Talaj

The U. S. dollar continues to maintain its strength in foreign exchange markets.

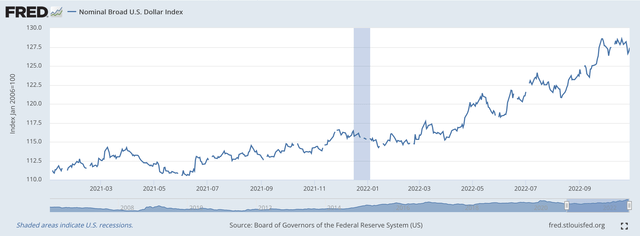

U.S. Dollar Index (Federal Reserve)

Since early January 2021, the value of the U.S. dollar has been on an almost steady upward trend as the Federal Reserve worked its way through the spread of the Covid-19 pandemic and the short recession that immediately followed.

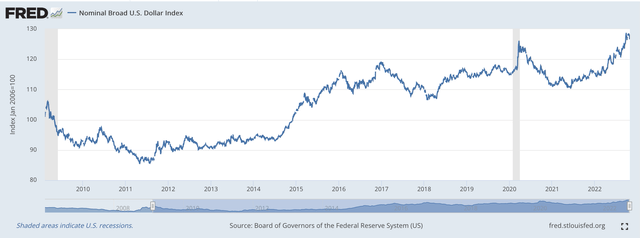

But, it seems that this upward movement was also a part of an even longer period of rising U.S. dollar value.

U.S. Dollar Index (Federal Reserve)

Since the spring of 2011, the general movement of the U.S. dollar has been upward.

In the spring of 2011, the index was around 88. In early January 2021, the index was around 111. And, currently, the index is around 127.

So for around 10 years, the trend of the U.S. dollar has been up.

This is surely not an accident.

Change Being Made

As a consequence, companies have been making changes to their operations.

Even more strongly recently, companies have moved even more strongly to respond to this continued dollar strength.

For example, Nina Trentmann writes in The Wall Street Journal:

“Finance executives at large U.S. companies are increasing their foreign currency hedges and covering longer times periods as the strong dollar continues to take a toll on earnings.”

But, this is just a part of a longer-term trend.

If this movement upwards in the value of the U.S. dollar is intentional on the part of the U.S. government, then more and more companies are going to have to react to this movement and change the way they do business.

Changing how companies protect themselves against short-term market movements is one way for companies to protect themselves. Changing how the companies compete in world markets through changing innovation and productivity.

This is how economies have always responded in the past.

This is how the United States seems to be responding in the present.

The U.S. currency is up about 15 percent since the beginning of the year against a “basket of other currencies.”

U.S. finance chiefs and treasurers, according to Ms. Trentmann, are responding:

“by looking for additional protection as they try to ensure that their overseas earnings are worth a certain amount when translated into U.S. dollars.”

“Changes to companies’ hedge contracts included covering larger amounts of earnings as well as longer durations beyond the usual 18 to 24 months.”

Goldman Sachs has noted that the share prices of S&P 500 companies with large overseas exposure are down by about 23 percent since the beginning of the year, compared with 18 percent for the wider index and 6 percent for companies with largely domestic businesses.

The longer hedges are put on to reduce the possibility of an “earnings surprise.”

But, this is just the start and is an indication that companies are very aware of the competitive situation and are responding to protect their performance measures.

This is where changes to innovation and productivity come in.

If companies are protected by weak currencies, then they have less incentive to improve the productivity of products or to enhance efforts to innovate.

The movement to a stronger currency, if positively responded to, can improve the competitiveness of companies and thereby improve the profitability of the companies.

Historically, this is what is seen in the longer run, as countries move to raise the value of their currencies in foreign exchange markets.

Number One Currency

The U.S. dollar is the number one currency in the world. It is the number one reserve currency in the world.

The Federal Reserve knows this and, I think, wants to protect this position.

To me, conditions in the world, following the Great Recession which ended in June 2009, called out the need for the U.S. to support the value of the U.S. dollar and to see that its strong value was to be maintained in the world.

I believe that this is why the value of the U.S. dollar has been supported since the middle of 2011. I believe that it was a part of the overall program that Ben Bernanke brought to the Fed along with its vision of the use of quantitative easing. This is consistent with what has happened to the data over the past decade.

I look forward to it continuing.

U.S. Companies Must Respond

The next stage of this saga is the U.S. companies’ response, knowing full well that the Federal Reserve is not going to provide a “weak dollar” to underwrite corporate competitiveness worldwide.

If U.S. companies face the reality that they will be living in a world of a very strong dollar, not only will they have to get their financial practices aligned to the fact that hedging is going to be a major part of their responsibilities, but they must recognize that continual aggressive improvements in productivity and innovation must be a major part of their business plans.

This needs to be the future of the United States.

The strength of the U.S. dollar must be sustained and protected.

The emphasis on productivity and innovation must be a top-tier objective of all U.S. companies.

And, these efforts must never cease.

Companies cannot count on governments to provide them with weak currencies so as to make their products competitive in world markets.

At least, this must be true of the country that has the number one reserve currency in the world and wants to maintain it.

Be the first to comment