019 fiscal year when the company reported sales of $5.55 billion. it’s likely that a similar trend will be seen this time around. Keep in mind that in the final quarter of the company’s 2021 fiscal year, these operations reported revenue of $4.17 billion. That compares to the $1.41 billion reported the same time of the 2020 fiscal year. And with these revenue figures will also come important operating income figures as well. A similar trend can be seen on that front, with significant differentiation between domestic and international operations.

*$ in Millions

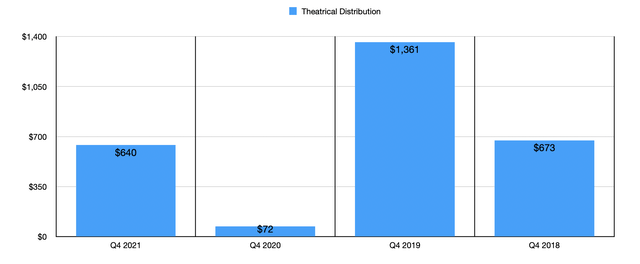

Of course, the Parks & Experiences portion of the company is not the only portion that has been significantly impacted by COVID-19. We should also be paying attention to the Theatrical Distribution side of the company. In the third quarter of this year, revenue of $620 million came in higher than the $140 million reported one year earlier and the $51 million reported in the third quarter of 2020. As for the fourth quarter, revenue in the 2021 fiscal year came in at $640 million. That’s up significantly from the $72 million reported in the final quarter of 2020. At the same time, however, it was still down from the $1.36 billion experienced in the final quarter of 2019.

A continued focus on key metrics

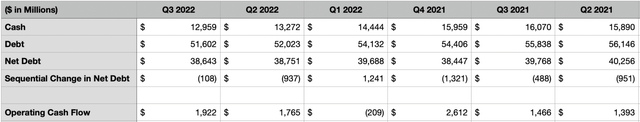

The last big thing that I believe investors should pay careful attention to would be how well the company performs fundamentally. What I mean by this specifically is from a cash flow perspective. Last year, the fourth quarter for the company was particularly appealing, with the firm generating cash flow of $2.61 billion. That was up from the $1.47 billion reported only one quarter earlier. What’s really interesting is that in the third quarter this year, the company reported operating cash flow of $1.92 billion. This suggests that we might be in for a rather positive final quarter of this year, especially if streaming performs well and the parts of the enterprise that were hit hardest by the COVID-19 pandemic also show improvement.

Besides just serving as a measure of value for the company, the other reason why I like to look at operating cash flow is because I’m interested in whether the company will use it to reduce leverage or not. After all, in four of the past five quarters, management has done well to reduce net leverage. At the end of the third quarter, total leverage was $38.64 billion. And in the final quarter of 2021, it came in slightly lower at $38.45 billion. Although I wouldn’t call The Walt Disney Company over-leveraged, it is always nice to see debt decrease since it ultimately lowers the risk for investors.

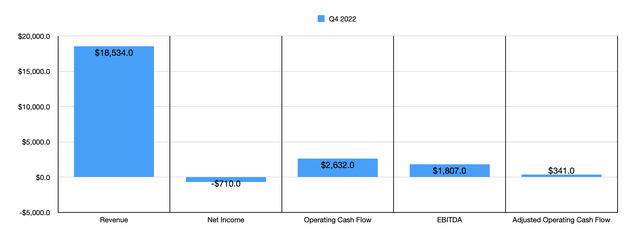

Investors should also pay attention to headline news items like revenue and earnings. At present, analysts anticipate revenue from the company of $21.44 billion. That would represent a significant increase over the $18.53 billion the company generated in the fourth quarter of its 2021 fiscal year. Earnings per share, meanwhile, should be $0.34 with adjusted earnings of $0.56. By comparison, the firm generated a loss per share in last year’s final quarter of $0.39. In absolute dollar terms, the firm’s net loss in last year’s fourth quarter totaled $710 million. If analysts are right this time around, the firm’s net profit for the quarter should total $619.8 million, with adjusted profits coming in higher at $1.02 billion.

Takeaway

I know the times are difficult in the market right now. Certainly, investors are worried about what the future holds. Having said that, I remain very confident in The Walt Disney Company and I believe that the trajectory for the company will remain positive yet again. Of course, it’s unlikely that the quarter as a whole will be perfect. But so long as the company can knock out some very important categories, particularly those related to what I discussed in this article, I believe that it will still represent a ‘strong buy’.

Be the first to comment