Dzmitry Dzemidovich

Investment Thesis

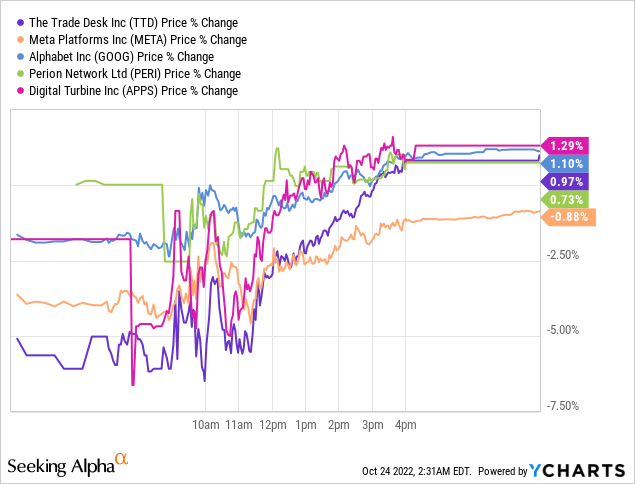

The Trade Desk (NASDAQ:TTD) shrugs off Snap’s (SNAP) Q3 results and The Trade Desk’s stock increases nearly 1% on Friday. What to make of this?

I believe that the market is in a bear market rally and that investors are too keen to buy the dip in tech stocks.

I don’t believe that paying 48x next year’s EPS for the Trade Desk offers investors a positive risk-reward profile.

This is not the time to buy the dip on The Trade Desk.

The Trade Desk’s Stock Reaction to Snap

As noted in the introduction, investors shrugged off Snap’s results. Investors believe that Snap’s results are idiosyncratic and not reflective of the broad dynamics that are bubbling throughout the adtech sector.

Outside of Meta (META), nearly all adtech stocks rallied on Friday. I find this nonsensical.

On the one hand, I recognize that The Trade Desk is vastly superior to Snap on a few fronts. Most critically in The Trade Desk’s cost structure.

But can we go so far as to fully shrug off the evidence that we are getting, that the ad market is showing significant weakness?

On the other hand, investors are now positively welcoming the likely scenario that the Fed may be done with raising rates. If that’s the case, investors are now positioning themselves back into tech stocks. Why?

Two reasons. Firstly, tech stocks have been largely decimated in 2022. There’s the argument to be had that tech is already pricing in a lot of negativity.

Secondly, and equally important, with interest rates starting to flatten out, there’s the belief that the pace at which the multiple has had to contract in 2022, as interest rates have risen, will lead to an overall slowdown.

Allow me to exemplify this with Snap. This time last year, Snap was being priced at approximately 40x trailing sales. Today it’s priced closer to 4x trailing sales.

So, it’s not so much that Snap’s growth rates have been the only problem. It’s also that Snap has had to struggle against an uphill battle against rapidly rising rates, which has culminated in its multiple contracting.

The same for The Trade Desk, its multiple has compressed significantly in 2022. But has it compressed enough to reflect its forward-looking underlying prospects?

This leads me to the next section, on investors’ expectations facing The Trade Desk.

Analysts’ Expectations Facing The Trade Desk

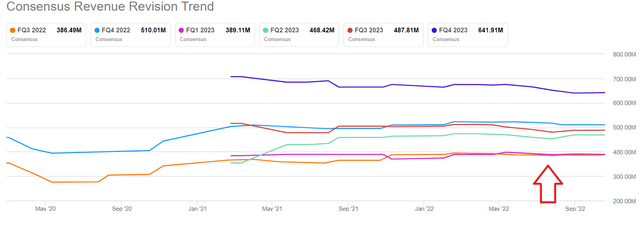

TTD analysts’ revenue consensus

What you see above is that analysts have not downwardly revised TTD’s revenue expectations at all since the summer!

Even though we now know that inflation and high energy costs are plaguing the economic environment, and companies are less willing to spend in this macro environment.

Yet, for their part, the sell side simply refuses to adjust their outlook for the Trade Desk’s 2023 revenue expectations.

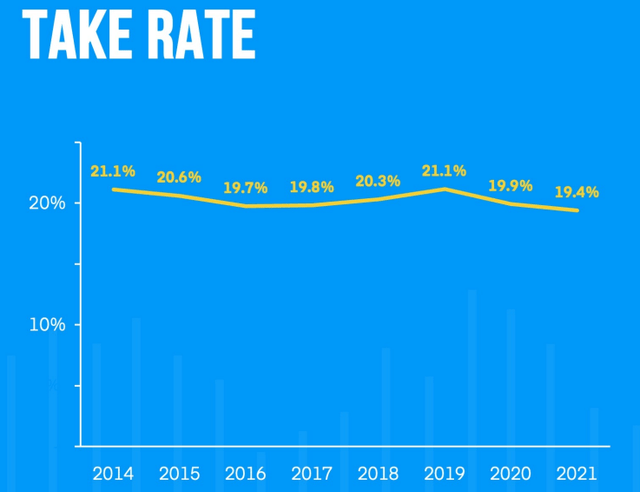

TTD investor day

The Trade Desk doesn’t normally openly discuss its take rate. But if Snap’s results are anything to go by, Snap had an increase in users, but its revenues were dragged lower by its ARPU ending the quarter lower, with its North America ARPU being down 1% y/y.

But remember, for the majority of Q3 the macro environment was still strong. What we saw from Snap’s guidance is that ”brand-oriented advertising revenue” was noticeably weak so far into Q4.

Again, it’s easy to brush this under the rug, after all, one could point a finger at this being a Snap-specific issue. But I don’t buy that argument. This is a sector-wide headwind. It’s not Snap-specific.

And most crucially, investors are still asked to pay a premium valuation for TTD.

TTD Stock Valuation — 48x Next Year’s EPS

Looking out to 2023, analysts are expecting TTD to report approximately $1.18 of EPS.

If we assume that a company that’s growing its EPS around 15% to 20% CAGR should normally be priced around 15x to 20x P/E, I struggle to see how paying nearly 48x next year’s EPS for The Trade Desk is justified.

Meanwhile, for now, investors continue to believe TTD’s stock-based compensation is a ”necessary evil”.

Even though the company is likely to be unprofitable on a GAAP basis for 2022 as a whole, investors believe that in 2023 The Trade Desk should see its SBC figures come down on a relative basis so that its GAAP EPS figures should turn positive.

The Bottom Line

I believe that TTD’s Q4 guidance will negatively surprise investors. Right now, I argue that investors are taking in on too much risk while paying 48x next year’s EPS.

I follow many adtech companies’ conference calls and hear the same comments echoed in all of them. That even though CTV spending is strong, there’s an elongation in the sales cycle.

Furthermore, even though Q4 2022 should see a lot of political ad spending, I don’t believe this will be enough of a positive driver to substantiate TTD’s 48x next year’s EPS valuation. Hence, I’m putting a sell rating on this stock.

Be the first to comment