Jonathan Kitchen

New York-based SuRo Capital (NASDAQ:SSSS) has had a colorful history as a public company. Three name changes in recent years first from GSV Capital to Sutter Rock and then to the current iteration have come against surging investor interest in private company investments as venture capital takes on a more outsized role in the economy. Many companies are choosing to stay private far longer than they historically have.

SuRo Capital is an internally managed investment fund that seeks to invest in high-growth, venture-backed private companies. The fund has built a diverse portfolio of fast-growing private startups, some of which like Forge Global (FRGE), Rover Group (ROVR), and Nextdoor (KIND) went public just last year on the back of the blank check boom. The SPAC phenomenon, driven by an incredible mix of euphoric animal spirits and non-prudent management guidance has all but come to a quiet end as the broader stock market crashed.

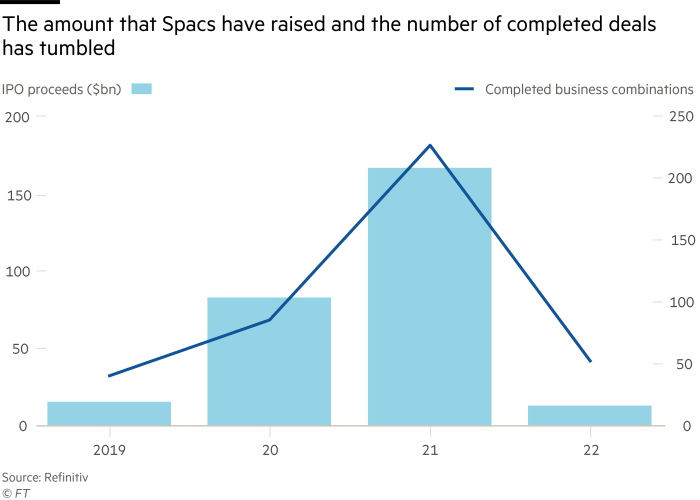

SPACs have raised around $12.7 billion this year, down from the $166 billion in 2021 as just 50 deals were completed. This was a fraction of 226 deals in 2021 and came on the back of a number of underwriters including Goldman (GS) pausing new offerings and withdrawing support from those they helped take public. As if things were not bad enough, the SEC under Gary Gensler is proposing a more onerous regulatory regime with reforms that would limit the ability of new SPACs to provide financial projections in excess of that which would have been permitted under the conventional IPO process. SPACs have become notorious for pulling these overly optimistic forecasts just after going public.

Financial Times – Refinitiv

For SuRo, the collapse of SPACs closes what has been a significant route for cash realizations. Indeed, the company continues to hold equity stakes in a number of pre-definitive agreement blank check firms like Churchill Capital Corp VI (CCVI) and Churchill Capital Corp VII (CVII).

A Material Discount To Book Value As Growth Collapses

As SuRo’s main operations involve the management of its investment portfolio of small fast-growing companies so conventional metrics like revenue are not entirely useful. The company’s last reported earnings for its fiscal 2022 second quarter saw net assets total $280.2 million, for a NAV per share of $9.24. This was a sequential decline from a NAV per share of $12.22 in the previous quarter.

The decline has been led by torrid equity market conditions since the first half of this year. The broad-based decline in public market common shares, the worst in half a century, spilt over to the private markets as numerous late-stage unicorns experienced turbulent conditions that led to new financing rounds completed at discounts to valuations from previous capital raises.

SuRo trades at a discount of 35.6% to NAV with shares currently at $5.95. This large discount to its book value pushed management to launch a now expired tender offer to purchase up to 2,000,000 shares of its common stock, roughly 6.60% of shares outstanding. It’s hard to assess this as a success as shares now trade below the $6 purchase floor implemented by management. However, in lieu of other investment opportunities, the tender offer makes sense when looked at from a long-term perspective.

The company holds positions in 40 portfolio companies of which 32 are privately held and 8 are trading publicly. Two new companies were added to the investment portfolio during the quarter. Boston-based WHOOP, a personal digital fitness and health coach and EDGE Markets, a software provider for legal betting. SuRo’s top five portfolio company investments constituted around 58% of the total portfolio at the end of the quarter with Course Hero being their largest investment at nearly 30% of their total portfolio and Forge Global following closely at $10.6%. The company still sits on significant unrealized gains on most of these, with their investment in publicly trading Forge subject to a lock-up until mid-September. With $150 million in cash, 40% of investable assets, SuRo is well placed to weather the current crash and capitalize on any opportunities that arise in the near future. Fundamentally, the pullback of private market valuations forms a tailwind for the fund when its high cash position is considered.

Macro Headwinds Persist

The broader market collapse has been driven by a surge in energy prices driving inflation to multi-decade highs and forcing the Fed to become hawkish after many years of low-interest rates. This has caused a significant retrenchment of investor appetite for high-growth companies whose valuations help drive their similarly high-growth private peers.

Hence, whilst SuRo provides an adequate medium for investors to get access to private startups, the current macro backdrop is not conducive for such an investment style. The discount to NAV provides a healthy margin of safety for prospective investors, but I’d still advise cautiousness.

Be the first to comment