Khanchit Khirisutchalual

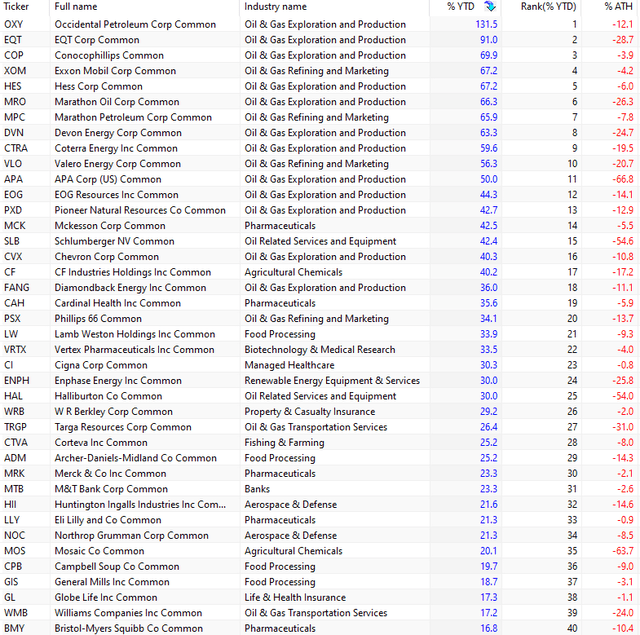

We will start with a scan of the S&P 500 index (SPX). Below are the results for the top 40 stocks based on year-to-date return.

Top 40 Stocks in S&P 500 Based on Year-to-Date Return (October 14, 2022) (Price Action Lab Blog – Norgate Data)

The Oil & Gas sector dominates top performance: 17 of the top 20 stocks are from this sector that has delivered significant profits this year. But energy-related equities may be forming a top soon, and the risks of a reversal have increased after an extended run. The risks of even a massive reversal will increase significantly if there are signs of a recession after the recent interest rate hikes. The risks will be greatest if the economy has a hard landing.

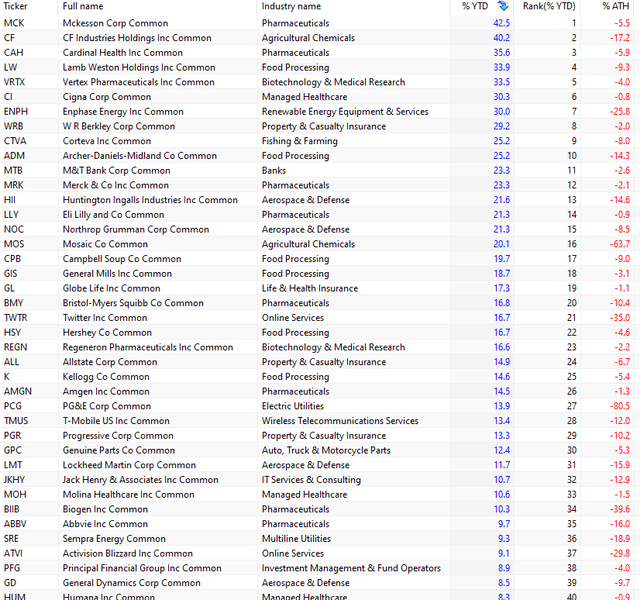

The smart money has been gradually increasing its allocation to sectors that can outperform even under conditions of a severe recession. The action is already reflected in the above table. After we remove oil and gas stocks, this is the new list of the top 40 stocks.

Top 40 Stocks in S&P 500 Excluding Oil & Gas Based on Year-to-Date Return (October 14, 2022) (Price Action Lab Blog – Norgate Data)

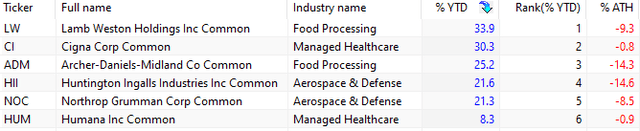

There are several stocks in Food Processing, Managed Healthcare, and Aerospace & Defense, which are three sectors that historically have performed well in recessions on a relative basis. I have selected two stocks from each of those sectors below.

Six S&P 500 Stocks in Food Processing, Managed Healthcare, and Aerospace & Defense, Based on Year-to-Date Return (October 14, 2022) (Price Action Lab Blog – Norgate Data)

Below are charts and fundamentals for three stocks, one from each sector.

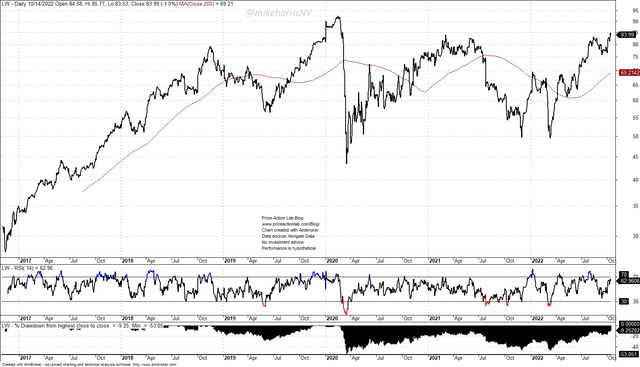

Lamb Weston Holdings Inc. (LW)

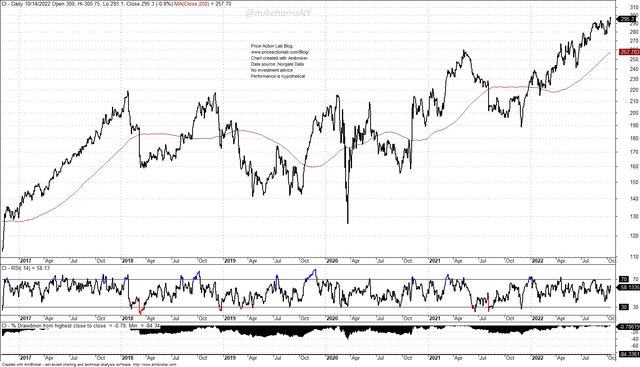

Daily Chart of LW (Price Action Lab Blog – Norgate Data)

Year-to-date, the stock is up nearly 34%. The beta (the measure of a stock’s volatility in relation to the S&P 500) is 0.5. The annual earnings (year ending 05/2022, released July 27, 2022) beat consensus by 6.6%. The P/E ratio (TTM, GAAP) is 29.27x and the dividend yield is 1.17%. Note that institutions hold nearly 89% of the 143.8 million outstanding shares (in the case of AAPL, for example, institutional ownership is at 57.6%). The stock is down 9.3% from its all-time highs. The February 2020 all-time highs could be challenged in the coming weeks.

Cigna Corp. (CI)

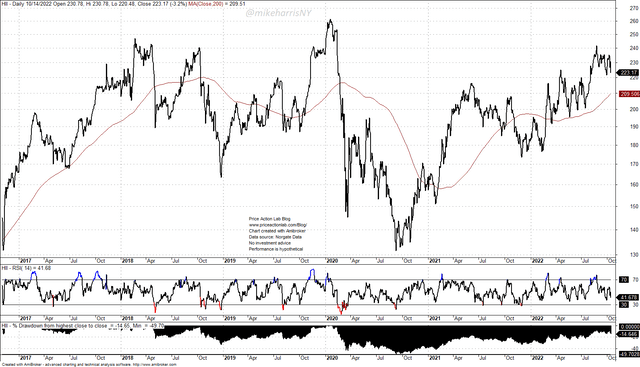

Daily Chart of CI. (Price Action Lab Blog – Norgate Data)

Year-to-date, the stock is up 30.3%. The beta (the measure of a stock’s volatility in relation to the S&P 500) is 0.7. The next earnings announcement is on November 3, 2022. The P/E ratio (TTM, GAAP) is 16.77x and the dividend yield is 1.52%. Institutional ownership is at 90.9%. The stock made new all-time highs on Thursday of last week (October 13, 2022).

Huntington Ingalls Industries Inc (HII)

Daily Chart of HII. (Price Action Lab Blog – Norgate Data)

Year-to-date, the stock is up 21.6%. The beta (the measure of a stock’s volatility in relation to the S&P 500) is 0.6. The next earnings announcement is on November 3, 2022. The P/E ratio (TTM, GAAP) is 16.11x and the dividend yield is 2.11%. Institutional ownership is at 87.3%. The stock is down 14.6% from its January 2020 all-time high.

Conclusion

Even in the case of a recession next year, as some economists and fund managers predict, there will be sectors that will outperform and stocks that will deliver large returns. Historically, the three sectors mentioned, Food Processing, Managed HealthCare, and Aerospace & Defense, have offered opportunities to stock pickers in a recession environment, among others. Stock picking is not easy, especially in a crowded market with high competition, and specific risk, as related to a company or sector, is always high. Forecasting turning points is impossible, but significant gains can be realized with even a fraction of the move in selected stocks as compared to passive investing that suffers from large drawdowns and long periods of recovery. All of these demand solid research and a sound process, as well as, a focus on risk and money management to diversify specific security risks.

Be the first to comment