monsitj/iStock via Getty Images

The story of what happened to the S&P 500 (SPX) in the past is a simple one. After running into President Biden’s wall of inflation the previous week, the index plunged into bear market territory. Through the end of the trading week ending 17 June 2022, the index was 23.4% below its 3 January 2022 record high peak.

S&P, CBOE, IndexArb, Author’s Calculations

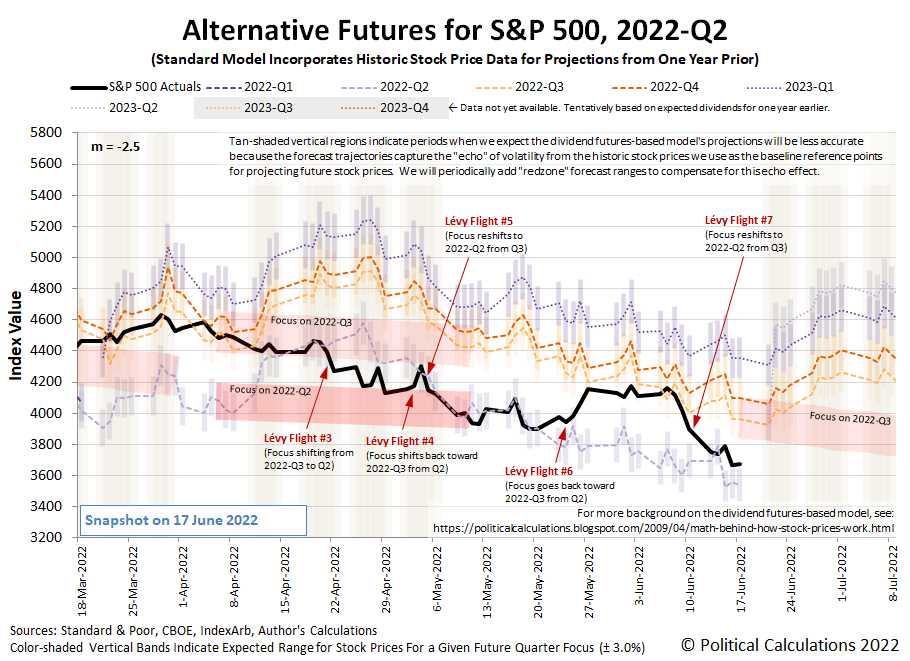

From our perspective, after the May 2022 inflation report came in higher than expected, investors sent the S&P 500 lower in a new Lévy flight event, the seventh of 2022, as investors scrambled to shift their attention back toward 2022-Q2 from 2022-Q3. But with the expiration of 2022-Q2’s dividend futures contracts on Friday, 17 June 2022, the market has effectively entered 2022-Q3, even though the calendar quarter won’t click over for another two weeks.

We think investors will, once again, shift their forward-looking attention toward 2022-Q3, because what actions the Fed will take next as it scrambles to get ahead of inflation will hold the focus of investors on this quarter. We’ve updated the alternative futures chart to add a new redzone forecast range to indicate where stock prices will likely go during the next several weeks, also assuming no deterioration of expected dividends or outbreaks of noise in the market.

In the very short term, that redzone forecast range suggests a higher level for the index, but one that could be relatively short-lived. We peeked ahead at the dividend futures-based model‘s projections for 2022-Q3, and see that the redzone range continues to drop to roughly where stock prices are today.

We can also confirm the bubble the Federal Reserve inflated for the S&P 500 through its coronavirus pandemic response has now fully deflated. We’ll explore the data supporting that assessment later this week.

Here are the market-moving headlines in the week the Federal Reserve was forced to hike the Federal Funds rate by 0.75%, its largest rate hike since 1994.

Monday, 13 June 2022

- Signs and portents for the U.S. economy:

- Fed minions starting to admit they won’t achieve “soft landing”, banks signaling they expect bigger rate hikes:

- BOJ minions trying to keep never-ending stimulus alive:

- ECB, EU minions getting on board with bigger rate hikes:

- S&P 500 confirms bear market as recession worry grows

Tuesday, 14 June 2022

- Signs and portents for the U.S. economy:

- Fed minions expected to hike rates by three-quarter points:

- Bigger trouble developing in Eurozone, China:

- BOJ minions putting Japanese government’s borrowing/spending interests ahead of Japan’s businesses:

- Confused ECB minion lacks effective communication skills:

- S&P 500 dips with Fed policy announcement on tap

Wednesday, 15 June 2022

- Signs and portents for the U.S. economy:

- Fed minions got a fever. The only prescription is bigger rate hike cowbell:

- Signs of recovery, but still bigger stimulus developing in China:

- ECB minions count on being clever to solve congenital problem, claim they’re not out to prop up EU countries with outsize debts:

- Wall Street rallies to close higher after Fed statement

Thursday, 16 June 2022

- Signs and portents for the U.S. economy:

- Bigger trouble developing in Japan:

- Bigger trouble, bigger stimulus developing in China:

- ECB minions thinking about three half point rate hikes in 2022, other central banks already acting:

- Wall St. fights for footing after steep selloff on recession worries

Friday, 17 June 2022

- Signs and portents for the U.S. economy:

- Fed minions say they’re out to fight inflation, not doing much to suggest they have a plan that doesn’t involve crashing economy:

- BOJ minions want to keep rates low and stronger yen, won’t get both:

- ECB minions thinking about bigger rate hikes to combat record high Eurozone inflation if it gets worse:

- Wall St ends up but still down on week as volatility rules

After the Fed’s 15 June 2022 three-quarter point rate hike, the CME Group’s FedWatch Tool projects half-point rate hike for both July and September 2022 (2022-Q3), then another half-point rate hike in early November (2022-Q4). Beyond that, the FedWatch tool anticipates three quarter-point rate hikes at six-week intervals from December (2022-Q4) and again in February 2023 (2023-Q1), topping out in the 3.75-4.00% range.

The Atlanta Fed’s GDPNow tool turned even more pessimistic in the past week. Its forecast of real GDP growth of 0.0% for the U.S. in 2022-Q2 is down from last week’s projection of 0.9% annualized growth. If that holds, it suggests the U.S. economy is in the midst of experiencing two consecutive quarters of real GDP shrinkage, which many people associate with the economy being in recession.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment