LIgorko/iStock via Getty Images

The market humbles us all. At some point, every investor experiences downside associated with one or more companies that they own shares of. The same especially holds true as you start analyzing other companies and designating them as attractive or not, even if you don’t own stock in those individual businesses. Sometimes it can be difficult to tell the difference between being wrong and requiring additional patience. At this point, investors in The Timken Company (NYSE:TKR) might be wondering which applies to them. As the general market declined, shares of Timken have followed suit. At the end of the day, the price will move where it needs to. But for those who are concerned about a permanent loss in value, the best thing that can be done is to look at the fundamentals and derive a conclusion from that process. By doing this, you can see that, despite the pain associated with the broader economy, Timken is still growing and creating cash flow for its investors. Add on top of this, shares of the company still look cheap. For all of these reasons, I have decided to retain my ‘buy’ rating on the business, even in light of recent declines.

The picture still looks great

The last time I wrote an article about Timken was in February of this year. At that time, I called the company a compelling long-term prospect that offered nice upside potential. This was based on my understanding of the company’s historical performance. However, it was also based on the price that shares were trading for. Due to these facts, I ended up writing the business a ‘buy’ prospect, indicating my belief that it would, over an extended timeframe, outperform the broader market. Since then, the company has experienced some downward pressure. The S&P 500 is currently down 16.2%. By comparison, shares of Timken have declined by an almost identical 16.3%.

What’s interesting is that this performance comes even as the fundamentals for the company continue to improve. In my prior article, we had data covering the firm’s entire 2021 fiscal year. Now, we have data covering one additional quarter. During that quarter, revenue came in at nearly $1.13 billion. That works out to a 9.8% increase over the $1.03 billion generated the same time one year earlier. Management attributed this increase to strong organic growth that included positive pricing for the company’s products. The firm was hit some by foreign currency fluctuations. But beyond that, management has not provided much in the way of details. The only thing management has said is that demand for its products has remained robust and that pricing actions have contributed to some of this increase.

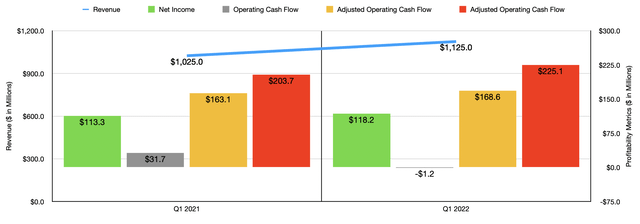

As revenue has risen, so too has profitability. Net income in the latest quarter came in at $118.2 million. That’s slightly higher than the $113.3 million generated the same time one year earlier. Interestingly, operating cash flow for the company did suffer, declining from $31.7 million in the first quarter of 2021 to negative $1.2 million the same time this year. But if we adjust for changes in working capital, this number would have actually increased, climbing from $163.1 million to $168.6 million. Over that same window of time, EBITDA for the company also improved, rising from $203.7 million to $225.1 million.

In addition to posting continued growth, management also announced the completion of a small acquisition. This acquisition was of a company called Spinea. According to management, this enterprise focuses on producing cycloidal reduction gears and actuators. It makes for a good bolt-on transaction for a business that is famous for producing a variety of industrial products like bearings, power transmission products, and other related technologies. Unfortunately, management did not disclose how much was paid for the deal. But they did say that the business should be responsible for about $40 million in revenue annually.

When it comes to the 2022 fiscal year, management said that revenue should increase by about 8%. This would take sales up from $4.13 billion to roughly $4.46 billion, marking the highest year for revenue in the company’s history. Earnings per share should be between $4.85 and $5.25. At the midpoint, this would translate to net income of $374.4 million. That’s a modest 1.4% rise over the $369.1 million reported for the firm’s 2021 fiscal year. Given inflation and supply chain issues, this would translate to the company’s net profit margin declining slightly, ultimately dropping from the 8.93% it’s all in 2021 to 8.39% this year. though this may not sound like much, based on 2022 estimated revenue, it will translate to $24.1 million in lower sales than if margins remained elevated. No guidance was given when it came to other profitability metrics. But if we assume that they would increase at the same rate that earnings should, we can anticipate adjusted operating cash flow of $546.1 million and EBITDA of $711 million.

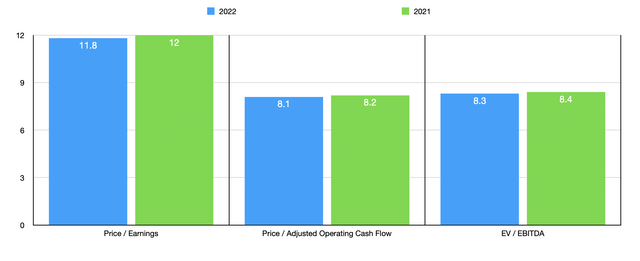

Taking this data, it becomes easy to price the company. Using our 2022 estimates, the firm is trading at a price-to-earnings multiple of 11.8. The price to adjusted operating cash flow multiple is even lower at 8.1, while the EV to EBITDA multiple should be 8.3. These numbers are marginally better than the multiples experienced in 2021. These are 12, 8.2, and 8.4, respectively. As the table above illustrates, shares in the business have also gotten a bit cheaper compared to when I last wrote about the firm. To put the pricing of the company into perspective, I decided to compare it to the same five firms that I compared it to in my last article. On a price-to-earnings basis, these companies ranged from a low of 5.4 to a high of 51.5. Using the price to operating cash flow approach, the range was from 7.6 to 300.9. And using the EV to EBITDA approach, the range was from 3.6 to 21.7. In all three cases, only one of the five companies was cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| The Timken Company | 12.0 | 8.2 | 8.4 |

| Parker-Hannifin (PH) | 19.5 | 14.7 | 13.5 |

| Dover Corporation (DOV) | 16.0 | 18.6 | 11.6 |

| Standex International (SXI) | 17.5 | 13.5 | 9.5 |

| Mueller Industries (MLI) | 5.4 | 7.6 | 3.6 |

| Welbilt (WBT) | 51.5 | 300.9 | 21.7 |

Takeaway

Based on the data provided, it looks to me as though Timken continues to get healthier. That is a difficult thing for a company that is already high quality to do. Yes, its net profit margin might contract some this year. But on the whole, the business is growing and cash flows are rising nicely. Add on top of this how cheap shares are on both an absolute basis and relative to similar players, and I cannot help but to be bullish enough on the company to retain my ‘buy’ rating on it for now.

Be the first to comment